Get the free Electronic Withdrawal Stop Payment Request Form

Get, Create, Make and Sign electronic withdrawal stop payment

Editing electronic withdrawal stop payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out electronic withdrawal stop payment

How to fill out electronic withdrawal stop payment

Who needs electronic withdrawal stop payment?

A Comprehensive Guide to the Electronic Withdrawal Stop Payment Form

Understanding electronic withdrawals

Electronic withdrawals represent a modern method of transferring funds directly from one bank account to another. These transactions are commonly utilized for various purposes, including paying bills, receiving direct deposits, and managing subscriptions. The rise of digital banking and payment platforms has facilitated these transactions, making them more accessible to everyday consumers.

There are several types of electronic withdrawals, with Automated Clearing House (ACH) transfers and direct debit transactions being the most prevalent. ACH transfers are often used for payroll and government benefits, enabling businesses and individuals to receive or send funds quickly. Direct debits, on the other hand, are typically associated with recurring payments such as utilities and subscription services, allowing companies to withdraw set amounts on predetermined dates.

Common reasons for electronic withdrawals primarily include subscriptions to services such as streaming platforms, gym memberships, and loan repayments. With so many subscriptions running concurrently, it can sometimes be challenging to keep track, leading to potential payment discrepancies without proper monitoring.

Why you might want to stop an electronic withdrawal

Stopping an electronic withdrawal could be necessary for several reasons. First and foremost, unauthorized transactions pose significant issues, potentially leading to financial loss or identity theft. It is critical for all bank account holders to regularly review their accounts to ensure all transactions have been authorized.

There are various situations where stopping electronic payments makes sense, including when changing service providers. If you’re switching gym memberships or switching to a new internet provider, ensuring you halt previous automatic payments is essential. Canceling subscriptions is another significant trigger, as many users find themselves paying for unwanted services simply because they forget to unsubscribe. Additionally, if a contract with a service provider comes to an end, ceasing the automatic withdrawal prevents unnecessary charges.

How to identify unauthorized transactions

To maintain control over your financial health, it's crucial to monitor bank statements regularly. Look for discrepancies or withdrawals that do not match your records and question any unfamiliar transactions immediately. Checking your statements every month can prevent unwanted extra charges and help identify potential fraud before it escalates.

Red flags for unauthorized transactions include unexpected amounts being withdrawn, transactions from businesses you’ve never partnered with, or the occurrence of withdrawals on unexpected dates. If you notice any of these distinctions, it's advisable to verify with your service provider to confirm if you have authorized those charges.

Steps to confirm payment authorization include contacting the service provider to inquire about the transaction and referring to your initial agreement terms. Having an organized method for keeping records can simplify this process.

Step-by-step process for stopping electronic withdrawals

Step 1: Gather relevant information

Before initiating a stop payment request, gather all relevant documentation to support your case. This includes bank account statements that highlight the withdrawals in question, service agreements, or contracts that discuss the payment terms, as well as personal identification and current contact details.

Step 2: Contact the company initiating the withdrawal

Reaching out directly to the company is often the most effective first step. Express your desire to stop the withdrawal politely, and ask for their procedure. A sample script for calling the company could be, "Hello, my name is [Your Name]. I would like to request the cancellation of my automatic payments as I am no longer using the service. Could you please assist me with this process?"

If you prefer written communication, ensure your email is concise and professional. State your request clearly and provide identification details for them to locate your account.

Step 3: Inform your bank or credit union

Once you've contacted the service provider, the next step is to inform your bank or credit union. Most banks have a process for stopping electronic withdrawals, and it's crucial to understand this procedure. Calling them directly can expedite the process; be ready to provide details such as your account type, the amount in question, and the transaction date.

If opting for an in-person visit, bring documentation that confirms your identity and any proof related to the transactions. It’s also essential to understand any fees associated with stop payments—some banks may charge for this service while others may offer it at no additional cost.

