Get the free Successor Liability with Joint and Several Liability Agreement (15enrollment DHCS 6217)

Get, Create, Make and Sign successor liability with joint

How to edit successor liability with joint online

Uncompromising security for your PDF editing and eSignature needs

How to fill out successor liability with joint

How to fill out successor liability with joint

Who needs successor liability with joint?

Understanding Successor Liability with Joint Form

Understanding Successor Liability

Successor liability refers to the legal doctrine under which a company that acquires the assets of another company may be held responsible for the liabilities of the selling company. This concept is particularly significant in business transactions, especially during mergers and acquisitions. Understanding this concept enables businesses to navigate potential legal pitfalls efficiently.

Unlike general liability, which pertains to the accountability concerning wrongful acts, successor liability tackles issues of responsibility that arise when one business entity takes over another. This can have serious implications for buyers who may inadvertently inherit legal obligations or debts.

Successor liability’s implications extend to various business arrangements where joint forms may play a role. This affects the intentions behind structuring transactions, particularly for risk-averse parties who need to mitigate potential liabilities.

Joint forms and their role in successor liability

Joint forms are legal documents executed by two or more parties working together, commonly used to clarify obligations, rights, and liabilities in business transactions. They play a vital role in determining how liabilities are shared among multiple entities, potentially shielding one party from the financial burdens of the other’s debts.

The utility of joint forms with regard to successor liability is visible in how they outline the distribution of liabilities among parties involved in a transaction. By utilizing mechanisms such as liability clauses, businesses can articulate which entity will retain responsibility for any pre-existing liabilities. This ensures a clear legal understanding and can significantly mitigate the risks involved in asset acquisitions.

Using joint forms in contractual setups provides several benefits including enhanced clarity of expectations, potential reduction of liability risk, and more robust negotiation positions during discussions.

Examples of successor liability in practice

Consider a manufacturing company, Company A, that acquires the assets of Company B, which faced lawsuits for defective products. In this instance, without any joint forms or explicit agreements, Company A may find itself liable for Company B’s past liabilities. A practical approach would employ a joint form detailing how each entity approaches these liabilities.

Significant court cases also help shape the understanding of successor liability. For example, the case of 'Flintkote Co. v. General Accident Assurance Co.' set important standards on how successor liability can apply to various business acquisitions, illustrating the necessity of joint forms to clarify liability assets in complex scenarios.

Filling out and using joint forms

Completing a joint form for successor liability involves meticulous attention to detail. Here’s a step-by-step guide to ensure that every necessary section is thoughtfully and accurately completed.

Editing and customizing joint forms to fit particular needs ensures they remain useful for various scenarios while providing clarity and protection.

Regular reviews and updates of these forms can enhance their effectiveness and relevance over time.

Collaboration and management of documents

Effective document management is crucial for maintaining legal forms like joint forms related to successor liability. Tools like pdfFiller enable users to create and manage their documents efficiently, ensuring easy access and collaboration.

With features that allow for the secure storage and sharing of documents, pdfFiller ensures that all parties can access the most recent versions of legal agreements. This is particularly important when multiple entities are involved, as maintaining clarity and accountability becomes paramount.

The platform also makes eSigning easy, enabling team members to sign documents remotely and quickly, streamlining the process and expediting crucial transactions.

Related documents and resources

Several forms complement the joint form specifically for successor liability. These may include liability waivers, indemnity agreements, and purchase agreements, among others. Utilizing these related documents helps businesses create a comprehensive understanding of obligations and rights during business transactions.

A glossary of key terms associated with successor liability can enhance understanding among parties involved, ensuring that legal jargon does not hinder communication or clarity. Documents should include terms like 'indemnity,' 'asset purchase,' and 'business merger' to facilitate discussions.

Common misconceptions about successor liability

There are prevalent myths surrounding successor liability that can lead to misunderstandings. One common belief is that acquiring a business automatically entails taking on all its liabilities. This is not true; various legal arrangements, particularly through joint forms, can mitigate this aspect.

Another misconception is that written agreements are unnecessary if there is a verbal understanding between parties. In reality, without formal documentation, liability issues can become complex, making joint forms essential to bridge gaps and establish clear agreements.

FAQs about successor liability and joint forms

Inquiries regarding successor liability and joint forms are common. Questions often revolve around the legitimacy and enforceability of these forms in court, how liability can be limited through strategic drafting, and the best practices for utilizing forms in various transactions.

Legal experts frequently emphasize the importance of clear language in these forms to ensure that all parties understand their obligations fully. When in doubt, consulting with a legal professional is advisable to tailor forms to specific needs and mitigate risks.

Contact and support

For those seeking expert assistance with successor liability forms or joint forms, it’s beneficial to reach out to legal professionals experienced in corporate law. Additionally, pdfFiller offers customer support options to guide users through any challenges they may face, enhancing the overall document management experience.

Having access to support resources can streamline the process of creating and utilizing legal documents, reducing the uncertainty that often accompanies complex legal transactions.

