Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q Form: How-to Guide

Understanding the Form 10-Q

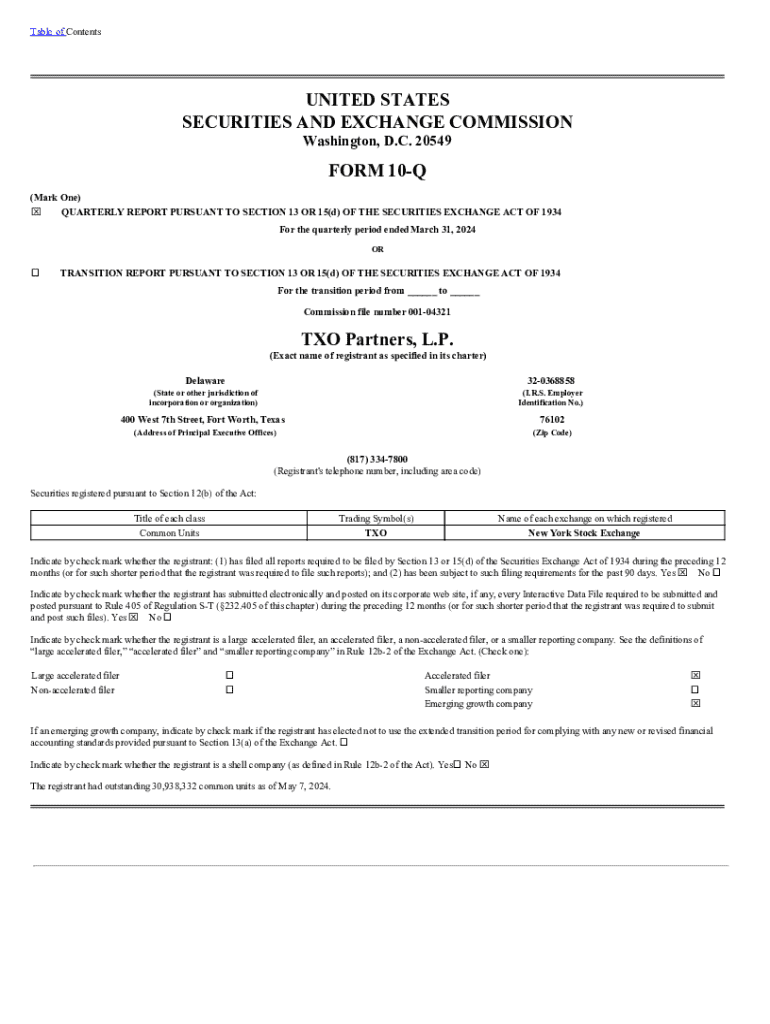

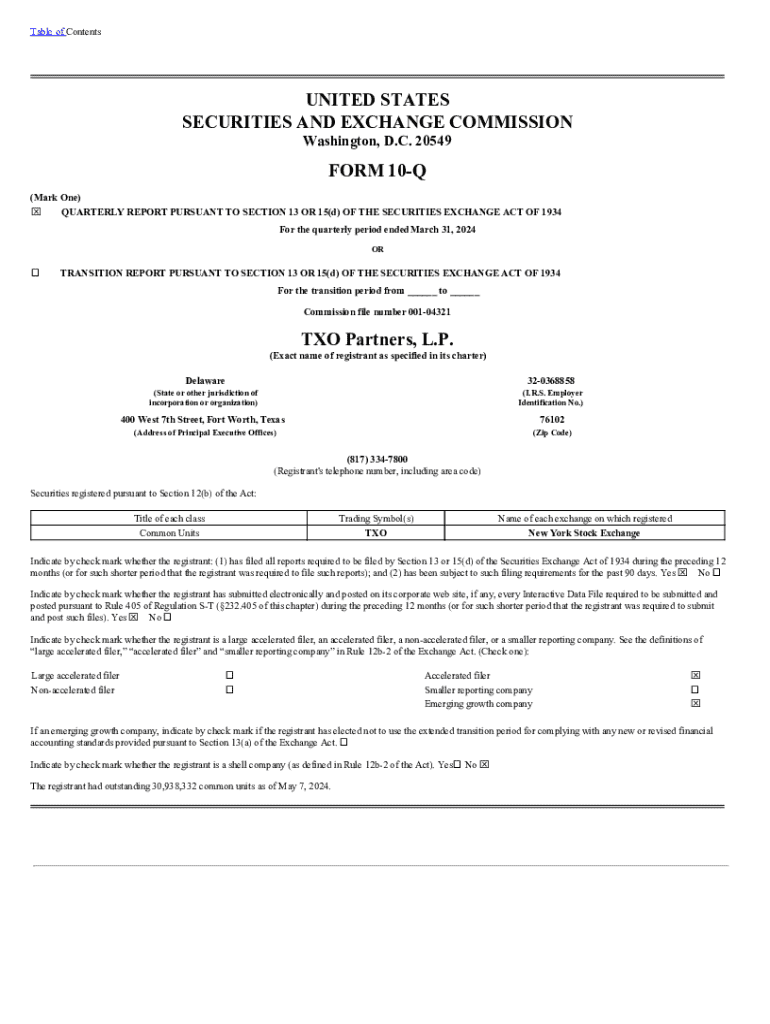

Form 10-Q is a comprehensive quarterly report mandated by the U.S. Securities and Exchange Commission (SEC) for publicly traded companies. This form provides a thorough overview of a company's financial performance over a fiscal quarter. Unlike the annual Form 10-K, Form 10-Q is less detailed but still crucial for stakeholders to gauge a company’s ongoing financial health. Investors, analysts, and regulatory authorities rely heavily on this document to make informed decisions.

The importance of Form 10-Q cannot be overstated; it offers key insights into a company’s operational results, including earnings and cash flow. Additionally, it highlights any significant changes within the business or its market environment since the last report. Understanding how Form 10-Q differs from other SEC filings, particularly the Form 10-K, is critical. The 10-Q is filed quarterly and consists of interim financial statements, while the 10-K is an annual comprehensive report including detailed accounts and management analysis.

Components of the Form 10-Q

The Form 10-Q is structured into several critical sections that report different aspects of a company's financial condition and operational results. Understanding these components allows stakeholders to quickly assess vital information. Each quarterly filing includes mandatory sections, such as financial statements, management's discussion and analysis (MD&A), a brief business description, and disclosures about market risks.

What’s included in the Form 10-Q?

Each section of the Form 10-Q provides valuable insights crucial for stakeholders. The financial statements section typically includes three primary documents— the balance sheet, the income statement, and the statement of cash flows. These statements provide detailed accounts of the company’s financial position and performance over the quarter.

