Get the free Property Assessment Appeal Packet

Get, Create, Make and Sign property assessment appeal packet

Editing property assessment appeal packet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property assessment appeal packet

How to fill out property assessment appeal packet

Who needs property assessment appeal packet?

Navigating the Property Assessment Appeal Packet Form: A Comprehensive Guide

Understanding the property assessment appeal packet form

A property assessment appeal packet form is a crucial document used by property owners who believe that their property's assessed value is higher than its actual market value. This form initiates the appeal process, allowing individuals to contest their tax assessments. Understanding this form and the associated processes is essential for homeowners wanting to ensure they're not overpaying on property taxes.

Filing an appeal can significantly reduce property tax burdens if the assessment is found inaccurate. This process is important as it directly impacts a person's financial standing and ensures equitable taxation. Key terms such as 'appraisal', 'market value', and 'board of equalization' will help navigate this complex landscape.

Preparing for your appeal

Before embarking on the appeal process, it is essential to undertake a thorough assessment of your property's value. Begin by reviewing your property assessment notice, which provides estimates and details on how your property's value was determined. Understanding these aspects will form the basis of your appeal.

Gathering necessary evidence is vital. Collect recent sales data of comparable properties in your area, photographs of your property, and any other pertinent documents. Knowing when to file an appeal is equally critical; indicators such as inconsistencies in assessments, or if neighboring properties with similar characteristics have significantly lower assessments, should prompt action.

