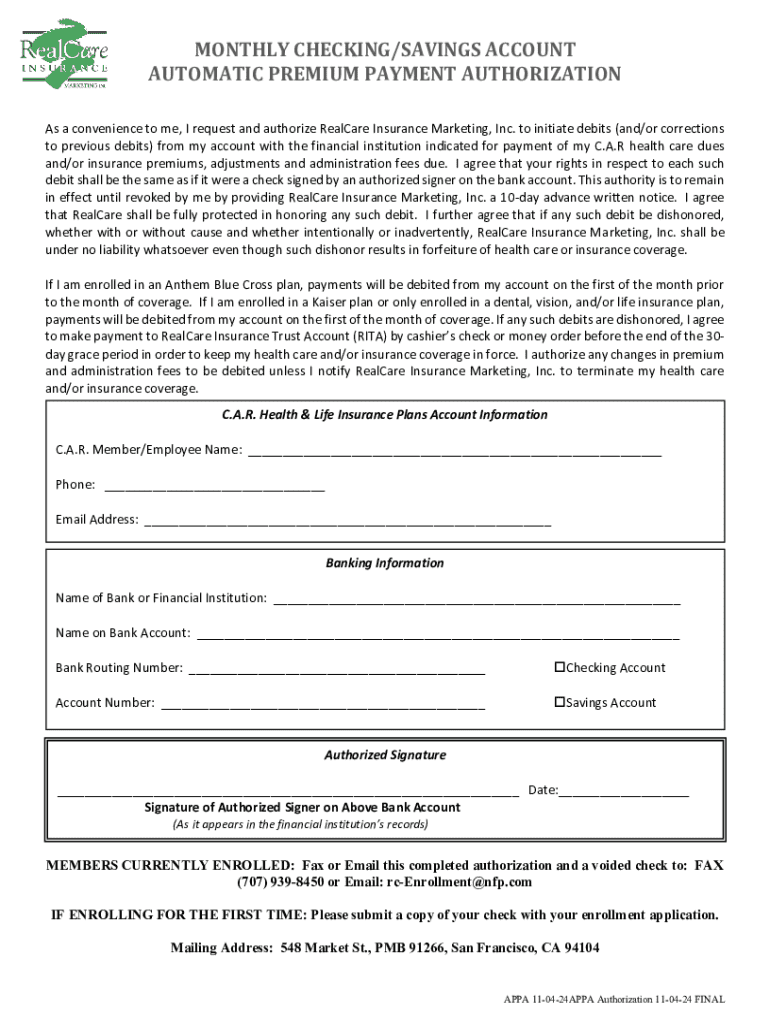

Get the free Monthly Checking/savings Account Automatic Premium Payment Authorization

Get, Create, Make and Sign monthly checkingsavings account automatic

Editing monthly checkingsavings account automatic online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly checkingsavings account automatic

How to fill out monthly checkingsavings account automatic

Who needs monthly checkingsavings account automatic?

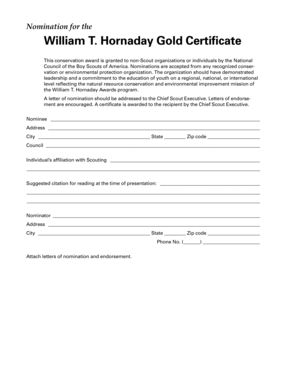

Navigating Your Monthly Checking Savings Account Automatic Form

Understanding monthly checking savings accounts

Monthly checking savings accounts serve as a hybrid between conventional checking and savings accounts, designed to meet the everyday financial needs while also encouraging savings. These accounts allow users to manage their spending directly from their checking balance while earning interest on savings.

The core benefit of opening a monthly checking savings account is the dual functionality it offers. You can make everyday purchases while simultaneously earning interest, making it a valuable tool for financial flexibility. Unlike traditional savings accounts, where funds may be limited by withdrawal restrictions, checking savings accounts combine ease of access with the incentive to save.

