Get the free W-4

Get, Create, Make and Sign w-4

Editing w-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-4

How to fill out w-4

Who needs w-4?

W-4 Form - How-to Guide

Understanding the W-4 form

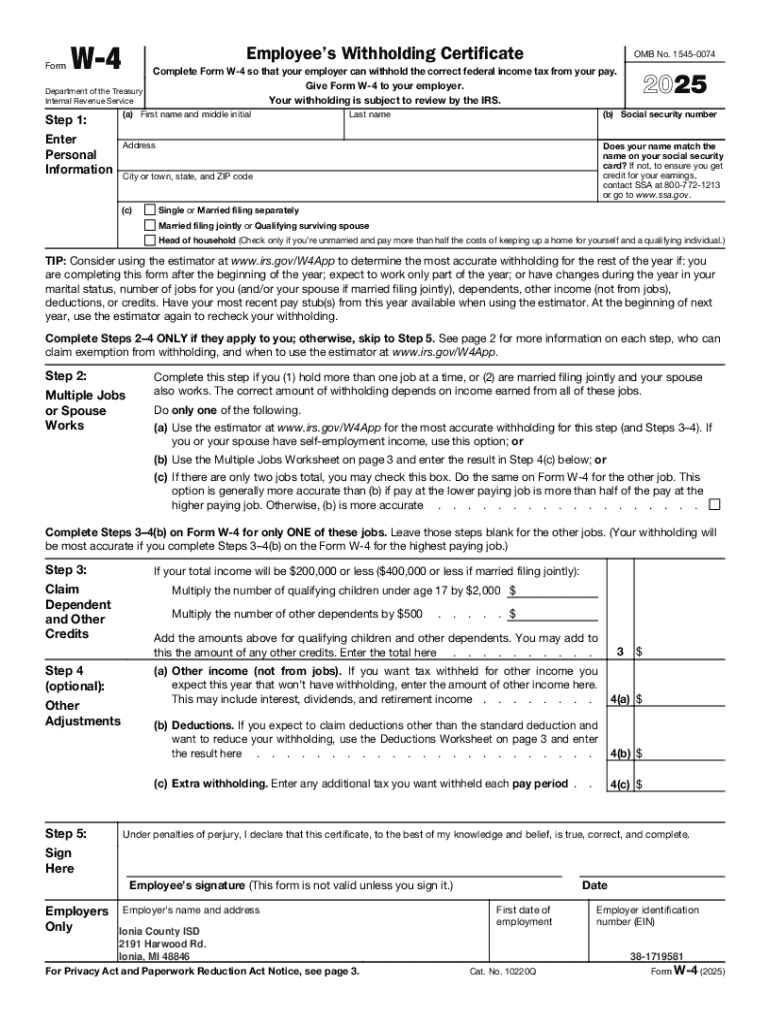

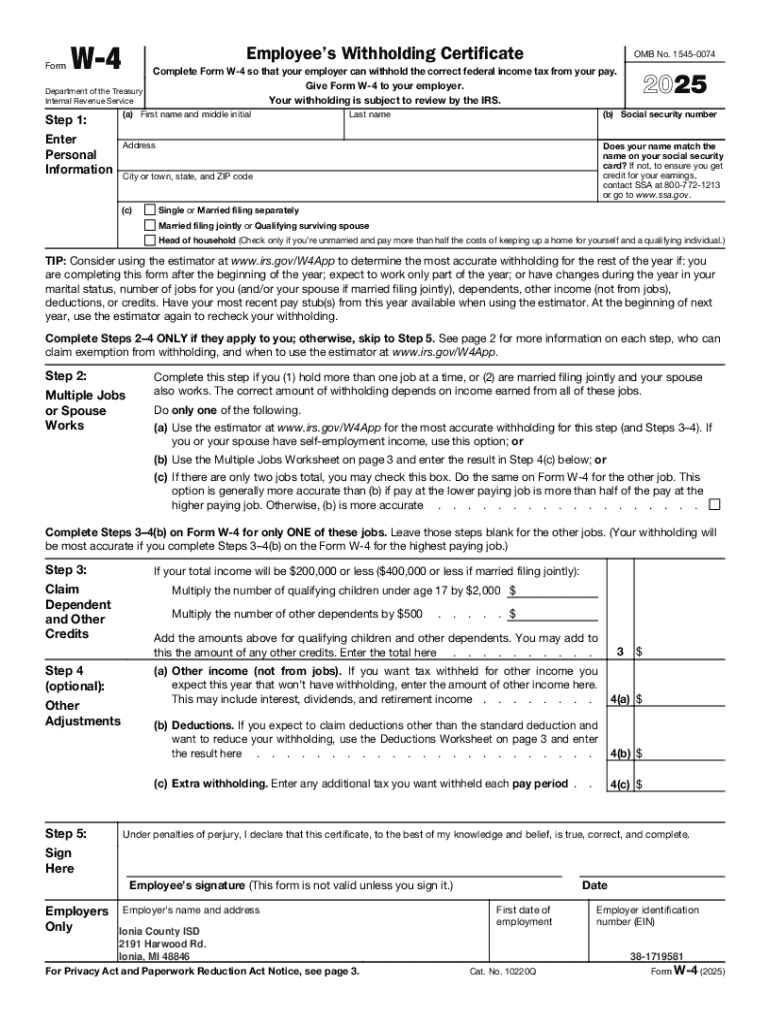

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document used by employers to determine the amount of federal income tax to withhold from their employees' paychecks. Completing this form accurately is vital for employees as it directly impacts their take-home pay and, ultimately, their tax liability at the end of the year.

