Get the free Printing 1099 Correction Forms

Get, Create, Make and Sign printing 1099 correction forms

Editing printing 1099 correction forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out printing 1099 correction forms

How to fill out printing 1099 correction forms

Who needs printing 1099 correction forms?

Printing 1099 Correction Forms: A Comprehensive Guide

Understanding the 1099 correction process

1099 correction forms are essential documents used by businesses to correct errors found on previously filed 1099 forms. Their primary purpose is to ensure both the businesses and the IRS have accurate tax information, which is critical for tax reporting. Corrections can be necessary for various reasons, such as reporting incorrect amounts or providing wrong recipient details.

Timing plays a significant role in the 1099 correction process. It is crucial to file corrected forms promptly to avoid potential penalties or complications with IRS audits. Filing timely corrections can also ensure that recipients receive accurate tax documents, helping them maintain correct tax records.

Types of 1099 forms and common errors

There are various types of 1099 forms, including 1099-MISC for miscellaneous income and 1099-NEC specifically for non-employee compensation. Each form serves a specific reporting purpose and is subject to unique IRS guidelines. Understanding these forms is essential when considering corrections, as different scenarios may arise depending on the nature of the error.

By identifying and understanding these common errors, businesses can more efficiently correct their 1099 filings and minimize the risk of tax-related issues.