Management’s discussion and analysis (MD&A) section delves into critical trends affecting the company's operational results, discussing factors such as sales growth, cost management, and external market conditions. In the business description, a company gives an overview of its operations and elucidates the competitive landscape in which it operates. The market risk disclosures highlight any key risks that could potentially impact business operations, offering a transparent view on factors affecting profitability and stability.

Filing requirements for Form 10-Q

Understanding the filing requirements is essential for compliance. Public companies, including both domestic corporations and foreign companies that have securities registered with the SEC, must file the Form 10-Q. The frequency of these filings is quarterly, while the deadlines depend on the filing status and market capitalization of the company.

Finding Form 10-Q filings

Accessing Form 10-Q filings is straightforward through the SEC’s EDGAR database. This online repository provides public access to a wide array of filings submitted by publicly traded companies. By utilizing search functions like company name, SIC code, or filing date, stakeholders can efficiently locate specific Form 10-Q documents.

For individuals seeking to keep track of multiple companies, setting alerts for particular filings can help streamline research. Furthermore, it's advantageous to become acquainted with the EDGAR system's search tools, as many investors and analysts find forms and data readily accessible through user-friendly queries.

Best practices for completing a Form 10-Q

Filling out a Form 10-Q accurately is critical for compliance and investor confidence. Start by gathering necessary financial documents and reports, ensuring all data is current and precise. Collaborating with finance and legal teams is essential to validate that reported figures reflect actual financial performance and adhere to SEC guidelines.

