Get the free Non-profit Corporation Annual Report

Get, Create, Make and Sign non-profit corporation annual report

Editing non-profit corporation annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-profit corporation annual report

How to fill out non-profit corporation annual report

Who needs non-profit corporation annual report?

Comprehensive Guide to the Non-Profit Corporation Annual Report Form

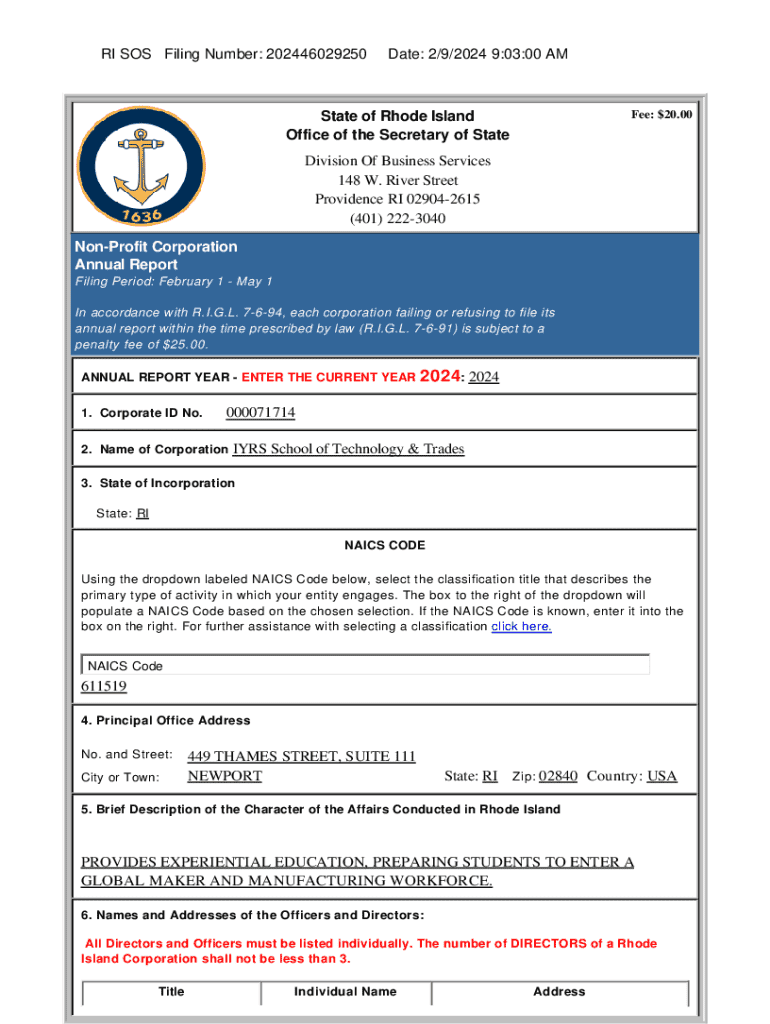

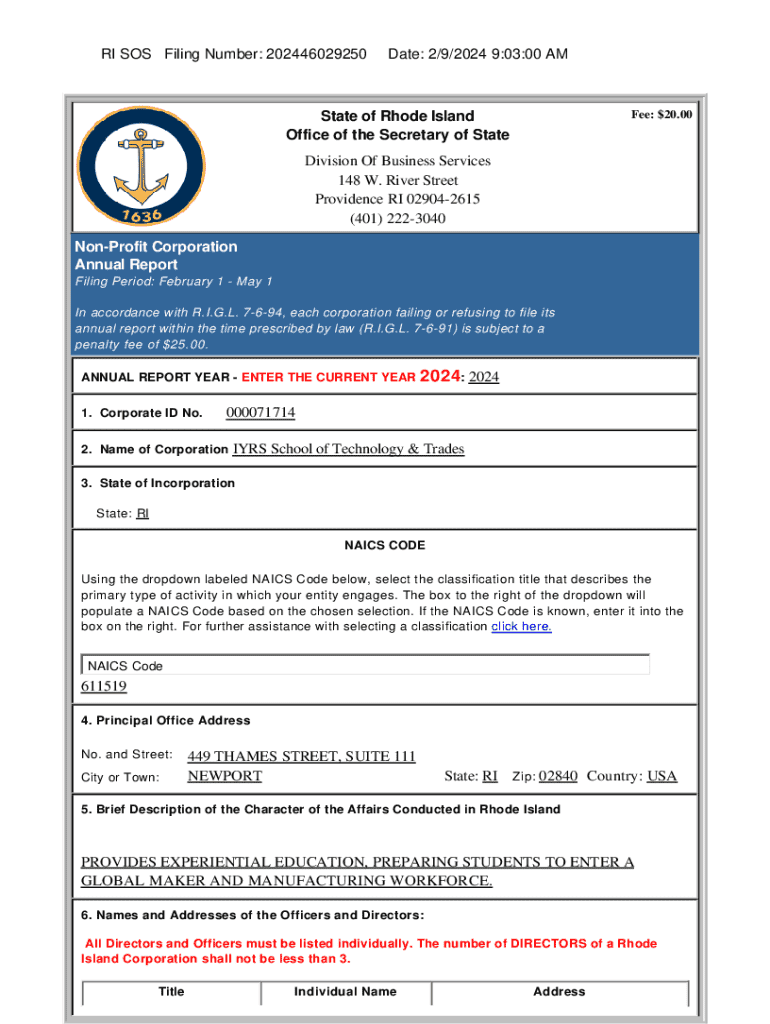

Understanding the non-profit corporation annual report

A non-profit corporation annual report is a vital document that summarizes the organization’s activities, financial status, and achievements over the previous year. It serves to inform stakeholders, including donors, board members, and the community, about the non-profit's progress towards its mission and goals. This report is not only a requirement for compliance but also a strategic tool for transparency and engagement.

The importance of the annual report for non-profits lies in its ability to enhance trust and credibility. It showcases the organization’s impact, accountability, and how effectively it utilizes resources. Additionally, a well-crafted annual report can also attract new donors and volunteers, reinforcing the organization's community appeal.

While the exact structure can vary, a non-profit corporation annual report typically includes an introduction, financial information, program highlights, and future goals. This organized approach ensures that stakeholders have a clear understanding of the organization’s journey and vision.

Key components of an annual report

An effective annual report should contain several key components that collectively present a comprehensive overview of the organization’s performance and plans.

Legal requirements for non-profit annual reports

Non-profit organizations must adhere to specific legal requirements regarding annual reports to maintain their status and credibility. At the federal level, the IRS mandates certain filings for tax-deductible donations under Section 501(c)(3). While not all non-profits must provide an annual report, those that do must file Form 990, which provides information about finances, personnel, and programs.