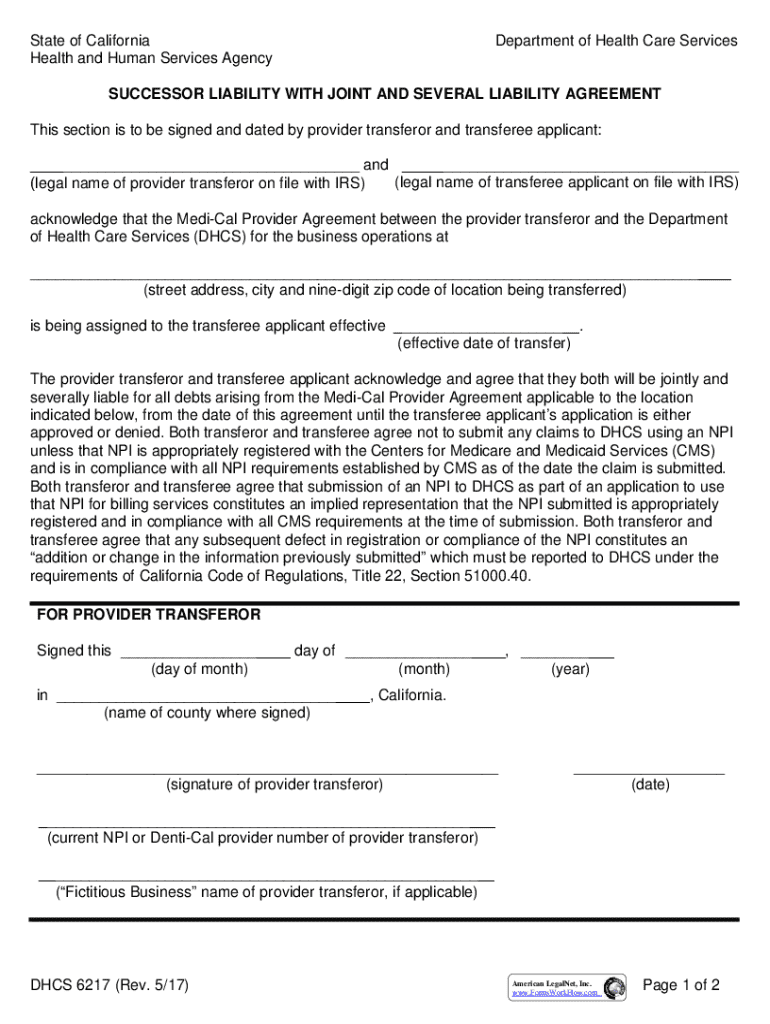

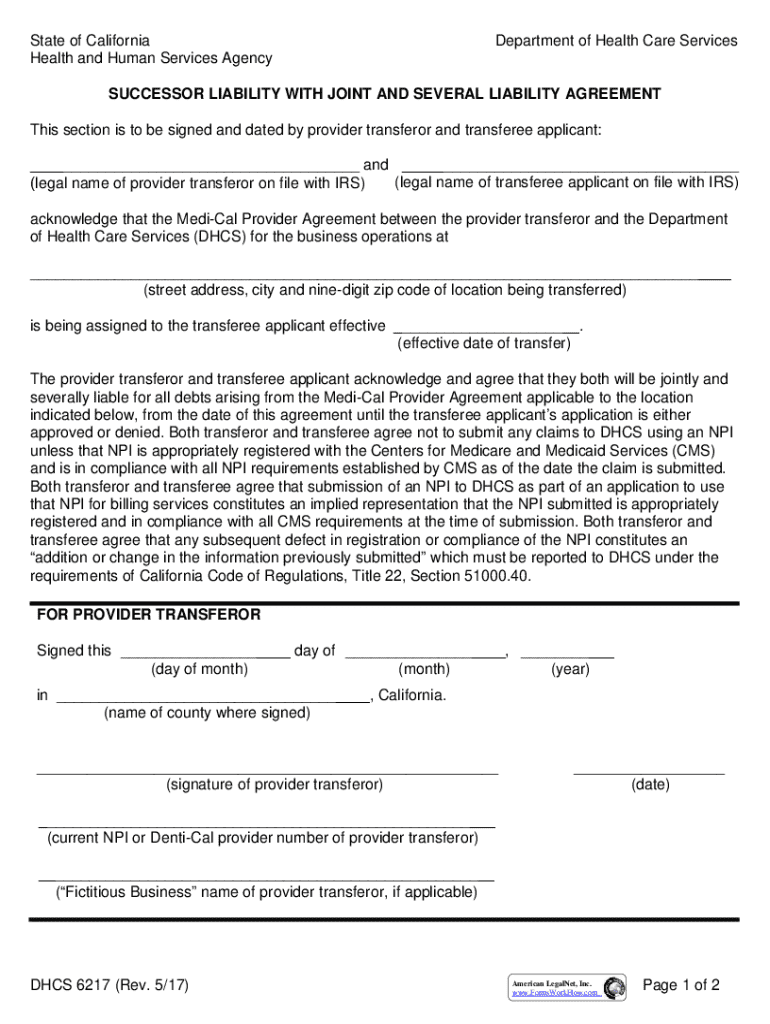

Form preview

Users can benefit from interactive features that allow them to preview and fill out the joint form for successor liability directly. This makes the process straightforward and user-friendly, offering clickable elements for filling out specific sections accurately.

Engaging with forms in a dynamic format allows users to understand precisely what each section entails, facilitating a smoother document preparation process.

What you get with pdfFiller

Utilizing pdfFiller for managing documents related to successor liability and joint forms offers numerous features and benefits. The platform allows seamless editing of PDFs, secure eSigning, and effective collaboration among team members, all accessible through a cloud-based environment.

This accessibility enhances the ability of individuals and teams to stay organized and efficient, particularly when handling essential legal documents. pdfFiller empowers users to manage their legal agreements effectively, reducing the burdens associated with traditional paper-based document processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit successor liability with joint in Chrome?

How can I edit successor liability with joint on a smartphone?

How do I complete successor liability with joint on an iOS device?

What is successor liability with joint?

Who is required to file successor liability with joint?

How to fill out successor liability with joint?

What is the purpose of successor liability with joint?

What information must be reported on successor liability with joint?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.