Get the free Duty Planner Standard Advice Request Form

Get, Create, Make and Sign duty planner standard advice

Editing duty planner standard advice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out duty planner standard advice

How to fill out duty planner standard advice

Who needs duty planner standard advice?

A comprehensive guide to the duty planner standard advice form

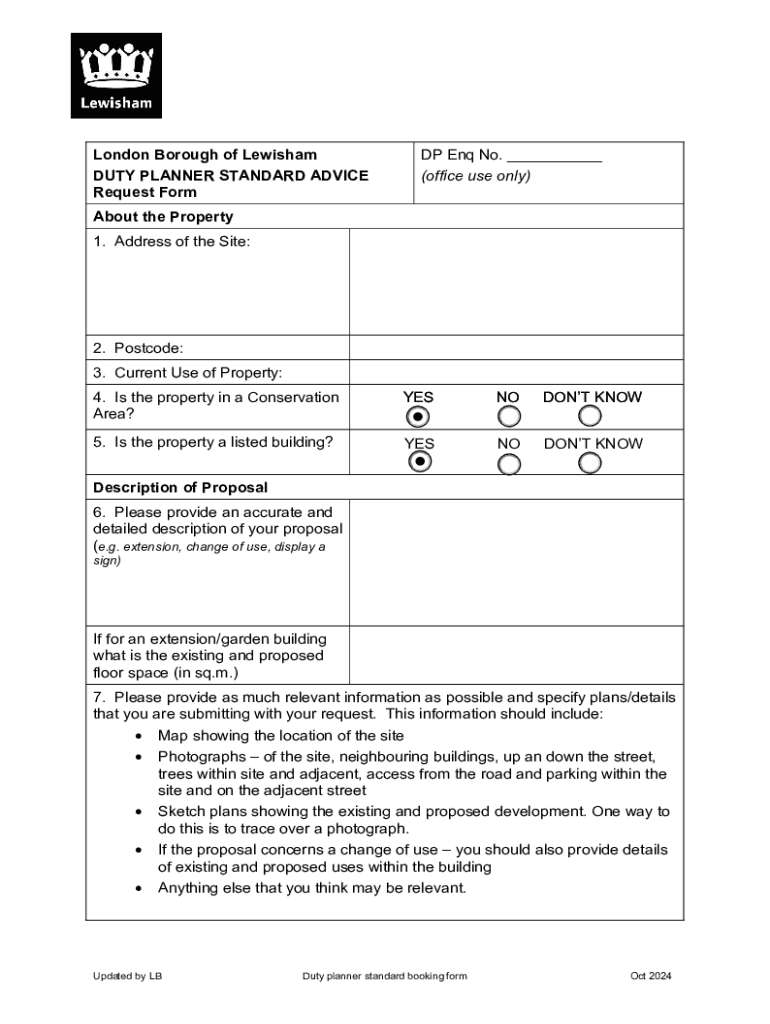

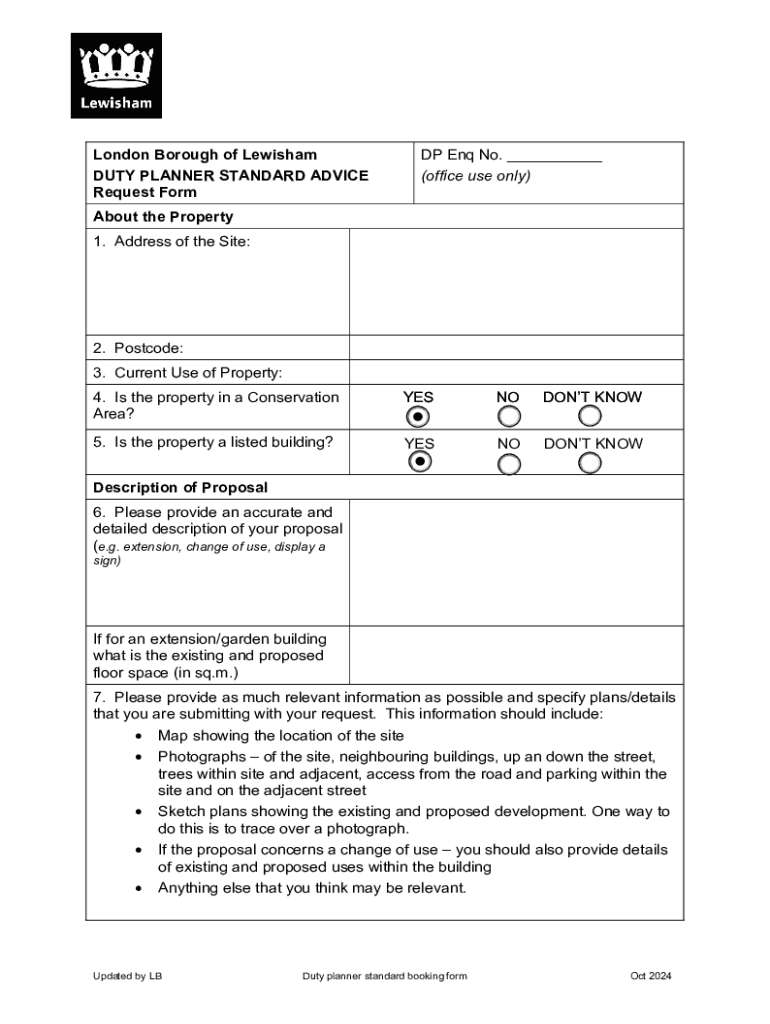

Understanding the Duty Planner Standard Advice Form

The Duty Planner Standard Advice Form is a structured document designed to provide comprehensive, client-specific advice in various professional fields, notably in financial services and legal sectors. This form serves not only as a record of advice given but also aids in building a transparent and accountable relationship between advisors and their clients. Its importance lies in standardizing the advice process, ensuring all critical elements are considered, and facilitating a clear flow of information.

Commonly used by financial advisors, portfolio managers, and legal professionals, the duty planner standard advice form captures key client data, financial goals, and personalized recommendations. This documentation is pivotal in helping practitioners adhere to regulatory requirements and protect both their and their clients' interests throughout the advisory process.

Key components of the Duty Planner Standard Advice Form

The duty planner standard advice form consists of several essential components that guide the advisory process. Key sections typically include Personal Information, Financial Goals and Objectives, and the Recommendations Section. Each of these sections must be completed accurately to ensure the advice provided is relevant, actionable, and tailored to the individual's unique situation.

Accurate completion of this form is paramount because any errors or omissions can lead to misunderstandings, compliance issues, and a potential lack of trust with clients. Critical fields—like financial status, specific goals, and advisor recommendations—require especially close attention to detail to maintain the integrity of the advisory process.

