Get the free De 4

Get, Create, Make and Sign de 4

Editing de 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out de 4

How to fill out de 4

Who needs de 4?

DE 4 Form: A Comprehensive How-to Guide

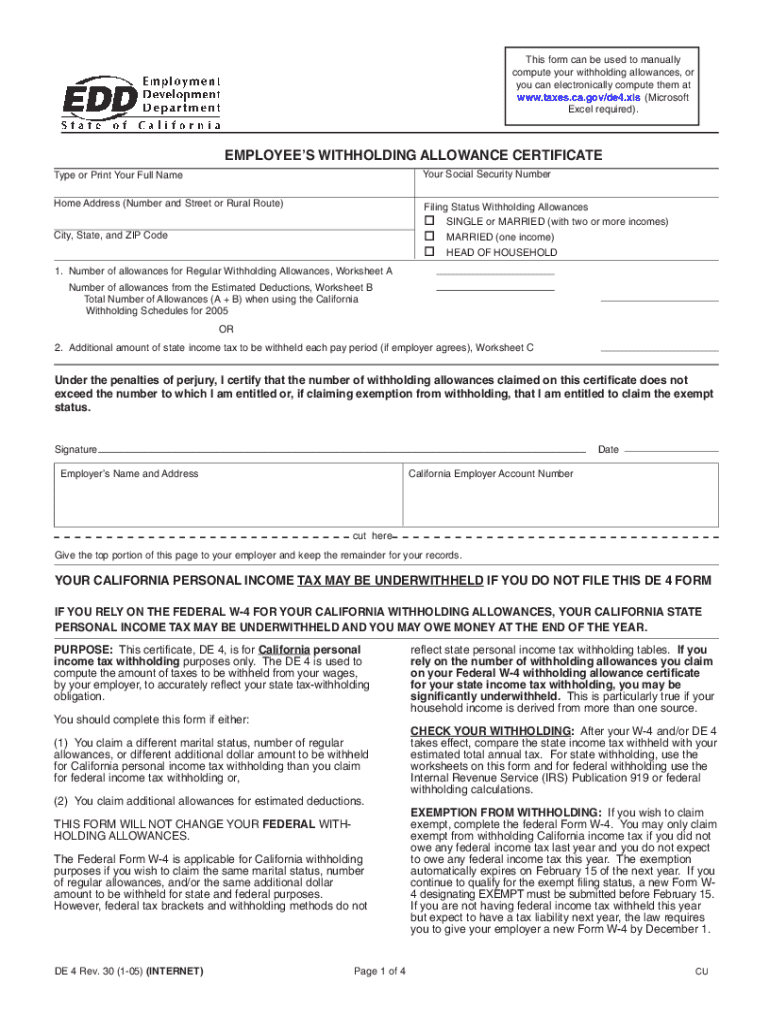

Understanding the DE 4 Form

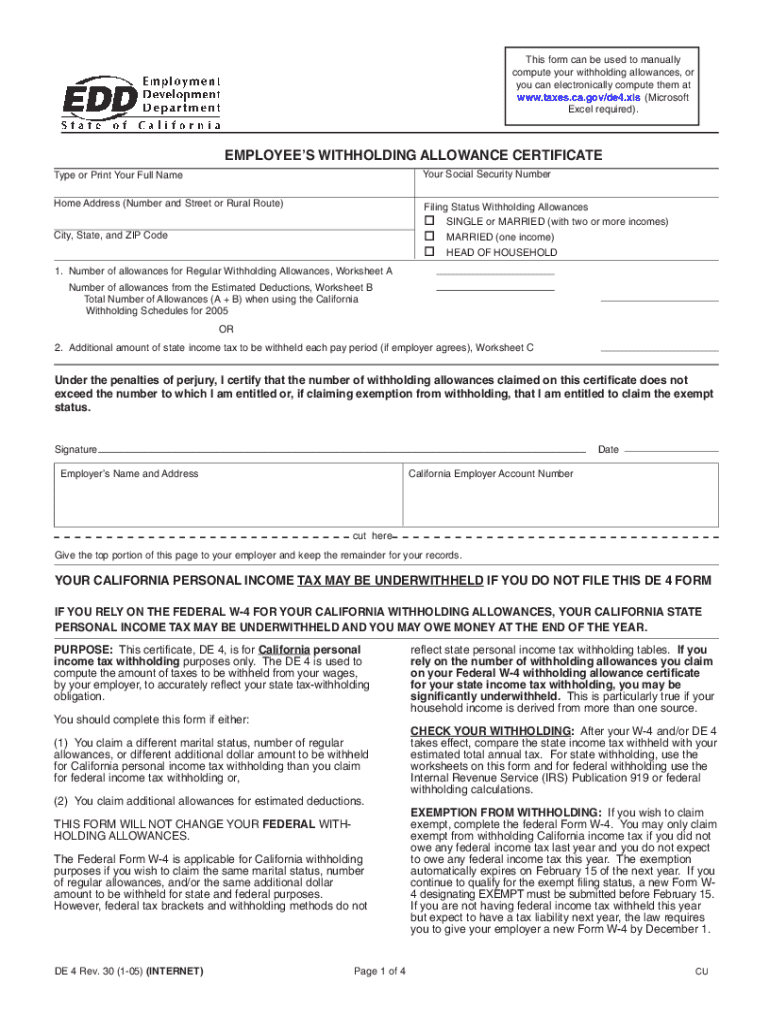

The DE 4 Form is an essential document used by California employees to manage their state income tax withholdings. It serves as a declaration of an individual's anticipated circumstances and demands for tax purposes, ensuring that employers withhold the correct amount of state tax from each paycheck. Properly completing this form is crucial; it helps avoid under-withholding, which can lead to unexpected tax bills, or over-withholding, which can result in reduced take-home pay.

Employers require the DE 4 Form to calculate how much state income tax to withhold based on your filing status, allowances claimed, and any additional withholding requests. By adjusting withholdings through this form, employees can tailor their financial situations to better suit their needs and avoid financial surprises come tax season.

Who Needs to Fill Out the DE 4 Form?

Employees who find themselves in certain situations should complete the DE 4 Form. New employees are often required to fill this out as part of the onboarding process. Additionally, current employees who experience any life changes—such as marriage, divorce, or the birth of a child—may also need to revisit this form to adjust their withholdings. Those looking to optimize their financial planning should also consider completing the DE 4 if they believe their tax situation has changed significantly.

Key components of the DE 4 Form

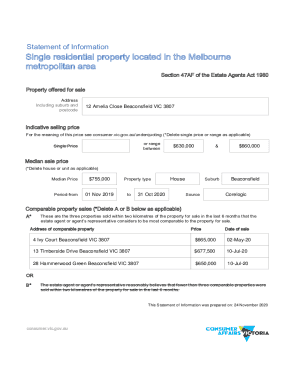

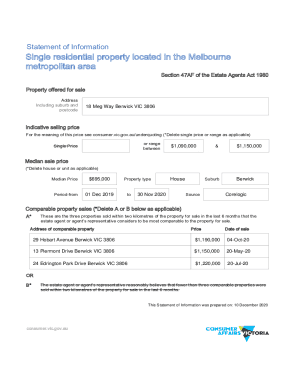

Understanding the specific sections of the DE 4 Form is vital for effective completion. The form begins with personal information such as your name, address, and Social Security number, which are crucial for identifying your records. It then includes a section to declare your filing status – whether you’re single, married, or head of household – which influences your tax calculation.

