Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

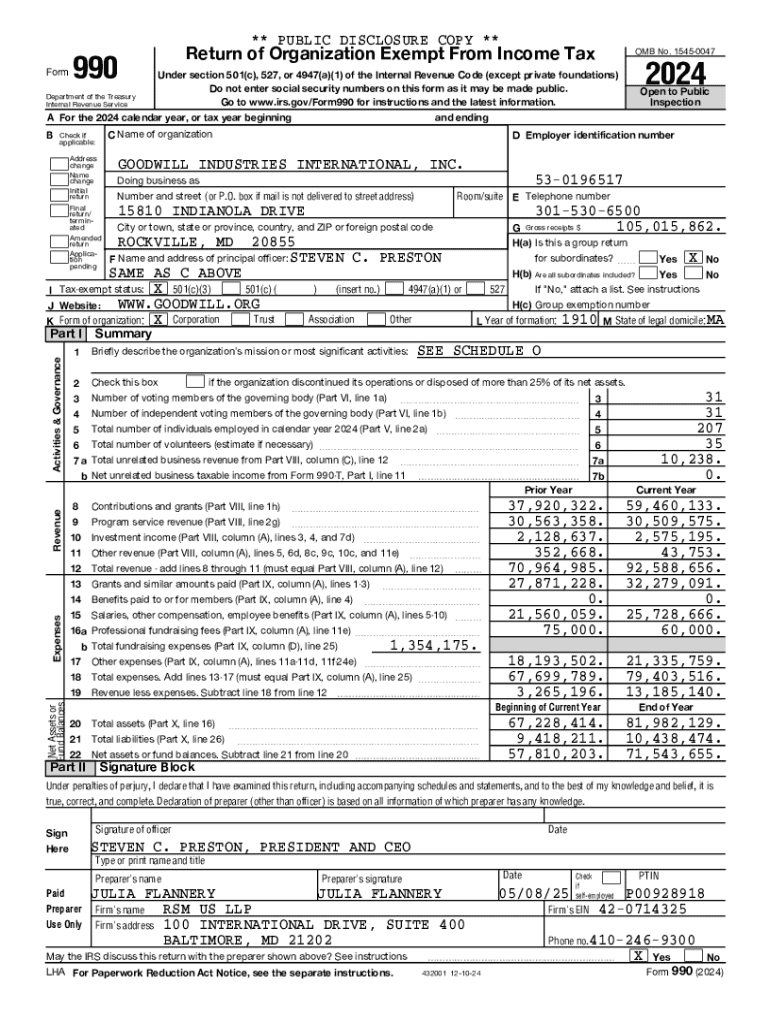

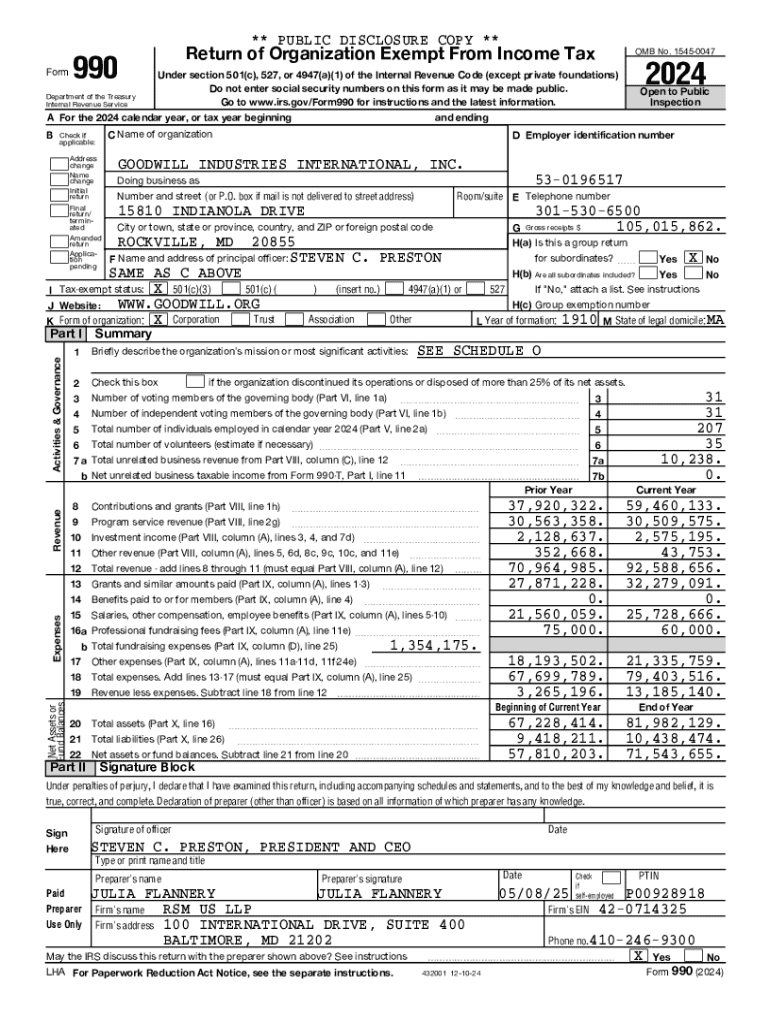

Understanding Form 990

Form 990 is a crucial IRS document required for tax-exempt organizations in the United States. It serves as an annual information return that provides the IRS and the public with essential information about a nonprofit organization's finances, governance, and activities. The primary purpose of Form 990 is to promote transparency and accountability among nonprofits, ensuring they adhere to the regulatory requirements set forth by the IRS.

Filing Form 990 is not only a legal obligation for most nonprofit organizations but also an opportunity to showcase their impact and financial health. This visibility helps to build trust with the public, potential donors, and grant-making organizations, which is vital for fundraising efforts.

Exploring the variants of Form 990

Form 990 has several variants tailored to specific types of organizations. Each version addresses different reporting needs, enabling organizations to present their financial data in an appropriate format.

The three main forms include:

Choosing the right form based on your organization type is essential for compliance and accurate reporting.

Key components of Form 990

Form 990 consists of several sections that detail various aspects of an organization's operation. Understanding these components is crucial for accurate and compliant reporting. Key sections include the summary of the organization, financial statements, governance policies, and program service accomplishments.

Additionally, Form 990 requires organizations to complete specific schedules that provide additional information about various aspects of operations, such as compensations for officers and employees, public support tests, and tax compliance.

