Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: Your Comprehensive How-to Guide

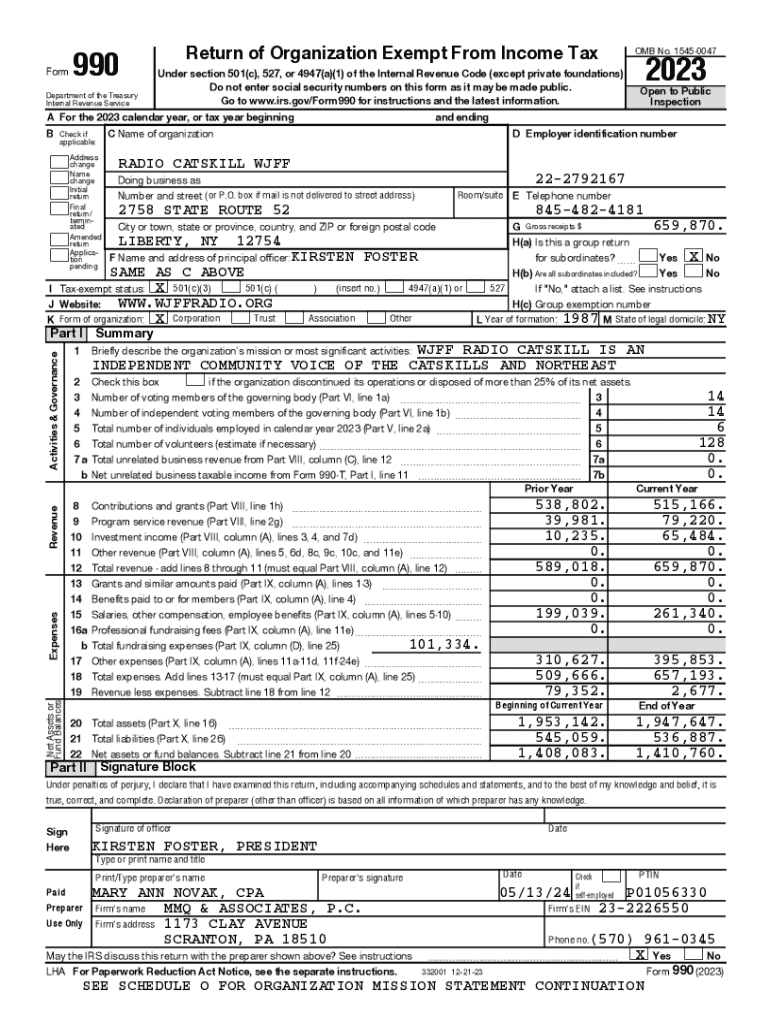

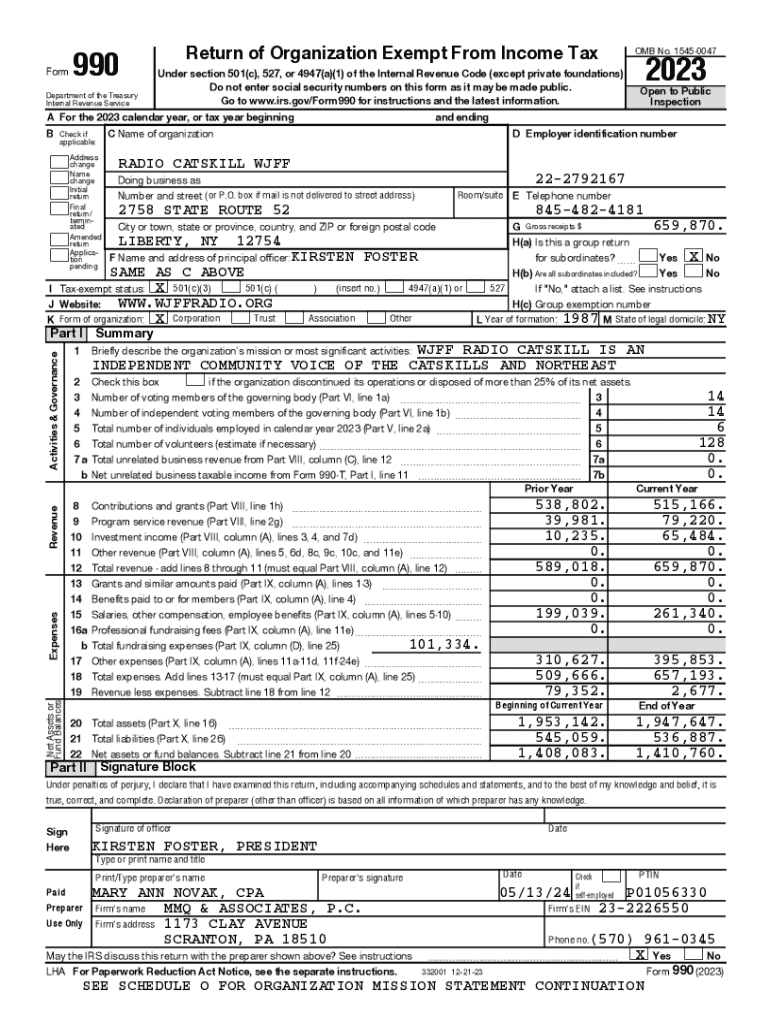

Understanding the Form 990

Form 990 is an essential reporting document that nonprofit organizations in the United States use to provide the IRS with an overview of their financial activities. This form serves multiple purposes, primarily focusing on enhancing transparency and accountability within the nonprofit sector. By requiring nonprofits to disclose their financial information, Form 990 helps potential donors and the public evaluate an organization’s financial health and operational effectiveness.

The importance of Form 990 extends beyond compliance; it promotes trust between nonprofits and their stakeholders. Through detailed financial disclosures, organizations demonstrate their commitment to ethical governance while ensuring funds are utilized appropriately.

Who must file Form 990?

Generally, all tax-exempt organizations classified under section 501(c) must file Form 990, provided they meet certain parameters regarding their revenue. This typically includes nonprofits with gross receipts of $200,000 or more or total assets exceeding $500,000. Smaller organizations may qualify for alternative forms such as Form 990-EZ or Form 990-N (e-Postcard), which are less comprehensive filing options designed to simplify the reporting process for entities with limited financial dealings.

Components of Form 990

Form 990 comprises various sections, each containing critical information about the organization's operations, programs, and finances. Understanding these sections allows nonprofits to present a comprehensive picture of their activities and impact. The main components include a mission statement, a detailed account of program achievements, and full financial disclosure, including revenue streams and expenses.

Moreover, the governance section of Form 990 highlights board composition, policies, and the organization’s procedures for ensuring ethical behavior, thus reinforcing accountability before the public.

Variants of Form 990