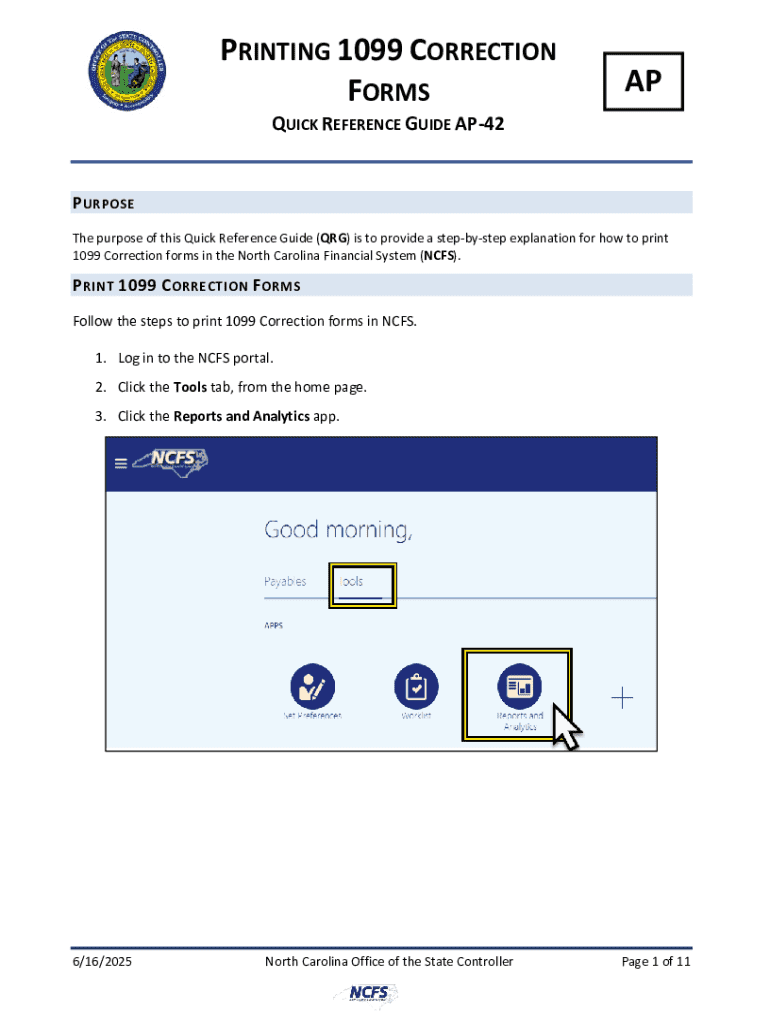

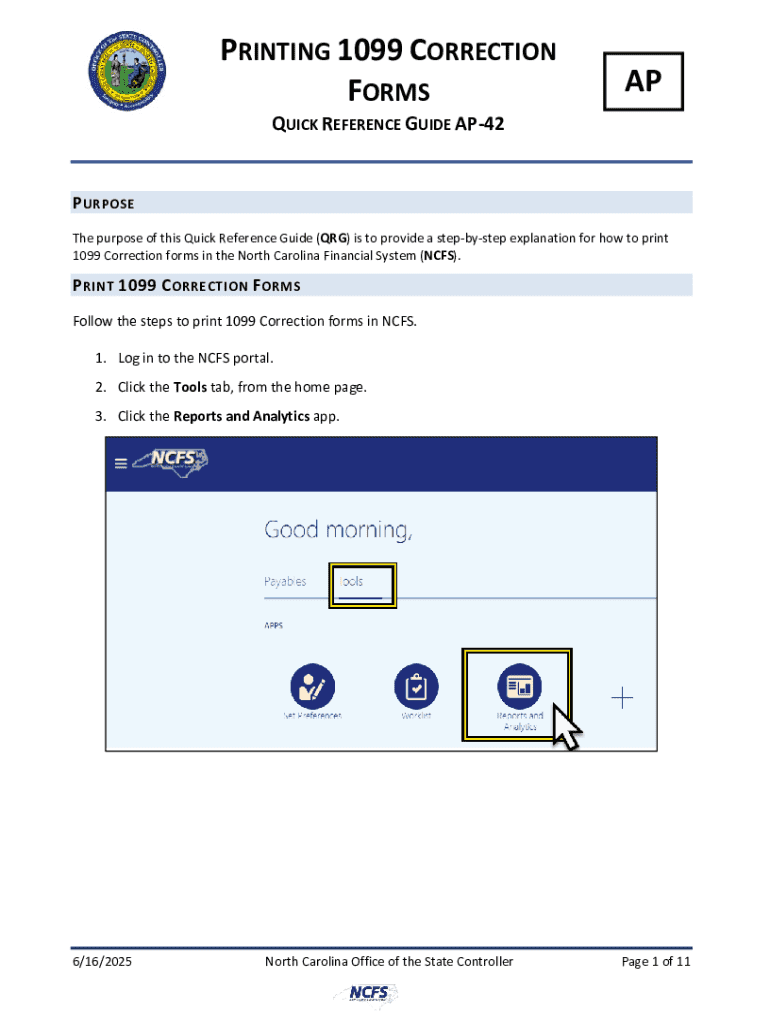

Step-by-step instructions: how to print corrected 1099 forms

Printing 1099 correction forms can seem daunting, but by following step-by-step instructions, the process becomes much more manageable.

By adhering to these steps, individuals and teams can meticulously complete their 1099 corrections, paving the way for accurate tax reporting.

Online vs. paper filing for 1099 corrections

When it comes to filing corrected 1099 forms, choosing between online and paper submission is crucial. Using pdfFiller for electronic filing offers several advantages, such as saving time, reducing human error, and allowing easy tracking of submissions.

Ultimately, selecting the right filing method can streamline the correction process and ensure compliance with IRS regulations.

Deadlines and responsibilities

The IRS has specific due dates for filing corrected 1099 forms. It’s imperative to adhere to these deadlines to avoid penalties. Generally, corrections should be submitted within 30 days of discovering an error, but it is always ideal to check the latest IRS guidelines for exact dates.

Being aware of these deadlines is essential for maintaining compliance and for ensuring that all recipients receive their corrected forms on time.

Tools and resources for 1099 corrections

Utilizing interactive tools like those available on pdfFiller can significantly ease the document management process. These tools allow for seamless creation, editing, and submission of the necessary forms.

By leveraging these tools, users can minimize hassle and streamline their document processes.

Tips for avoiding common 1099 mistakes

Avoiding common mistakes when completing 1099 forms is essential for reducing the need for later corrections. Keeping careful records and ensuring all entered information is verified significantly reduces errors.

Incorporating these best practices into your filing strategy can lead to fewer corrections and a more streamlined tax process.

When to seek professional help

Certain situations may call for the guidance of a tax professional. If the errors on your 1099 forms are complex or involve substantial amounts, getting expert assistance can prevent further complications.

Seeking help at the right time can save time and stress, especially during tax season.

Printing and delivering your 1099 correction form

Once you have completed the form, the next step is printing and delivering it. Ensure that you use a high-quality printer to produce clear, legible forms that adhere to IRS specifications.

Proper delivery ensures that recipients receive corrected information swiftly, allowing them to adjust their tax filings as needed.

Navigating future changes in 1099 tax rules

Tax rules are subject to change, and staying updated on IRS announcements is vital for individuals and businesses alike. Understanding and preparing for upcoming changes can safeguard your operations against potential compliance issues.

By proactively seeking information, you can navigate potential tax pitfalls and ensure compliance in future filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit printing 1099 correction forms in Chrome?

Can I create an electronic signature for signing my printing 1099 correction forms in Gmail?

How do I fill out printing 1099 correction forms using my mobile device?

What is printing 1099 correction forms?

Who is required to file printing 1099 correction forms?

How to fill out printing 1099 correction forms?

What is the purpose of printing 1099 correction forms?

What information must be reported on printing 1099 correction forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.