Get the free Lien Search

Get, Create, Make and Sign lien search

Editing lien search online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lien search

How to fill out lien search

Who needs lien search?

Comprehensive Guide to Lien Search Forms

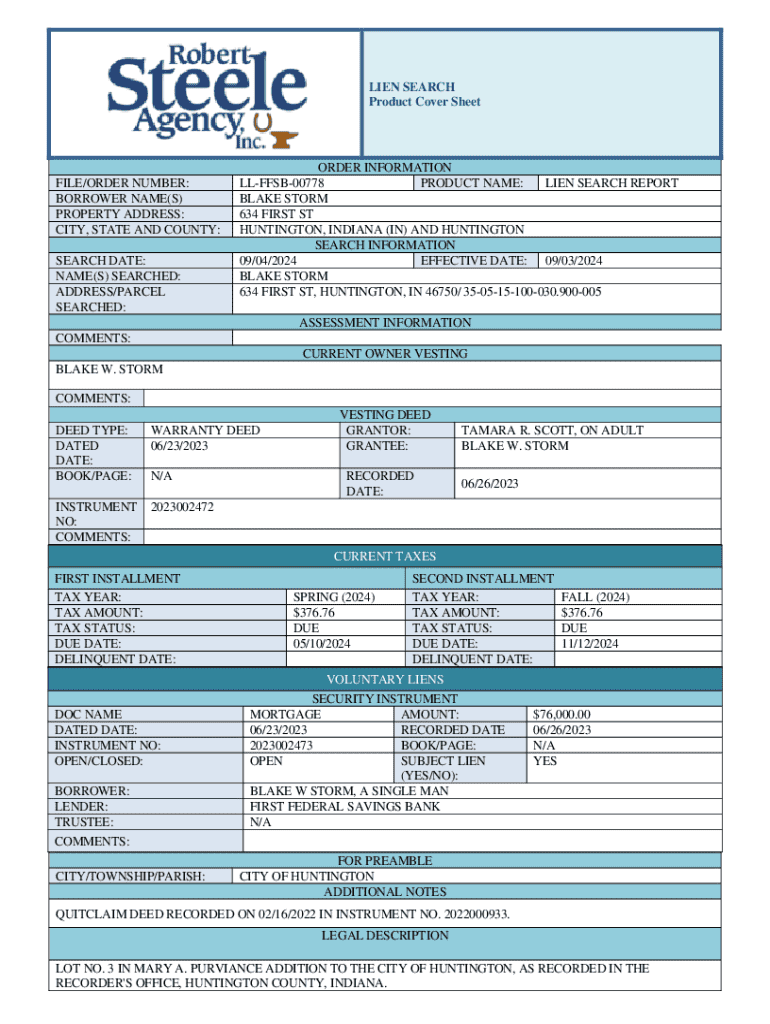

Understanding lien searches

A lien is a legal claim or right against an asset, often used to secure a debt or obligation. It represents the lender's interest in the property until the debt is repaid. Liens can be associated with various forms of property, including real estate and personal property. The importance of conducting thorough lien searches is particularly critical in real estate transactions, as unknown liens can lead to significant financial setbacks for buyers and investors.

Types of liens vary, but common categories include tax liens, which arise from unpaid taxes, and UCC liens, which are associated with secured transactions for business personal property. By understanding these types and their implications, individuals and businesses can safeguard their interests when engaging in any property transaction.

Overview of the lien search process

Conducting a lien search can be an essential step in ensuring a clear title for real estate and preventing future disputes over ownership. Following a structured approach simplifies the process, ensuring no vital steps are overlooked. Here’s a concise guide to performing an effective lien search:

Types of lien search forms

Various lien search forms cater to specific types of liens, making it essential to use the correct document based on your needs. Understanding each type of lien is crucial for effective searches.

UCC lien search form

A UCC (Uniform Commercial Code) lien is filed to establish a secured party's interest in a debtor's collateral. When engaging in business financing or purchasing commercial goods, utilize the UCC lien search form to check for existing claims.

Tax lien search form

Tax liens are imposed by the government for unpaid taxes. Using a tax lien search form allows individuals to verify if a property has outstanding tax obligations, essential information for prospective buyers.

Other relevant lien forms

Beyond UCC and tax lien forms, other forms like judgment lien forms and mechanic's lien forms exist, each serving different purposes. Judgment lien forms are used when a creditor obtains a judgment against a debtor, while mechanic’s liens protect contractors who haven’t been paid for their work.

Filling out the lien search form

Completing a lien search form accurately is crucial to ensure a comprehensive search. Essential information includes property details and contact information, which aid in efficiently locating any liens associated.

When completing these forms, avoid common pitfalls such as misspelling names or omitting critical information. Ensure clarity and completeness to improve the chance of an accurate return.

Fees associated with lien searches

Understanding the costs associated with lien searches helps budget appropriately. Fees vary by jurisdiction and the type of search conducted, so it’s essential to review local regulations and guidelines.

Accessing lien search results

After submitting a lien search form, the next step is reviewing the results. Expect results to include critical information such as liens filed, their corresponding dates, and amounts owed.

Understanding these findings is crucial, as they can influence real estate transactions and affect ownership rights. If a lien is found, consider legal implications, including options for disputing erroneous claims or resolving legitimate debts.

Managing and interpreting lien information

Once search results are obtained, documenting the findings is critical for future reference and legal processes. Keeping organized records helps convey pertinent information when negotiating or explaining a transaction.

Consider seeking expert advice when the search reveals complicated lien issues. Consulting a legal professional ensures that any potential disputes are handled correctly and efficiently.

Interactive tools for lien searches

Utilizing online tools can streamline the lien search process significantly. pdfFiller offers an array of features tailored specifically for conducting lien searches effectively.

Using pdfFiller provides an interface that is intuitive and designed for efficiency. By following the platform's step-by-step instructions, users can navigate through forms quickly and accurately.

Frequently asked questions (FAQs)

Lien searches often raise many questions. Here, we address some common queries:

Real-world case studies

Numerous situations illustrate the critical value of lien searches. For example, in real estate transactions, a buyer uncovered a hidden tax lien during their search, preventing a costly mistake. In other instances, a business secured a loan after confirming their assets were free of UCC liens. These examples highlight how lien searches can avert financial pitfalls and facilitate smooth transactions.

Whether in real estate or business financing scenarios, the right lien search tools and forms are essential for informed decision-making and legal compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit lien search from Google Drive?

How can I send lien search to be eSigned by others?

How can I edit lien search on a smartphone?

What is lien search?

Who is required to file lien search?

How to fill out lien search?

What is the purpose of lien search?

What information must be reported on lien search?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.