Get the free Form Nport-p

Get, Create, Make and Sign form nport-p

Editing form nport-p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form nport-p

How to fill out form nport-p

Who needs form nport-p?

Mastering the NPORT-P Form: A Comprehensive Guide for Investors and Fund Managers

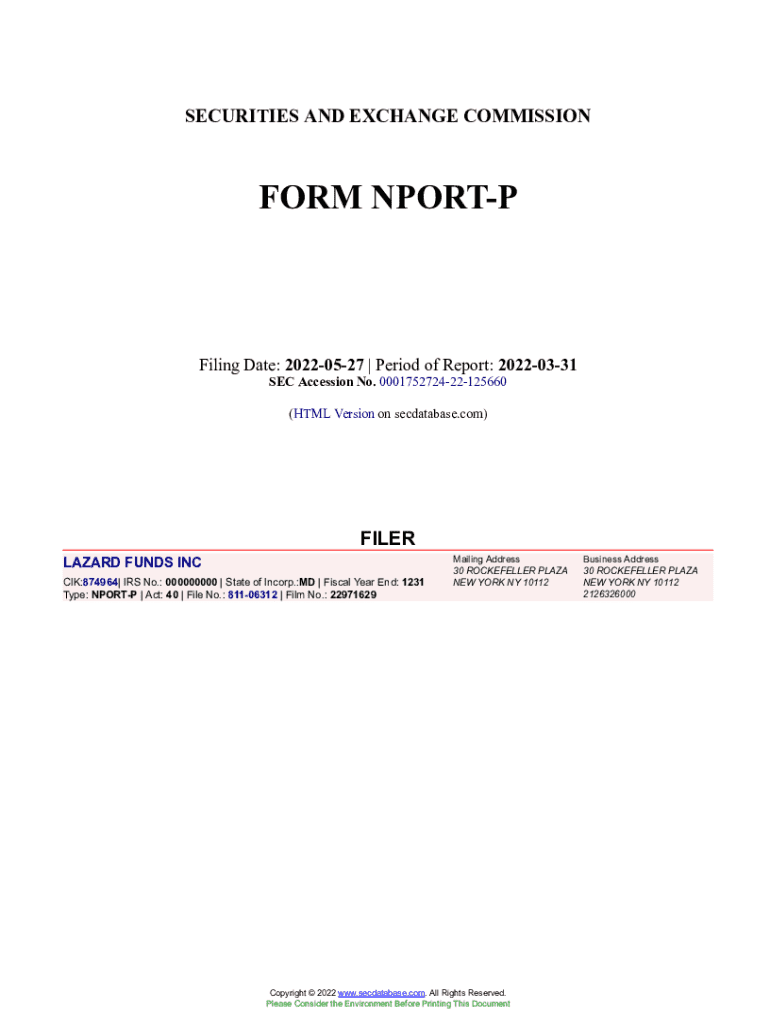

Understanding the NPORT-P form

The NPORT-P form is a critical tool in the realm of investment reporting, designed to ensure transparency for funds and their investors. This form provides a comprehensive overview of a fund’s portfolio, aligning with the regulatory demands imposed by the Securities and Exchange Commission (SEC). By mandating detailed disclosures, the NPORT-P form plays an essential role in helping funds and investors meet their compliance obligations while fostering enhanced investor confidence in the integrity of their investments.

Historically, the introduction of NPORT requirements stemmed from the need for improved portfolio transparency following the 2008 financial crisis. This crisis underscored the risks associated with opaque investment strategies, prompting regulators to require more detailed reporting. The NPORT-P form specifically enhances portfolio transparency, allowing investors to make informed decisions, thereby restoring trust in financial markets.

Key components of the NPORT-P form

To effectively utilize the NPORT-P form, it’s essential to understand its key components. The filing entity’s information is foremost, which includes details like the name, address, and tax identification number of the organization submitting the report. Different classifications of filers, such as registered investment advisors or mutual funds, have distinct requirements, underscoring the need for accurate identification.

The NPORT-P form is structured into three main parts: Part A covers general information about the registrant and series, while Part B offers insights into the fund's characteristics, such as investment objectives and strategies. Part C is particularly detailed, requiring a schedule of portfolio investments that outlines asset categories, their fair value, and other relevant metrics vital for evaluating fund performance.

