Get the free Request a Distribution to Another Company

Get, Create, Make and Sign request a distribution to

Editing request a distribution to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out request a distribution to

How to fill out request a distribution to

Who needs request a distribution to?

Request a Distribution to Form: A Comprehensive How-to Guide

Understanding the request for distribution process

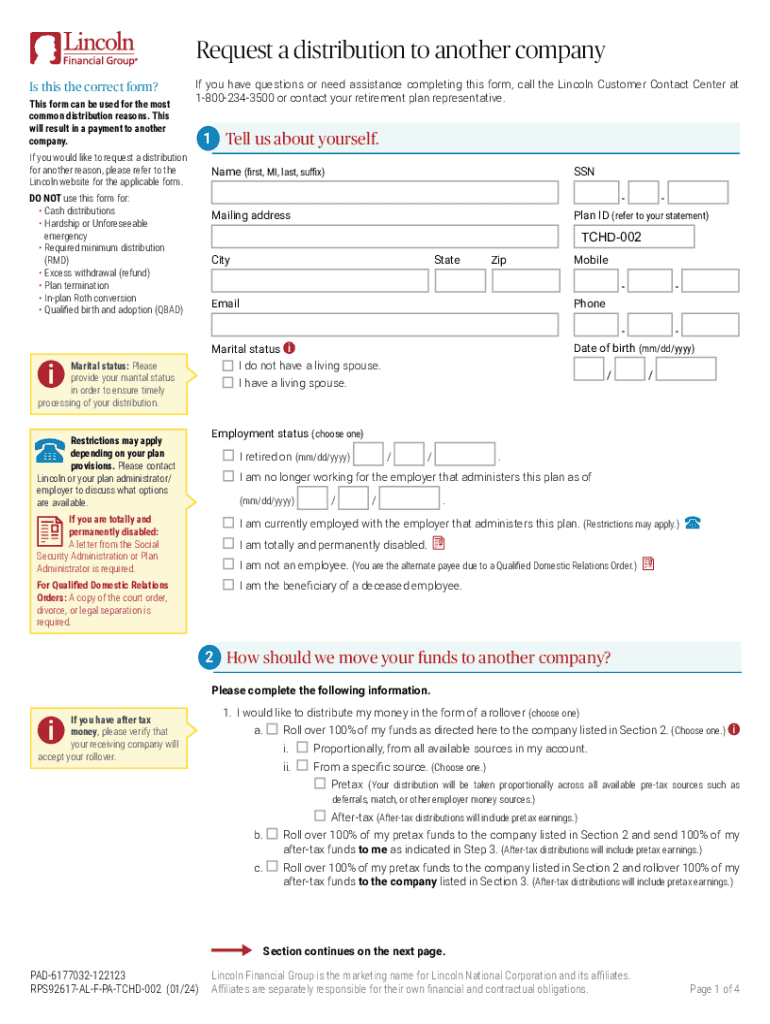

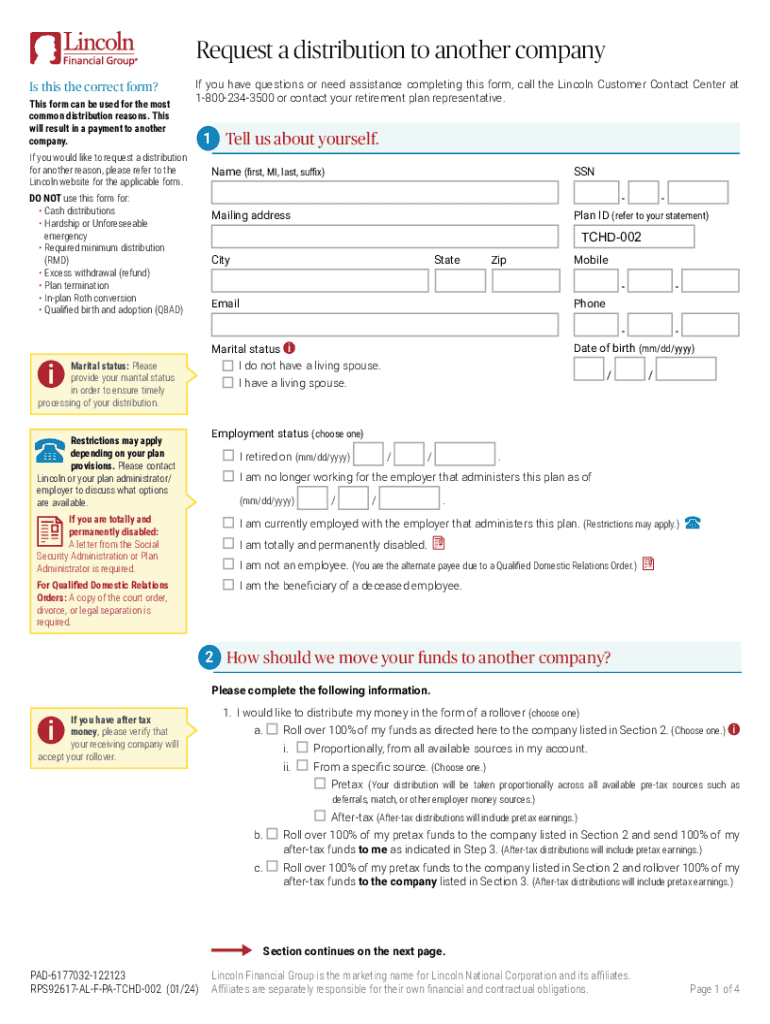

A distribution request, often referred to simply as a withdrawal or disbursement request, is a formal process through which individuals request the transfer of funds or assets from their retirement accounts, trust funds, or other financial entities. Whether it's to access savings, settle bills, or reinvest elsewhere, understanding how to effectively navigate this process is crucial to ensuring the fulfillment of your financial needs. Proper documentation plays a pivotal role in this process as it validates the legitimacy of the request made and mitigates potential processing delays.

