Get the free New Accounts Report

Get, Create, Make and Sign new accounts report

Editing new accounts report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new accounts report

How to fill out new accounts report

Who needs new accounts report?

A Complete Guide to the New Accounts Report Form

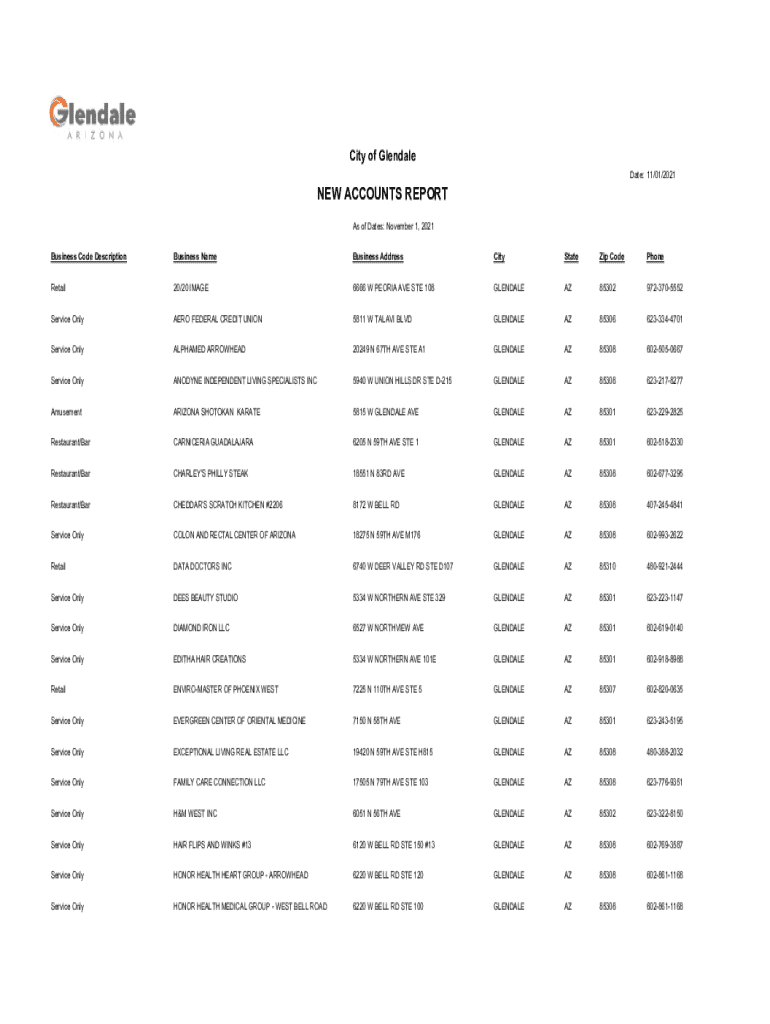

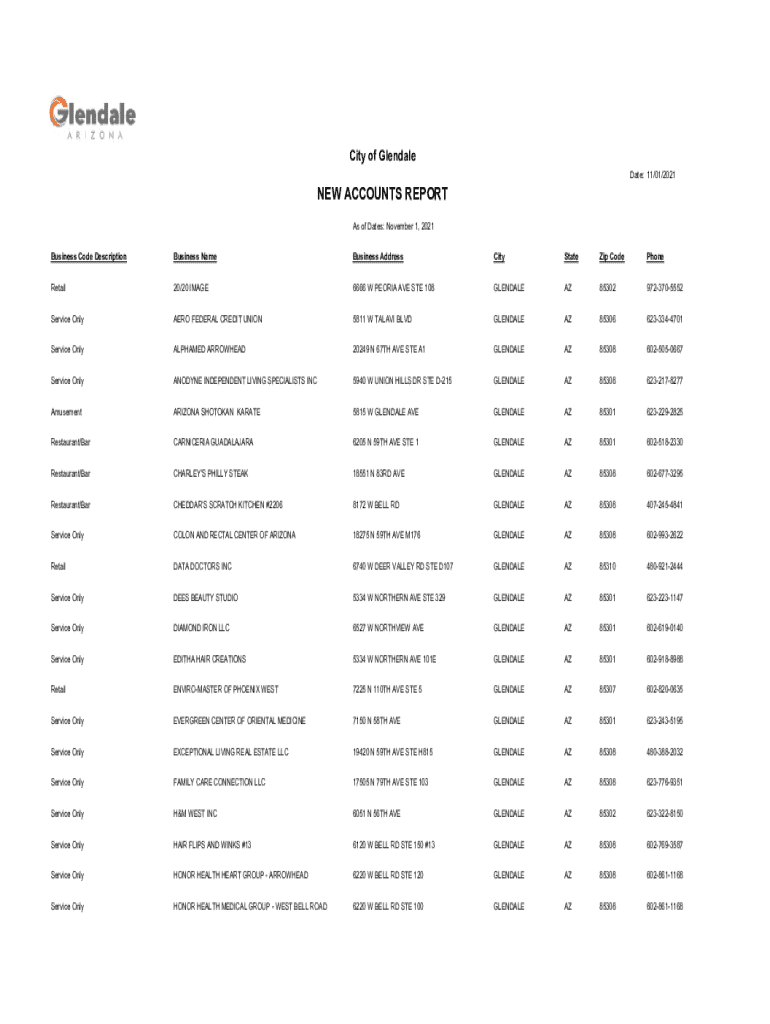

Overview of the new accounts report form

The new accounts report form is a vital tool used by financial institutions to document essential details about newly created accounts. This form ensures regulatory compliance and helps maintain accurate records across various banking and financial services. By capturing crucial information about account holders, such as their identity, financial background, and account activities, this form plays a pivotal role in risk assessment and fraud prevention.