Another critical aspect of the form is the Allowance Worksheet, which helps you determine how many allowances to claim. Allowances directly impact your withholding amounts; the more you claim, the less tax is withheld. Finally, don’t forget the signature and date section, which authenticates the document. It’s imperative to check each section thoroughly to avoid common mistakes that can affect tax withholdings.

Common mistakes to avoid

When filling out the DE 4 Form, errors can lead to incorrect withholdings, causing future financial issues. One common mistake is misreporting the Social Security number, which can create mismatches in identity verification. Another frequent pitfall is miscalculating allowances due to improper use of the worksheet; it’s important to understand your financial situation to determine the correct number.

Additionally, overlooking required signatures can result in a rejected form. To ensure accuracy, double-check all entered information, consult resources if uncertain about tax situations, and consider using digital tools that can help prevent errors.

How to fill out the DE 4 Form

Filling out the DE 4 Form is straightforward, but careful attention to detail is crucial. Start by inputting your personal information in the first section. Be accurate with your name and ensure your address is up to date, as this is how the IRS will recognize you. Next, select your filing status; if your situation fluctuates, choose the option that best reflects your current situation to get the most accurate withholding rate.

Moving onto the Allowance Worksheet, you’ll want to assess your financial circumstances, including dependents and potential tax credits when calculating your allowances. Once you’ve completed these sections, don’t forget to sign and date the form at the bottom. Ensuring that every part is filled out correctly may seem tedious, but it’s necessary for your financial well-being.

