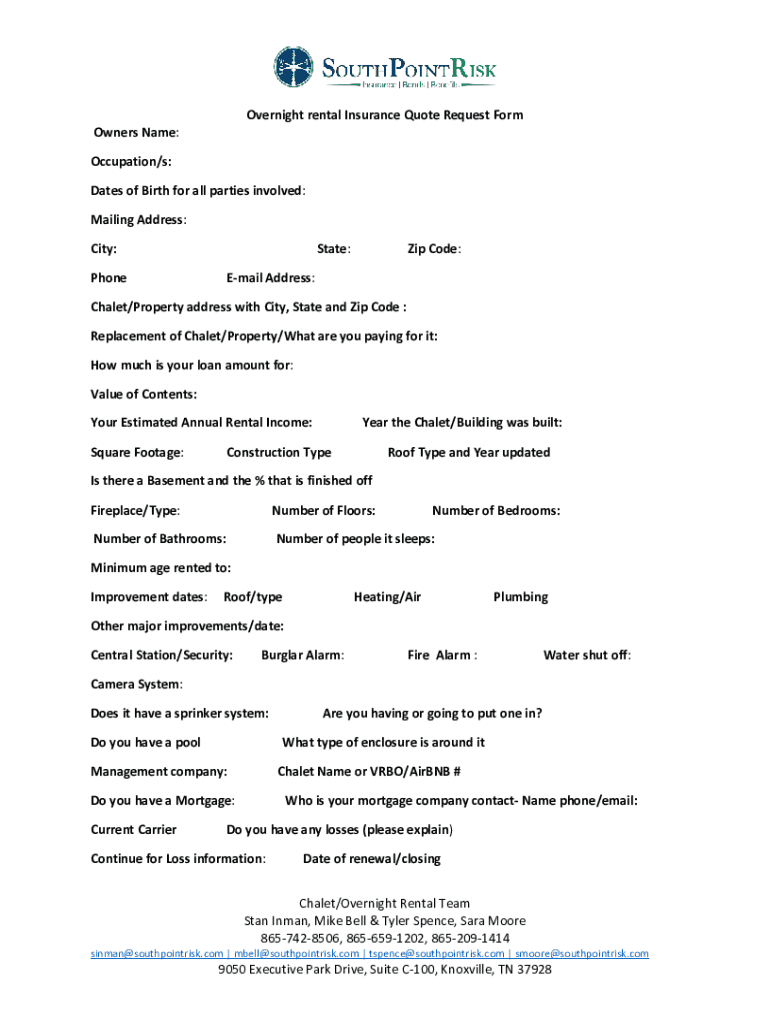

Get the free Overnight Rental Insurance Quote Request Form

Get, Create, Make and Sign overnight rental insurance quote

Editing overnight rental insurance quote online

Uncompromising security for your PDF editing and eSignature needs

How to fill out overnight rental insurance quote

How to fill out overnight rental insurance quote

Who needs overnight rental insurance quote?

Comprehensive Guide to Overnight Rental Insurance Quote Form

Understanding overnight rental insurance

Overnight rental insurance is a specialized type of coverage designed to protect individuals who rent out their properties on a short-term basis. The importance of this insurance cannot be overstated, particularly as the popularity of platforms like Airbnb continues to rise. Property owners face numerous risks, including property damage, liability concerns, and potential loss of income due to unforeseen disasters.

Common risks associated with short-term rentals include accidental damage by guests, theft, and injury claims. Without appropriate coverage, property owners can be left vulnerable to significant financial losses.

Who needs it?

Anyone involved in hosting overnight rentals, whether individuals or teams, needs this insurance. Property owners benefit from peace of mind knowing they have financial protection against various risks. This insurance is particularly crucial for those renting out multiple properties or those who frequently have guests.

Key features of overnight rental insurance

When considering overnight rental insurance, understanding the key features is essential. Comprehensive coverage options generally include property damage protection that safeguards the owner’s investments against malicious or accidental damage caused by tenants. Additionally, liability protection ensures that property owners are covered if a guest or visitor is injured on the premises.

Additional benefits often extend to loss of income coverage, which compensates property owners for earnings lost while repairs are made or the property is uninhabitable. Such policies may also address damage from specific risks, including natural disasters, theft, or vandalism.

Comparing to traditional homeowners insurance

It's crucial to understand that traditional homeowners insurance does not automatically cover short-term rentals. Distinctions between coverage for primary residences versus rental properties can leave property owners exposed if claims arise. Overnight rental insurance provides tailored solutions that address the unique needs of hosts.

