Get the free Ptax-343-r

Get, Create, Make and Sign ptax-343-r

Editing ptax-343-r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-343-r

How to fill out ptax-343-r

Who needs ptax-343-r?

Understanding the PTAX-343-R Form: A Complete Guide for Individuals and Teams

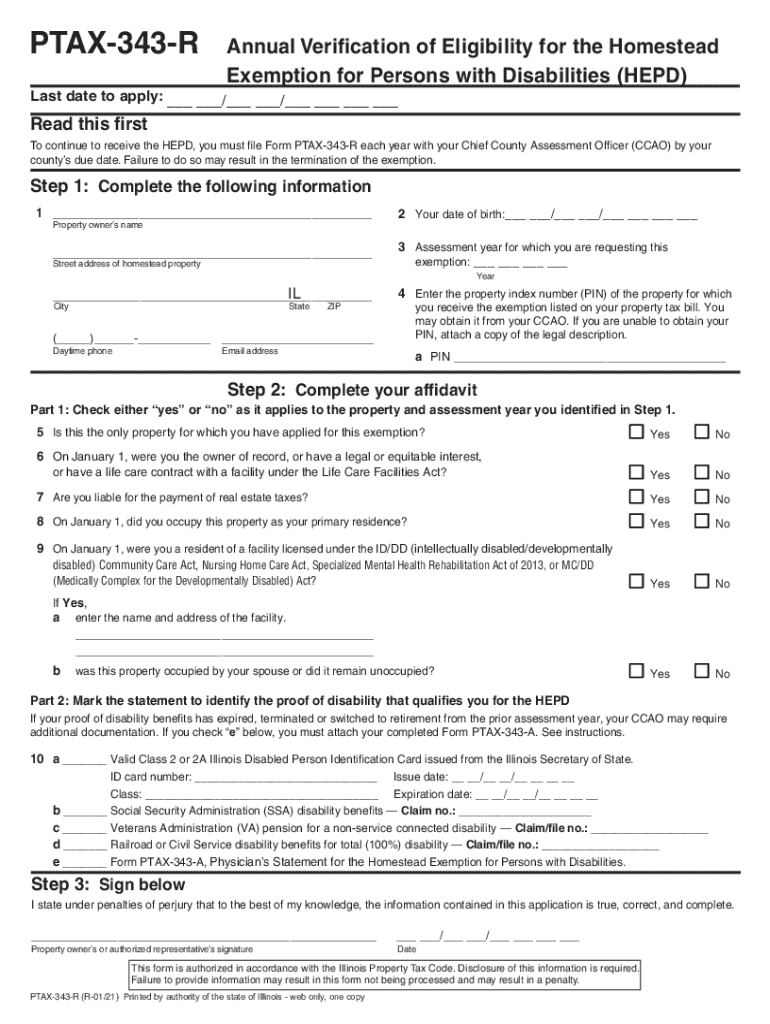

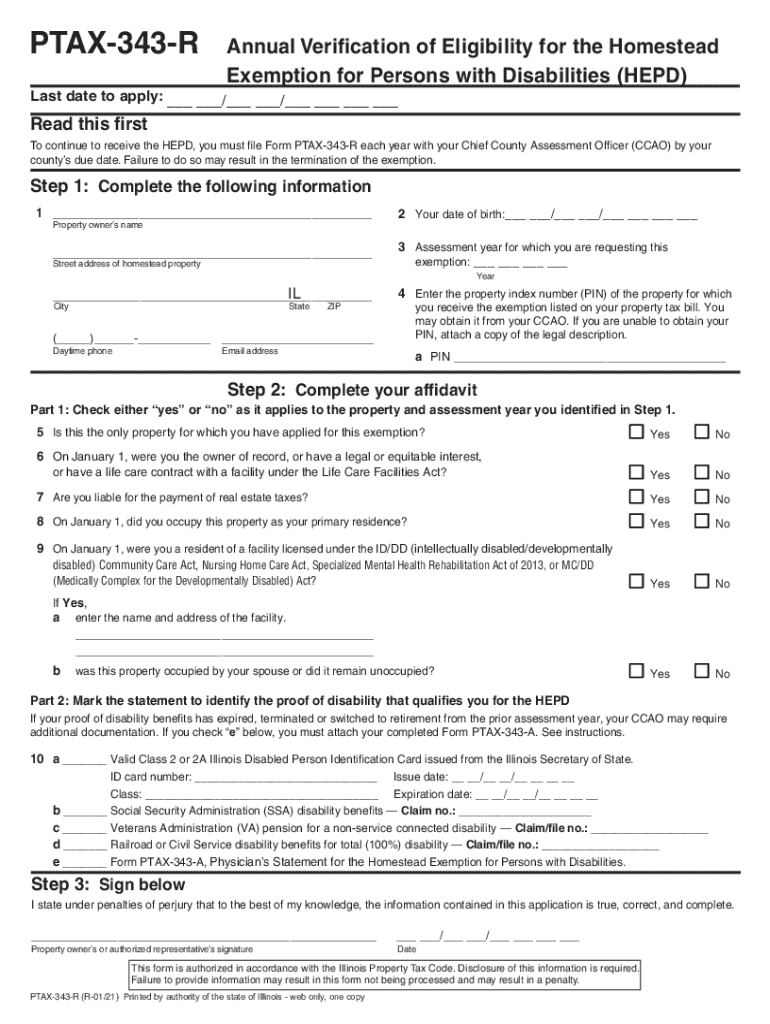

Overview of the PTAX-343-R form

The PTAX-343-R form is a crucial document primarily used for property tax appeals. It serves as a formal request for the reassessment of property taxes that an individual or organization believes to be unfair or incorrect. By filing this form, taxpayers can challenge the assessed value of their property, seeking to ensure that they are not overpaying taxes based on inflated assessments. Its importance cannot be overstated, as accurate property taxation directly impacts both individual wallets and community services funded by those taxes.

One of the unique aspects of the PTAX-343-R form is its specificity. Unlike many standard tax forms, this document is tailored for specific situations regarding property value disputes. This targeted nature makes it crucial for those looking to contest their assessments and potentially reduce their tax burden, making it a vital resource for individuals and corporations alike.

Who needs the PTAX-343-R form?

The PTAX-343-R form is predominantly used by property owners and stakeholders involved in property taxation disputes. This includes individuals who own residential properties, organizations that possess commercial properties, and even property management teams responsible for overseeing multiple units. Understanding who qualifies for this form is key to ensuring that appeals are filed correctly. Those who believe their properties have been overvalued during tax assessments should consider this form as a vital part of their appeal process.

