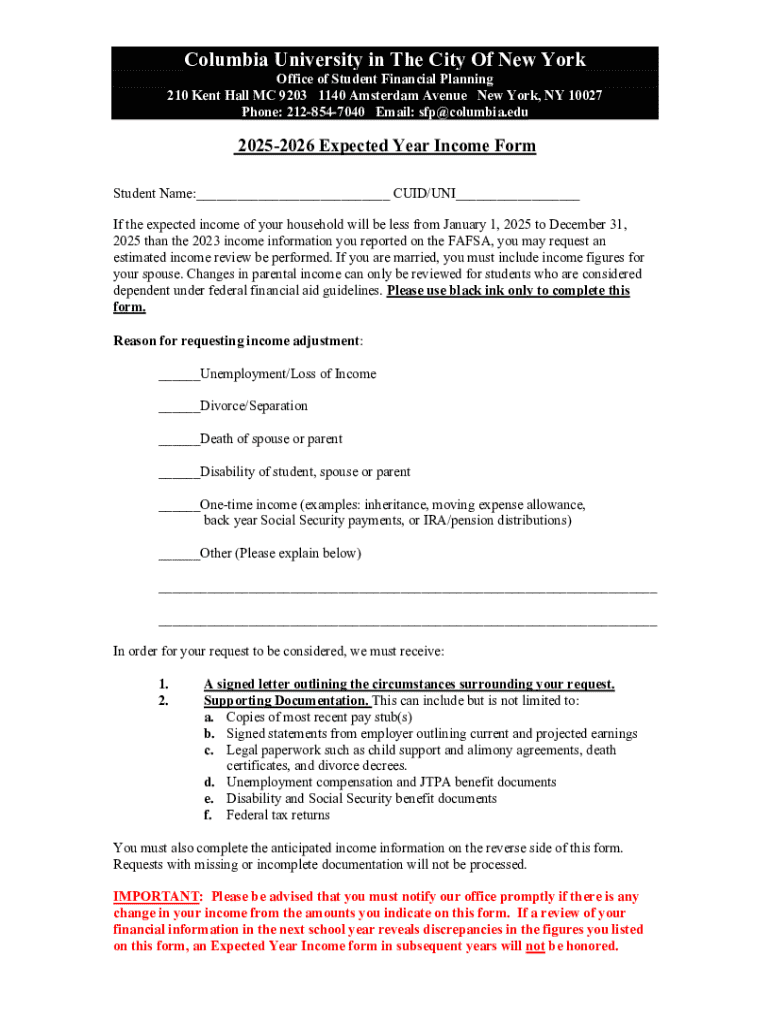

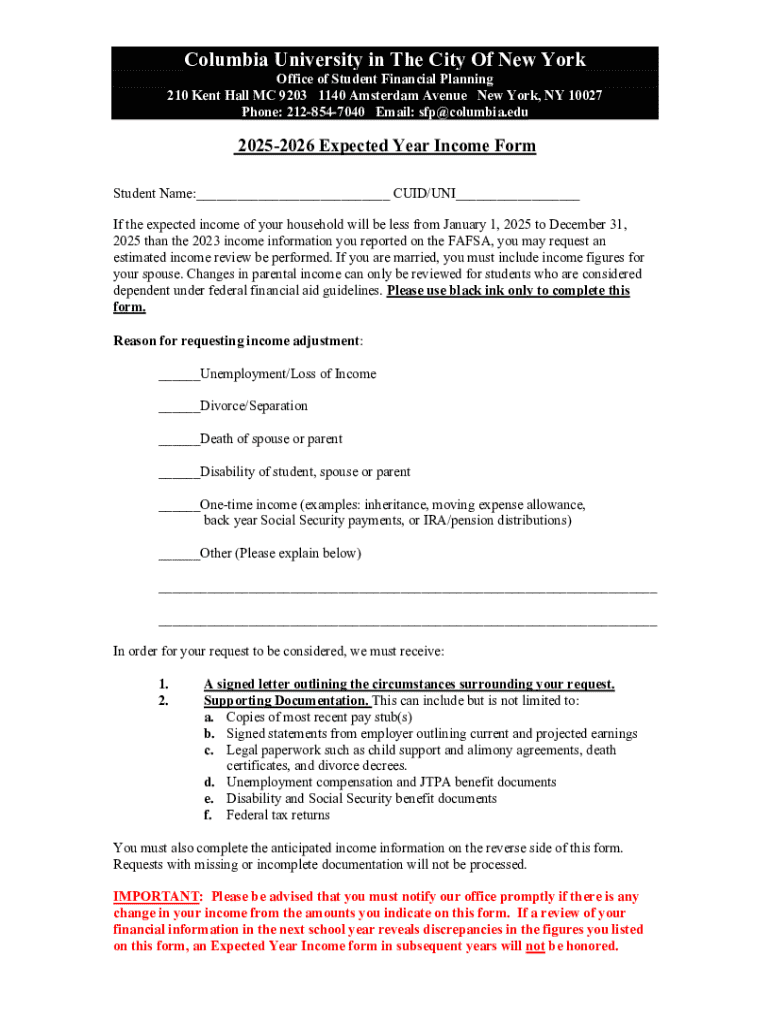

Get the free Expected Year Income Form

Get, Create, Make and Sign expected year income form

How to edit expected year income form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out expected year income form

How to fill out expected year income form

Who needs expected year income form?

