Get the free Standard Chartered Credit Card Application Form

Get, Create, Make and Sign standard chartered credit card

Editing standard chartered credit card online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standard chartered credit card

How to fill out standard chartered credit card

Who needs standard chartered credit card?

Standard Chartered Credit Card Form: A Comprehensive Guide

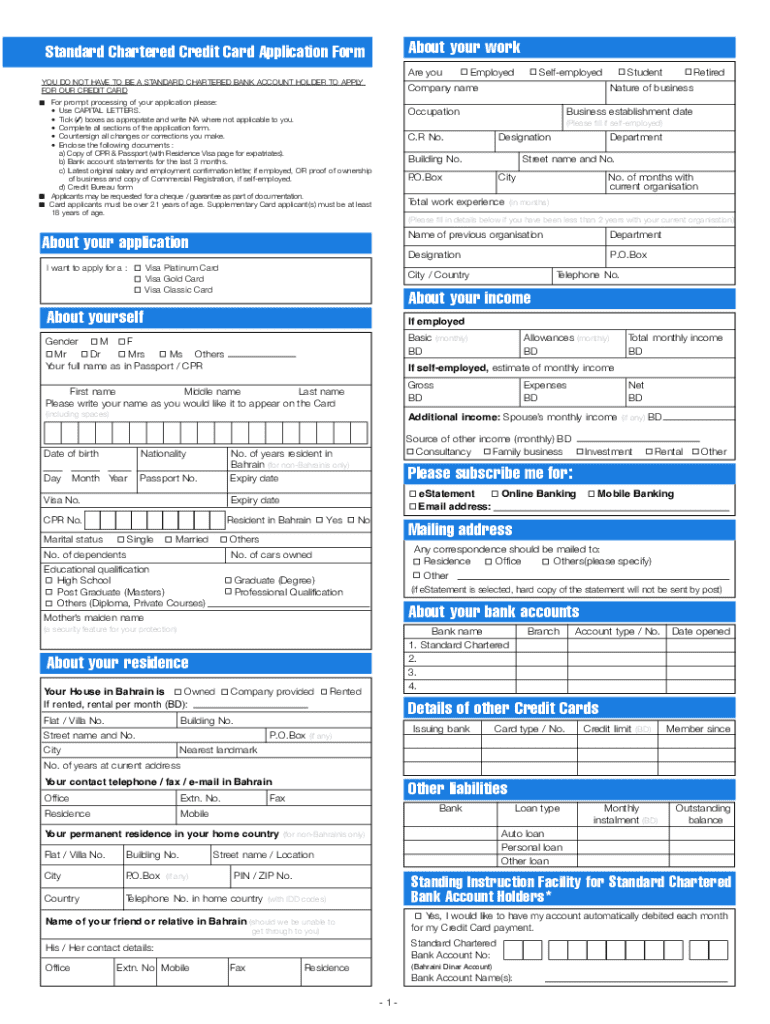

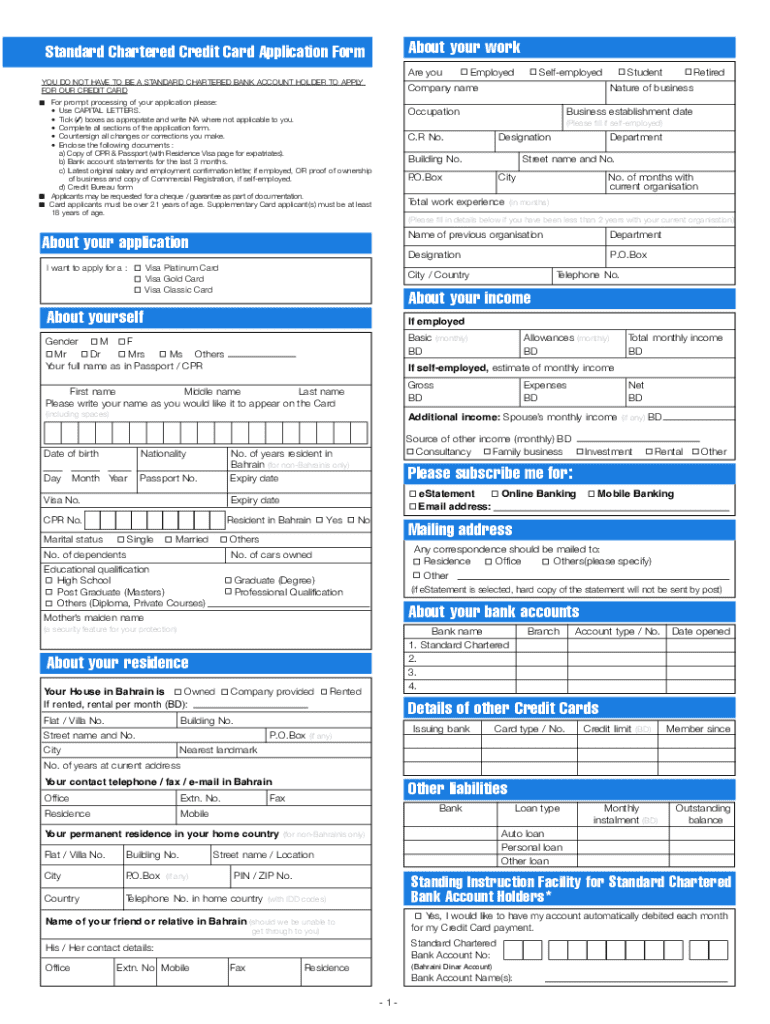

Understanding the Standard Chartered Credit Card Form

The Standard Chartered Credit Card Form is a pivotal document for anyone looking to apply for a credit card from Standard Chartered. This form consolidates essential personal and financial data that the bank requires to assess an applicant's eligibility. Completing the form accurately is crucial as it directly affects the approval process.

The significance of the Standard Chartered credit card form extends beyond mere paperwork. It serves as a gateway to various financial benefits, including lower interest rates, reward points, and exclusive offers. Standard Chartered provides a plethora of credit card options tailored for diverse financial needs, making this form a crucial first step towards unlocking those advantages.

Step-by-Step Guide to Completing the Form

Applying for a credit card can seem daunting, but by breaking down the process into manageable steps, you can complete the Standard Chartered credit card form efficiently. Here's a structured approach to guide you through each stage.

Step 1: Gathering Necessary Documents

Before filling out the application form, ensure you have all the necessary documents at hand. Typically, Standard Chartered will require:

Organizing these documents efficiently ensures you can fill out the form without interruption. Group related documents and keep them handy to speed up the process.

Step 2: Filling Out Personal Information

The personal information section of the form is straightforward yet vital. You will need to fill in your full name, residential address, and contact information. Pay extra attention here—any discrepancies can lead to delays.

Common mistakes to avoid include misspelling your name or providing incorrect addresses. Ensure that all entries are clear and accurate.

Step 3: Financial Information Section

The financial information section requires applicants to disclose income sources and recent earnings. It’s crucial to declare all income accurately, as any inconsistency can adversely affect approval prospects. Often, a higher, stable income increases your chances of receiving a credit card with favorable terms.

Step 4: Choosing Your Credit Card Type

Standard Chartered offers various credit card models—from cashback to travel rewards. Each card comes with unique benefits and fees. When choosing, consider your personal spending habits to select a card that offers maximum value.

Step 5: Reviewing and Submitting Your Application

Before you hit submit, take time to double-check all information in the form. Look for errors or missing details that could delay your application. After submission, you can expect confirmation from Standard Chartered regarding the status of your application.

Interactive Tools for Enhancing Your Application Experience