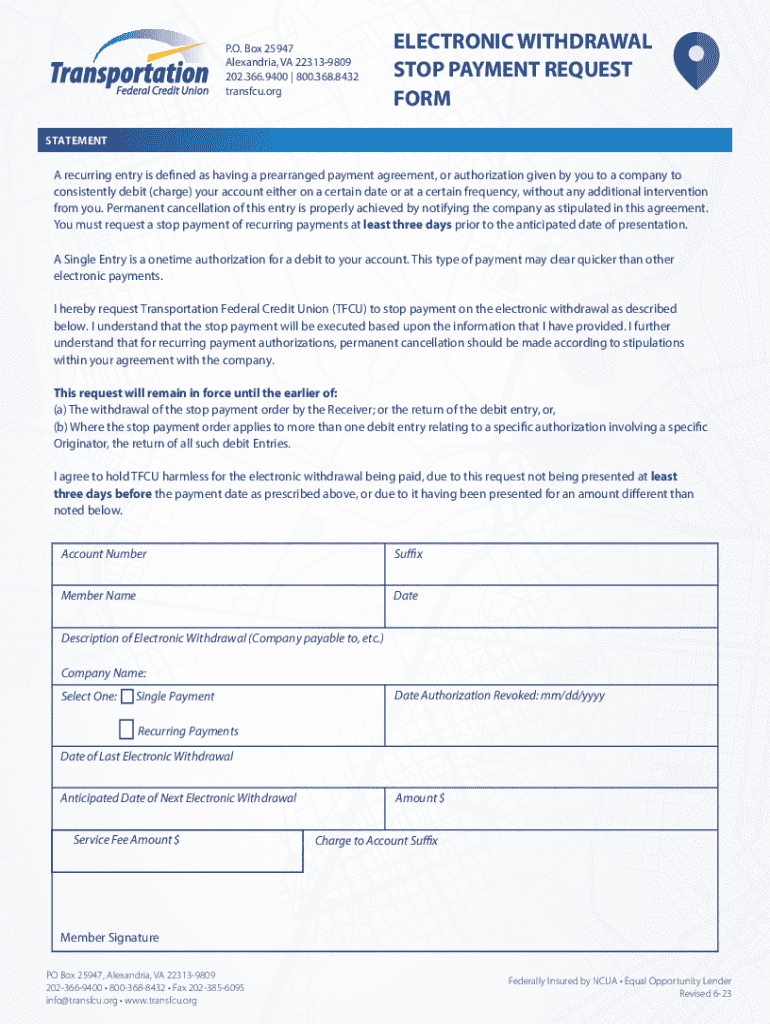

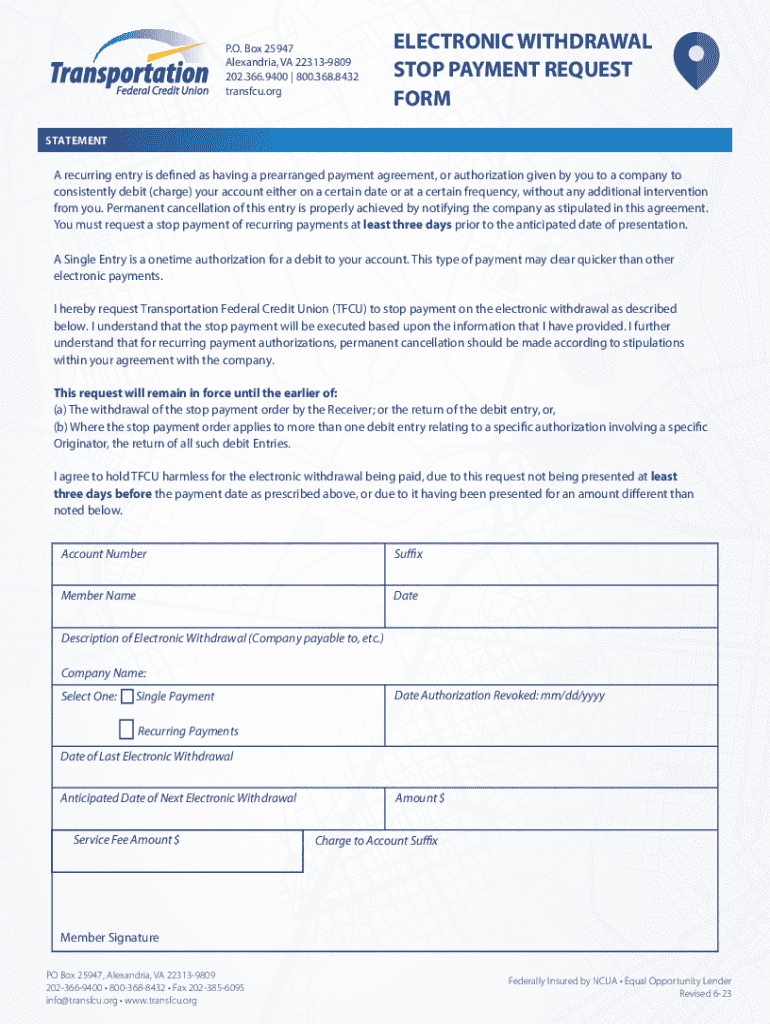

Step 4: Utilize an electronic withdrawal stop payment form

When directed by your bank, fill out an electronic withdrawal stop payment form. This form is designed to streamline the process of halting electronic withdrawals. Key sections typically include account information, specific withdrawal details such as the amount and transaction date, and signature requirements to validate your request.

When completing the form, accuracy is crucial. Double-check all information, ensuring there are no errors that could delay processing. Providing as much detail as possible helps your bank respond efficiently.

Step 5: Confirm the stop payment request

It's vital to get acknowledgment of your stop payment request from both the company and your bank. Retain any confirmation numbers or reference materials for future reference. After submitting the request, continue to monitor your bank account closely for any further unauthorized transactions, ensuring compliance with your request.

Additional tips for managing electronic withdrawals

Proactive management of electronic withdrawals is key to financial health. Regularly reviewing your bank accounts and statements will help ensure you’re aware of your financial obligations and prevent accidental overdrafts or payment failures.

Setting up alerts can also help you monitor any unusual transactions. Many banking apps offer this feature, giving users immediate notifications for dollar amounts or types of transactions that they may want to evaluate more closely. By utilizing document management tools, such as the ones provided by pdfFiller, your paperwork can become streamlined and accessible.

Frequently asked questions (FAQs)

Understanding the nuances of stopping electronic withdrawals can prompt pressing questions among users. Here are some of the most common inquiries:

Legal considerations

The domain of electronic withdrawals is governed by various federal and state laws, including the NACHA rules. It’s essential for consumers to be aware of their rights regarding unauthorized transactions and stop payment requests, as these laws protect individuals from fraudulent financial activity. When in doubt, seeking legal assistance is advisable, especially in dispute cases with service providers.

