Get the free Smu Family Assistance Loan Program Credit Application

Get, Create, Make and Sign smu family assistance loan

How to edit smu family assistance loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out smu family assistance loan

How to fill out smu family assistance loan

Who needs smu family assistance loan?

Navigating the SMU Family Assistance Loan Form: A Comprehensive Guide

Overview of the SMU Family Assistance Loan

The SMU Family Assistance Loan serves as a critical financial resource for students and their families navigating the complexities of higher education financing. Its primary purpose is to bridge the gap between family contributions and the overall cost of education, ensuring that students can access necessary funds without an overwhelming financial burden.

The Family Assistance Loan is crucial in supporting education as it enables more families to pursue higher learning without accumulating unmanageable debt, thus enhancing educational accessibility.

Types of Family Assistance Loans Offered

Understanding the types of Family Assistance Loans available is essential for discerning which loan best fits your financial situation. SMU offers various loan options designed to accommodate the differing needs of its student body.

When comparing Family Assistance Loans with other financial aid options, it’s vital to note the differences in terms of repayment obligations and eligibility. Grants and scholarships, for instance, do not require repayment but are often competitive. In contrast, other loan types include credit-based and private-alternative loans, which may entail higher interest rates and less favorable terms.

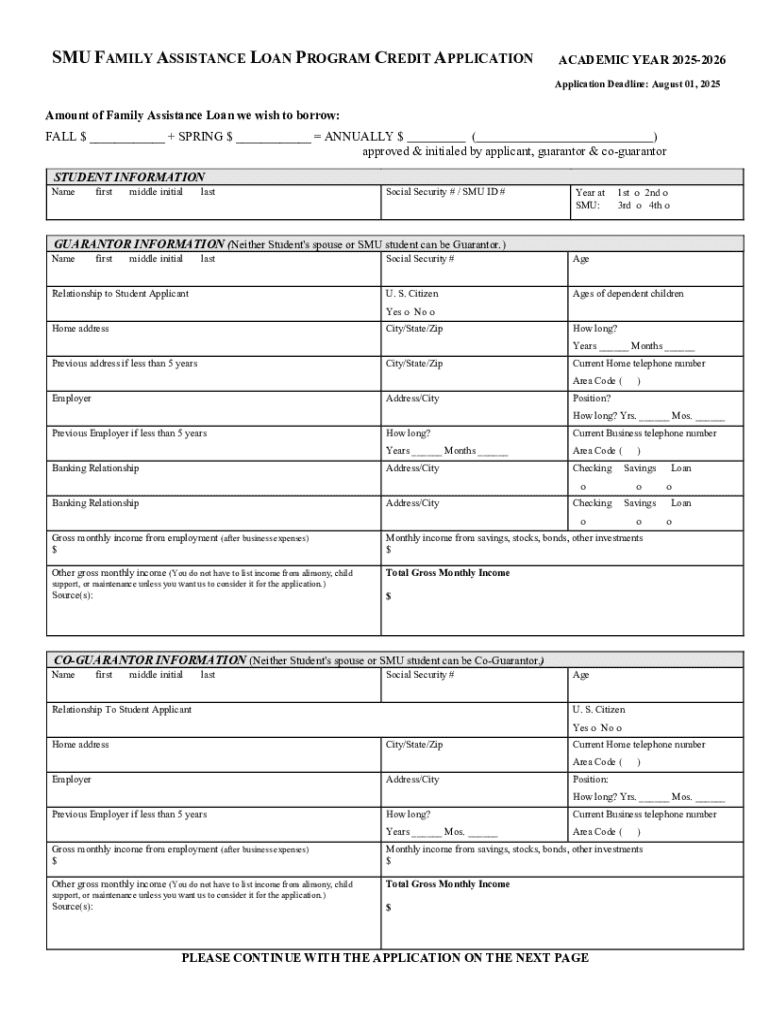

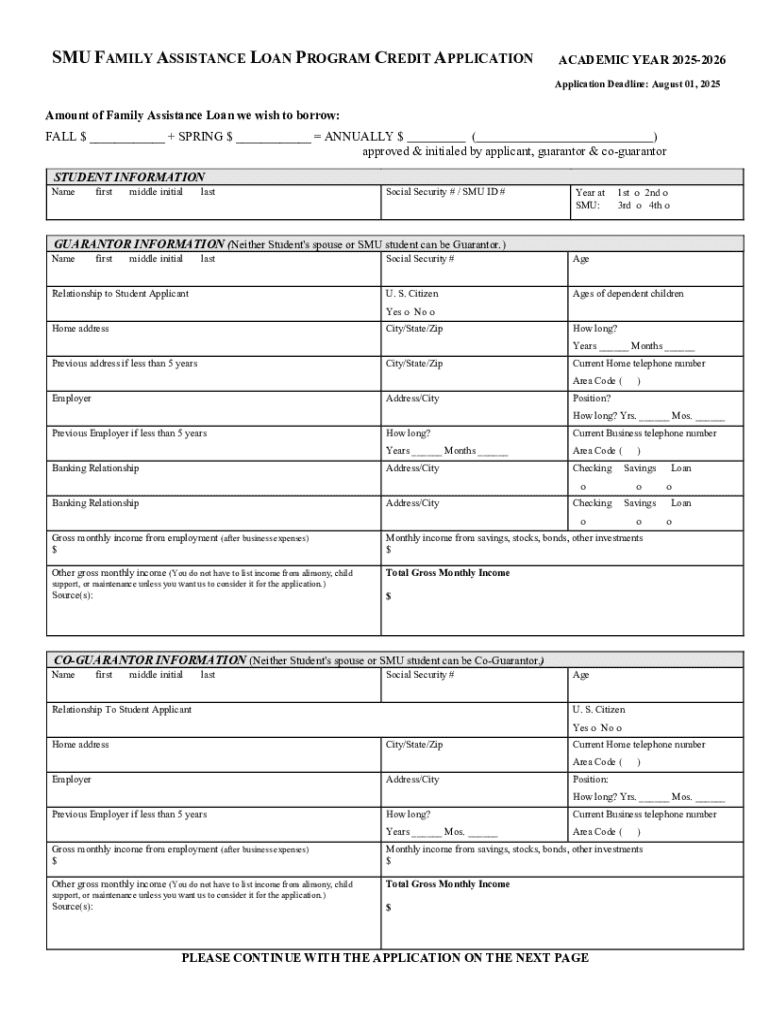

Requirements for Completing the SMU Family Assistance Loan Form

Successfully completing the SMU Family Assistance Loan Form requires careful attention to detail and a few essential documents. Proper documentation ensures a smooth application process and minimizes potential delays.

Common mistakes to avoid include overlooking required documents and failing to provide accurate financial details, as these can result in application delays or denials.

Step-by-step guide to filling out the loan form

Filling out the SMU Family Assistance Loan Form can feel daunting, but breaking it down into manageable steps simplifies the process. Here’s a detailed guide.

Following these steps carefully can significantly reduce the likelihood of errors and help expedite the review process.

Editing and managing your loan form

After submitting your SMU Family Assistance Loan Form, you may find the need to make edits. Utilizing tools such as pdfFiller enables you to edit your loan form easily.

It's crucial to keep a digital copy of your loan form, not just for record-keeping but also for reference during future interactions with the financial aid office.

eSigning the loan form