Using digital tools can notably improve data accuracy. For example, pdfFiller’s platform provides functionalities that assure the integrity of the form’s data by incorporating templates and editing features. Clear disclosures and a commitment to transparency are crucial as they help demonstrate the integrity of the company's reporting practices. Remember always to ensure compliance with SEC guidelines to avoid potential penalties.

Common mistakes to avoid when filing a Form 10-Q

Despite the structured format of Form 10-Q, companies can still encounter pitfalls during the filing process. Common mistakes range from simple documentation errors, such as typos and incorrect figures, to misinterpretation of reporting requirements that may lead to inaccuracies in financial data.

Leveraging tools for form management

Utilizing platforms like pdfFiller can ease the complexities of managing Form 10-Q filings. Features such as PDF document editing facilitate accurate alterations to financial statements and ensure that all updates reflect the latest figures. The eSigning functionalities streamline the approval process, allowing for quick responses within financial teams and expediting the filing process overall.

Moreover, collaboration tools allow for seamless inputs from multiple departments, enhancing the accuracy and quality of reports. Embracing a cloud-based solution for filing and managing Form 10-Qs promotes efficiency, as users can access and modify documents from anywhere, thus significantly reducing time constraints typically faced in the filing process.

Understanding the impact of 10-Q filings

The implications of Form 10-Q filings extend beyond mere compliance; they significantly influence investor behavior and market perceptions. Timely and accurate disclosures foster trust among investors and serve to attract new stakeholders. Stakeholders analyze these quarterly reports for indicators of financial health and company trends, which can trigger market reactions, such as fluctuations in stock prices.

Consistency in reporting reflects a management culture committed to transparency and accountability. Frequent disclosures bolster investor confidence, while irregularities can lead to skepticism, affecting stock performance and company reputation in the long run.

Interactive tools for Form 10-Q preparation

pdfFiller offers a suite of interactive tools designed to enhance the process of preparing Form 10-Q filings. Access to templates in the platform simplifies the start of the reporting process, while pre-filled form features allow users to save time on repetitive entries. Digital workflow capabilities further support document management by enabling teams to keep track of changes and updates efficiently.

To maximize these tools during the filing process, teams should employ a collaborative approach, utilizing shared access features to enable real-time updates and discussions. This ensures that various inputs are harmonized while maintaining the integrity of reported data, allowing for a smooth and efficient submission.

Regulatory landscape surrounding Form 10-Q

The regulatory environment surrounding Form 10-Q filings is shaped primarily by the SEC, which continues to adjust requirements to promote transparency and investor protection. Recent regulatory changes have introduced more stringent requirements regarding risk disclosures and the presentation of financial data, making it essential for companies to stay informed about ongoing updates.

As the regulatory landscape evolves, companies must adapt their reporting approaches accordingly. Future trends may emphasize greater integration of technology in the reporting process, pushing firms towards increased digitization and real-time disclosures, thereby enhancing the quality and timeliness of information shared with stakeholders.

Connecting with additional resources

Engaging with forums and communities focused on financial filings can provide additional insights and support for professionals navigating the complexities of SEC requirements. Many organizations host workshops and webinars that detail the latest best practices in financial reporting, including Form 10-Q filings. Utilizing these resources can enrich your understanding and help maintain compliance.

Official SEC resources are also invaluable tools for companies and individuals seeking to enhance their knowledge of Form 10-Q and other related filings. Staying informed through these channels ensures that companies remain current with regulations while reinforcing a commitment to compliance and accountability.

Expanding your knowledge: Next steps in SEC filings

For professionals looking to deepen their understanding of SEC filings, familiarizing oneself with other related forms, such as Form 10-K and Form S-1, is essential. Each form serves a unique purpose in the reporting spectrum but together they provide a holistic view of a company's financial standing and strategic direction.

Building a comprehensive financial reporting toolkit with pdfFiller can greatly streamline the filing process, enabling swift adjustments and maintaining accuracy across multiple documents. This adaptability helps companies navigate the regulatory landscape while ensuring a consistent and professional approach to financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 10-q online?

How do I edit form 10-q in Chrome?

Can I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.