Get the free 990ez

Get, Create, Make and Sign 990ez

How to edit 990ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990ez

How to fill out 990ez

Who needs 990ez?

Filing Form 990-EZ with pdfFiller: A Comprehensive Guide

Understanding Form 990-EZ

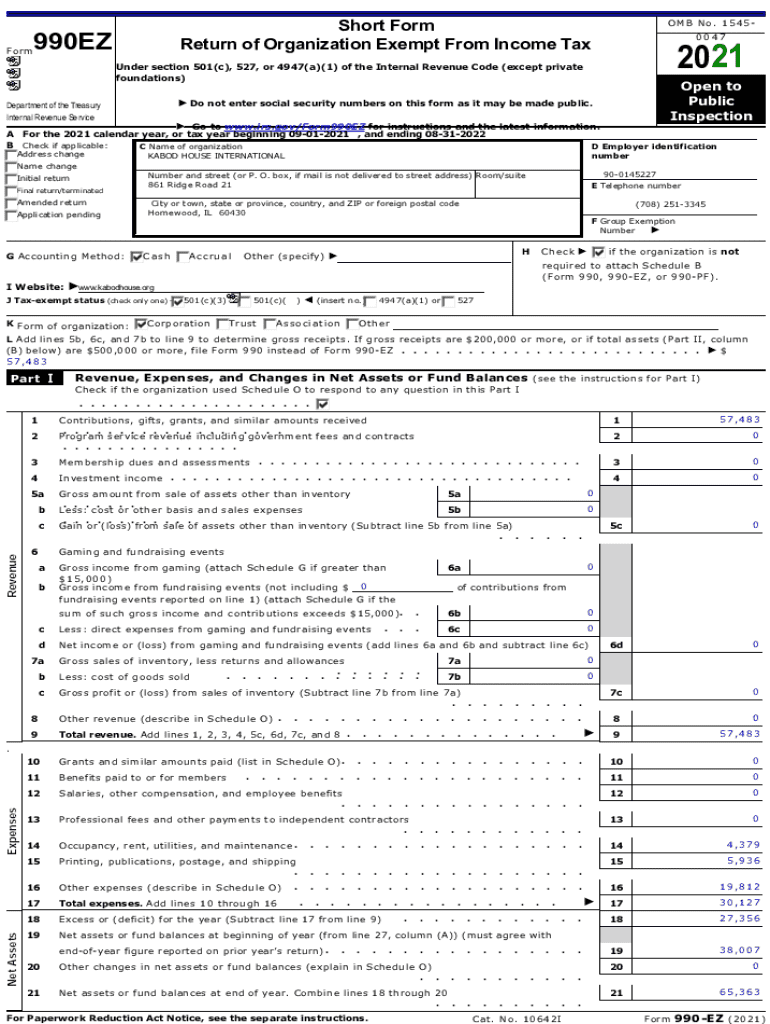

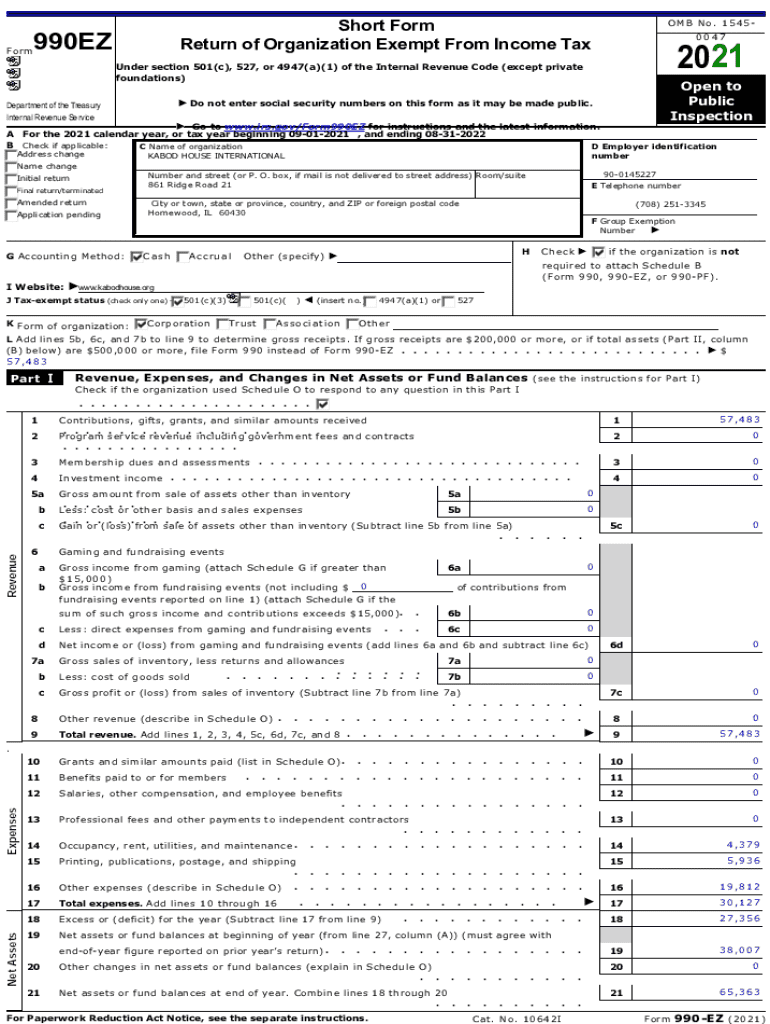

Form 990-EZ is an essential IRS form tailored for small to mid-sized tax-exempt organizations, offering a simplified reporting structure compared to its more comprehensive counterpart, Form 990. This form facilitates transparent financial reporting while enabling nonprofits to demonstrate their eligibility for tax-exempt status. It's particularly beneficial for organizations whose gross receipts are normally less than $200,000 and whose total assets are less than $500,000 at the end of the year.

