Get the free Operational Trading Procedures

Get, Create, Make and Sign operational trading procedures

How to edit operational trading procedures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out operational trading procedures

How to fill out operational trading procedures

Who needs operational trading procedures?

Operational Trading Procedures Form: How-to Guide

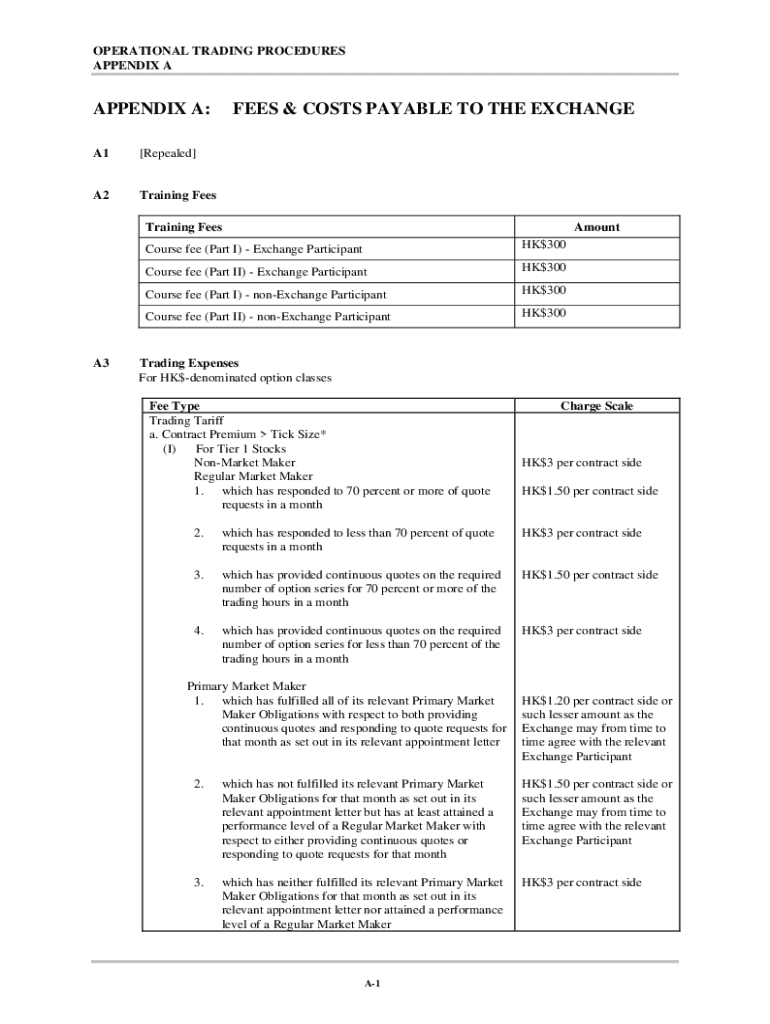

Understanding operational trading procedures

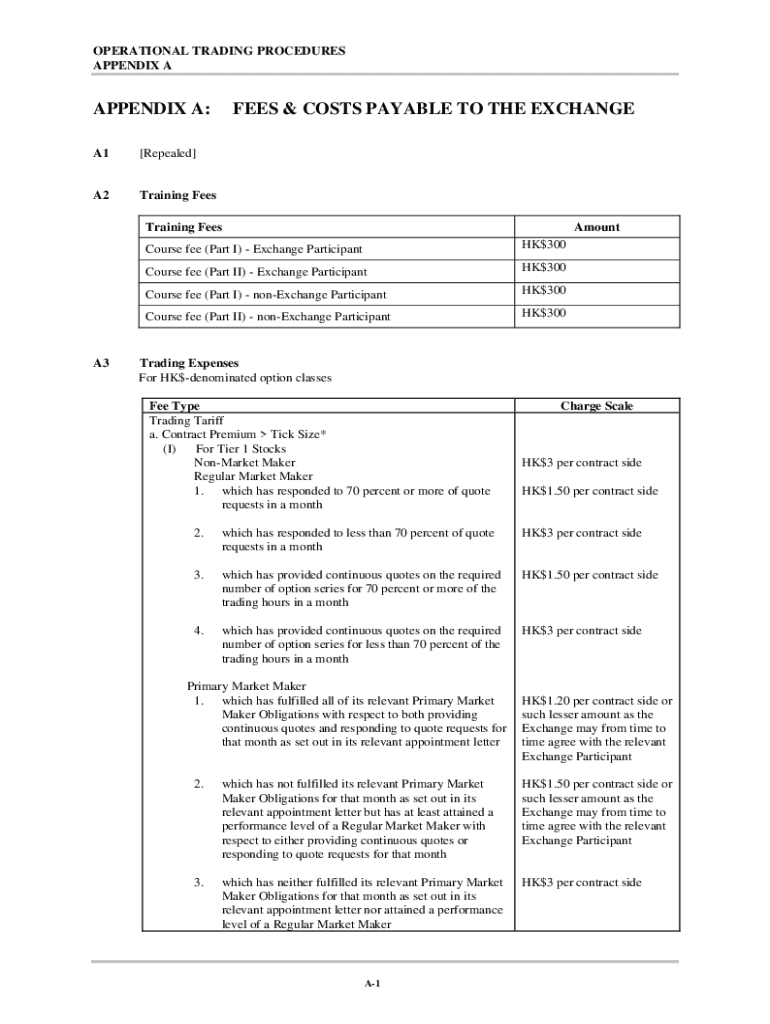

Operational trading procedures refer to standardized guidelines and processes that govern how trading activities are conducted within an organization. The importance of these procedures can’t be overstated; they are crucial in risk management and compliance, ensuring that all trading practices align with regulatory standards and organizational objectives.

Key components of trading procedures include risk management strategies, compliance with legal frameworks, and well-defined Standard Operating Procedures (SOPs) that outline the specific steps traders should follow in different scenarios.

Overview of the operational trading procedures form

The operational trading procedures form serves as a central document for capturing all relevant information regarding a trade. Its primary purpose is to ensure that all traders follow the same protocols, which increases efficiency and reduces errors. This form targets individuals and teams involved in trading, helping them to outline their processes systematically.

One of the main benefits of using the operational trading procedures form is its contribution to creating a transparent trading environment. By having documented procedures, organizations can easily identify areas for improvement and ensure that all departments are aligned.

Preparing to use the operational trading procedures form

Before filling out the operational trading procedures form, it is vital to gather all necessary information and documents. This includes trader identification, transaction specifics, and risk assessment data which provide the groundwork for effective risk management.

In addition, traders should gather supplementary resources such as market analysis tools and relevant regulatory guidelines to ensure informed decision-making and comprehensive risk assessments.

Step-by-step guide to filling out the operational trading procedures form

Filling out the operational trading procedures form is straightforward. Here’s a step-by-step overview:

Managing your operational trading procedures form

After completing the form, managing it efficiently is essential. Keeping forms organized can save time and minimize confusion. pdfFiller offers document management features that allow users to store, categorize, and retrieve their operational trading procedures forms easily.