The eSignature process for your SMU Family Assistance Loan Form is straightforward and legally binding. It streamlines the application process without the hassle of paper trails.

All electronically signed documents hold legal standing, ensuring that your submissions are recognized and processed effectively.

Tips for collaborating with family members on the application

Involving family members can enhance the application process for the SMU Family Assistance Loan. Collaborative input can ensure accurate reporting and understanding of family financial circumstances.

Utilizing technology allows for efficient collaboration, making the process less cumbersome and more straightforward.

What to expect after submission

After submitting your SMU Family Assistance Loan Form, it’s normal to wonder about next steps and processing times. Typically, loan applications are reviewed promptly but can vary in timing.

Knowing what to expect can lessen anxiety and help you prepare for the next steps in this important financial journey.

Frequently asked questions (FAQs)

Addressing common inquiries about the SMU Family Assistance Loan can demystify the process for potential applicants. Understanding eligibility, repayment terms, and available resources is vital.

Utilizing the FAQs can provide quick answers and guide you towards additional support if necessary.

Resources and tools for financial planning

Planning financially for your education is paramount. Several resources are readily available to assist students and families in this process. From budget calculators to financial aid resources, these tools can simplify your financial planning efforts.

Leveraging these resources allows families to make informed decisions about financing education.

Next steps after receiving your loan approval

Receiving approval for your SMU Family Assistance Loan is just the beginning of your financial journey. Understanding the subsequent steps is crucial for ensuring a successful experience with your loan.

By understanding your obligations following loan approval, you can better navigate your educational finances.

Staying informed: updates and changes to family assistance loans

Remaining informed about updates and changes to the SMU Family Assistance Loan is paramount for current and prospective students. Policies can evolve, impacting eligibility and terms.

By actively seeking out information, students can ensure they are making well-informed decisions regarding their financial futures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my smu family assistance loan in Gmail?

How do I edit smu family assistance loan straight from my smartphone?

How do I fill out smu family assistance loan using my mobile device?

What is smu family assistance loan?

Who is required to file smu family assistance loan?

How to fill out smu family assistance loan?

What is the purpose of smu family assistance loan?

What information must be reported on smu family assistance loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.