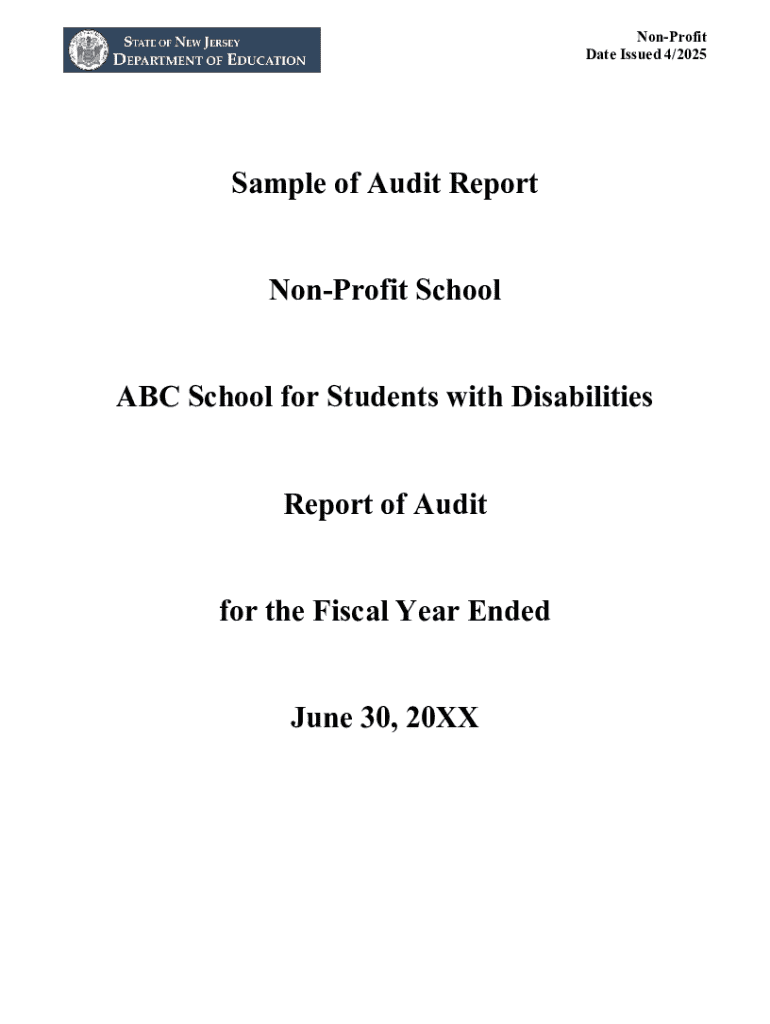

Get the free Sample of Audit Report

Get, Create, Make and Sign sample of audit report

Editing sample of audit report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sample of audit report

How to fill out sample of audit report

Who needs sample of audit report?

Sample of Audit Report Form - A Comprehensive How-to Guide

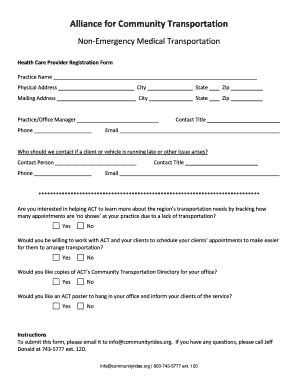

Understanding the audit report form

An audit report form is a formal document generated after the completion of an audit, reflecting the auditor's findings and opinions about an organization's financial activities. This form serves as a crucial communication tool between the auditor and the stakeholders, providing assurance regarding the accuracy of financial statements. It not only addresses compliance issues but also highlights any discrepancies or areas for improvement.

The primary purpose of the audit report is to express an opinion on the reliability of the financial statements prepared by the entity. This opinion plays a significant role for stakeholders, investors, and regulatory bodies by reinforcing confidence in the reported financial information.

Importance of an audit report in various contexts

Audit reports play a pivotal role in different organizational contexts, such as not-for-profit organizations, corporate governance, and compliance with legal regulations. Each of these sectors benefits from the structured insights provided by a proper audit report form. For not-for-profit organizations, for instance, transparency is critical. An audit report assures donors and stakeholders that contributions are being utilized effectively and as intended.

In corporate governance, audit reports serve as a tool for companies to manage risks, create accountability, and maintain ethical standards. This is particularly crucial for publicly traded companies that must demonstrate financial integrity to shareholders. Additionally, audit reports are often required by law, thus reinforcing compliance and helping organizations avoid potential legal issues.