Additionally, collaboration among team members is facilitated through sharing and commenting features, ensuring that everyone is on the same page when it comes to trading procedures. This organized approach not only boosts productivity but also fosters better communication.

Exploring common issues and solutions

While filling out the operational trading procedures form may seem straightforward, users often encounter common issues. Typically, problems arise from incorrect information input, such as missing vital details, or forgetting signatures, which can delay the processing of trades.

Being proactive about these issues can streamline the process. Regularly reviewing the filled form before submission can help identify and correct mistakes early.

Advanced features of pdfFiller for trading documentation

pdfFiller offers advanced features that enhance the management of operational trading procedures forms. These features include automating form management processes to reduce the time spent on manual entries and errors.

Additionally, pdfFiller integrates with various tools that can enhance trading operations, offering a holistic solution for document management. Users can also access historical records and edits to ensure complete traceability of changes made to trading documents.

Best practices for operational trading procedures

Adopting best practices in managing operational trading procedures can yield significant benefits. For starters, regularly updating your procedures form helps keep contents relevant and aligned with current trading guidelines and regulations.

Moreover, maintaining a compliance checklist ensures adherence to regulatory standards, reducing potential penalties or enforcement actions. Engaging team members in procedure reviews fosters a culture of transparency and collective responsibility.

Real-world applications and case studies

Real-world applications of the operational trading procedures form demonstrate its effectiveness. Many organizations have shared success stories detailing how using this form streamlined their trading processes and reduced errors dramatically.

Conversely, some lessons learned from trading errors highlight the importance of meticulous documentation. Instances where improper trading procedures led to financial losses underscore the need for robust operational trading procedures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send operational trading procedures to be eSigned by others?

Can I sign the operational trading procedures electronically in Chrome?

Can I create an electronic signature for signing my operational trading procedures in Gmail?

What is operational trading procedures?

Who is required to file operational trading procedures?

How to fill out operational trading procedures?

What is the purpose of operational trading procedures?

What information must be reported on operational trading procedures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.