Interactive tools for calculating allowances

Many online resources can assist in determining the appropriate number of allowances for your DE 4 Form. Tools like tax calculators and worksheets available on reputable tax websites simplify this process. One such tool is provided by pdfFiller, which offers interactive templates to aid in calculating your allowances based on current tax regulations and personal financial details.

By utilizing these calculators, you can enter your financial situation, and they will provide a recommendation on how many allowances to claim, making it easier to adjust withholdings accurately and manage your finances effectively. These resources add an extra layer of convenience and accuracy, whether for a seasoned tax filer or a new employee.

Editing and customizing your DE 4 Form with pdfFiller

pdfFiller empowers users with cloud-based editing features that streamline the process of filling out and customizing the DE 4 Form. You can easily upload a blank or previously completed version of the form to the platform. Once uploaded, tools are available for text addition, highlighting, and annotating to clarify details or add notes, ensuring your form is tailored to your specific needs.

Moreover, pdfFiller’s user-friendly interface allows easy transitions between different sections of the DE 4 Form. The ability to have your form ready for submission at any time also contributes to efficiency in your tax preparation process, particularly if you need to make last-minute adjustments. Collaborating with team members in a corporate setting is also enhanced, as multiple users can edit and comment on the same document simultaneously.

eSigning the DE 4 Form

Once your DE 4 Form is complete and customized, you can easily apply an electronic signature using pdfFiller's eSigning feature. This step ensures that your document is legally binding and expedites the submission process. The benefits of eSigning include faster processing times and improved convenience, as you can sign the form directly from your device without the hassle of printing, signing, and scanning. This seamless process saves time and simplifies tax documentation for everyone involved.

Submitting the DE 4 Form

After completing your DE 4 Form, it's crucial to understand where to submit it. The submission process varies based on your employment situation. For new hires, submitting the DE 4 Form directly to your payroll or human resources department is typically required. If you are a contractor, follow your client's guidelines for submitting tax documents to ensure compliance.

Utilizing pdfFiller, submission can be monitored easily. The platform provides tracking capabilities that let you see when your form is received and processed. Such tracking is especially useful if you are submitting the form close to deadlines, as you can confirm completion and ensure everything is in order for your personal records.

Frequently asked questions (FAQ) about the DE 4 Form

Understanding the intricacies of the DE 4 Form often raises several questions. A common inquiry revolves around what to do if a mistake occurs after submission. In this case, the best approach is to promptly notify your employer and submit a corrected form outlining the necessary changes. Keeping lines of communication open with HR can help you address any discrepancies effectively.

Another question is regarding how often employees should update the DE 4 Form. Ideally, any significant life event—change in marital status, number of dependents, or tax filing strategy—should prompt a review and possible update of your DE 4 Form. Regularly revisiting this document ensures your tax withholdings remain aligned with your financial situation.

Additional considerations

Adjusting your withholding allowances through the DE 4 Form can have significant implications for your state tax return. For instance, increasing your allowances may lead to less withheld tax, which would boost your take-home pay initially. However, if not balanced correctly, it could result in a tax liability at year-end. Conversely, decreasing allowances increases withholdings, which may lead to a tax refund but affects liquid cash flow during the year.

It's vital to engage in proactive financial planning when it comes to tax withholdings. Utilizing resources available through platforms like pdfFiller, such as calculators and templates, can help facilitate informed decisions regarding your DE 4 Form. Educating yourself about how these changes affect your taxes empowers you to make strategic choices that align with your broader financial goals.

Conclusion on managing your DE 4 Form

Managing your DE 4 Form is a vital aspect of ensuring appropriate tax withholdings throughout the year. By keeping your form updated with accurate information that reflects your current financial and personal situation, you can avoid complications during tax season. Reviewing the form regularly and making necessary adjustments is encouraged for maintaining optimal financial health.

Utilizing tools available through pdfFiller enhances this process, enabling an efficient and effective way to complete, edit, and submit your DE 4 Form. Streamlining this critical aspect of your tax management through pdfFiller not only simplifies the task but also helps you stay organized, making your overall tax experience smoother and more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get de 4?

How do I execute de 4 online?

How do I make edits in de 4 without leaving Chrome?

What is de 4?

Who is required to file de 4?

How to fill out de 4?

What is the purpose of de 4?

What information must be reported on de 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.