Get the free Arizona Form

Get, Create, Make and Sign arizona form

Editing arizona form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form

How to fill out arizona form

Who needs arizona form?

Arizona Form - How-to Guide

Overview of Arizona forms

Completing forms accurately is vital in Arizona, whether you're filing taxes, applying for a driver's license, or navigating real estate transactions. Understanding the various Arizona forms available ensures compliance and efficiency, saving time and preventing unnecessary delays.

Common types of Arizona forms include: - State tax forms, which must be filled out in accordance with Arizona's tax regulations. - Driver's license applications, including renewals and replacements, which require specific personal identification and documentation. - Real estate documents, crucial for buying, selling, or leasing property in the state.

It's important to stay updated on any key changes to Arizona forms for the current year, such as alterations to tax brackets or adjustments in licensing procedures. This ensures you're always working with the correct information and avoiding any errors.

Accessing Arizona forms

Accessing Arizona forms has never been easier, thanks to the state’s digitized processes. A quick visit to the Arizona state website provides you with a comprehensive assortment of forms necessary for various state requirements.

To navigate the Arizona state website: 1. Visit az.gov and click on 'Forms' or use the search feature. 2. Browse the categories or use keywords relevant to your needs, such as 'tax,' 'licensing,' or 'real estate.' 3. Download the forms directly to your computer.

Alternatively, pdfFiller offers a convenient option to find and download Arizona forms quickly. Simply go to their site and search for the form you need, then download it in PDF format for easy editing.

If you prefer traditional methods, you can obtain forms from local government offices, like the Department of Motor Vehicles or county assessor's office. You can also request forms by mail by contacting the relevant agency directly.

Step-by-step instructions for filling out Arizona forms

Completing Arizona forms accurately can seem daunting, but with a few tips and guidelines, it can be straightforward. Always read through the instructions thoroughly before starting and gather any required documentation.

For instance, when filling out the Individual Income Tax Form, consider the following: 1. **Section-by-section breakdown**: Understand each section of the form, such as personal information, income sources, and tax credits. 2. **Common pitfalls to avoid**: Double-check calculations and ensure all required fields are filled. Misreporting income or overlooking deductions are frequent errors.

As another example, the Vehicle Registration Form requires specific information: - **Required information and documentation**: This includes your vehicle's VIN, title, and proof of insurance. - **Tips for accurate submission**: Ensure all personal details match with what the DMV has on record.

Editing Arizona forms with pdfFiller

With pdfFiller, users can easily edit Arizona forms online, utilizing tools that enable you to add text, images, and annotations. This flexibility allows for corrections and adjustments in real time.

Editing features include: - Adding text with customizable fonts and sizes for clarity. - Inserting images or logos to make documents more professional. - Annotating forms to highlight crucial points.

One significant advantage of editing forms online is the increased accessibility and convenience. You're not tethered to paper, which can easily be lost or damaged. Additionally, pdfFiller allows for team collaboration, facilitating document reviews and approvals efficiently.

Signing Arizona forms

Using pdfFiller, signing Arizona forms electronically is seamless. The process is straightforward, allowing users to create an electronic signature and apply it to any document.

The advantages of using e-signatures in Arizona include: - **Efficiency**: Eliminate the need for physical copies and ink signatures. - **Legality**: E-signatures are recognized as valid under Arizona law, providing security and authenticity.

Follow these steps to electronically sign a form: 1. Open your document in pdfFiller. 2. Click on the 'Sign' button. 3. Add your signature and place it appropriately in the document.

Submitting Arizona forms

Submitting completed Arizona forms is another crucial step that requires attention to detail. Adhering to best practices can ensure your submissions are accepted without delays.

Consider the following submission methods: - **Electronic submission options**: Many forms can be submitted online through the respective state agency websites, streamlining the process. - **Mailing options and tips for tracking**: If you opt to mail forms, use a reliable service and consider tracking options to confirm delivery.

Be aware of deadlines and timelines for specific forms: - Important dates to keep in mind include tax filing deadlines, license renewal dates, and real estate transaction cut-offs. - Late submissions may incur penalties or additional fees, making awareness crucial.

Managing your Arizona forms

To reduce stress and maintain organization, managing Arizona forms effectively is essential. With pdfFiller, users can easily organize and store electronic files securely.

Consider these tips for managing your documents: - Using pdfFiller’s cloud storage allows you to access forms from any device at any time. - Maintain accurate records with naming conventions and folder sorting to find documents quickly.

Retrieving previously submitted forms is also streamlined through the platform, eliminating the hassle of searching through physical copies. Additionally, regular updates to form revisions help you stay compliant and informed.

Troubleshooting common issues with Arizona forms

As you navigate Arizona forms, encountering issues is a possibility. Common problems include misplaced or missing forms and rejected submissions, which can cause frustration.

To address these issues, consider: - Contacting state offices directly for help or clarification on specific forms. - Utilizing pdfFiller customer support, which provides guidance and troubleshooting solutions for their platform.

Additional features of pdfFiller for form management

Beyond basic functionalities, pdfFiller offers a plethora of additional features tailored for comprehensive form management. Collaborative tools enable teamwork on shared documents, enhancing productivity.

Advanced features for repeat users include: - Templates for frequently used forms, allowing for quick replication of repetitive tasks. - Integration with other applications, simplifying workflow and documentation processes. - Security and compliance features ensure that your sensitive documents are handled according to the highest standards.

Conclusion: Mastering Arizona forms with pdfFiller

Successfully navigating, completing, and managing Arizona forms is essential for compliance and effective document handling. With the powerful tools provided by pdfFiller, users can create, edit, sign, and submit forms with confidence.