However, it’s crucial to distinguish between checking and savings accounts. Checking accounts prioritize transactional capabilities, enabling easy bill payments and purchases, while savings accounts are designed for storing funds with the goal of growth through interest. Understanding these differences can help users choose the suitable account for their financial strategy.

Overview of the automatic form process

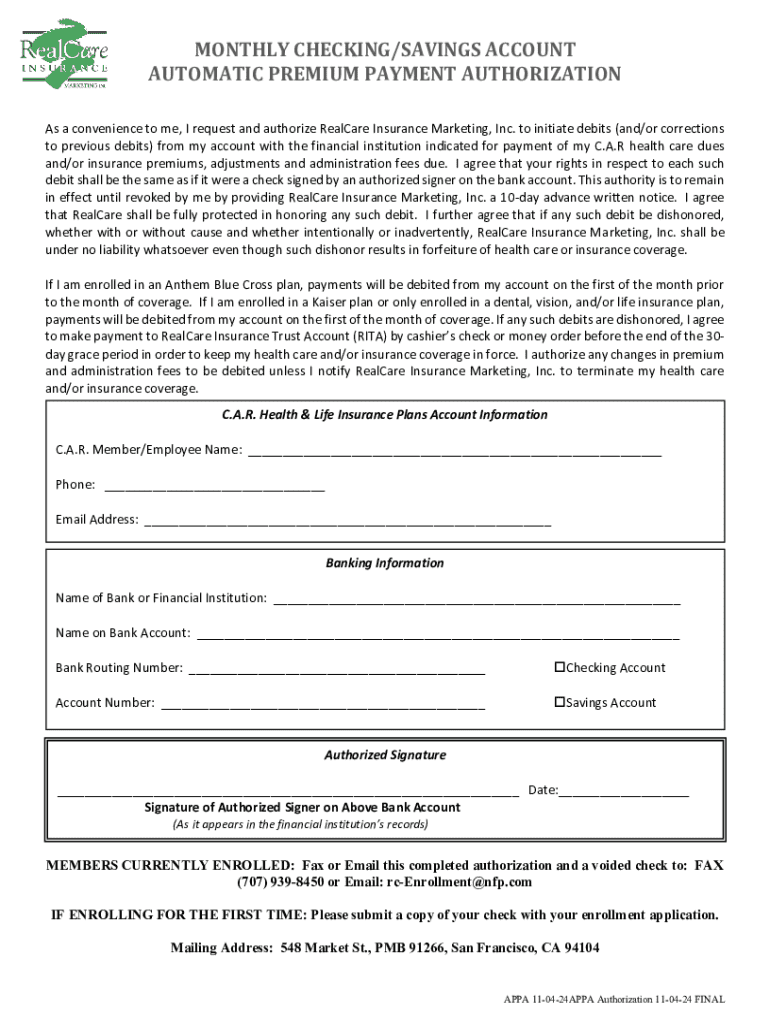

The monthly checking savings account automatic form is a crucial document for customers looking to establish or manage their accounts seamlessly. This form facilitates the automation of certain transactions, such as monthly deposits or automated transfers to your savings, ensuring consistent handling of finances.

Using an automatic form benefits account holders by streamlining the banking process, reducing the need to remember numerous manual transactions. Through setting automatic transfers, users can optimize their saving strategies and improve their financial health over the long term.

Step-by-step guide to filling out the automatic form

Filling out the monthly checking savings account automatic form may seem daunting initially, but breaking it down into clear steps simplifies the process. To get started, you need to gather necessary information.

Step 1: Gather necessary information

Step 2: Key sections of the form

After gathering your information, the next step involves completing key sections of the automatic form. You'll need to specify the account type, indicating whether it's individual, joint, or a business account. This section is critical as it determines the ownership and responsibility of the account.

Additionally, include details about your monthly deposit, indicating the preferred amount and frequency. Selecting your banking preferences in this section aids in personalizing your account experience, making sure your settings align with your financial goals.

