Get the free 2025 General Tax Relief Application

Get, Create, Make and Sign 2025 general tax relief

Editing 2025 general tax relief online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 general tax relief

How to fill out 2025 general tax relief

Who needs 2025 general tax relief?

Your Comprehensive Guide to the 2025 General Tax Relief Form

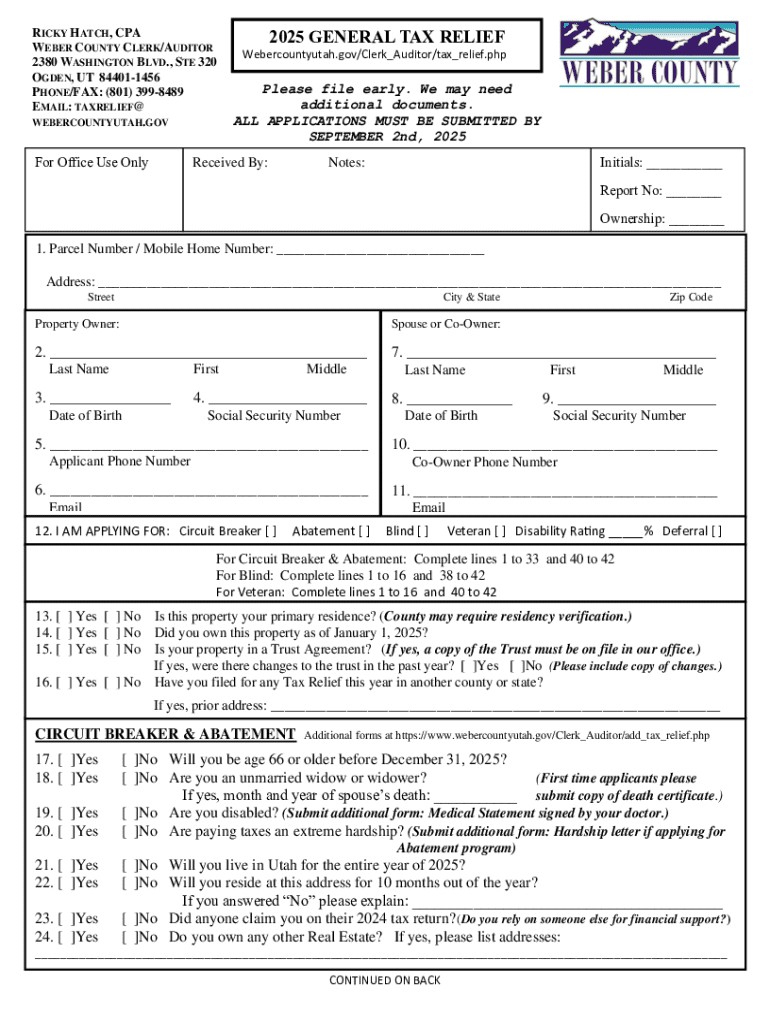

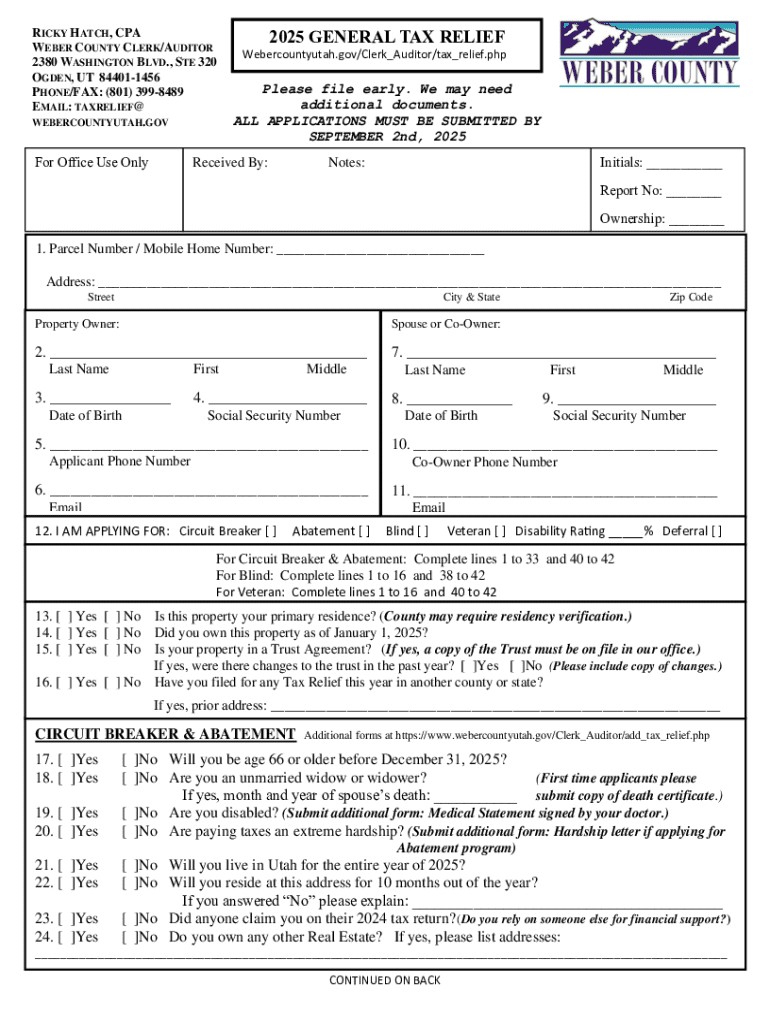

Understanding the 2025 general tax relief form

The 2025 General Tax Relief Form is a crucial document designed to assist individuals and organizations in accessing tax relief benefits available for the tax year 2025. This form serves multiple purposes, primarily aimed at helping taxpayers minimize their taxable income through various credits and deductions. With evolving tax policies, the significance of understanding and efficiently utilizing this form cannot be overstated, especially in ensuring financial stability during an uncertain economic climate.

In 2025, tax relief options are particularly relevant due to the continuing impacts of global economic challenges. As governments implement stimulus measures to support their citizens, the need for effective tax relief becomes essential not just for individuals, but also for small businesses grappling with the changing market landscape.

Key features of the 2025 tax relief program

The 2025 tax relief program offers a variety of options tailored to meet the diverse needs of taxpayers. Key features include tax credits and deductions aimed at reducing overall tax liabilities. Common relief options include the Earned Income Tax Credit (EITC), deductions for student loan interest, and enhancements to the Child Tax Credit, among others.

The potential impact of these tax relief measures varies across demographics. Families with children, for instance, will benefit immensely from enhanced credits, while low-income earners can leverage the EITC to significantly reduce their tax bills. It’s important to assess which options best align with personal or organizational financial circumstances to maximize available benefits.

Document requirements for filing the 2025 general tax relief form

Preparing to file the 2025 General Tax Relief Form involves gathering various critical documents. Accurate documentation ensures a smoother filing process and maximizes the potential for receiving applicable credits and deductions.

Compiling these documents ahead of time can significantly reduce stress and errors during the filing process.

Step-by-step instructions for completing the 2025 general tax relief form

Completing the 2025 General Tax Relief Form requires careful attention to detail. Follow these steps to ensure an accurate submission:

Editing and managing your 2025 general tax relief form with pdfFiller

pdfFiller provides an efficient platform for editing, signing, and managing your 2025 General Tax Relief Form. With user-friendly tools, you can easily modify the document as needed, ensuring that all information is accurate and up-to-date.