Leverage pdfFiller’s solutions to revolutionize your document management experience, making the process efficient, accessible, and stress-free. Master your Arizona forms today and enjoy the benefits of a well-organized, fully equipped approach to paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona form to be eSigned by others?

How do I fill out the arizona form form on my smartphone?

How do I complete arizona form on an iOS device?

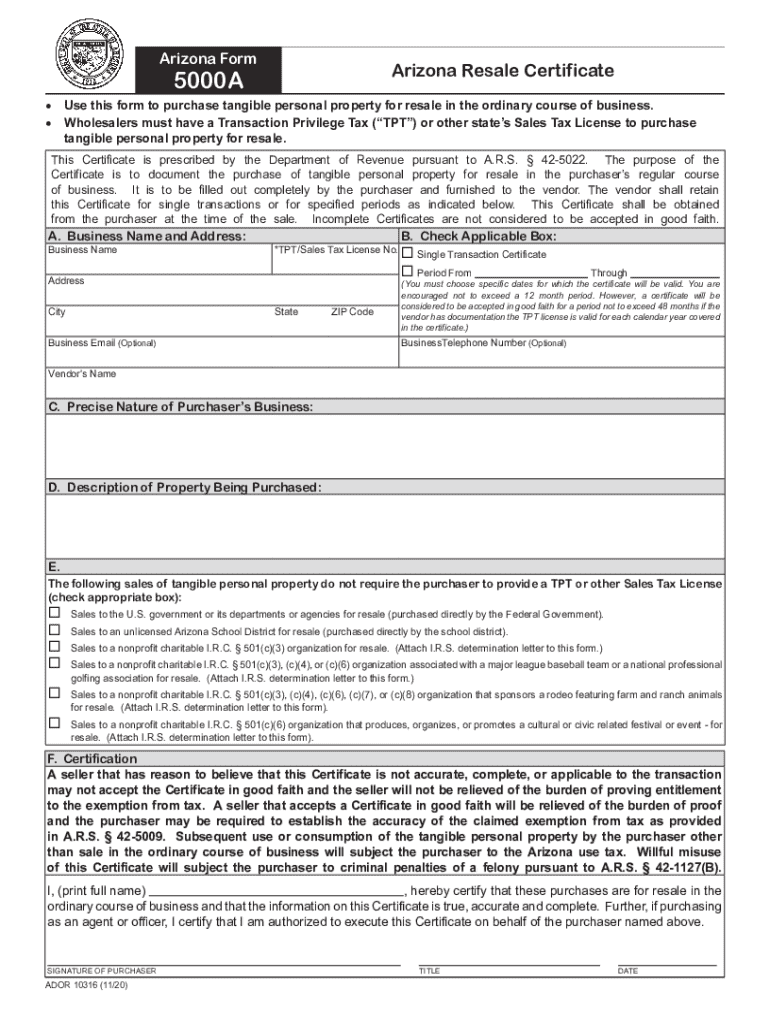

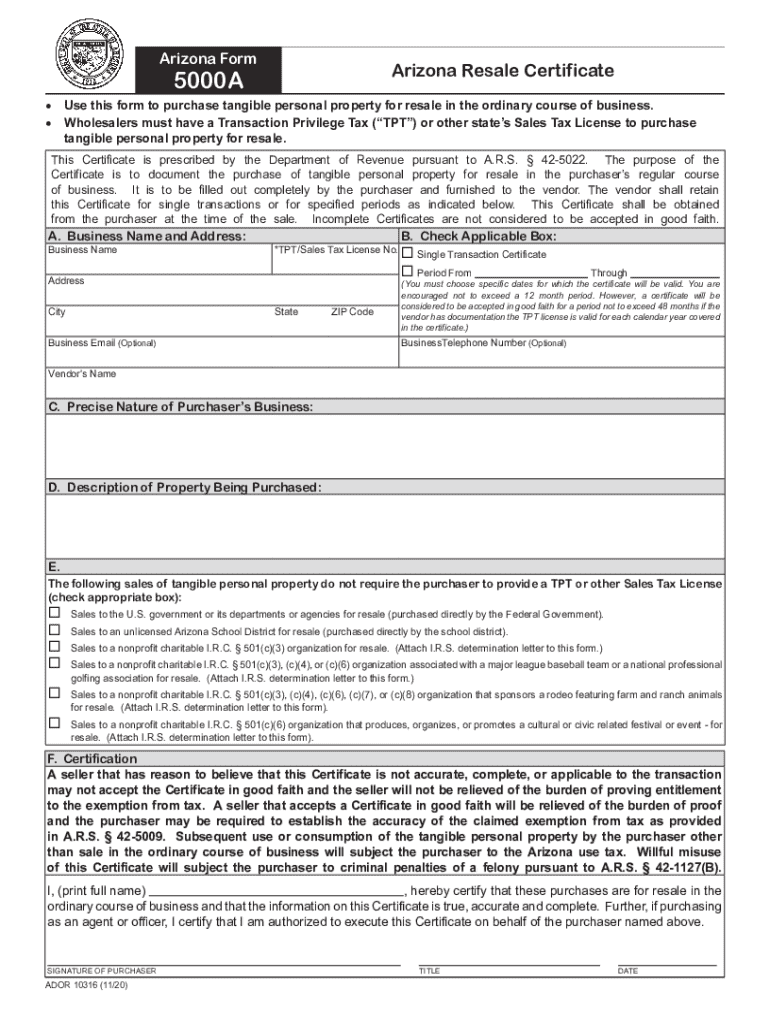

What is Arizona form?

Who is required to file Arizona form?

How to fill out Arizona form?

What is the purpose of Arizona form?

What information must be reported on Arizona form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.