Nonprofits have different versions of Form 990 to accommodate varying organizational sizes and financial complexities. The full Form 990 provides comprehensive details and disclosure requirements for larger organizations, while Form 990-EZ caters to smaller nonprofits with less complex financial situations. Form 990-N, or e-Postcard, is the simplest alternative for very small organizations, requiring minimal information to maintain compliance with IRS regulations.

Filing requirements and deadlines

Nonprofit organizations must file Form 990 annually, usually on or before the 15th day of the 5th month after the organization’s fiscal year-end. For example, if a nonprofit's fiscal year ends on December 31, the Form 990 is due by May 15 of the following year. However, many nonprofits opt for extensions to avoid penalties associated with late submissions, prolonging the deadline up to six months.

Consequences of late filing can range from financial penalties to loss of tax-exempt status, emphasizing the need for timely compliance with IRS regulations.

Preparing to file Form 990

Preparing to file Form 990 requires careful documentation and thorough organization. A checklist of necessary documents can streamline the process and reduce the risk of errors. This documentation may include financial statements, a detailed list of assets and liabilities, board meeting minutes, and summaries of program activities. Gathering this information in advance can significantly ease the burden of completing the form.

Additionally, establishing best practices for reporting ensures that all financial data is accurate. Regular audits and maintaining meticulous financial records can assist in providing a sound basis for your Form 990 submissions.

Step-by-step instructions for completing Form 990

Filing Form 990 may seem daunting at first, but breaking it down into manageable components simplifies the process. Starting with the general information section, organizations must enter basic details about their mission, address, and contact information. Every detail is crucial as it forms the basis of the organization's public representation.