Eligibility criteria for using the PTAX-343-R form vary slightly by jurisdiction, but generally, individuals must be the legal owners of the property. Common scenarios for usage include homeowners who have received a property tax bill they feel does not reflect the true market value of their home, or businesses contesting property valuations that have a direct impact on their financial health. In such circumstances, the PTAX-343-R form becomes an essential tool for advocacy against perceived inaccuracies.

How to access the PTAX-343-R form

Accessing the PTAX-343-R form is straightforward, particularly through digital platforms. On pdfFiller, users can quickly locate the PTAX-343-R form by searching its database, which is specifically designed to house essential documents, including tax-related forms. This not only saves time but ensures that users are accessing the most up-to-date version of the form, which is vital for the accuracy of applications.

Aside from online access, individuals can request hard copies of the PTAX-343-R form through their local tax office. This traditional method remains viable for those who prefer to fill out forms manually or do not have reliable internet access. Regardless of the method chosen, ensuring that the correct and most current version of the form is obtained is crucial for a successful appeal.

Filling out the PTAX-343-R form

Filling out the PTAX-343-R form requires attention to detail and accurate documentation. The process can be broken down into three key steps. First, gathering required information is essential. Users will need to compile various documents, including previous tax statements, property descriptions, and any relevant appraisal reports. Having this information readily available will streamline the filling process.

Next, the actual completion of the form should be done section by section. Make sure to read the instructions carefully and provide accurate information where requested. Common mistakes include misreporting property size or failing to provide necessary supporting documents, which can lead to automatic rejections of the appeal. Therefore, paying close attention to these details can save significant time and effort.

For those needing assistance, interactive tools offered by pdfFiller can aid in form completion, ensuring users navigate smoothly through the process.