One of the key features offered by pdfFiller is the ability to electronically sign documents, facilitating a quick and secure submission process. This cloud-based solution allows users to access their forms from anywhere, share documents with others as needed, and collaborate on the adjustments seamlessly.

Interactive tools to aid in completion

To further simplify the tax relief process, pdfFiller provides several interactive tools designed to assist users in completing the 2025 General Tax Relief Form accurately.

These resources enhance the overall experience of filing and can significantly reduce the anxiety associated with tax season.

FAQs about the 2025 general tax relief form

As tax season approaches, a common concern among taxpayers revolves around the 2025 General Tax Relief Form. Here are some frequently asked questions to clear up any uncertainties:

Related tax topics and resources

To gain a comprehensive understanding of the tax relief landscape in 2025, consider exploring additional related topics. These include:

Keeping updated on tax changes in 2025

Remaining informed about ongoing tax legislation is essential for understanding any new opportunities for relief. Tax laws can change frequently, impacting deductions and credits available to taxpayers.

Best practices for tracking these changes include subscribing to IRS newsletters, following reputable financial websites, and engaging with community tax forums. Staying proactive about these updates will enhance your readiness and strategic planning for future tax years.

Contact information and support

For those seeking assistance with the 2025 General Tax Relief Form, pdfFiller offers robust customer support. Users can reach out via email, live chat, or phone for quick responses to queries or issues.

Additionally, community forums can serve as invaluable resources, where users can share insights, experiences, and advice, fostering a collaborative environment for tackling tax-related challenges.

Conclusion on utilizing pdfFiller for the 2025 tax relief process

Utilizing pdfFiller for managing the 2025 General Tax Relief Form streamlines the tax relief process significantly. The platform is not only user-friendly but also enhances efficiency in editing, signing, and collaborating on tax documents.

By taking advantage of these features, you can focus more on maximizing your tax benefits and less on the complexities of documentation. As tax laws become increasingly intricate, embracing technology like pdfFiller ensures that individuals and teams are well-prepared and informed when navigating the 2025 tax landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 general tax relief to be eSigned by others?

How do I edit 2025 general tax relief straight from my smartphone?

Can I edit 2025 general tax relief on an iOS device?

What is general tax relief?

Who is required to file general tax relief?

How to fill out general tax relief?

What is the purpose of general tax relief?

What information must be reported on general tax relief?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.