Moving onto the statement of program service accomplishments, nonprofits should showcase their impact through succinct narratives that highlight core programs, populations served, and tangible outcomes. A clear and compelling presentation of these achievements can significantly bolster an organization’s reputation.

In the financial statements section, nonprofits report all revenue sources, expenses, and changes in net assets. Utilizing organized financial records is critical to ensure the accuracy of these disclosures. The governance, management, and disclosure section details board practices and policies, showcasing the organization’s integrity.

Finally, analyzing expenses allows organizations to detail the nature of their expenses while justifying decisions made concerning resource allocation, emphasizing effective use of donor funds.

Common mistakes to avoid

Completing Form 990 can be fraught with pitfalls. Many organizations overlook crucial details or misrepresent figures, inadvertently leading to incomplete or inaccurate filings. Failing to provide adequate documentation to support financial figures is another frequent mistake that can result in penalties from the IRS.

Moreover, organizations sometimes neglect to revisit previous submissions, which could lead to inconsistency across years. Such discrepancies may raise red flags during audits and lead to the question of credibility.

Discovering and utilizing Form 990 data

Organizations and individuals can access filed Form 990s via websites like the IRS or guidestar.org. These sites allow users to research and review the financial and operational data of nonprofits, providing valuable insights into an organization’s performance and governance. By effectively analyzing this information, stakeholders can make informed decisions regarding volunteer opportunities, donations, or partnerships.

Understanding how to interpret Form 990 disclosures equips potential donors and the general public with an understanding of an organization’s operational framework, financial stability, and programmatic effectiveness, ultimately fostering greater transparency across the nonprofit sector.

Penalties for noncompliance

Noncompliance with Form 990 filing requirements can lead to significant repercussions. Organizations that neglect to file the Form 990, or fail to meet specified deadlines, may incur penalties of up to $20 per day, capped at $10,000 per year. Additionally, prolonged failure to file may result in the IRS revoking an organization’s tax-exempt status, pushing nonprofits into dire financial situations.

To avoid noncompliance, organizations should establish policies that prioritize timely filings. Regular audits and an annual calendar of compliance deadlines can serve as effective methods to maintain constant oversight regarding Form 990 submissions.

Supporting tools and resources

Utilizing modern technology can significantly simplify the Form 990 filing process. pdfFiller is one such platform that empowers users to edit, eSign, collaborate, and manage their Form 990 documents seamlessly from a single, cloud-based interface. It offers interactive tools that streamline the completion of the form, allowing organizations to focus on their mission rather than tedious paperwork.

Additionally, organizations can seek assistance from reputable third-party resources such as the National Council of Nonprofits or state charity officials, which provide services to ensure compliance with Form 990 regulations, offering workshops, webinars, and guidance accessible for all nonprofits.

Historical context and evolution of Form 990

Form 990 has a rich history tied to the establishment of nonprofit registration and reporting standards in the United States. It was first introduced in the 1940s to ensure that nonprofits maintain a degree of transparency with the public. Over the decades, amendments and updates to the form have sought to refine and bolster this transparency, with particular emphasis on improving the understanding of how organizations operate and allocate their resources.

In recent years, requirements have evolved to capture more detailed financial data, including the need for disclosures regarding executive compensation and related-party transactions, contributing to a more informed public understanding and improved organizational accountability.

Conclusion

Understanding the intricacies of the Form 990 form is imperative for all nonprofit organizations striving to maintain transparency and accountability. A comprehensive and accurate filing not only fulfills IRS requirements but also enhances the credibility of the organization among stakeholders. User-friendly platforms like pdfFiller empower organizations to effectively navigate the complexities of Form 990 filing, ensuring compliance and fostering trust within the community they serve.

Additional considerations

As the nonprofit landscape continues to evolve, so too will the requirements surrounding Form 990. Anticipated changes may include increased data requirements on program effectiveness and diversified funding sources, necessitating enhanced reporting practices from nonprofits. Staying ahead of these trends remains vital as organizations adapt to ensure they sustain funding and remain aligned with public expectations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 990 in Chrome?

How can I edit form 990 on a smartphone?

Can I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.