Troubleshooting common issues

Even after following all the prescribed steps, you may encounter hurdles. If a company ignores your stop payment request, gather your documentation and reach out to your bank again. They may assist you in advocating for your rights or provide guidance on alternative measures.

Document all interactions with both the provider and the bank, as having detailed records will bolster your case. Understanding your rights helps in resolving disputes more effectively.

Monitoring your financial health

To avoid issues with electronic withdrawals in the future, adopt best practices for keeping track of authorized payments. This includes leveraging budgeting tools or apps that help oversee your finances efficiently. Regular audits of your accounts mean that discrepancies can be spotted immediately, which is vital for managing your overall financial health.

Employing resources such as pdfFiller not only empowers users with efficient document management but can also help integrate all your tools for monitoring finances into one cohesive cloud-based platform.

Making future electronic withdrawals safe

As electronic transfers become more commonplace, it’s vitally important to ensure that future authorizations are done securely. Always review service agreements and proper usage rights before authorizing any electronic payment. Being aware of the terms of service and what your rights are can protect you in the long run, potentially avoiding future headaches with unauthorized payments.

Taking proactive measures when authorizing electronic transfers will not only streamline many processes but also reduce the risk of issues arising down the road.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the electronic withdrawal stop payment electronically in Chrome?

Can I create an electronic signature for signing my electronic withdrawal stop payment in Gmail?

How do I fill out electronic withdrawal stop payment on an Android device?

What is electronic withdrawal stop payment?

Who is required to file electronic withdrawal stop payment?

How to fill out electronic withdrawal stop payment?

What is the purpose of electronic withdrawal stop payment?

What information must be reported on electronic withdrawal stop payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.