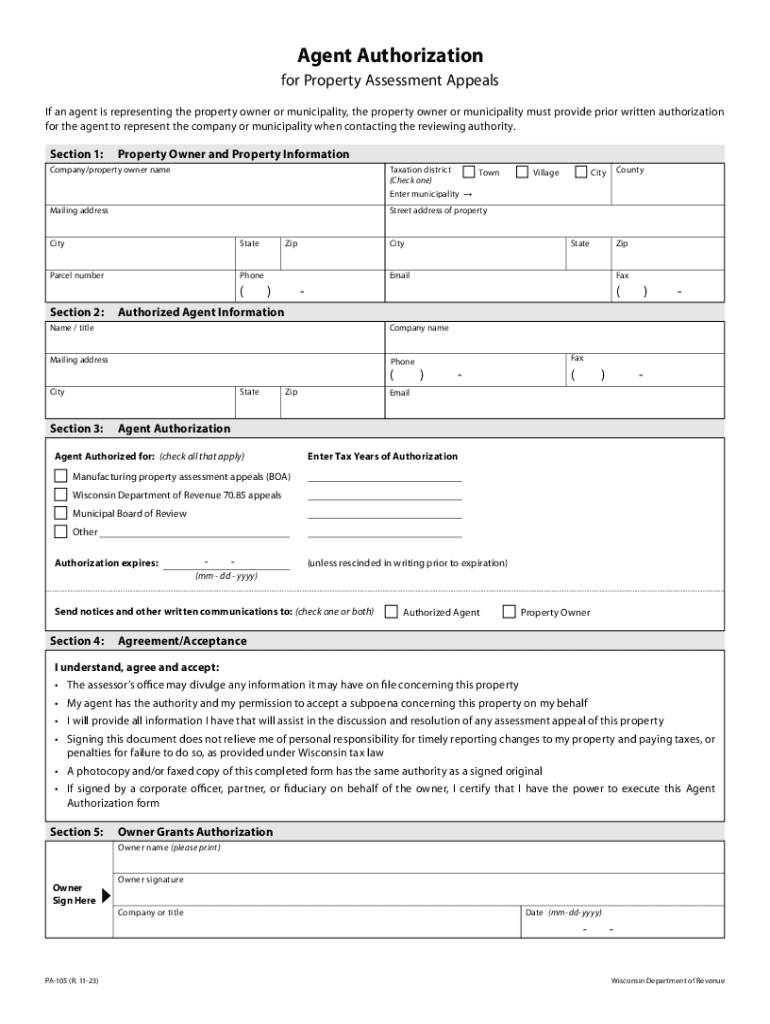

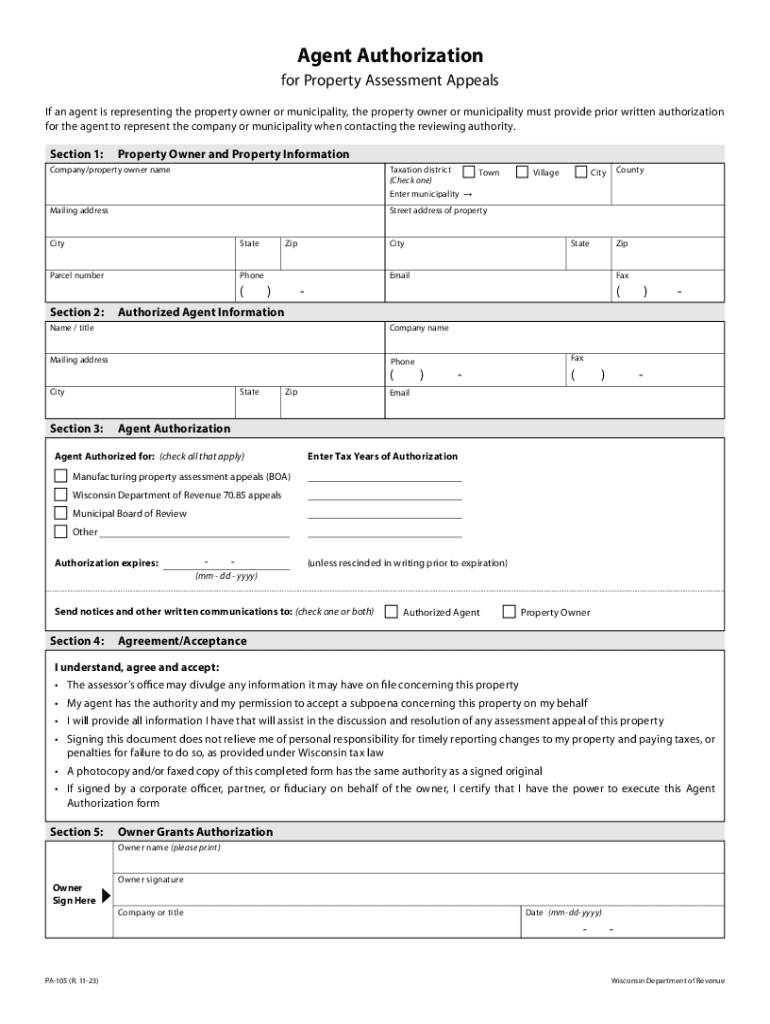

Completing the property assessment appeal packet form

Filling out the property assessment appeal packet form requires careful attention to detail. Start with identifying information, including your name, address, and relevant property details. Accurate property descriptions are crucial; report square footage, type of property, and any unique features that impact its value.

When articulating grounds for your appeal, clearly state your reasons for contesting the assessment. Collect supporting documents to attach to your form, such as comparative sales data and any photographs taken to document the property's condition. Accuracy and clarity are key here, as part of your appeal's success may hinge on how well you present your case.

Submitting your appeal

Once you’ve completed the property assessment appeal packet form, you have two options for submission—online or via mail. Online submission through platforms like pdfFiller offers the convenience of managing your form efficiently with immediate access and oversight of the process.

If you choose mail submission, ensure that you are following guidelines for sending physical forms. It's imperative to send them to the correct address and to use secure delivery methods to prevent any potential delays or loss of your appeal. Keeping a record of your submission can be beneficial.

The appeal process after submission

Once submitted, your appeal will be reviewed by the Board of Equalization or a designated appeal board. This body examines the details of your submission, evaluates the evidence, and makes a determination on your case. Key milestones include notification of your hearing date, discussion of your appeal, and the final decision.

If your appeal is accepted, it may result in a lowered property assessment, thus reducing your tax obligation. Conversely, if denied, you will receive a written explanation of the decision. Understanding these possible outcomes is essential, as they will dictate your next steps whether you will accept the decision, or consider further appeal routes.

Getting help with your appeal

Filing an appeal can be a complex process that often requires keen attention to detail. Common challenges include navigating various forms, understanding legal language, and ensuring all documents are correctly filled out. Many local government resources provide assistance, which can be invaluable during this process.

Additionally, seeking professional appraisal assistance can smooth the process, giving you expert insight into the local market conditions and helping you present a solid case.

Additional considerations and FAQs

When preparing your appeal, be aware of potential costs, such as filing fees and other associated expenses. Understanding these costs from the outset can help you budget appropriately and avoid surprises.

Frequently asked questions often include how often appeals can be filed, what to do if you own multiple properties, and the differences in appeal processes across various states or counties. These insights are critical for a comprehensive understanding of your situation.

Success stories and real-world examples

Examining case studies of successful appeals showcases the importance of preparation and understanding your local property market. In one notable case, a homeowner presented compelling evidence proving that the assessed value was inflated based on local property sales. This appeal resulting in a substantial decrease in their property taxes—demonstrating the power of informed advocacy.

On the flip side, lessons learned from unsuccessful appeals often revolve around the need for thorough evidence and clarity in presenting one's case. These real-world examples highlight that effective preparation combined with clear communication can yield positive results.

Managing your documents with pdfFiller

Utilizing a platform like pdfFiller for managing the property assessment appeal packet form and other related documents simplifies the entire process. Users benefit from streamlined document management that includes editing, e-signing, and secure storage. The collaborative features enable teams to work together efficiently, especially helpful for businesses or groups managing multiple properties.

From signing to sharing, pdfFiller’s tools are designed to enhance your workflow, making it easy to keep all your documents organized and accessible. This not only saves time but also ensures that all necessary information is at your fingertips when filing your appeal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit property assessment appeal packet online?

How do I edit property assessment appeal packet on an iOS device?

How do I complete property assessment appeal packet on an iOS device?

What is property assessment appeal packet?

Who is required to file property assessment appeal packet?

How to fill out property assessment appeal packet?

What is the purpose of property assessment appeal packet?

What information must be reported on property assessment appeal packet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.