Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding the Form 8-K: A Comprehensive Guide

Understanding Form 8-K: A Comprehensive Overview

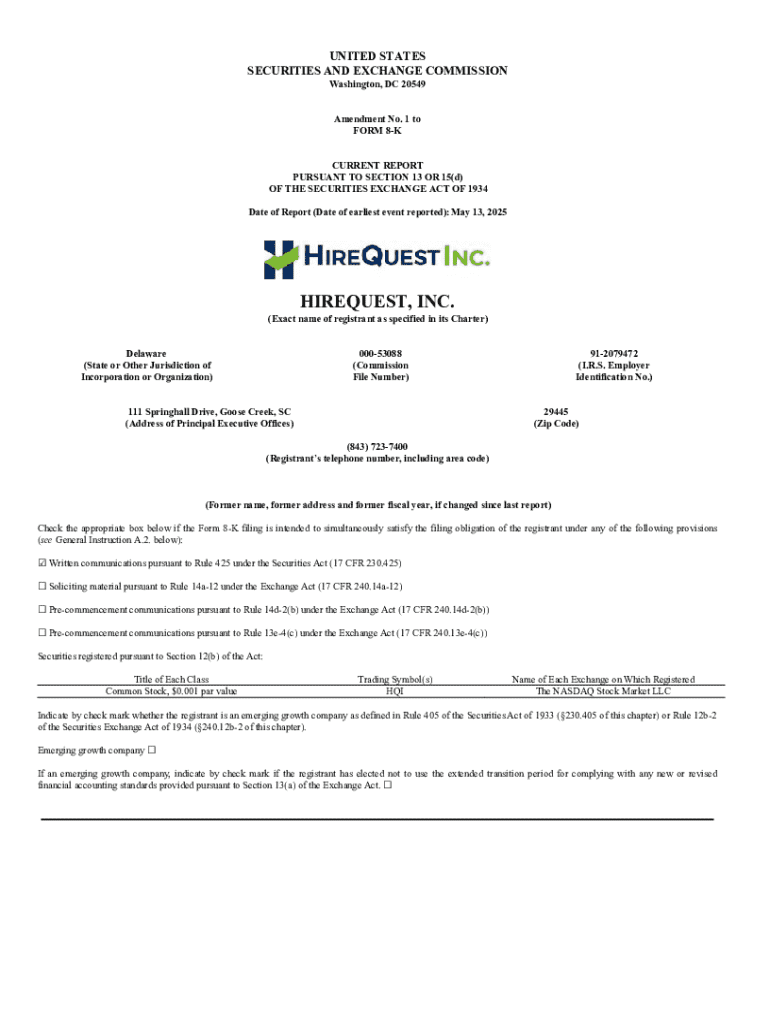

Form 8-K is a crucial reporting requirement mandated by the U.S. Securities and Exchange Commission (SEC) that publicly traded companies must complete to disclose significant events that affect the company. This form notifies stakeholders of important information that might influence their decision-making concerning the company’s securities. Unlike periodic reports like Form 10-Q or Form 10-K, which focus on regular financial performance, Form 8-K is filed as events occur, ensuring timely updates.

The importance of Form 8-K lies in its role in promoting transparency within the market. By requiring companies to disclose information promptly, the SEC ensures that all investors, irrespective of their expertise, have equal access to material information. This accessibility ultimately enhances investor confidence and contributes to the integrity of financial markets.

When is Form 8-K Required?

Form 8-K is required during specific situations that materially affect a company's operations, financial condition, or governance. Understanding these circumstances helps companies determine when to file the form. Some common triggers include significant corporate events, changes in control, and financial issues or events like bankruptcy.

Additionally, when the important changes occur, companies are obligated to file Form 8-K within four business days of the event. This tight timeline necessitates swift action and thorough communication within corporate management to ensure compliance with SEC regulations.

Key components of Form 8-K

Form 8-K consists of several sections that allow companies to provide detailed information concerning the events that triggered the filing. Each section addresses different aspects of the company and its operations, enabling stakeholders to grasp a comprehensive understanding of the situation.

