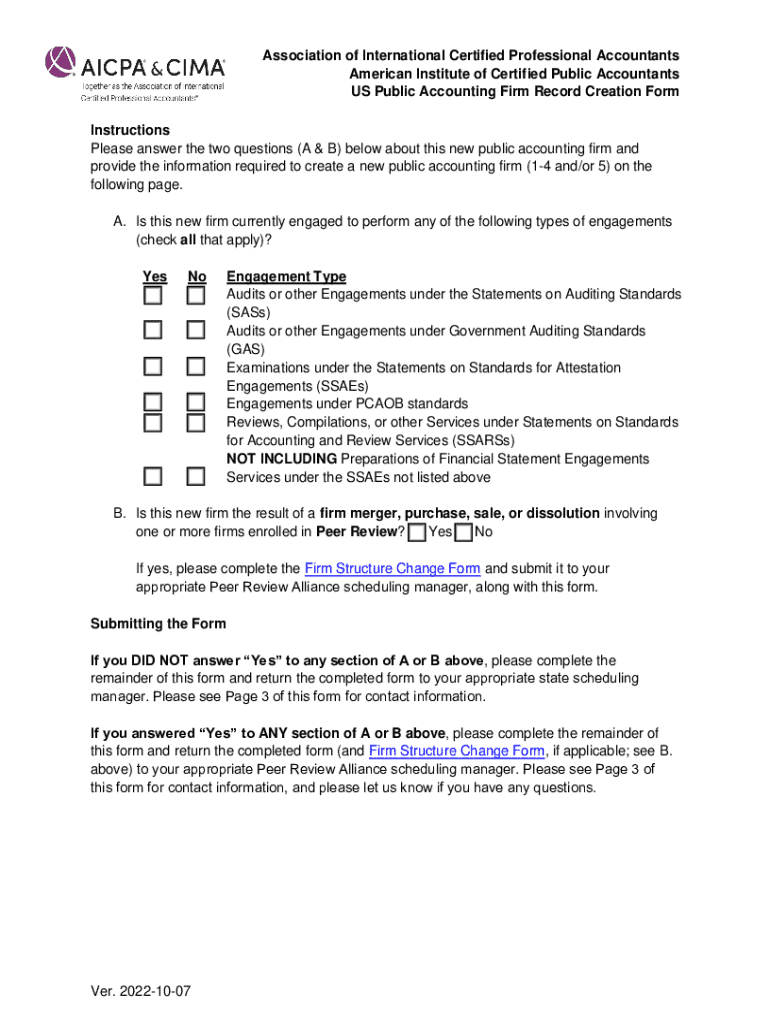

Get the free Us Public Accounting Firm Record Creation Form

Get, Create, Make and Sign us public accounting firm

How to edit us public accounting firm online

Uncompromising security for your PDF editing and eSignature needs

How to fill out us public accounting firm

How to fill out us public accounting firm

Who needs us public accounting firm?

Comprehensive Guide to US Public Accounting Firm Forms

Overview of US public accounting firms

Public accounting firms play a pivotal role in the financial ecosystem by providing essential services such as auditing, tax preparation, and consultancy to diverse clients, including individuals, corporations, and government entities. These firms are often the first line of defense against financial misconduct, ensuring integrity in financial reporting and compliance with regulatory standards. Their expertise not only benefits their clients but also strengthens the overall economic framework by fostering trust and transparency in financial markets.