Not all organizations are mandated to file this form. Entities that qualify include charities, social welfare organizations, and more, provided they meet the aforementioned financial thresholds. That said, the choice to file the 990-EZ should not be taken lightly, as it holds significant implications for accountability and tax compliance.

When and how to file Form 990-EZ

Filing deadlines are crucial for nonprofits. For most organizations, the form is due on the 15th day of the 5th month after the end of the fiscal year. For instance, if a nonprofit operates on a calendar year, the due date would be May 15. Missing this deadline can lead to penalties and complications that risk the organization’s tax-exempt status.

Extensions are available, typically granted for an additional six months. However, organizations should not rely solely on extensions and should prioritize timely filings to avoid unnecessary stress and penalties.

Preparing to file Form 990-EZ

Preparing to file Form 990-EZ requires meticulous organization and readiness. Nonprofits need to collect accurate financial records, including income statements, assessments of total assets, and detailed expenditure reports. Additionally, documentation regarding employee compensation and any grants received should be readily available, as they are critical to completing the form accurately.

Using streamlined financial software can help organizations compile this information effectively. Furthermore, resources such as pdfFiller can simplify the organization and assembly of required documents, ensuring nothing is overlooked before submitting the form.

Filing Form 990-EZ electronically

Filing Form 990-EZ electronically offers numerous advantages. With pdfFiller, nonprofits can navigate the filing process efficiently, saving time and reducing errors. The electronic format allows for instant checks against common filing errors and enables faster processing by the IRS, which can be crucial for organizations awaiting confirmation of their filings.

To file Form 990-EZ online using pdfFiller, follow these steps: First, sign up or log into your pdfFiller account. Next, locate Form 990-EZ within the platform, a straightforward process thanks to the site’s user-friendly interface. Enter your data in the required sections, paying close attention to details, and then review your form summary to check for errors. Finally, transmit your return after performing a final review.

Amending a previously filed Form 990-EZ

Sometimes, organizations find that previous filings of Form 990-EZ need to be amended. This process is straightforward and can often be done without incurring additional costs, which is a considerable advantage for nonprofits operating on tight budgets. Typically, the IRS allows filers to correct previously submitted forms to address any inaccuracies or to update relevant information.

Common reasons for amending a return might include correcting errors in revenue reporting, adjusting board member compensation, or reflecting new information about grants received. Engaging in this process as soon as discrepancies are identified is essential for maintaining compliance and integrity in financial reporting.

Frequently asked questions about Form 990-EZ

Filing Form 990-EZ often raises several questions among nonprofit organizations. For example, missing the filing deadline can result in significant penalties that accumulate over time. Understanding the penalties for late filing helps organizations maintain compliance and avoid pitfalls that could jeopardize their operations.

Additionally, organizations with a group exemption number should be aware of how this designation affects their filing requirements. Many wonder if they should file electronically, with e-filing being highly recommended for its convenience and speed. Others ask about what information can be amended on Form 990-EZ and how to determine if companion Form 990-T is necessary.

Post-filing considerations

Once Form 990-EZ is successfully filed, there are still important steps to consider. Keeping track of the filing status is vital; nonprofits should set reminders or utilize services that notify them of any updates or potential queries from the IRS. Additionally, organizations should understand the relevance of the tax year for which the form is filed, ensuring that the information remains accurate and relevant.

Establishing best practices for tracking Form 990-EZ filings can also help simplify future submissions. Regularly reviewing financials and ensuring all documentation is in order not only assists with compliance but also enhances organizational transparency and trust among stakeholders.

Utilizing pdfFiller for enhanced filing experience

By leveraging pdfFiller, organizations can gain access to diverse features that enhance the filing experience for Form 990-EZ. Collaborative capabilities allow teams to communicate efficiently, sharing responsibilities and draft versions seamlessly. Smart AI assistance further simplifies the process, providing automated checks and guidance, thereby reducing errors and streamlining workflows.

User feedback highlights the effectiveness and ease of use associated with pdfFiller when dealing with Form 990-EZ. Reviews consistently point out that the platform's functionalities significantly lessen the time spent on paperwork, consequently allowing nonprofit teams to focus more on mission-driven activities rather than administrative duties.

Additional tools and resources on pdfFiller

Educating staff on filing Form 990-EZ can be enhanced through the variety of resources available on pdfFiller. From interactive webinars to comprehensive video tutorials, the platform offers training materials that equip teams with the necessary knowledge and skills to navigate their tax obligations comfortably. Moreover, a robust knowledge base and FAQ section ensure that users have answers readily available for common queries.

Additionally, pdfFiller offers due date reminders to keep organizations on track for their filings, alongside various filing tools designed to streamline the submission process. Excellent customer care and live support options further support users navigating this crucial compliance task, ensuring help is not far away.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 990ez in Gmail?

How do I complete 990ez on an iOS device?

How do I complete 990ez on an Android device?

What is 990ez?

Who is required to file 990ez?

How to fill out 990ez?

What is the purpose of 990ez?

What information must be reported on 990ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.