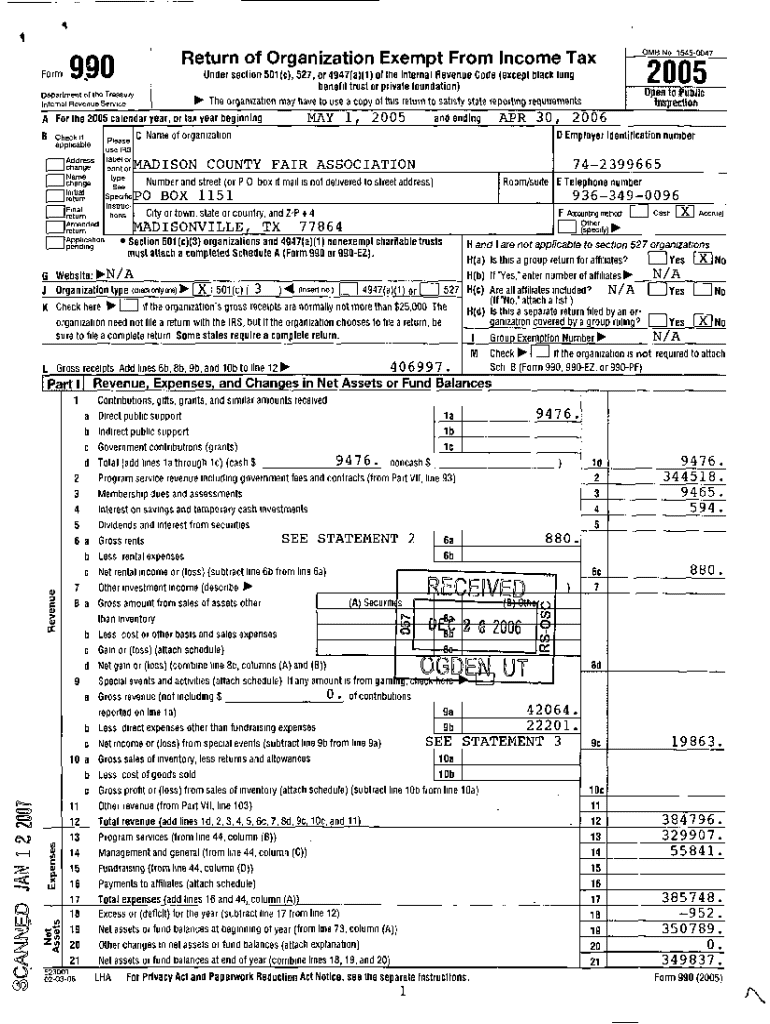

Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Your Comprehensive Guide to Form 990: Everything You Need to Know