Step-by-step instructions for completing the NPORT-P form

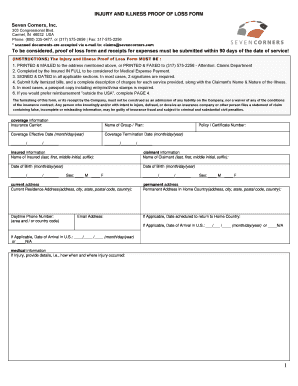

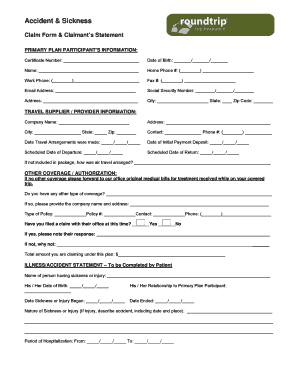

Completing the NPORT-P form can be daunting without proper guidance. Start by gathering necessary information such as fund performance data, asset class details, and fair value assessments. From there, it's essential to have a clear documentation strategy to accurately reflect each investment's specifics. Utilizing robust financial software or well-organized spreadsheets can facilitate this process.

As you fill out each section of the form, focus on the clarity and consistency of your entries. Establish a checklist of common pitfalls—such as categorization errors or incorrect valuations—to streamline your completion process. Always remember that your entries must align with U.S. Generally Accepted Accounting Principles (GAAP), ensuring compliance with regulatory standards.

Specific reporting requirements

The NPORT-P form is comprised of numerous line items, each carrying specific reporting requirements. It is important to break down each line item, analyzing what is required under each heading. For instance, the section on investment types demands accurate classification of asset categories like equities, fixed income, and derivatives. It's crucial to provide clear examples of acceptable entries to guide filers in reporting accurately.

Moreover, common misconceptions often arise around terms related to valuation metrics and categorization. Clear distinctions between terms like ‘net asset value’ and ‘fair value’ should be highlighted to mitigate confusion. In handling uncommon scenarios—such as a fund comprised of specialized asset types—it is advisable to provide hypothetical case studies that clarify how to report complex fund structures effectively.

Common pitfalls in NPORT-P filing

Filing the NPORT-P form isn’t without its challenges. Incomplete or inaccurate information can lead to significant repercussions, including penalties from regulatory agencies. Best practices involve meticulous double-checking of entries and utilizing detailed checklists to ensure all required information is captured, thereby avoiding oversights. Additionally, it is essential to stay updated on deadlines and submission windows to prevent late filing repercussions.

Timing issues can also create significant problems, particularly if funds wait until the last minute to finalize reports. Establishing calendar reminders and tracking submissions can provide ample time for review and amendments, ensuring a smoother filing process overall.

Interactive tools to simplify the process

Leveraging advanced tools like pdfFiller can significantly ease the NPORT-P filing process. With features that enable users to interactively fill forms, collaborate in real-time, and securely eSign documents, pdfFiller streamlines many administrative burdens associated with investment reporting. Its cloud-based platform ensures that individuals and teams can access and edit their documents from anywhere, enhancing productivity and collaboration.

Moreover, utilizing document management solutions within pdfFiller aids in organizing multiple filings, preserving historical records, and facilitating thorough audits. Staying organized with your forms is essential, as it allows for efficient tracking of changes over time and ensures a more controlled filing process overall.

Conclusion: mastering your NPORT-P filing

The successful completion of the NPORT-P form is paramount for maintaining rigour and investor trust in today’s financial landscape. Accuracy and transparency are not just regulatory requirements; they are the foundation of investor confidence. Filers are encouraged to leverage tools like pdfFiller to enhance their productivity and ensure compliance with this essential reporting mandate.

Ultimately, mastering the NPORT-P filing process not only fulfills compliance obligations but also reinforces the trust and credibility that funds hold in the eyes of their investors. By ensuring meticulous attention to detail and utilizing available tools effectively, fund managers can navigate the complexities of regulatory requirements with greater assurance and professionalism.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form nport-p in Gmail?

How can I send form nport-p for eSignature?

Can I create an electronic signature for the form nport-p in Chrome?

What is form nport-p?

Who is required to file form nport-p?

How to fill out form nport-p?

What is the purpose of form nport-p?

What information must be reported on form nport-p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.