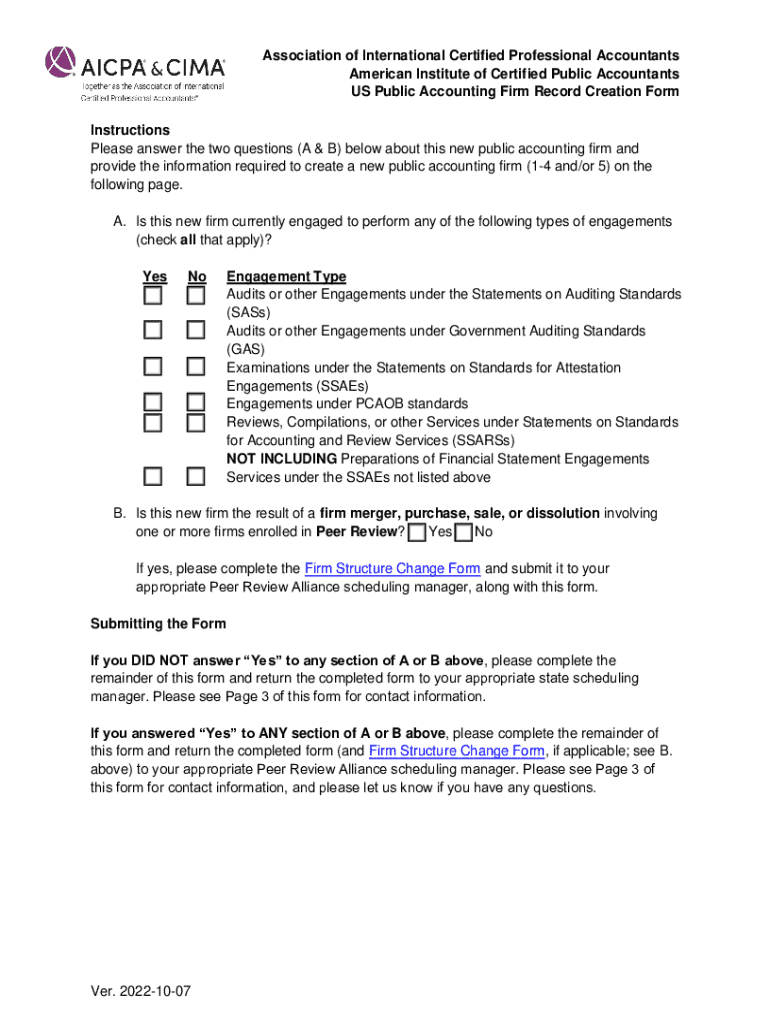

Adhering to regulatory standards is critical for the functionality of these firms. Agencies such as the Public Company Accounting Oversight Board (PCAOB) and the American Institute of Certified Public Accountants (AICPA) set stringent guidelines that all public accounting firms must follow. Compliance ensures that firms maintain a high level of professional conduct, which is crucial in building credibility with clients and stakeholders.

Key forms for public accounting firms

To operate effectively, public accounting firms must complete and submit a variety of forms to comply with statutory and regulatory requirements. Each of these forms serves a specific function in documenting the firm's status, operational procedures, and compliance with professional standards. Understanding the purpose and requirements of these documents is essential for the smooth operation of any public accounting firm.

Form 6R - Application for Public Accountancy Firm Registration

Form 6R is a foundational document that establishes your firm as a licensed public accounting entity. This application must be completed accurately to ensure approval and compliance. The necessity of this form cannot be overstated, as it serves as the first step in formalizing your public accounting operations.

To complete Form 6R, follow these detailed steps: Gather the necessary documentation, including proof of CPA licensure, business structure, and partnership agreements if applicable. Fill out the form accurately with all required information, and be cautious to review your entries for errors, as inaccuracies can lead to delays.

Common mistakes include incomplete information, misrepresenting ownership, and neglecting to provide necessary documentation. Avoiding these pitfalls is crucial for an efficient registration process.

Form 6C - Certification of Ownership and Attest Competency

Form 6C verifies the ownership structure of the firm and assesses the competency of individuals responsible for attestation services. This certification not only reinforces the credibility of your firm but also ensures compliance with state regulations governing public accountants.

The required documentation typically includes ownership declarations, proof of CPA licenses for stakeholders, and any attest competency certifications. The submission process involves including these documents with Form 6C when sending it to the appropriate regulatory body.

Challenges during certification often stem from incomplete ownership disclosures or discrepancies in licensing. Ensuring all documents are organized and filled out completely will mitigate these issues.

Form 6PR - Peer Review, Competency, and Annual Statements

Peer reviews are essential in maintaining professional standards within public accounting firms. Form 6PR documents the outcome of these reviews and assesses the firm's overall competence in providing accounting services. This form is integral for firms to demonstrate their qualifications and to maintain public trust.

To prepare Form 6PR, firms must conduct a self-assessment followed by an external peer review based on prescribed guidelines. Submissions must include findings of the review and corrective actions taken in response to any identified deficiencies.

Understanding competency requirements entails being aware of state-specific mandates and ensuring that team members meet ongoing professional education standards.

Form 6T - CPA Firm Triennial Registration

Triennial registration is crucial for the continuity of practice for CPA firms. Form 6T must be completed and submitted every three years, confirming that the firm continues to meet all licensing and operational standards.