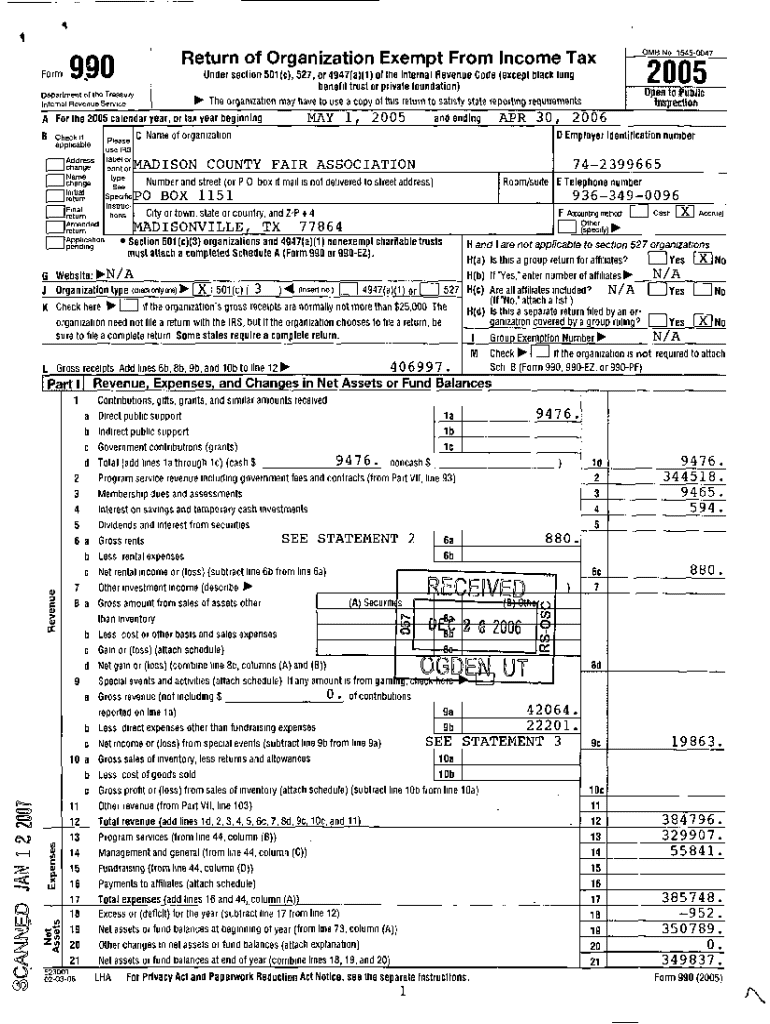

Understanding Form 990

Form 990 serves as a critical tool in upholding transparency and accountability within the nonprofit sector. As a public disclosure document, it sheds light on the financial and operational health of exempt organizations, thereby fostering public trust and allowing donors to make informed decisions. The form provides essential insights into how nonprofits allocate resources, their fundraising activities, and their operational expenditures.

Organizations required to file Form 990 include charities, foundations, and other tax-exempt entities under IRS classification 501(c)(3) through 501(c)(9). Depending on the structure and financial activities of the organization, some may be eligible for streamlined filings, such as Form 990-EZ or Form 990-N (the e-Postcard), which have fewer requirements.

Components of Form 990

Form 990 comprises several key sections, each designed to convey specific facets of the organization’s financial operations. One of the most impactful sections is the Summary of Program Service Accomplishments, where nonprofits disclose their achievements and community impact. This narrative provides potential donors with a snapshot of the organization’s mission in action.

In addition to the main components, several schedules further contextualize the data provided in Form 990. For example, Schedule A verifies Public Charity status, essential for maintaining tax-exempt status, while Schedule B lists the organization’s contributors and Schedule C addresses any political activities and lobbying, further ensuring compliance with legal requirements.

Filing requirements and deadlines

Understanding annual filing requirements is essential for nonprofits. Organizations must determine whether they operate on a fiscal year basis versus a calendar year, as this affects their filing timeline. Nonprofits typically need to file Form 990 by the 15th day of the 5th month after the end of their fiscal year, which is crucial to ensure compliance and avoid penalties.

Deadlines vary based on the filing method as well. E-filing via IRS approved software must be completed by the specified due date, while paper forms must be mailed by the same deadline, with allowances for processing times. Nonprofits can manage their schedules closely to ensure timely filings.

Filling out Form 990

Filling out Form 990 can appear daunting, but with a structured approach, it can be accomplished smoothly. Begin by thoroughly preparing your organization’s financial data, ensuring that all numbers reflect accurate bookkeeping practices. Each section of the form requires specific information, from revenues and grants to functional expenses and governance disclosures.

Particular emphasis should be laid on common areas of error, such as incorrect figures or incomplete disclosures. Familiarize yourself with typical mistakes, like misclassification of expenses or inaccurate reporting of donor information, to bolster the accuracy of your submission.

Interactive tools for Form 990

Utilizing online platforms like pdfFiller can significantly streamline the Form 990 preparation and filing process. pdfFiller offers powerful document management tools that allow users to access and edit the form seamlessly. Organizations can open Form 990 in a user-friendly format, facilitating easy input of information and corrections.

The collaboration tools enhance the drafting experience by allowing multiple parties to work on the same document, making suggestions and improvements that lead to a polished final version.

Filing modalities

When ready to submit Form 990, nonprofits face options for filing: electronic vs. traditional paper filing. E-filing remains the most convenient method and is often required for larger organizations, as it can reduce processing times and ensure immediate confirmation of submission. Organizations opting for e-filing can also leverage online platforms like pdfFiller, which enhances convenience and versatility.