To embark on a request for distribution, it's essential to comprehend the entire process, from understanding what documentation is required to knowing the types of distributions available. Having a proper grasp enables users to make informed decisions suited to their financial goals, ultimately leading to a smoother experience when requesting a distribution.

What is a distribution form?

A distribution form is a specific document that individuals must complete to formally request their distribution. This form essentially serves as a declaration of intent, outlining the details of the request, including the type of distribution desired and the amount to be withdrawn or transferred. This structured approach ensures that both the requestor and the financial institution have a clear understanding of the transaction at hand.

Distribution forms may be required in various situations, such as when a retiree starts withdrawing from a retirement plan, an individual needs financial assistance, or during the process of estate settlement. Key information typically required on these forms includes personal identification details, account information, and specifics regarding the desired distribution type.

Types of distributions

When considering how to request a distribution to form, it's important to know the different types of distributions available. Each option varies in terms of structure, timing, and financial implications.

Lump-sum distributions

A lump-sum distribution involves withdrawing the entire balance from an account at once. This option is often appealing for individuals who need immediate cash for large expenses, like a home purchase or medical bills. However, it's crucial to be aware that a lump-sum distribution may have significant tax implications, as it may push you into a higher tax bracket in that year.

Periodic payments

Periodic payments, often referred to as an annuity option, allow individuals to receive funds over time, such as monthly or quarterly distributions. This choice can provide a reliable income stream for those in retirement but comes with the downside of potentially limiting access to funds in the short term.

In-kind distributions

In-kind distributions involve transferring assets rather than cash, such as stocks or bonds. This option might be ideal if an individual wants to maintain their investment strategy or avoid realizing capital gains immediately. Situations benefiting from in-kind distributions could include estate planning or diversifying an investment portfolio.

Rollover options

Rollover options allow individuals to transfer retirement funds from one account to another without incurring taxes or penalties, provided the rollover is executed properly within a specific timeframe. Understanding how to properly process a rollover is essential to avoid any pitfalls that might arise from mismanagement.

Required documentation for requesting distributions

Requesting a distribution often necessitates specific documentation to validate the request. Ensuring you have the right documents can facilitate a smoother submission and processing experience.

Primary documents needed

At the very least, you will need personal identification documents such as a driver's license or passport and your account information, which typically includes your account number and any passwords necessary for verification.

Additional supporting documentation

Depending on your situation, additional documentation may also be required. For instance, tax forms might be necessary for compliance purposes, and proof of financial need could be requested if you’re withdrawing for hardship reasons. Collecting these documents beforehand can prevent delays in your distribution request.

Steps to request a distribution

Successfully requesting a distribution can be broken down into manageable steps.

Fees associated with distribution requests

When requesting a distribution, it's essential to be aware of any potential fees that might apply. Financial institutions often charge fees for processing distributions, which can vary based on the type of distribution requested.

To minimize costs, individuals should consider options like choosing the most cost-effective distribution type and verifying fee schedules beforehand. Comparing fees across different distribution types can also help in making an informed decision.

Timeline for processing distribution requests

Understanding the timeline for processing your request is critical to managing your financial expectations. Each type of distribution request has varying processing times.

Typically, lump-sum requests may be processed faster than rollovers or in-kind distributions due to the complexity involved. However, various factors can influence these timelines, such as the workload of the financial institution and the completeness of your submitted information.

If you need to expedite your request, inquire directly with your financial institution about any expedited processing options they may offer.

Need help with your distribution request?

If you encounter challenges during the distribution request process, don't hesitate to reach out for help. Most institutions have customer support available to assist with questions. You can also find various tools and resources on pdfFiller that are designed to guide users through the process efficiently.

Who we serve

Our services cater specifically to individuals seeking personal financial management solutions, such as retirees needing to navigate their distribution options. We also assist teams and organizations managing employee benefits and provide support for financial advisors assisting their clients with the distribution process.

Solutions offered by pdfFiller

pdfFiller empowers users to seamlessly edit PDFs, sign documents electronically, collaborate, and manage documents from a cloud-based platform. Whether you need to fill out a distribution form or explore document management features, we provide a comprehensive solution for accessing and managing your forms.

Resources for further assistance

For those who prefer visual learning, pdfFiller offers a variety of step-by-step video tutorials on how to request distributions and complete specific forms. You can also access user guides tailored to address common questions about distribution types and processes. Explore our FAQs for additional clarity and support.

Interactive tools on pdfFiller

Utilize our interactive tools to customize your documents effectively. From our document customization interface to eSignature solutions designed for fast approval, pdfFiller streamlines the completion of distribution forms, enabling users to accomplish their tasks with ease.

Quick links

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute request a distribution to online?

Can I create an electronic signature for signing my request a distribution to in Gmail?

How can I fill out request a distribution to on an iOS device?

What is request a distribution to?

Who is required to file request a distribution to?

How to fill out request a distribution to?

What is the purpose of request a distribution to?

What information must be reported on request a distribution to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.