The timeline for registration renewal should be noted; firms need to set reminders several months in advance to avoid lapses in their operating authority. All necessary documentation should be prepared before submission, ensuring timely processing.

Key considerations for compliance include updating any changes in ownership, structure, and ensuring that continuing education requirements for all CPAs in the firm are fulfilled.

Other relevant forms and documentation

In addition to the primary forms discussed, firms should also be aware of other relevant documentation such as Form 2, the Annual Report Form. This form provides a summary of firm operations and compliance status over the past year.

The purpose of this form is to communicate any changes to regulatory bodies and to ensure all operational standards continue to be met. Compliance guidelines typically require that this form be submitted annually, detailing financial information and any changes in ownership or structure.

General instructions for form submission

Submitting forms correctly is vital to avoid penalties and ensure compliance. Here’s a step-by-step guide: First, gather all required documents corresponding to your form. Second, fill out the form completely, checking for accuracy. Lastly, submit your form either electronically via the designated online portal or by mail according to the instructions provided.

When considering electronic submissions, ensure you comply with any digital signature requirements. For paper submissions, use certified mail for tracking purposes. If you have questions about form requirements or need clarification on specific sections, consulting with legal or financial advisors can provide valuable guidance.

Identity and contact information requirements

Accurate identity and contact information are paramount when submitting forms. Regulatory bodies need this information to verify the legitimacy of the firm and to maintain updated records. Applications without clear identification may face processing delays or rejections.

Required details typically include the firm’s registered name, physical and mailing addresses, and primary contact information for correspondence. Double-checking this information against official documents can prevent issues during submission.

Insights on completing the forms

Best practices for filling out these forms effectively include allocating ample time to complete each document. Rushing increases the likelihood of errors. Break down the requirements into manageable sections and tackle them one at a time to ensure thoroughness.

Utilizing platforms like pdfFiller can streamline this process. With its capabilities, users can edit PDFs easily, apply electronic signatures, and collaborate in real time, ensuring every team member has access to the latest version of a document. This cloud-based solution enhances workflow efficiency significantly.

Common pitfalls to avoid include misreading questions, failing to attach necessary documentation, and neglecting to keep copies of submitted forms for records. Regularly reviewing form instructions will help mitigate these errors.

Collaboration tools for teams

Collaboration is essential for ensuring accurate and timely completion of required forms. Utilizing tools such as shared document storage and collaboration platforms allows team members to work together effectively. Features like version control and comment capabilities can help streamline communication around form requirements.

Real-time collaboration in tools like pdfFiller means everyone can edit and view changes instantaneously, which enhances the quality of submissions and reduces the potential for miscommunication.

Managing your forms and documentation

Robust document management is crucial for public accounting firms. Establishing strategies for storing and organizing submitted forms is essential for compliance and potential audits. Create a file management system that categorizes documents by type and year, making retrieval straightforward.

Long-term management of documentation involves regularly updating records to reflect current status and any changes within the firm. It’s important to maintain an audit trail to demonstrate compliance during regulatory reviews or audits.

Legal and compliance considerations

Operating a public accounting firm entails several legal obligations. From adhering to ethical conduct standards to maintaining specific insurance policies, compliance is not negotiable. Regularly reviewing state and federal regulations relevant to public accounting can keep firms ahead of potential complications.

Compliance checklists can serve as helpful tools in ensuring that all necessary forms are submitted timely and accurately. Keeping abreast of regulatory changes is critical, which can be achieved through ongoing education and professional development for firm members.

Interactive tools and resources

Numerous online tools are available to assist with filling and managing accounting forms. pdfFiller stands out with features that enhance the document workflow, including easy editing, eSigning, and comprehensive collaboration capabilities. Its user-friendly interface simplifies the process from start to finish.

Case studies of firms that successfully navigated the form submission process using these tools demonstrate practical application. From streamlining document workflows to ensuring regulatory compliance, the right resources can significantly enhance a firm’s operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute us public accounting firm online?

How do I fill out us public accounting firm using my mobile device?

How do I complete us public accounting firm on an iOS device?

What is a US public accounting firm?

Who is required to file with a US public accounting firm?

How to fill out a US public accounting firm?

What is the purpose of a US public accounting firm?

What information must be reported on a US public accounting firm?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.