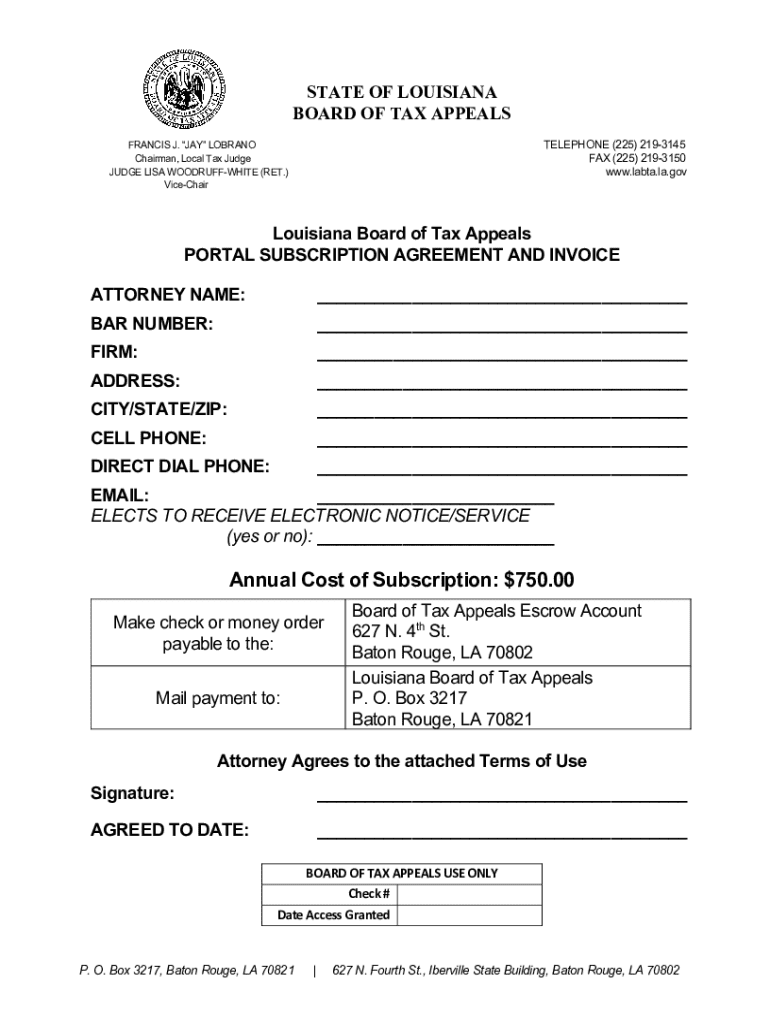

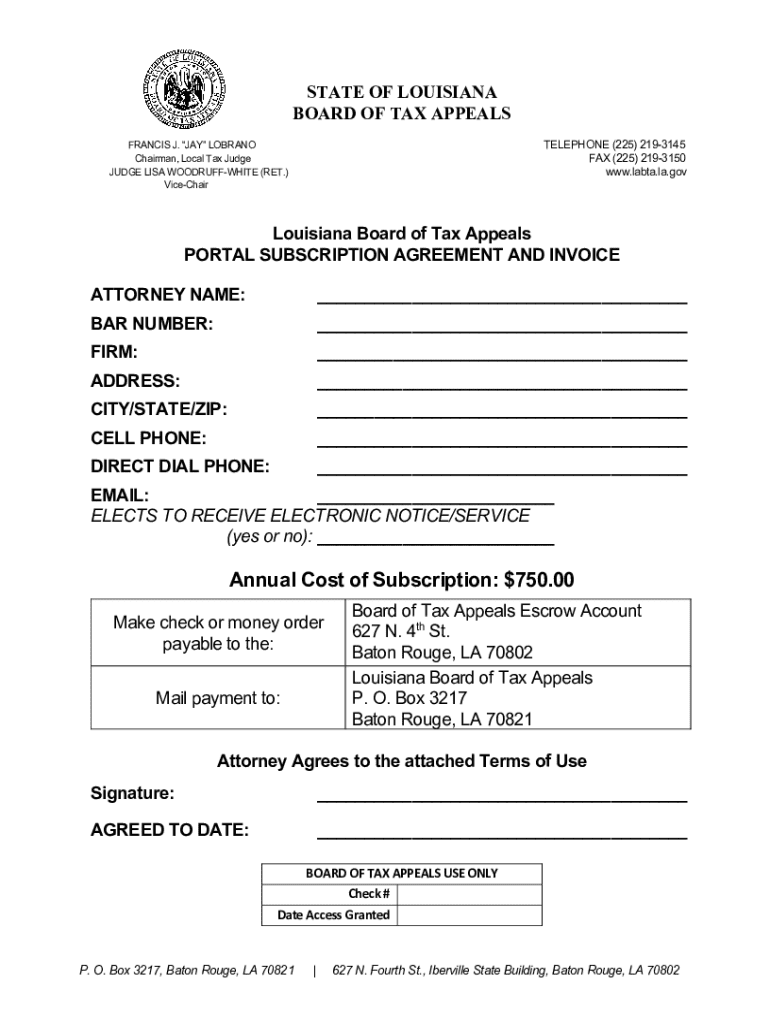

Get the free Louisiana Board of Tax Appeals Portal Subscription Agreement and Invoice

Get, Create, Make and Sign louisiana board of tax

How to edit louisiana board of tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out louisiana board of tax

How to fill out louisiana board of tax

Who needs louisiana board of tax?