To simplify the application process, pdfFiller offers an array of digital tools. These tools enable users to fill out forms electronically and access them from anywhere. Features like document editing and cloud storage make managing applications straightforward.

With pdfFiller, users can collaborate easily, ensuring that all necessary inputs or corrections can be made seamlessly before finalizing the credit card form.

Frequently Asked Questions (FAQs) about the Standard Chartered Credit Card Form

When applying for a credit card, questions are bound to arise. Here are some common queries related to the Standard Chartered credit card form:

Finding clear answers to these questions can ease the application process.

Tips for a successful credit card application

Understanding your credit score is essential for a successful application. A higher score typically leads to better card offers. To prepare, check your score and take steps to improve it, such as paying down debts and making on-time payments.

Employ best practices; ensure that all information is current and accurate. Knowing the card’s benefits can also help you select the best option for your lifestyle.

Related financial forms and resources

In addition to the credit card form, several other banking and financial forms may be relevant depending on your financial needs. Some commonly used forms include:

These forms can play a vital role in various financial transactions and planning.

Navigating challenges with your credit card application

Applications can sometimes be rejected for reasons such as insufficient income or poor credit scores. Understanding these challenges can help you avoid common pitfalls. If your application is declined, it is essential to review the reasons provided.

Steps for resolving issues include contacting customer support for clarification and understanding how to improve your financial profile before reapplying.

Best credit card offers and promotions

Standard Chartered frequently offers promotions that can enhance your credit card experience. From cash back offers to travel rewards, these promotions are designed to provide added value and can sometimes include waived fees for the first year.

Comparing these offers with competitors helps ensure that you are making a well-informed choice regarding your credit card.

Conclusion on managing your credit card application effectively

Effective management of your credit card application involves being proactive with your documents, understanding each step, and utilizing tools like pdfFiller for an easier process. Leveraging the features of pdfFiller allows for seamless editing and collaboration, ensuring the required documents are well-organized and easily accessible.

Ultimately, a thorough understanding and careful completion of the Standard Chartered credit card form can pave the way for a successful credit card application, opening doors to beneficial financial opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my standard chartered credit card in Gmail?

How can I edit standard chartered credit card on a smartphone?

How do I fill out standard chartered credit card on an Android device?

What is standard chartered credit card?

Who is required to file standard chartered credit card?

How to fill out standard chartered credit card?

What is the purpose of standard chartered credit card?

What information must be reported on standard chartered credit card?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.