Get the free Female Preferred Rates

Get, Create, Make and Sign female preferred rates

How to edit female preferred rates online

Uncompromising security for your PDF editing and eSignature needs

How to fill out female preferred rates

How to fill out female preferred rates

Who needs female preferred rates?

Understanding the Female Preferred Rates Form: A Comprehensive Guide

Overview of female preferred rates

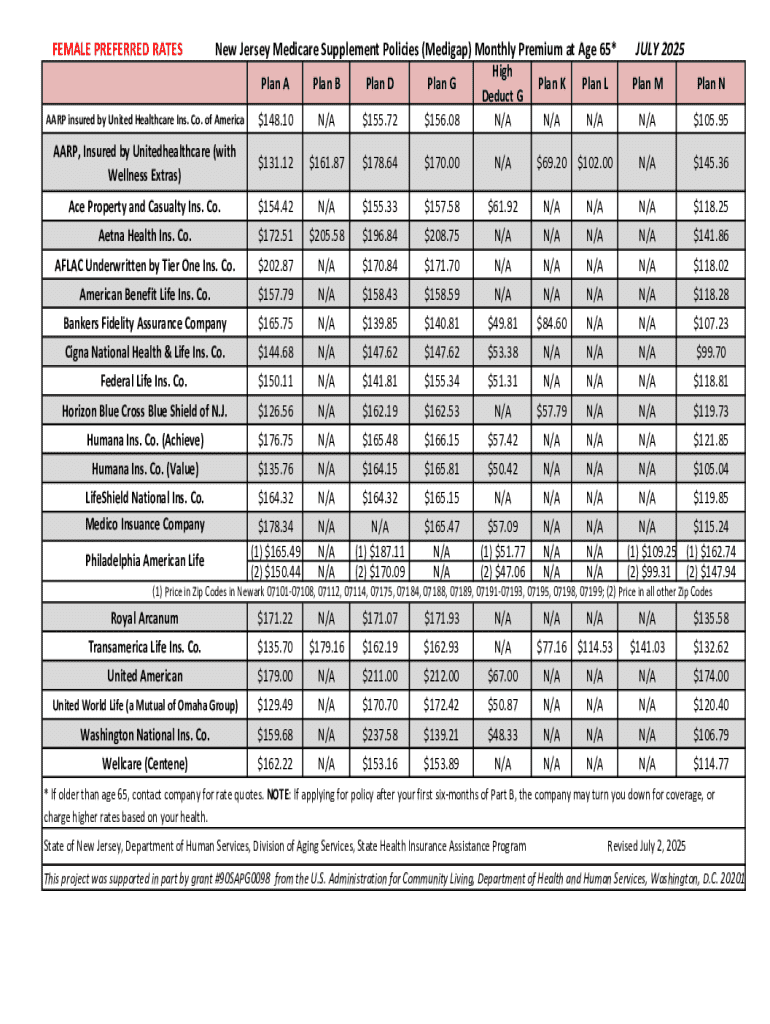

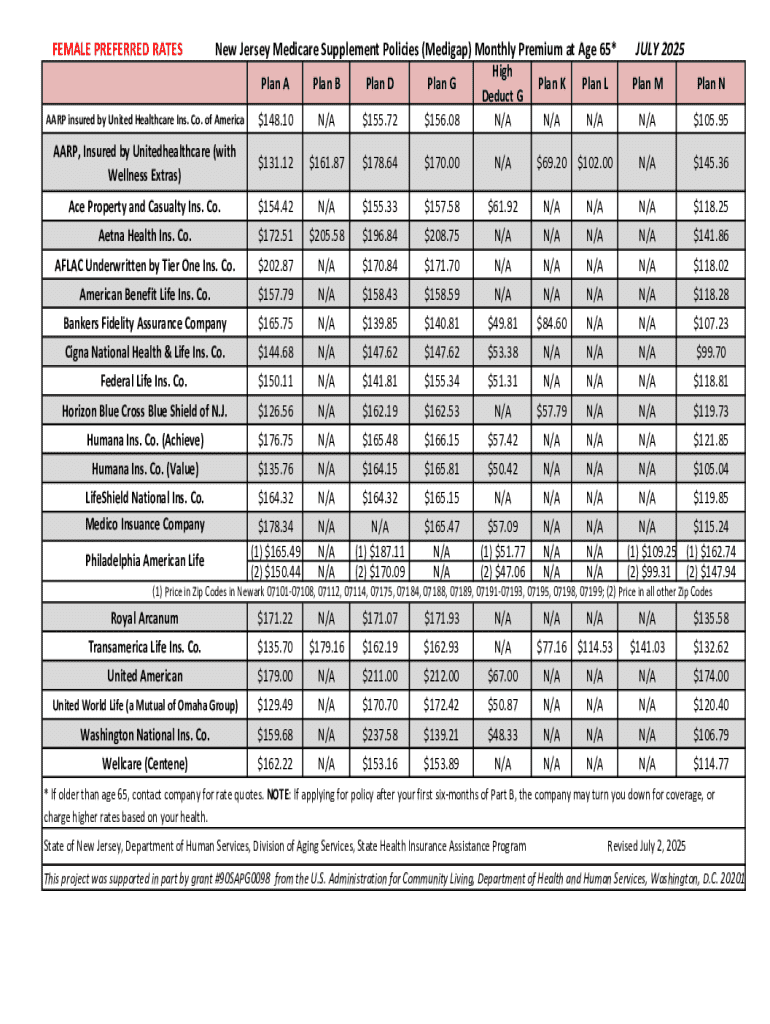

Female preferred rates pertain to modified insurance pricing structures that favor female applicants due to lower associated risk profiles. These rates reflect statistical trends indicating lower mortality and morbidity rates among women compared to men, leading to more favorable terms for females seeking insurance products.

The significance of female preferred rates lies in their potential to make insurance products more accessible and affordable for women, who often face unique health considerations and financial planning needs. By recognizing these factors, insurance companies can offer premium rates that reflect the real risks involved.

Understanding rate categories

Female preferred rates differ significantly from standard rates, primarily influenced by a comprehensive analysis of risk factors during the application process. Insurance providers assess various criteria such as age, health history, and lifestyle choices, which can substantially affect the rate quoted to female clients.

Factors that influence female preferred rates often include age, with younger applicants generally receiving more favorable terms. Health history, including previous medical conditions and family health patterns, plays a crucial role as well. Moreover, lifestyle choices like smoking status and physical activity levels can further refine risk assessments, potentially unlocking better rates for healthier applicants.

The female preferred rates form: A step-by-step guide

Completing the female preferred rates form is essential for securing a favorable insurance rate. The form typically consists of several key sections that need to be filled out accurately to help insurances evaluate the applicant's risk properly.

The main sections include Applicant Information, Health History, and Lifestyle Choices. Each area plays a crucial role in determining the rate and coverage.

Filling out each section requires attention to detail. For instance, when detailing health history, include any chronic conditions or significant health events. It's beneficial to describe lifestyle choices accurately because they can often tip the scales toward a more favorable rate.

To enhance accuracy during the form completion process, applicants can utilize interactive tools such as online calculators to estimate potential rates. These tools can provide personalized feedback based on the entered data, ensuring users make informed decisions.

Managing and submitting your female preferred rates form

After completing the female preferred rates form, managing and submitting it correctly is crucial for ensuring a smooth processing experience. Editing the form can be easily accomplished with tools like pdfFiller, which allows users to make revisions before finalizing submissions.