Investing in the right overnight rental insurance can help avoid disputes and ensure that hosts are adequately protected against financial losses.

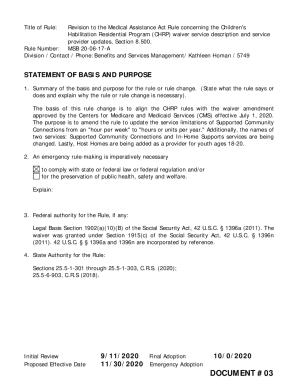

The overnight rental insurance quote form

The overnight rental insurance quote form serves as a gateway for property owners to receive personalized insurance quotes. It streamlines the quoting process and includes interactive elements to enhance user experience. By filling out this form, users can specify their unique coverage needs and receive tailored insurance options.

Accessing the form on pdfFiller is straightforward. Users can navigate to the pdfFiller website, select the overnight rental insurance section, and access the quote form to get started.

Step-by-step instructions for filling out the quote form

Filling out the overnight rental insurance quote form requires providing specific information to ensure accurate quotes. Start with basic personal information such as your name and contact details. The next step involves detailing the property information, which includes the location and type of rental.

Next, identify your specific coverage needs. Depending on your property type, select the relevant coverage options. Consider questions around guest protection and liability to find options that best suit your situation.

Finally, submit the form. Review your entries carefully before submission to avoid errors. After submitting, you will receive confirmation and information on your quote.

Managing your overnight rental insurance quote

Once you have submitted your quote request, managing it effectively is crucial. Utilizing pdfFiller tools allows users to edit and modify their quotes if circumstances change. Regularly reviewing and updating coverage is vital to reflect any alterations in your rental circumstances.

Understanding the quoting process is essential as well. Quotes are calculated based on the information you provide regarding your property and its usage. Typically, you can expect to receive quotes within a few hours, but the timeline may vary based on your chosen insurance provider.

Tips for choosing the right overnight rental insurance

Choosing the right overnight rental insurance is pivotal for property owners. Begin by assessing your specific needs based on guest demographics and potential property risks. Different guests may lead to varying risks; for instance, larger parties may increase the likelihood of damage. Evaluate specific features of your rental property, such as pools or unique installations, which could affect coverage.

When considering different insurance options, it’s essential to compare multiple quotes. Look beyond pricing; assess coverage options to find the best policy for your situation. Utilizing tools on pdfFiller simplifies this process, allowing for easy comparison.

Frequently asked questions (FAQs)

Understanding commonly asked questions can help demystify overnight rental insurance. One frequently asked question is regarding the coverage specifics included in these policies. Typically, overnight rental insurance covers property damage, liability, loss of income, and specific risks associated with short-term rentals.

Another question often raised is about the claims process. Most insurance companies have streamlined claims procedures, allowing for timely resolutions. Additionally, many users wonder what makes pdfFiller unique for managing insurance forms. The platform's interactive tools and cloud-based features offer convenience and accessibility for users.

Best practices for maintaining your rental property insurance

Maintaining your overnight rental insurance is an ongoing responsibility. Regularly updating your coverage based on changes in your property or rental patterns is essential. As your business grows, new risks may emerge, making it vital to reassess your insurance needs.

Documenting the condition of your rental property through visual records is another best practice. Such documentation can be invaluable during the claims process, helping substantiate any claims made. Additionally, maintaining open communication with tenants can foster transparency and safety, ultimately enhancing the rental experience.

Resources for overnight rental hosts

Navigating the landscape of overnight rentals also requires awareness of legal regulations in your area. Familiarize yourself with both state and local laws to ensure compliance, as these can vary significantly across regions. Engaging with community forums or support groups can offer shared insights and experiences from other hosts, supporting your journey as a landlord.

Consider accessing educational materials such as blogs, articles, or webinars that address key aspects of insurance and hosting. Continuous learning not only enhances your hosting experience but also improves your capability to manage risks effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my overnight rental insurance quote in Gmail?

How do I complete overnight rental insurance quote online?

How do I edit overnight rental insurance quote on an Android device?

What is overnight rental insurance quote?

Who is required to file overnight rental insurance quote?

How to fill out overnight rental insurance quote?

What is the purpose of overnight rental insurance quote?

What information must be reported on overnight rental insurance quote?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.