Step 3: Review and validate your information

Once the form is completed, take the time to validate the information entered. Accuracy is paramount to prevent delays or issues in the processing of your automatic form. A checklist of common mistakes includes checking for typos in personal identifiers or numerical details related to deposits.

Editing and managing your automatic form

After submitting your monthly checking savings account automatic form, you may need to make changes or updates in the future. Accessing your form in the cloud with pdfFiller allows seamless edits, ensuring your account information remains current.

How to edit your automatic form using pdfFiller

Saving changes is critical to ensure that any adjustments are recorded. Staying organized and routinely reviewing your account settings will facilitate smoother management and ensure your finances stay on track.

Signing and submitting the automatic form

Once you've filled out and reviewed your monthly checking savings account automatic form, the next step is to sign and submit it. Utilizing electronic signatures is a convenient option for most users, allowing for quick processing without in-person visits.

How to electronically sign your form

You can choose from a variety of eSignature options provided by pdfFiller, which are legally recognized and secured to protect your identity. This provides the assurance that your signed document will be accepted by banking institutions.

After signing, it’s important to choose a submission method. Most banks allow online submissions through their website or secure portals. Alternatively, you may submit in person, depending on your preference and urgency of the changes.

Don’t forget to monitor expected processing times to ensure that your account updates via the automatic form are completed promptly.

Financial insights and tips for your monthly checking savings account

Setting up automatic transfers can significantly benefit the growth of your savings without needing constant manual effort. Automating saving habits means that specific amounts are regularly moved from your checking account to your savings account, encouraging consistent saving.

The advantages of this approach include reaching savings goals sooner and creating a buffer for unexpected expenses. As your balance grows, you can leverage higher interest rates offered by savings accounts, ensuring your money works for you.

Managing account fees is also crucial. Familiarize yourself with potential fees associated with your monthly checking savings account, such as transaction or maintenance fees. Understanding these charges will help avoid any unnecessary expenses, ensuring your account remains profitable.

Tools and resources for maximizing your banking experience

pdfFiller provides numerous interactive tools that help manage financial documents effectively. From customizable templates to calculators that estimate your savings potential, these tools are beneficial for both individuals and teams.

Accessing these resources enhances your ability to create financial documents tailored to your specific needs, ensuring accuracy and relevance. Educational materials, such as articles about effective saving strategies, can also enrich your financial literacy, offering valuable insights on optimizing your money management.

Security features for your checking savings account

Ensuring your accounts are secure is critical in today’s digital world. pdfFiller offers a range of security measures that protect your documents and personal information, guaranteeing peace of mind during your online banking activities.

What to do in case of unauthorized access

In the unfortunate event of unauthorized access, immediate action is essential. Contact your bank to report any suspicious activity and follow their guidelines to secure your account. Regularly updating passwords and monitoring account statements can help prevent future breaches.

FAQs related to monthly checking savings accounts

When considering a monthly checking savings account automatic form, you might have several questions. Common inquiries include the types of documents needed for application, which typically involve proof of identity and residence.

It's also crucial to know about possible monthly maintenance fees—many banks are waiving these charges if certain conditions are met. Even after opening the account, users often wonder how to change account settings; banks typically provide straightforward processes for adjustments.

Getting help with your monthly checking savings account

If you encounter challenges while managing your monthly checking savings account, various assistance options are available. Banks usually provide customer service avenues such as phone support, chat assistance, or email inquiries for personalized support.

Additionally, engaging with community resources or forums focused on wealth-building can provide valuable insights and strategies from other users navigating similar paths, enhancing your financial journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit monthly checkingsavings account automatic from Google Drive?

How do I execute monthly checkingsavings account automatic online?

Can I edit monthly checkingsavings account automatic on an iOS device?

What is monthly checkingsavings account automatic?

Who is required to file monthly checkingsavings account automatic?

How to fill out monthly checkingsavings account automatic?

What is the purpose of monthly checkingsavings account automatic?

What information must be reported on monthly checkingsavings account automatic?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.