Step-by-step guide to completing the audit report form

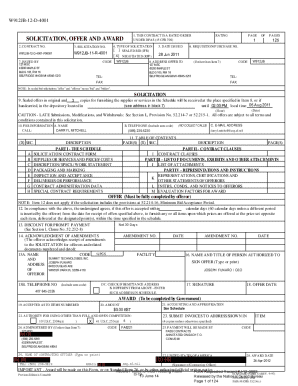

Completing an audit report form requires diligent attention to detail and accurate data. The first step involves gathering necessary information pertinent to the audit process. This includes financial records, regulatory documentation, and any internal reports that may provide context to the financial statements.

Once you have collected the relevant materials, you can proceed to fill out the form. Each section of the audit report form has specific requirements that must be meticulously addressed. For example, the statement of financial position should accurately reflect the assets, liabilities, and equity of the organization. Similarly, detailing the statement of activities helps summarize income and expenses.

Identifying common mistakes to avoid during this process is equally as crucial. Mislabeling figures or misunderstanding the components of financial statements can lead to misrepresentations that might affect audit outcomes.

Following completion, review and finalize the document with a checklist for accuracy. Seeking professional insights at this stage can provide added assurance that your audit report is comprehensive and free from errors.

Interactive tools for enhancing audit report preparation

In today’s digital world, utilizing tools like pdfFiller for document management streamlines the process of creating an audit report form. This platform allows users to upload existing templates and edit them efficiently, fostering a more organized workflow.

The eSignature feature offered by pdfFiller significantly speeds up the approval process. This means that once the audit report is complete, it can be signed and shared with relevant stakeholders instantaneously, saving time and enhancing productivity.

Collaborative tools for team input enhance the document’s quality. Features such as real-time comments and edits let team members provide feedback directly on the audit report, promoting a more thorough review process and preventing miscommunications.

Best practices for drafting an effective audit report

Drafting an effective audit report requires clarity and precision in language. Avoiding jargon ensures stakeholders understand the findings without ambiguity. Presenting financial data visually through charts, graphs, and simplified tables can also enhance readability, making complex information easily digestible.

Objectivity and professionalism must guide the content of the audit report. It is essential to report findings as they are without any bias. This maintains the integrity of the document and strengthens the reliability of the audit.

Additional considerations when using audit report forms

When using audit report forms, it's critical to consider industry-specific guidelines and variations. Different sectors may have unique reporting standards that auditors must adhere to, ensuring compliance and accuracy. For example, audits in the healthcare sector might require additional patient confidentiality considerations.

The role of external auditors is also key. Engaging an auditor is advisable when an organization lacks the internal resources or expertise to perform a thorough audit. Understanding when to seek external help and how to navigate auditor recommendations can lead to more effective auditing processes.

Evaluating and improving your audit reporting process

Evaluating the usability of your audit report forms can offer valuable insights into the report creation process. Soliciting feedback from users can pinpoint areas that require enhancements, ensuring that the forms are user-friendly and effectively meet stakeholder needs.

As regulatory standards change, adapting your audit reporting process accordingly is essential. Continuous learning and professional development in auditing practices can help maintain high standards, ensuring your audit reports remain relevant and practical.

Related topics in audit reporting

In addition to the sample of audit report form, understanding common audit report formats across various industries can prove beneficial. Each industry has tailored requirements that must be met, leading to variations in reporting styles. Familiarizing yourself with these differences can help streamline the audit process.

Staying informed about recent trends in audit practices, such as the rise of technology-driven audits and data analytics, can position your organization at the forefront of effective financial reporting. Engaging in workshops and forums can also introduce useful tools and resources for effective financial reporting.

What you think of this guide?

Your feedback is invaluable as we refine our resources. Understanding how effectively this guide has served your needs can help us improve and develop further material that is beneficial to all users. Consider sharing your thoughts or suggesting topics you wish to explore further.

About pdfFiller

pdfFiller is a robust platform dedicated to simplifying document management. With functionalities that allow users to edit PDFs, eSign documents, and collaborate seamlessly, it serves as a one-stop solution for efficient document creation and management.

User testimonials highlight the effectiveness of pdfFiller, with many praising its user-friendly interface and versatile features, making document management a hassle-free experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit sample of audit report on an iOS device?

How can I fill out sample of audit report on an iOS device?

How do I fill out sample of audit report on an Android device?

What is sample of audit report?

Who is required to file sample of audit report?

How to fill out sample of audit report?

What is the purpose of sample of audit report?

What information must be reported on sample of audit report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.