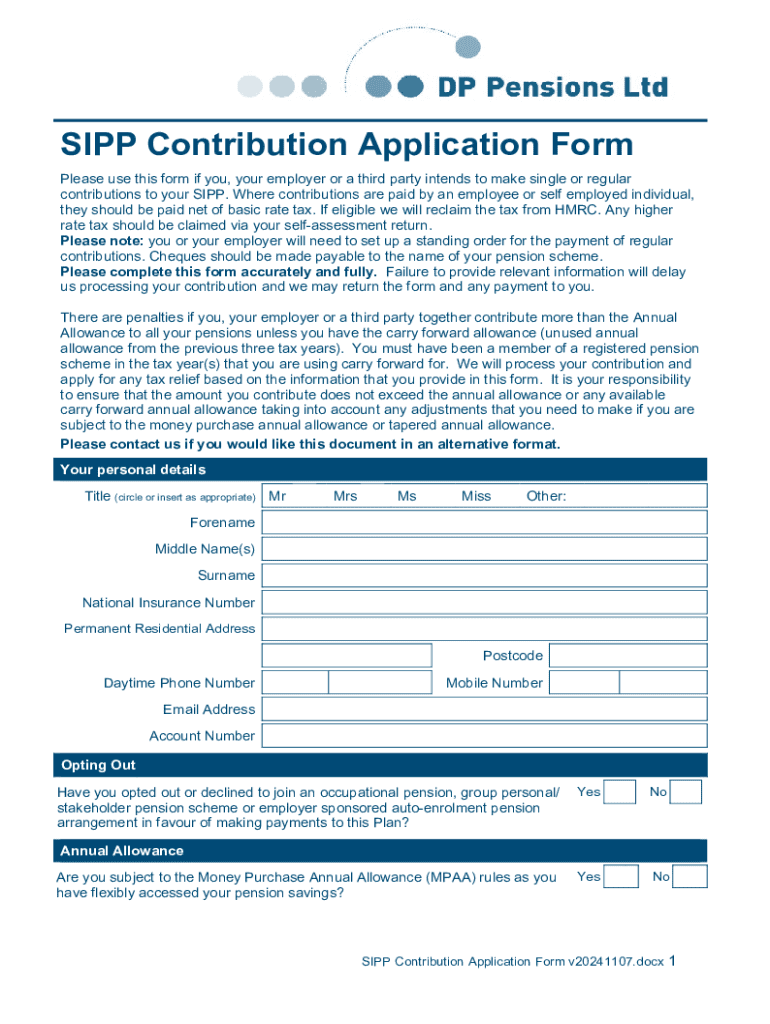

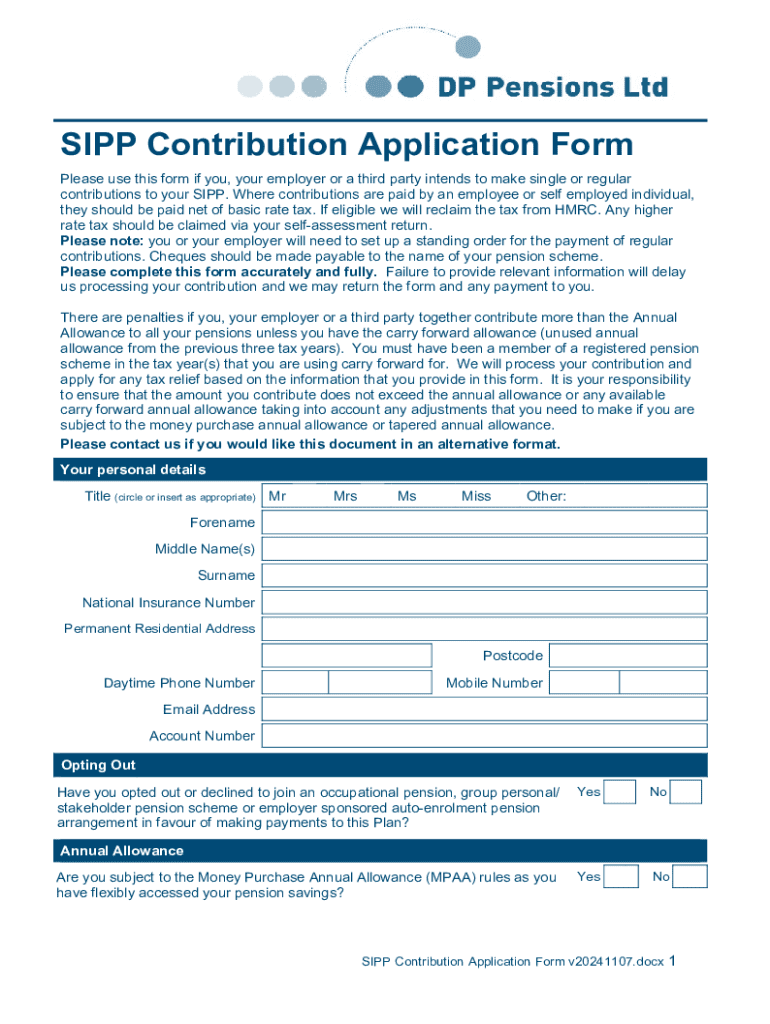

Get the free Sipp Contribution Application Form

Get, Create, Make and Sign sipp contribution application form

How to edit sipp contribution application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sipp contribution application form

How to fill out sipp contribution application form

Who needs sipp contribution application form?