Preparing to fill out the Duty Planner Standard Advice Form

Before diving into the duty planner standard advice form, gathering all necessary information is vital. Preparation starts with collecting relevant documents, such as financial statements, investment accounts, and any prior advice received. Having a detailed understanding of the client's situation aids in crafting tailored recommendations.

Common pitfalls during this preparation phase include overlooking key documents and neglecting to verify the accuracy of the information. To mitigate these issues, advisors should create a checklist of required materials, ensuring nothing is missed. Furthermore, understanding the audience for your advice is crucial; tailoring recommendations based on the client’s financial situation, goals, and risk tolerance will enhance the overall effectiveness of the advice.

Step-by-step instructions on using the Duty Planner Standard Advice Form

Accessing the duty planner standard advice form through pdfFiller is intuitive. Users can navigate the pdfFiller interface, employ the search bar, and locate the form either through templates or custom uploads. Once found, opening the form is just a click away, allowing for immediate access to begin filling out vital information.

When completing the form, a detailed breakdown of each section is essential. First, the Personal Information section gathers basic data about the client, setting the stage for personalized advice. The Financial Goals and Objectives section requires clarity and focus on what the client aims to achieve, ensuring these aspirations guide the advisor's recommendations. The Recommendations Section then articulates specific strategies or actions to realize these goals.

After completing the necessary sections, it’s essential to utilize pdfFiller’s editing tools to ensure all details are accurate. Any pre-filled information can be modified easily, following best practices for editing to avoid introducing errors. Then, eSigning the form can be executed swiftly with pdfFiller’s integrated electronic signature function, enhancing the approval process.

