Get the free Refund of Franking Credits Application and Instructions 2025

Get, Create, Make and Sign refund of franking credits

How to edit refund of franking credits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out refund of franking credits

How to fill out refund of franking credits

Who needs refund of franking credits?

Refund of Franking Credits Form: A Comprehensive How-to Guide

Understanding franking credits

Franking credits play a crucial role in the taxation of dividends for investors, allowing them to receive tax credits that help offset their tax liabilities. Essentially, franking credits represent the tax that a company has already paid on its profits before distributing dividends to shareholders. This ensures that shareholders are not taxed again on income that has already been taxed at the corporate level.

When a company issues dividends, it often attaches franking credits to these payments, indicating how much tax has been paid. These credits can reduce the amount of tax payable by the investor, and in many cases, may lead to a refund if the franking credits exceed their tax obligations.

Eligibility for franking credits refund

To be eligible for a refund of franking credits, several criteria must be met. Generally, individual investors, companies, and certain entities can apply for these refunds. Common scenarios include self-managed super funds (SMSFs) or individuals who may fall below the taxable income threshold, potentially leading to excess franking credits after their tax liabilities are calculated.

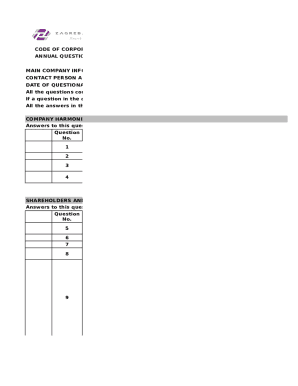

The refund of franking credits form

The Refund of Franking Credits Form is essential for investors looking to claim their franking credits back from the Australian Taxation Office (ATO). This form ensures that individuals and entities accurately present their claims, facilitating a smoother refund process. Proper completion of the form can significantly speed up the assessment and approval timeline.

The form requires specific details, including personal information, the amounts relating to franking credits, and the associated dividend payments. Therefore, ensuring all necessary information is provided and correctly filled out is critical to avoid delays in the refund process.

Where to find the form

The Refund of Franking Credits Form can typically be found on the official website of the Australian Taxation Office. You can download this form directly from their resources page, or utilize platforms like pdfFiller that offer easy access to forms and allow for online editing.

Step-by-step guide to completing the refund of franking credits form

Successfully completing the refund of franking credits form involves a series of organized steps to ensure accuracy and compliance. Let’s break down these steps.

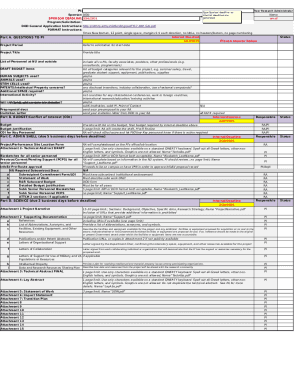

Gather necessary documentation

The first step in the process is to gather all relevant documentation. This includes proof of income, details of shares held, and prior tax returns if applicable. Having all necessary documents at hand can streamline the completion of your application.

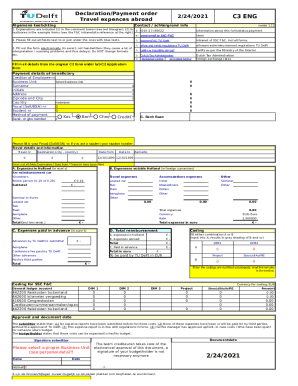

Filling out the form

Carefully fill out each section of the form, ensuring to include accurate personal and financial details. Some key sections to address include personal information like your name and address, dividend information that captures the amounts received, and franked amounts—specifying how many credits you are claiming.

Common mistakes to avoid

While completing the form, be aware of common pitfalls. Errors in personal details or incorrect dividend amounts can delay your refund process. Always double-check your figures and ensure that all required sections are filled accurately.

Editing and customizing the form with pdfFiller

pdfFiller allows users to upload the refund of franking credits form easily for editing. Within this platform, you can access numerous tools to help modify your form effectively.

eSigning your form

Once the form is completed, adding your eSignature is a critical step. This serves as a formal acceptance of the information presented and is essential for the submission process. Using pdfFiller, the eSigning process is user-friendly, allowing you to legally sign documents within moments.

Final review and submission

Before submitting, conduct a final review of your application. Checklist items include ensuring all areas of the form are filled, verifying your eSignature is included, and that there are no blank spaces or unanswered questions. After confirming all is in order, you can submit your form through the specified channels provided by the ATO.

Follow-up actions after submission

After submitting your refund application, staying informed about your application's progress is important. The ATO provides methods to track the status of your request, making it easier to know whether your application is in review or if additional information is requested.

What to expect after submission

You can expect a timeline for processing your application after submission. Generally, processing times vary depending on the complexity of your claim and the current workload at the ATO. However, commonly, applications are reviewed within a few weeks, and you may receive updates or requests for further documentation during this period.

Common FAQs regarding refund of franking credits

A lot of questions arise when individuals approach the process of claiming franking credits back. Here are some frequently asked questions:

Exploring related resources and tools

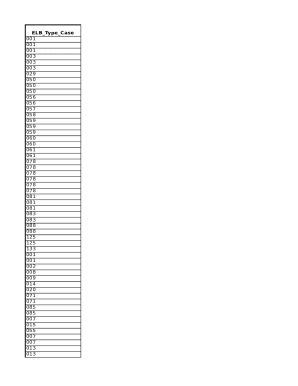

Apart from the Refund of Franking Credits Form, there are other forms and online tools available that are instrumental in calculating franking credits and related claims. Utilizing online calculators can provide immediate insights into your potential franking credits before submission, ensuring you understand what to expect.

How pdfFiller supports your documentation needs

pdfFiller serves as an empowering tool for users managing form submissions. The platform integrates multiple features that streamline the completion and submission process, allowing users to save time and effort.

Overview of integrated features

On pdfFiller, users can enjoy real-time collaboration on the same document, cloud-based access for any device, and efficient storage solutions. This ensures that your applications remain organized and accessible wherever you are.

Testimonial highlights from users leveraging pdfFiller for refund applications

Users have found pdfFiller invaluable for managing their refund applications. With feedback highlighting the ease of use and efficiency of the platform, many mention how the editing tools and eSigning features have saved time and reduced stress during the lengthy application process.

Tips for successful refund applications

Obtaining a successful refund involves more than just filling out a form; it requires careful preparation and understanding of taxation principles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my refund of franking credits in Gmail?

How can I modify refund of franking credits without leaving Google Drive?

How do I make edits in refund of franking credits without leaving Chrome?

What is refund of franking credits?

Who is required to file refund of franking credits?

How to fill out refund of franking credits?

What is the purpose of refund of franking credits?

What information must be reported on refund of franking credits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.