A Comprehensive Guide to the SIPP Contribution Application Form

Understanding SIPP contributions

A Self-Invested Personal Pension (SIPP) is a type of retirement savings plan that gives individuals more control over their investment choices. Unlike traditional pensions, a SIPP allows you to pick your investments from a wide range of options, including stocks, bonds, mutual funds, and property. The importance of contributions to a SIPP cannot be overstated, as they directly impact the size of your pension pot at retirement. Regular contributions not only enhance your savings but also maximize your tax efficiency. Understanding the SIPP contribution application process is crucial to ensuring that your pension savings grow effectively.

The SIPP contribution application process involves specific steps designed to ensure that your contributions are eligible and properly directed into your SIPP account. This comprehensive guide aims to demystify the application form and provide you with the necessary tools to complete it efficiently and accurately.

Who should use the SIPP contribution application form?

The SIPP contribution application form is ideal for a variety of users. Individuals looking to manage their pensions with more flexibility will find it useful, allowing them to tailor their investments to their risk tolerance and financial goals. For personal investors seeking to maximize returns, this form provides a straightforward way to make contributions into their pension pots.

Additionally, teams such as financial advisors and companies managing employee pensions can utilize the SIPP contribution form to streamline contributions on behalf of clients or employees. This centralized approach not only saves time but also ensures compliance with any regulatory requirements.

Case studies illustrate how different individuals and teams have successfully leveraged the SIPP contribution application form to grow their retirement funds while complying with legal and tax obligations.

Essential documents needed for the application

Before filling out the SIPP contribution application form, ensure you gather all necessary documents for a smooth and hassle-free process. Below is a list of essential documents required for the application:

Be sure to prepare these documents ahead of time to prevent any delays in your application. Consider digital options for document submission, which can further expedite the process and enhance accuracy.

Step-by-step instructions for filling out the SIPP contribution application form

When filling out the SIPP contribution application form, it's vital to follow a structured approach for clarity and accuracy. The form is typically divided into several sections:

Utilizing interactive tools can simplify your experience in completing the form. These tools can offer auto-fill capabilities and highlight common errors in real-time. To avoid mistakes, double-check all entries before submitting your application.

Editing and managing your SIPP contribution application form

After filling out your SIPP contribution application form, you may want to review and edit the information for accuracy. pdfFiller's editing tools empower you to make necessary changes easily. You can annotate sections that require additional clarification or notes for future reference.

The platform also enables you to save and export your completed form in various formats, ensuring you can access it when needed. Staying organized contributes to efficient management of your contributions and overall financial planning.

eSigning your SIPP contribution application form

eSigning your SIPP contribution application form simplifies the process of legally validating your submission. Financial documents often require signatures for legitimacy, and pdfFiller's eSignature feature ensures compliance without the need for physical document handling.

The benefits of using pdfFiller’s eSignature feature include convenience, enhanced security, and time-saving benefits. To eSign your application form, simply follow these steps:

Collaboration on SIPP contributions: inviting advisors and teams

Collaborating with financial advisors or team members on your SIPP contributions can lead to more informed decision-making. pdfFiller facilitates collaboration by allowing you to share your application form easily, enabling others to provide input or necessary approvals.

The platform's collaborative features let you track changes and comments made by your advisors, ensuring everyone is on the same page as you work towards your retirement goals.

Managing your application post-submission

After you submit your SIPP contribution application form, you may wonder what the next steps are. It's important to know that there will be processing times, and regularly checking the status of your application can give you peace of mind. Generally, organizations provide updates on application progress, so stay attentive to communications.

If you have queries regarding your application, contacting support can be a proactive measure. This is particularly useful for clarifying specific inquiries about contributions or adjustments to your pension plan.

FAQs about the SIPP contribution application form

The SIPP contribution application form often raises common questions that potential users might have. Addressing these frequently asked questions can provide additional clarity and help in making informed decisions throughout the process.

Staying updated on current regulations and guidelines surrounding SIPP contributions is vital, as these can affect how you manage your pension investments.

Maximizing your SIPP contributions

To maximize your SIPP contributions, a strategic approach to your investment choices is essential. Consider factors such as risk tolerance, age, and retirement goals, which play a significant role in determining your ideal contribution amount and frequency.

Understanding contribution limits is also critical. Current policies may have limits on annual contributions that offer tax relief; exceeding these can incur penalties. Therefore, it’s essential to plan your contributions wisely to enjoy benefits while ensuring compliance.

In addition to tax benefits, planning for your retirement should involve considering various investment vehicles within your SIPP. Balancing a diverse portfolio can help in achieving long-term financial health and success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sipp contribution application form in Gmail?

How do I execute sipp contribution application form online?

How can I edit sipp contribution application form on a smartphone?

What is sipp contribution application form?

Who is required to file sipp contribution application form?

How to fill out sipp contribution application form?

What is the purpose of sipp contribution application form?

What information must be reported on sipp contribution application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.