After ensuring all sections are filled out accurately, applicants can transition to the eSigning process. Electronic signatures are increasingly important in the document management sphere, offering both security and convenience for applicants.

When submitting the form, ensure that all information is complete. After submission, anticipate further communication from the insurance provider regarding your application status, as some providers may offer feedback or requests for additional information.

Potential challenges and solutions

While applying for female preferred rates can seem straightforward, applicants may encounter common issues. Incomplete information is often the most significant barrier, as missing data can delay the processing of applications.

Another challenge might arise from a misunderstanding of form requirements. It’s crucial to read instructions carefully or reach out to support channels provided by the insurance companies to clarify doubts.

Frequently asked questions (FAQ)

Understanding female preferred rates can raise several questions among prospective applicants. Common misconceptions may include the idea that these rates are exclusive or that eligibility is overly complicated. Familiarizing oneself with the terms can demystify the whole process.

Regarding the form process, concerns about personal information frequently surface. Applicants can take comfort in knowing that insurance companies adhere to strict privacy regulations to protect sensitive data.

Personal finance considerations

Integrating female preferred rates into your financial planning can provide a distinct advantage. Understanding the long-term impacts of choosing this rate can enhance budgeting practices, as lower premiums can free up funds for other financial goals.

Furthermore, considering other financial products available for women can help create a well-rounded financial strategy. Aligning insurance choices with comprehensive financial planning ensures that individuals are better prepared for future uncertainties.

Interactive tools and additional resources

Leveraging interactive tools can significantly streamline the assessment of eligibility for female preferred rates. Various online calculators available on pdfFiller allow users to input personal data and receive quick estimations tailored to their unique circumstances.

Additionally, having access to templates and examples of previously successfully filled forms can serve as a valuable resource. This guidance can demystify the documentation process and provide clarity on how to present oneself favorably.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete female preferred rates online?

How do I fill out the female preferred rates form on my smartphone?

Can I edit female preferred rates on an Android device?

What is female preferred rates?

Who is required to file female preferred rates?

How to fill out female preferred rates?

What is the purpose of female preferred rates?

What information must be reported on female preferred rates?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.