These sections range from the registrant's business and operations to matters related to accountants and financial statements. Properly completing each section ensures compliance and provides clarity for investors.

Reading and understanding Form 8-K

Understanding how to read Form 8-K is essential for investors looking to analyze a company’s current situation. Each section of the form provides insights into different areas of the company's operations and changes. Stakeholders should focus on relevant sections depending on their specific interests, whether it be financial stability, management changes, or significant corporate actions.

For example, investors interested in a company’s financial stability should closely examine Section 2 (Financial Information) and Section 9 (Financial Statements and Exhibits). Understanding these sections allows for an immediate grasp of how specific events may impact stock performance and overall investor sentiment.

Key highlights and benefits of filing Form 8-K

Filing a Form 8-K has several benefits that enhance corporate governance and investor relations. One significant highlight is the enhancement of investor confidence. By providing timely and accurate information, companies reassure investors regarding transparency and accountability.

Moreover, compliance with SEC regulations through timely Form 8-K filings mitigates legal risks and potential penalties for non-compliance. This proactive communication strategy also ensures that stakeholders remain informed, ultimately aiding in maintaining a positive corporate reputation and stakeholder trust.

Guiding steps for completing and filing Form 8-K

Completing and filing Form 8-K requires careful preparation of corporate information. First, gather all necessary data regarding the event triggering the filing. Engage relevant departments to ensure all information is accurate and comprehensive. Following the preparation, utilizing tools such as pdfFiller can streamline the document creation process.

Engage in step-by-step instructions for filling out each section of the form. This involves ensuring clarity and precision with the data presented. Remember, common mistakes often arise from unclear language or omitted data, so thorough proofreading and updates are critical before the final submission.

Frequently asked questions about Form 8-K

Addressing common concerns regarding Form 8-K can further guide companies and investors. For instance, failure to file Form 8-K within the required timeframe can lead to severe penalties, including fines or reputation damage within the market. Thus, companies should prioritize punctual filings.

Moreover, Form 8-K can be amended after submission if new information becomes available or clarifications are necessary. Companies must ensure that any amendments are accurately reflected to maintain transparency with the SEC and investors. Additionally, understanding how the filing impacts stock prices is crucial as it can directly influence market behavior and investor decisions.

Real-world examples and case studies

Examining real-world examples of Form 8-K filings reveals the implications of timely disclosures. For instance, a major corporation announcing a merger via Form 8-K experienced significant market reactions that affirmed stakeholder trust in the relationship's strategic value. Companies across industries approach Form 8-K filings with varying levels of detail and urgency, which subsequently affects market perceptions.

Industries heavily reliant on regulatory compliance, such as finance and healthcare, tend to file more comprehensive Form 8-K reports to convey trust with stakeholders. Conversely, smaller firms may file less frequently, which can lead to critical gaps in investor information and these companies must be vigilant about their communication strategies.

Tools and resources

Utilizing tools such as pdfFiller offers streamlined resources for managing Form 8-K filings. Features such as document creation, e-signatures, and interactivity provide comprehensive solutions for businesses looking to simplify their filing process. The platform's user-friendly interface and cloud-based solutions facilitate easy access and management of essential documents.

Additionally, companies can access historical Form 8-K data through pdfFiller's expansive database, providing insights into filing trends and patterns that could guide future decision-making and enhance corporate compliance. This access not only allows firms to benchmark their performance but also helps them stay ahead of potential regulatory challenges.

Industry insights

Form 8-K filings evolve continuously in response to changing regulatory landscapes and market demands. Industries have adapted their compliance approaches, especially in light of crises—highlighting the crucial role Form 8-K plays in crisis communication management. Companies that leverage Form 8-K effectively during crises can mitigate adverse effects on their reputation and maintain stakeholder trust.

Emerging trends also show that companies are increasingly utilizing technology to automate and expedite the reporting process. This trend towards digitization of compliance and reporting not only enhances accuracy but also fosters a proactive regulatory culture within organizations, thus positioning them better in a competitive environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 8-k online?

How do I edit form 8-k online?

How do I complete form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.