Consideration of filing methods should also factor in the organization’s digital capacity and internal processes. For many, e-filing coupled with tools from pdfFiller simplifies the process beyond traditional methods.

Penalties for non-compliance

Nonprofits failing to file Form 990 or submitting incorrect information face potential penalties imposed by the IRS. Fines can vary based on the size of the organization and the nature of the infraction. Entities may incur daily fines for failure to file or continue facing additional penalties for more serious offenses, highlighting the importance of timely and accurate submissions.

Organizations should remain vigilant about compliance to avoid these steep penalties and maintain their tax-exempt status. Taking proactive steps such as creating a filing calendar can mitigate risks.

Public inspection regulations

Form 990 is a publicly accessible document, meaning that the general public has the right to inspect it. This transparency serves as a mechanism for accountability, allowing stakeholders, donors, and the general public to assess a nonprofit’s fiscal health. Organizations have a legal obligation to make Form 990 available upon request, further enforcing standards of openness in the nonprofit sector.

The accessibility of Form 990 emphasizes the importance of accuracy, as inaccuracies can severely impact donor perception and the organization's reputation.

History of Form 990

Form 990 has evolved significantly since its inception, adapting to changes in regulations and the nonprofit landscape. Initially introduced to track the finances of tax-exempt organizations, the form has undergone numerous revisions to enhance reporting clarity and transparency. Adjustments in response to high-profile scandals and growing concerns over nonprofit accountability have informed many of these changes.

These updates reflect the ongoing commitment to improving donor trust and organization effectiveness, making Form 990 a dynamic part of the nonprofit field.

Utilizing Form 990 for evaluation and research

Researchers and evaluators can leverage data provided in Form 990 to gain insights into the financial and operational status of nonprofits. The form contains invaluable information that guides the assessment of charity efficacy, expenditure patterns, funding sources, and program developments. By analyzing Form 990 data, stakeholders can derive meaningful assessments that drive strategic decision-making.

Researchers can also dissect the evolving trends within the nonprofit sector, which aids in creating more impactful funding strategies and advocacy. Insights gathered can inspire both prospective donors and established nonprofits to align with transparent and accountable practices.

Fiduciary reporting and responsibilities

Fiduciary responsibilities implicate a profound accountability framework, where the nonprofit board must ensure that all actions taken and reported are in alignment with the mission of the organization. Fiduciaries are tasked with overseeing the adherence to legal requirements detailed within Form 990, including financial honesty and ethical practices. Each board member's understanding of these responsibilities is crucial, as they directly reflect on the organization's credibility and operational legality.

The oversight of fiduciaries is integral to maintaining donor confidence and operational success, reminding every nonprofit stakeholder of the importance of ethical considerations.

Third-party resources for assistance

Numerous organizations provide guidance for nonprofits navigating the complexities of Form 990 and overall compliance. Resources such as the National Council of Nonprofits, the IRS, and specialized tax advisors offer crucial assistance. Further, various software exists that assists users with data entry and filing, enhancing the compliance management process for nonprofits.

Leveraging these third-party resources, organizations can enhance their understanding of reporting obligations while ensuring that their practices adhere to current regulations.

How to read Form 990 effectively

Reading Form 990 effectively requires a keen understanding of its varied sections and the information they provide. Start by familiarizing yourself with the layout and the sections that detail income, expenses, and program accomplishments. Delving deeper into financial statements will reveal crucial metrics, while understanding certain jargon can clarify information significantly.

Paying attention to commonly misinterpreted sections, like ‘Functional Expenses,’ can yield valuable insights that drive funding and operational strategies, thereby enhancing understanding of the nonprofit landscape.

Locating your Form 990 text

Locating previously filed Form 990 texts is crucial for compliance and review purposes. The IRS provides a system for accessing these documents, but organizations can also create robust internal archival systems to manage their records effectively. Accessing the Internet Archive or platforms such as Guidestar allows for quick retrieval of Form 990 data.

Implementing best practices for digital storage and retrieval ensures that organizations can access essential documents efficiently whenever necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 online?

How do I edit form 990 straight from my smartphone?

How do I fill out the form 990 form on my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.