Familiarizing yourself with commonly used terminology, such as 'unrelated business income' or 'functional expenses,' will further enhance your reporting accuracy.

Filing requirements for Form 990

Organizations required to file Form 990 must adhere to specific guidelines. The general filing requirement states that nonprofits with gross receipts exceeding $200,000 or total assets over $500,000 must submit Form 990 annually.

Filing deadlines vary depending on the month of the fiscal year-end, typically falling on the 15th day of the fifth month following the end of the organization’s fiscal year. Extensions may be requested but must be filed ahead of the deadline.

How to fill out Form 990

Filling out Form 990 can be a complex process. However, breaking it down into manageable steps can ease the burden. Start by gathering financial records from the previous year and ensure you have up-to-date information regarding your organization's activities.

When navigating each section, be thorough and accurate, ensuring that data is consistent with prior forms if applicable. Utilizing accounting software and consulting financial professionals can help in accurately reporting financial data.

By following best practices and double-checking inputted data, organizations can avoid common mistakes that may lead to IRS scrutiny or penalties.

Interactive tools for Form 990 completion

Using online resources can make completing Form 990 more efficient. pdfFiller provides tools for editing, signing, and managing your Form 990 seamlessly. The platform is user-friendly, allowing organizations to fill out the form without unnecessary hassle.

With pdfFiller, teams can collaborate in real-time, enhancing the process of form completion. You can utilize templates and pre-fill certain sections, saving time during the reporting process.