Finally, submitting the duty planner standard advice form is straightforward, with multiple options available such as printing or emailing directly from the platform. Ensuring proper record-keeping post-submission protects both the advisor and client—and aids in future interactions.

Managing your Duty Planner Standard Advice Form

Once the duty planner standard advice form has been completed and submitted, the next step is effective management of the document. Utilizing cloud storage within pdfFiller allows users to save and store their forms securely and access them from anywhere. This aspect enhances organizational efficiency, particularly for teams working with multiple clients or on various cases.

Accessing saved documents is streamlined within pdfFiller, making it easy to retrieve, review, and make necessary updates as situations evolve. Collaboration with team members is also facilitated through shared access. Team reviews and approvals can occur efficiently, using pdfFiller’s features to incorporate feedback or amend suggestions based on collaborative discussions.

Best practices for using the Duty Planner Standard Advice Form

To maximize the efficacy of the duty planner standard advice form, adhering to best practices is essential. These include ensuring compliance with relevant regulations and ethical standards in your industry. Understanding and following established guidelines while providing advice fosters trust between advisors and clients, ultimately leading to stronger relationships and positive outcomes.

Equally important is the emphasis on continuous improvement of advice provided. Gathering feedback from clients once the form is completed can illuminate areas of success and opportunities for growth. This practice encourages advisors to adapt and adjust recommendations as circumstances change, ensuring that the advice remains relevant and impactful.

Frequently asked questions about the Duty Planner Standard Advice Form

Users frequently encounter several common issues with the duty planner standard advice form. These can range from accessing certain fields to understanding how to effectively use editing functionalities. Troubleshooting these problems often involves checking for missing information or ensuring compatibility with devices being used.

To clarify misconceptions surrounding standard advice forms, it remains essential to address common myths. For instance, many believe these documents are too rigid and do not allow for personalization; in reality, the form is designed to be adaptable, providing a framework that can be tailored to meet the specific needs and circumstances of each client.

Conclusion: Maximizing the value of your Duty Planner Standard Advice Form experience

Effectively utilizing the duty planner standard advice form can yield long-term benefits for both advisors and clients. By enhancing document management and streamlining advisory processes through pdfFiller, efficiency is improved significantly, allowing individuals and teams to focus more on strategy rather than paperwork. A systematic approach to financial advice documentation builds a robust legacy of diligence and thoroughness.

Furthermore, fostering a culture of continuous improvement and learning expands the advisor's capability to provide value. With pdfFiller, users gain access to powerful tools that not only make document management straightforward but also ensure that all documentation aligns with best practices and evolving regulatory demands.

Testimonials and case studies

Many users have shared how the duty planner standard advice form has transformed their advisory practices. Success stories often highlight a notable increase in client satisfaction due to clear, actionable, and tailored advice that the form facilitates. Users have reported that the streamlined process of creating, editing, and submitting the form has saved them valuable time and increased their efficiency.

By adopting pdfFiller’s comprehensive tools for document management, advisors have discovered enhanced collaboration with teams, allowing for better preparation for client meetings. This collaborative approach has led to a more unified advisory voice, ensuring clients consistently receive the best possible guidance.

Additional advanced features in pdfFiller

Beyond the duty planner standard advice form, pdfFiller offers advanced document solutions that integrate seamlessly with other tools and platforms. This flexibility allows users to customize their paperwork experience, making workflows even more efficient. Features such as template creation, automated reminders for follow-ups, and analytical tools to evaluate client interactions enhance the overall document management process.

Customization options further distinguish pdfFiller, allowing users to create unique forms that align specifically with their practice needs. Whether adjusting fields to gather specific client data or setting up personalized templates for consistent use, the opportunities for enhancement are boundless, encouraging a more organized and predictable advisory environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send duty planner standard advice to be eSigned by others?

How do I make changes in duty planner standard advice?

Can I create an electronic signature for signing my duty planner standard advice in Gmail?

What is duty planner standard advice?

Who is required to file duty planner standard advice?

How to fill out duty planner standard advice?

What is the purpose of duty planner standard advice?

What information must be reported on duty planner standard advice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.