On a state level, reporting requirements vary significantly. Most states require organizations to submit an annual report or similar documents to maintain their registered status. It’s crucial to be aware of deadlines, as failing to file on time can result in penalties, including loss of tax-exempt status. By ensuring compliance, non-profits can continue to operate and thrive.

Preparing your annual report

Preparation for an annual report begins long before the actual writing process. Organizations need to gather necessary information and data that will populate the report. This includes financial statements, operational data, and qualitative information like testimonials and case studies that showcase program success.

Collaboration with stakeholders is equally important. Engaging board members and staff in the process ensures that multiple perspectives are included, enriching the final product. Additionally, involving donors and beneficiaries can provide meaningful narratives that enhance the report’s depth and authenticity, making it resonate even more with the audience.

Best practices for crafting an engaging annual report

Creating an engaging annual report goes beyond meeting basic requirements; it is about building a connection with your audience. A donor-centric approach emphasizes the contributions and roles of supporters, making them feel essential to the organization’s impact. Use a 'you-attitude' in communication — focus on what matters to your audience.

Selecting the right format for your report

The format of your annual report can significantly affect its reach and engagement. Traditional print formats, while tactile and personal, may not reach as wide an audience in our increasingly digital world. Therefore, digital formats are becoming more popular, allowing for easier distribution, potential for interactivity, and even updating content post-release.

