Get the free Uniform Residential Loan Application

Get, Create, Make and Sign uniform residential loan application

How to edit uniform residential loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uniform residential loan application

How to fill out uniform residential loan application

Who needs uniform residential loan application?

Uniform Residential Loan Application Form - How-to Guide

Understanding the Uniform Residential Loan Application

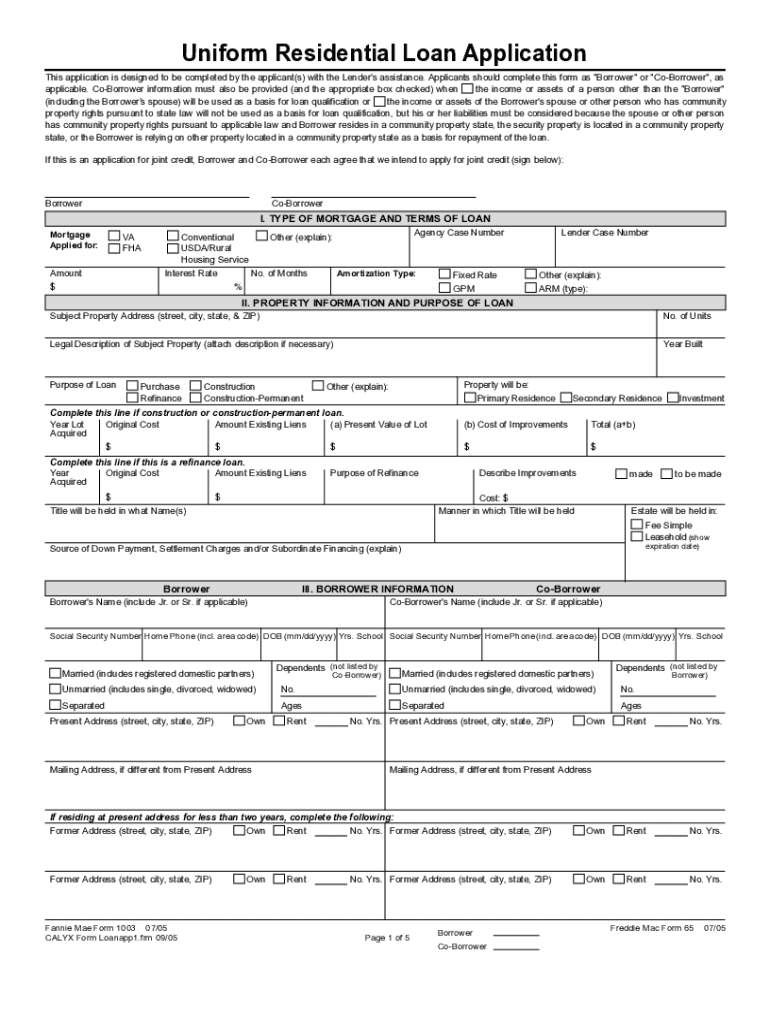

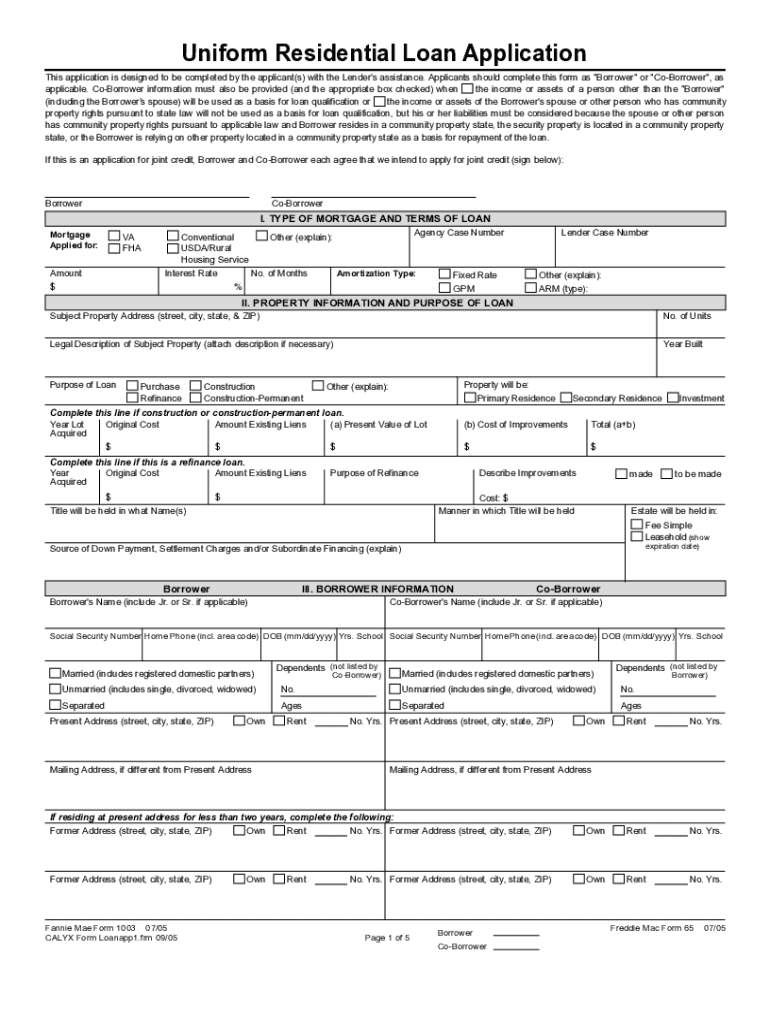

The Uniform Residential Loan Application (URLA), also known as Fannie Mae Form 1003, serves as a standardized tool used by mortgage lenders to assess borrowers. Its primary purpose is to collect detailed financial information necessary for evaluating a borrower's eligibility for a loan. This form essentially acts as a snapshot of an applicant’s financial health and aids in the decision-making process for lenders.

The significance of the URLA in the loan process cannot be overstated. It streamlines the qualification and underwriting process by ensuring that lenders have all pertinent information, which can reduce delays and increase efficiency. By using a consistent format, lenders can quickly compare applications, making it easier for them to decide on approving or denying loans.

Key stakeholders involved in the URLA process include borrowers, loan officers, underwriters, and brokers. Each entity plays a crucial role, from gathering the necessary information to providing approvals based on the applicant's financial status.

Navigating the form structure

Understanding the components of the Uniform Residential Loan Application can simplify the process significantly. The main sections of the form consist of borrower information, employment history, monthly income, assets and liabilities, and loan and property information.

Here’s a breakdown of the essentials included in each section:

Familiarity with the common terminology used throughout the URLA is crucial. Terms like LTV (Loan-to-Value), debt-to-income ratio, and CLTV (Combined Loan-to-Value) are essential metrics that lenders assess.

Step-by-step instructions for completion

Completing the Uniform Residential Loan Application requires careful preparation. Follow these steps to ensure an accurate and thorough application.

Step 1: Gathering Necessary Documents

Step 2: Filling Out the Form

Begin with your personal details, ensuring accuracy in spelling and numbers. Proceed to complete the employment and income sections with precise figures from your gathered documents. Be thorough when disclosing assets and liabilities, as this impacts your financial assessment.

Step 3: Reviewing the Form

Checking for accuracy is critical. Common mistakes can include inconsistent income reporting or missing information. A thorough review helps avoid delays in the approval process.

Step 4: Submitting the Application

Finally, submit your completed application. If using pdfFiller, you can do this electronically. An electronic submission often accelerates processing times, allowing you to receive updates on your application swiftly.

Interactive tools for form management

Using pdfFiller offers an array of tools specifically designed for managing the Uniform Residential Loan Application easily. Editing and customizing your form can be done seamlessly through its user-friendly interface.