Filing modalities and submission options

Nonprofits can choose between electronic filing and paper submission for Form 990. E-filing is increasingly popular due to its speed and efficiency. Most organizations filing Form 990 must submit electronically through an IRS-approved e-file provider.

To e-file, organizations need to prepare the form accurately and use the IRS-approved software. Once filed, the IRS confirms receipt electronically, providing a streamlined approach to submissions.

Regardless of submission type, ensure you keep a copy for your records.

Understanding penalties and compliance

Nonprofits that fail to file Form 990 by the deadline or provide incorrect information may face penalties from the IRS. These fines can accumulate quickly, with late filings incurring potential fines of up to $200 per day, up to a maximum of $10,000.

Maintaining compliance is crucial for organizations wishing to preserve their tax-exempt status. Regular training for board members and financial staff on compliance matters can mitigate risks associated with incorrect filings.

Public inspection regulations

Form 990 is considered a public document, which means the information contained within it is accessible to the public. Nonprofits are required to make copies of their Form 990 filings available for public inspection, ensuring that transparency is prioritized.

Members of the public can access Form 990 data of nonprofits in various ways, including IRS websites, watchdog organizations, or directly from the nonprofits themselves. Researchers and analysts often use this data to evaluate the financial health and strategies of charitable organizations.

Historical context of Form 990

Form 990 has evolved significantly over the years, reflecting changes in regulations and the nonprofit sector's complexities. Initially established in 1942, the form has undergone numerous revisions to enhance transparency and simplify reporting requirements for charities.

Significant amendments to Form 990 have included revising its structure, requiring additional disclosures, and implementing new schedules. Understanding this historical context can provide insights into the current requirements and best practices.

Using Form 990 for charitable evaluation research

Researchers often analyze Form 990 data to gain insights into the nonprofit sector's dynamics, identifying trends in funding, spending, and operational practices. By examining these forms, it becomes possible to evaluate how organizations utilize funds and measure effectiveness.

Data analysis from Form 990 can also unveil industry-wide patterns or highlight exemplary philanthropic practices among nonprofits. Organizations can leverage this understanding to improve their strategies and compliance.

Specific considerations for nonprofits

While Form 990 is an essential tool for most nonprofits, organizations should remain aware of potential red flags that may arise during reporting. High executive compensation, significant fluctuations in revenue, and declining public support can all raise questions from regulators and stakeholders.

Leveraging insights from Form 990 can also benefit fundraising campaigns. Highlighting successful program outcomes, sustained financial health, and responsible governance can enhance the organization’s credibility and attract donations.

The role of third-party sources of Form 990

Many external tools are available for accessing and analyzing Form 990 data, offering users the opportunity to gain valuable insights without extensive manual research. Platforms like GuideStar and Charity Navigator provide comprehensive analyses, allowing for better comparison among organizations.

Using third-party resources to access Form 990 data can enhance the understanding of nonprofit performance, trends, and best practices sector-wide.

How to read and interpret the Form 990

Understanding how to navigate Form 990 is essential for stakeholders aiming to gain insights into a nonprofit's operations. Key sections and schedules should be carefully examined to recognize critical financial indicators, such as total revenue, total expenses, and net assets.

Additionally, focusing on specific metrics, such as fundraising efficiency, program service expenditures relative to total expenses, and changes over time, can provide a clear picture of the organization's sustainability and focus.

Locating a Form 990 text

Finding Form 990 filings for various organizations has been made simpler due to advances in digital accessibility. The IRS provides online access to Form 990 documents, and numerous nonprofit watchdog websites offer searchable databases of nonprofit filings.

When searching for the Form 990 of specific organizations, using search queries that include the organization’s name alongside 'Form 990' will typically yield reliable results. This can aid donors and researchers in making informed decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 990 without leaving Google Drive?

How do I execute form 990 online?

How do I edit form 990 in Chrome?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.