Consider options like interactive PDFs or online presentations that allow readers to engage with the content actively. Additionally, ensuring that your report is mobile-friendly is imperative in today's on-the-go society. Reports that are easy to navigate on smartphones and tablets increase accessibility and reader engagement.

Tools and resources for creating your annual report

Creating an impactful annual report requires the right tools and resources. Document creation software, such as pdfFiller, simplifies the editing process, enabling teams to collaborate seamlessly on their reports. This platform allows for easy integration of text, graphics, and charts that are visually appealing and informative.

Inspirational non-profit annual report examples

Examining successful non-profit annual reports can provide valuable insights and inspiration. For instance, [Effective Non-Profit Name] showcased their impact through compelling narratives and readable financial summaries, making their report both informative and engaging. Their design choices and layout made it visually appealing, encouraging readers to delve deeper into the content.

Lessons learned from these examples include the importance of clarity in financial reporting and the effectiveness of personal stories in illustrating impact. Comparative analysis of different organizations’ formats and styles reveals that while financial transparency is vital, it’s the storytelling that often captivates audiences.

Leveraging your annual report for future growth

Your non-profit corporation annual report should not be a one-time publication; it can be an invaluable asset for future growth. Utilizing the report in fundraising campaigns is an effective strategy, providing potential donors with concrete evidence of your organization's impact. Moreover, sharing your achievements and future goals can help to establish a deeper connection with your community and stakeholders.

Publishing the report beyond mere compliance not only helps strengthen relationships but can also enhance your non-profit’s visibility in the community. Distributing your report through newsletters, social media, and your website can extend its reach and improve engagement. By fostering ongoing conversations around the content, you can inspire commitment and action among your supporters.

Additional considerations

After developing your annual report, marketing and distributing it is crucial to maximize its impact. Share it through various channels such as social media, email newsletters, and during community events. Encourage feedback from readers to improve future reports, creating a participatory cycle that values stakeholder input.

Additionally, consider how the insights gained from your annual report can inform organizational strategy. Engaging stakeholders in discussions post-release can lead to new initiatives driven by community input, fostering a sense of partnership and shared purpose.

Interactive tools for document management

The process of creating and managing your non-profit corporation annual report becomes simpler and more efficient with the right interactive tools. pdfFiller streamlines document management by providing features that allow for seamless editing, signing, and collaboration on reports in a cloud-based environment.

FAQs about non-profit annual reports

Non-profit organizations often have numerous questions regarding annual reports. Common inquiries include whether non-profits are required to publish annual reports and what the repercussions are if a report is not filed. While it is not universally mandatory, having an annual report can enhance transparency and foster donor trust.

Failure to file the necessary documents may lead to consequences such as penalties or risk of losing tax-exempt status. Organizations must also ensure effective reporting of financial activities to comply with legal obligations and maintain community trust.

Connect with your audience

Building a community around your annual report is essential for gauging public interest and fostering engagement. Use insights gleaned from the report to champion initiatives that resonate with your audience and encourage community participation. By calling for action, you strengthen connections and ensure your supporters feel involved in achieving your mission.

Leverage your annual report not just to inform but to inspire continued support and participation. Engaging readers post-release, inviting discourse, and eliciting feedback can set the stage for future collaboration and communal growth.

Advanced resources and tools for non-profit management

As non-profit leaders navigate the complexities of report creation and overall management, access to advanced resources and tools becomes essential. Platforms dedicated to continuous document management streamline operations, making it easier to maintain organization and compliance throughout the year.

Moreover, networking opportunities and workshops can provide non-profit leaders with additional strategies and insights on effective management and reporting practices. This continuing education fosters skill development and adaptation to best practices, which can benefit not only the organization but also the communities they serve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-profit corporation annual report directly from Gmail?

Can I create an eSignature for the non-profit corporation annual report in Gmail?

How can I edit non-profit corporation annual report on a smartphone?

What is non-profit corporation annual report?

Who is required to file non-profit corporation annual report?

How to fill out non-profit corporation annual report?

What is the purpose of non-profit corporation annual report?

What information must be reported on non-profit corporation annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.