Complete Guide to the Expected Year Income Form

Understanding the expected year income form

The expected year income form is a critical document that enables individuals and teams to forecast and document their anticipated earnings over the upcoming year. This form is essential for budgeting, financial planning, and ensuring compliance with various tax obligations. By accurately estimating their income, users can make informed decisions regarding expenditures, investments, and savings.

For both individuals working independently and teams in corporate environments, this form serves as a financial roadmap. It provides a clear picture of expected earnings, allowing one to adjust their financial strategies accordingly. This not only enhances personal financial management but also ensures organizational teams are aligned with their financial goals.

Key components of the expected year income form

When filling out the expected year income form, various components need careful attention to detail to ensure a comprehensive understanding of one’s financial landscape. The primary sections include personal information, income details, and deduction information.

Personal information section

This section requires essential details such as your name, address, and contact information. Accuracy is vital here. Even a minor error can cause complications later. To ensure all information is correct, double-check spelling and confirm that these details match your official documents.

Income details

In the income details section, it's important to capture all sources of income. This could include wages from employment, dividends from stocks, rental payments, or freelance earnings. Providing a comprehensive list of acceptable income sources helps to ensure a clearer financial picture.

Deduction information

The deduction information section considers various expenses that can reduce taxable income, such as student loan interest and charitable donations. Properly reporting deductions not only can lower tax liabilities but also strengthens your overall financial strategy.

Step-by-step guide to filling out the expected year income form

Filling out the expected year income form may seem daunting, but by following these systematic steps, one can navigate the process effectively.

Step 1: Gather required documents

Start by gathering all necessary documents, which may include W-2s for wages, 1099s for freelance work, and bank statements for interest income. Having these documents at hand simplifies reporting and minimizes errors.

Step 2: Complete personal information

Carefully fill out the personal information section. Accuracy here is crucial, as incorrect details can complicate your filing process. Consider cross-referencing this information with official ID and address proof.

Step 3: Report income

When reporting income, categorize your earnings into distinct types. For employment income, use W-2 amounts, and for other sources, ensure to list proceeds from 1099s appropriately. Finally, sum your income to calculate your total annual income accurately.

Step 4: Enter deductions

In the deductions section, include all relevant expenses that can be subtracted from your income. This could involve everything from professional fees to business expenses. For a streamlined experience, consider using pdfFiller, which simplifies the reporting process for you.

Editing and managing the expected year income form

After filling out the expected year income form, users may find they need to adjust or revise specific parts of it. Utilizing pdfFiller’s editing tools allows you to make changes easily and efficiently. Whether you need to add information or correct errors, pdfFiller facilitates a user-friendly experience.

Saving and version control

Best practices for saving your forms involve using cloud storage solutions to ensure secure access from anywhere. Regularly checkpoint your versions, allowing you to track changes over time and revert if needed. This is particularly useful in avoiding any data loss during updates.

eSigning the expected year income form

In today’s digital age, the ability to eSign documents has become invaluable. It not only speeds up the signing process but also provides an added layer of security and verification. When using pdfFiller to eSign your expected year income form, you ensure your signature is legally binding and accepted by authorities.

Step-by-step guide to eSigning using pdfFiller

Begin by opening your completed form in pdfFiller. Navigate to the eSignature option, select your signature style, and place it accordingly on the document. Confirm and save your signed document immediately for your records.

Legal considerations for electronic signatures

Keep in mind that electronic signatures hold the same weight in legal terms as traditional signatures, provided they adhere to regulations set forth by the ESIGN Act and UETA. Ensure your signing method meets these requirements for it to be valid in a court of law.

Frequently asked questions (FAQs)

Users often have common questions about the expected year income form. Clarifications on how to estimate income, important deadlines, and possible deductions are frequently sought. These FAQs can guide you in resolving issues and understanding potential tax implications.

For issues during filing, troubleshooting steps such as double-checking documentation and using pdfFiller’s support can alleviate many concerns. Addressing these points proactively can save time and frustration down the line.

Helpful links and resources

Numerous resources are available for further assistance regarding the expected year income form. Links to state tax departments, as well as federal aids from the IRS, provide solid backing for your financial planning. Additionally, pdfFiller offers various financial management tools, helping streamline your processes.

Contacting support for help

pdfFiller provides robust support options for users. If you encounter challenges with the expected year income form, accessing their help center can connect you to various resources, including live chat support or email assistance. By reaching out, you can get timely and effective guidance.

Language assistance and accessibility

For non-English speakers, pdfFiller provides resources and support in various languages, ensuring that everyone can create, edit, and manage their documents effortlessly. Furthermore, accessibility features are incorporated for users with disabilities, making their platform user-friendly for all.

About pdfFiller

pdfFiller is a powerful platform designed to empower users in their document management needs. With capabilities that include PDF editing, eSigning, and collaboration, it stands as a comprehensive solution for individuals and teams. The platform is widely praised for its user-friendly interface and extensive functionality.

User testimonials emphasize the positive experiences encountered while utilizing pdfFiller's features. Many have shared success stories of how the platform streamlines their work processes, simplifies the creation of essential forms like the expected year income form, and ultimately improves financial management efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my expected year income form in Gmail?

How can I modify expected year income form without leaving Google Drive?

How do I edit expected year income form on an iOS device?

What is expected year income form?

Who is required to file expected year income form?

How to fill out expected year income form?

What is the purpose of expected year income form?

What information must be reported on expected year income form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.