Louisiana Board of Tax Form: Comprehensive How-to Guide

Understanding the Louisiana Board of Tax Forms

Tax forms in Louisiana are essential documents utilized by individuals and businesses to report their income and calculate their tax obligations. The Louisiana Board of Tax, under the Department of Revenue, oversees these forms, ensuring that the tax system operates smoothly. Accurate filing is paramount, as it determines tax liabilities and eligibility for refunds or credits. Missing deadlines or submitting incorrect information can lead to penalties or delays in refunds.

Louisiana has various forms tailored to distinct demographics and entities, such as individuals, corporations, and partnerships. Understanding the specific requirements of each form and maintaining accuracy in completion is crucial for compliance and avoiding complications with state tax authorities.

Types of Louisiana Tax Forms

Louisiana offers a range of tax forms tailored to different filing needs. For individual taxpayers, the primary forms include the Form IT-540, which is specifically for Louisiana residents to report personal income, and the Form IT-540B, designated for non-residents earning income in Louisiana. Businesses also have their specific reporting requirements.

Corporate entities must file the Form CIFT-620 to report corporate income taxes, while partnerships utilize the Form LA-3. For those needing additional time to prepare their returns, the Form R-1349 serves as a request for an extension. Furthermore, businesses managing sales tax are required to file the Form R-540 to report monthly sales and use tax obligations.

Navigating the Louisiana Tax Form Submission Process

Filing Louisiana tax forms begins with gathering the necessary information. Taxpayers should prepare documentation like W-2s, 1099 forms, and any relevant business expense records before selecting the correct tax form. It's important to ensure that you are using the most updated forms, which can be found on the Louisiana Department of Revenue's official website.

When completing the Form IT-540, a detailed understanding of each section is vital. Starting with personal information at the top, taxpayers need to accurately report their income, deductions, and credits. Common mistakes include miscalculating income, failing to claim eligible deductions, and missing signature sections. Referencing guides or consulting with tax professionals can help diminish such pitfalls.

Filing options available for Louisiana tax forms

Individuals and businesses alike have multiple avenues for filing Louisiana tax forms. The most streamlined method is through the official Louisiana Department of Revenue website, where online submission is available. eFiling provides benefits such as instantaneous confirmation of receipt, faster processing times, and built-in error checks, but some users may prefer traditional paper methods for personal records.

For paper filing, ensure all forms are signed and dated. Mail filings must be sent to the correct address specified by the Department of Revenue, and it's advised to plan ahead for postal delivery times. Deadlines vary for different forms; for instance, individual returns are generally due on May 15. Staying informed of these timelines is essential to avoid fines.

Common questions regarding Louisiana tax forms

Taxpayers often have questions about the nuances of Louisiana tax filing. One common inquiry is how to file an amended Louisiana return, which requires using the appropriate amendment form and adjusting your original submissions. Additionally, many might wonder about the potential size of their tax refunds in future years; tax credits and changes in personal income can impact refund amounts.

Lastly, understanding your refund status can help alleviate anxiety during the processing period. Taxpayers can check the status of their refund through the Louisiana Department of Revenue's online portal. Knowing the general processing times can also aid in planning accordingly.

Utilizing pdfFiller for your Louisiana tax forms

pdfFiller offers a powerful solution for completing Louisiana tax forms with ease. With its interactive tools, users can fill out tax forms efficiently, ensuring they capture all necessary information without hassle. Through pdfFiller, eSigning becomes a seamless process—ideal for maintaining a legally binding signature on your returns.

Additionally, pdfFiller facilitates collaborative efforts by allowing teams to work together on tax form preparations. Users can share forms for review and approval, making it an excellent choice for businesses with shared responsibilities over tax filings. Such features enhance productivity and reduce the potential for errors.

Tips for efficiently managing your tax forms

Managing your tax forms effectively is crucial during tax season. Start by organizing all your tax-related documents, including receipts, prior returns, and any correspondence with the IRS or state tax agency. Establishing a dedicated folder for these documents, whether digital or physical, can save you time and energy.

Additionally, implementing a tagging system in your digital file storage can enhance your retrieval process, allowing for quick access to specific forms as needed. Regular backups of your files ensure that you never lose important documentation due to unforeseen events like computer crashes. By prioritizing organization and backup, you set the stage for an efficient tax filing experience.

Staying updated on tax policies and changes in Louisiana

Keeping abreast of changes in tax policies is vital for ensuring compliance. The Louisiana Board of Tax frequently releases important announcements that may affect tax rates, credits, or filing procedures. Regularly checking their updates can help prevent any surprises during tax season.

By subscribing to newsletters or alerts from the Louisiana Department of Revenue, taxpayers can receive timely notifications regarding recent tax law changes or new form requirements. Staying proactive about these updates not only keeps individuals compliant but also maximizes potential returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify louisiana board of tax without leaving Google Drive?

How can I get louisiana board of tax?

How do I edit louisiana board of tax in Chrome?

What is Louisiana Board of Tax?

Who is required to file Louisiana Board of Tax?

How to fill out Louisiana Board of Tax?

What is the purpose of Louisiana Board of Tax?

What information must be reported on Louisiana Board of Tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.