Here are some features that can enhance your experience:

Incorporating collaboration in the application process

Engaging with others during the application process is simplified with pdfFiller’s collaboration features. You can work simultaneously on the application with your team members, ensuring everyone is in sync.

The commenting and feedback tools allow users to make suggestions directly on the document, which promotes clarity and reduces the possibility of miscommunication.

Additionally, these features bolster compliance by ensuring all necessary entries are reviewed collectively before submission, enhancing the overall accuracy of your application.

Managing your loan application

Once submitted, it’s crucial to track your loan application effectively. With pdfFiller’s helpful tools, you can monitor the progress of your application, keeping communication lines open with your lender.

In the event that you need to revise or update your application information, pdfFiller makes it easy to access your document for modifications. This flexibility enables you to keep your application aligned with any changes in your financial situation.

Remember to follow up with lenders post-submission. Having a proactive approach ensures you receive timely updates and address any potential issues quickly.

Frequently asked questions

Support and resources

Having access to support is crucial when navigating the complexities of the Uniform Residential Loan Application. pdfFiller offers robust customer support to assist you with any questions or issues you may encounter.

Additionally, a variety of tutorials and guides are available for users, providing step-by-step instructions on using the platform effectively. Community forums also allow users to share experiences and tips, creating a valuable resource pool.

Exploring other document solutions

Beyond the Uniform Residential Loan Application, pdfFiller accommodates numerous related forms and applications. Utilizing its services can optimize your entire document process, from applications to contracts, enhancing productivity and organization.

By focusing on continuous improvements and introducing new features, pdfFiller aims to cater to evolving user needs, ensuring that you have access to the latest tools for document management and collaboration.

This comprehensive guide to the Uniform Residential Loan Application Form provides the necessary tools and insights you need to navigate the loan application process effectively. By leveraging pdfFiller's features, you can ensure that your application is accurate, collaborative, and submitted efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit uniform residential loan application from Google Drive?

How can I send uniform residential loan application to be eSigned by others?

Can I create an electronic signature for signing my uniform residential loan application in Gmail?

What is uniform residential loan application?

Who is required to file uniform residential loan application?

How to fill out uniform residential loan application?

What is the purpose of uniform residential loan application?

What information must be reported on uniform residential loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.