Accurate reporting via the new accounts report is crucial for financial institutions, as it fulfills the requirements set forth by regulatory bodies like the Financial Crimes Enforcement Network (FinCEN) and the Bank Secrecy Act (BSA). These regulations aim to combat money laundering and protect the integrity of financial systems. These institutions must ensure that the individuals responsible for filling out this form—typically financial professionals and compliance officers—understand its significance.

Key components of the new accounts report form

The new accounts report form includes several vital sections that collect essential information. The first section typically requires personal identification details. This may encompass an individual's full name, address, date of birth, and Social Security number. Accurate data collection in this area safeguards against identity theft and enhances the security of the financial institution.

In addition to personal data, the financial information section captures details pertinent to the new account. This includes account numbers, types of accounts being opened, and transaction histories, if applicable. Understanding the various sections of the new accounts report form allows for effective and compliant completion of required reports.

Step-by-step instructions for filling out the new accounts report form

Before diving into filling out the new accounts report form, it's crucial to gather all the necessary documentation. This step ensures that you have all required information at hand, streamlining the process and reducing errors during completion. Collect identification documents, proof of address, and any previous banking records.

Detailed instructions for filling out the form include:

Common mistakes to avoid include transposing numbers in account information, omitting required details, and using outdated forms. By being proactive and methodical, the completion of the form can be both accurate and efficient.

Editing and managing the new accounts report form

Utilizing tools like pdfFiller enhances the editing and management of the new accounts report form, providing a user-friendly platform for users. To upload and access your form on pdfFiller, you simply navigate to their website, select the upload option, and choose your document.

Once your form is uploaded, several editing tools will be at your disposal. These include options to add text,Highlight, strikethrough, and mark expiration dates, among others. Additionally, pdfFiller allows collaboration with team members by inviting them to review or contribute to the document, streamlining the workflow.

Electronic signing of the new accounts report form

In today's digital environment, electronic signatures have become indispensable for streamlining the signing process. The eSignature feature available on pdfFiller simplifies this with a straightforward signing process that includes uploading your document and adding your signature electronically.

Security is paramount when it comes to eSigning documents. pdfFiller embeds various security features to ensure compliance, making signers feel safeguarded while engaging in this digital process. Verifying identity and ensuring confidentiality is essential to maintain the integrity of your reporting.

Submitting the new accounts report form

Upon completing the new accounts report form, it is essential to understand the submission options available. Organizations may opt for electronic submission, leveraging the pdfFiller platform's efficiency, or choose traditional mail procedures. Electronic submission often expedites processing times and enhances tracking capabilities.

After submission, it is prudent to follow up on the report's progress. This can involve checking confirmation emails or logging into the pdfFiller account to view the status of your submission. Should there be any corrections needed, knowing the process for amendments will be vital to ensure adherence to compliance standards.

Resources for completing the new accounts report form

pdfFiller offers a variety of helpful tools designed to assist users in effectively completing the new accounts report form. The platform provides interactive templates tailored to meet reporting requirements, allowing for easy filling and editing.

In addition to templates, pdfFiller has extensive support resources, including FAQs and guides, enhancing user understanding of compliance and financial reporting. Exploring these resources equips individuals and teams with the knowledge required to handle documentation competently.

Insights on building a strong compliance culture

A robust compliance culture within financial institutions is paramount, underscoring the relevance of accurately filling out the new accounts report form. Correctly capturing data not only fulfills regulatory obligations but also builds trust with customers and stakeholders.

Implementing training programs for team members fosters this culture. Best practices include regular workshops on regulatory changes, emphasizing the importance of compliance, and encouraging communication among team members to discuss challenges encountered while filling out forms. A shared understanding of the reporting process leads to greater accuracy and efficiency.

FAQs about the new accounts report form

Frequently asked questions about the new accounts report form often concern the types of information required and the implications of inaccuracies. Clear understanding is key for all stakeholders involved.

Navigating the new accounts reporting landscape

As regulations evolve, staying updated on changes in the reporting landscape is essential. Financial professionals must continuously monitor updates from regulatory bodies to ensure compliance. This knowledge is crucial to adapt reporting practices effectively.

Engaging with networks and community forums provides opportunities to share insights and glean knowledge from peers in the industry. These forums often prove beneficial for identifying best practices and addressing common challenges faced by organizations in their reporting processes.

Further engagement options with pdfFiller

pdfFiller offers a range of features extending far beyond just the new accounts report form, catering to various document management needs. Users can leverage its capabilities to create custom templates for future accounts, optimizing their processes and ensuring standardization.

Moreover, pdfFiller's customer support provides avenues for connection with representatives who can offer tailored advice on maximizing your document management experience. This support sets users up for success in navigating the complexities of financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the new accounts report in Chrome?

How can I edit new accounts report on a smartphone?

How do I fill out new accounts report using my mobile device?

What is new accounts report?

Who is required to file new accounts report?

How to fill out new accounts report?

What is the purpose of new accounts report?

What information must be reported on new accounts report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.