Editing the PTAX-343-R form

Editing the PTAX-343-R form, when necessary, is an important step to ensure accuracy before submission. It is crucial to have a final look at the document to check for any inconsistencies that might discredit your appeal. pdfFiller provides a host of editing tools that make modifications and customizations simple. Users can easily change, remove, or add any sections of the form as needed.

Furthermore, considering the legal implications of a successful property tax appeal, it is essential to ensure that all data is accurately represented. The ability to use electronic signatures through pdfFiller’s platform provides an additional layer of convenience and security, ensuring that your document has the necessary signatures without the hassle of printing and scanning.

Signing the PTAX-343-R form

Signing the PTAX-343-R form is not merely a formality; it carries significant legal weight. The signature indicates that the information provided is accurate to the best of the signer's knowledge and a binding agreement to the details therein. Immediate electronic signing options available via pdfFiller enhance the filing process, saving users both time and effort.

For those unfamiliar with electronic signing, the process is simple. After completing the form, users can navigate to the signing section on pdfFiller, follow the prompts to input their electronic signature, and securely save the document. Security features incorporated into this process ensure compliance with legal standards, providing peace of mind that the signed document will be accepted by tax authorities.

Managing your PTAX-343-R form

Once the PTAX-343-R form is completed and signed, it is essential to manage the document effectively. Secure storage is vital to prevent loss or accidental deletion. pdfFiller provides cloud-based storage options, allowing users to access their documents anywhere and at any time with just a few clicks.

Additionally, sharing and collaborating on the PTAX-343-R form with stakeholders is straightforward through pdfFiller. Its platform supports sharing options that allow team members to view or edit the document as necessary. This feature is especially beneficial for organizations submitting multiple appeals or working on complex property disputes that require collaborative input.

Frequently asked questions (FAQs)

Common queries about the PTAX-343-R form often revolve around its usage, submission deadlines, and what to do in case of errors upon submission. Users often wonder whether they can amend a form after submission and the typical time frames for receiving responses from tax authorities. Consulting the FAQ section of pdfFiller can provide quick answers to these common concerns.

Aside from general questions, troubleshooting issues is also an important aspect. For those facing problems with their forms – such as difficulty in editing or signing – pdfFiller’s customer support can assist in resolving these common issues efficiently.

Related forms and documents

In addition to the PTAX-343-R form, users may find it helpful to be aware of other related forms that address property taxation and appeals. For instance, forms such as PTAX-340, used for property tax exemptions, offer valuable parallel functions to taxpayers engaging in disputes. Knowing which forms are available can better equip users to navigate the intricacies of property taxation.

Furthermore, a comprehensive understanding of the documentation related to property assessments and appeals can greatly enhance one’s ability to challenge inaccurate valuations effectively. pdfFiller facilitates access to these resources, helping users find the right documents for their needs.

Contacting support for assistance

For users needing additional help while navigating the PTAX-343-R form or related processes, pdfFiller offers robust support channels. Whether through email, live chat, or their comprehensive help center, users can get timely assistance. These resources are designed to streamline the experience of completing and managing important documents.

The help center is teeming with guides and tips, enhancing one’s understanding of the platform's features and the functionalities that aid in managing documents like the PTAX-343-R form. Ensuring that users utilize these resources can significantly reduce frustration and enhance overall satisfaction with the process.

User testimonials and success stories

Real experiences from users can shed light on the effectiveness of pdfFiller for PTAX-343-R form completion. Many taxpayers have successfully utilized the platform to file their forms, citing ease of use, quick access to editing tools, and efficient eSigning features as significant benefits. These testimonies highlight the platform’s capacity to empower users throughout the often complicated process of property tax disputes.

Statistics from user feedback indicate that a significant percentage reported increased satisfaction with their property tax appeal outcomes after utilizing pdfFiller. Users often appreciate how the platform not only expedites the completion of the PTAX-343-R form but also supports enhanced collaboration among teams, ultimately leading to a more successful appeal process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ptax-343-r online?

How do I make changes in ptax-343-r?

How do I complete ptax-343-r on an Android device?

What is ptax-343-r?

Who is required to file ptax-343-r?

How to fill out ptax-343-r?

What is the purpose of ptax-343-r?

What information must be reported on ptax-343-r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.