In essence, the W-4 allows employees to specify their withholding allowances, which helps ensure they neither overpay nor underpay their federal taxes. An accurate W-4 form is essential for financial planning, as it helps maintain cash flow through appropriate paycheck adjustments.

Who needs to fill out a W-4?

Every employee who receives a paycheck is typically required to submit a W-4 form to their employer. This includes new hires who must complete the form before their first paycheck is issued. Furthermore, existing employees should revisit their W-4 if they experience significant life milestones—such as marriage, divorce, or the birth of a child—as these events often necessitate adjustments to their withholding allowances.

In situations where an employee is changing jobs or moving to a different employer, they must complete a new W-4 form for their current employer to reflect any changes in their financial situation. This can lead to substantial variations in withholding tax amounts.

Key elements of the W-4 form

Filling out a W-4 form requires accurate completion of several key pieces of information. Initially, employees must provide their personal details, including their full name, mailing address, and Social Security number. These elements ensure that the form is correctly linked to the individual and their tax records.

Next, individuals must indicate their filing status. This status classifies how they are taxed and can significantly influence their withholding amounts. Options typically include Single, Married Filing Jointly, Married Filing Separately, and Head of Household. Furthermore, employees can claim dependents and detail any additional adjustments needed for factors such as increased income or deductions.

Step-by-step guide to filling out the W-4 form

Filling out the W-4 form can seem daunting, but following a streamlined guide can simplify the process. Start by providing your personal details in Step 1. Ensure that your name, address, and Social Security number are entered accurately. Confirm the information matches your official documentation to avoid complications later.

In Step 2, select the proper filing status, crucial for setting your withholding rates. Assess your living situation carefully to pick the one that best matches your circumstance. Next, in Step 3, you’ll have the opportunity to claim dependents. Calculate any tax credits based on the number of qualifying children or other dependents.

Step 4 allows you to make further adjustments if needed. Specify any additional withholding amounts or other adjustments related to income or deductions. Finally, in Step 5, ensure you sign and date the form. Your signature serves as confirmation that the information provided is accurate. Neglecting this step can deem your W-4 invalid.

Interactive tools for W-4 form completion

Several tools are available to assist with W-4 form completion, making the process simpler and more accurate. Online calculators, for example, allow individuals to accurately determine the appropriate withholding amounts based on specific financial scenarios. These calculators require input such as income level, filing status, and number of dependents, providing an estimation of the correct withholding.

Additionally, sample scenarios can illustrate how different factors, like additional income from a side job or significant tax deductions, could influence the selections on the W-4. Furthermore, using tools like pdfFiller allows users to efficiently manage their W-4 forms. You can edit, sign, and securely store your W-4 documents in the cloud, making it easier to revisit and update as circumstances change.

Common mistakes to avoid

Filling out the W-4 comes with its pitfalls, and avoiding common mistakes can save you from long-term issues. One of the most frequent errors includes providing incorrect personal information. A simple typo in your Social Security number can lead to significant tax complications down the line. Ensuring accuracy initially can prevent these headaches later.

Another major mistake is misinterpreting your filing status. Choosing the incorrect status can lead to either too much or too little withholding, which often results in surprise tax bills at year-end. Finally, many people fail to update their W-4 forms during pivotal life changes. It’s crucial to revisit your form whenever major events occur, such as marriage or having a child, to ensure that your withholding accurately reflects your situation.

FAQs about the W-4 form

The W-4 form often generates several questions, especially among those who are new to completing it. A common query is how often one should update their W-4. As a rule of thumb, it's advisable to revisit your W-4 whenever you undergo changes in your life that might affect your finances, such as getting married or having children.

Another frequent question pertains to managing multiple jobs. Individuals with various incomes should fill out a W-4 for each job but should carefully calculate total withholding to avoid overpaying. Additionally, many wonder if they can change their W-4 at any time, and the answer is yes—there is no restriction on how frequently you can submit a new W-4. Finally, understanding how the W-4 affects overall tax returns is crucial, as improper withholding can lead to unexpected financial scenarios when tax season approaches.

Related resources for tax preparation

For those seeking further assistance, numerous government resources are available regarding the W-4 form. The IRS website provides updated forms, instructions, and valuable information about how withholding affects your overall tax obligations. Additionally, utilizing tax software and services can simplify the filing process and help users accurately prepare their forms. Many programs offer specialized support for completing a W-4, making it easy to navigate.

Connecting with tax professionals can also offer significant advantages, especially for unique reporting situations. Experienced individuals can provide tailored advice based on your specific financial landscape, ensuring optimal tax management. Together, these resources enable users to approach their tax obligations with confidence.

Further learning and support

To support continuous learning, consider enrolling in online workshops focused on tax-related topics. These sessions often cover forms like the W-4 and other critical aspects of tax regulation, providing both fundamental knowledge and the opportunity to ask questions in real-time. Moreover, community forums can be invaluable for sharing experiences and insights with others who are navigating similar tax-related challenges.

Staying informed about tax form updates is also essential. Subscribing to relevant newsletters and alerts can ensure that you are aware of changes affecting your tax situation, assisting you in making necessary adjustments proactively. Such initiatives contribute to more effective financial management and offer peace of mind as tax deadlines approach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-4 for eSignature?

Can I create an electronic signature for signing my w-4 in Gmail?

How do I fill out the w-4 form on my smartphone?

What is w-4?

Who is required to file w-4?

How to fill out w-4?

What is the purpose of w-4?

What information must be reported on w-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.