Get the free 4-709

Get, Create, Make and Sign 4-709

Editing 4-709 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 4-709

How to fill out 4-709

Who needs 4-709?

A comprehensive guide to the 4-709 form

Understanding the 4-709 form: Overview

The 4-709 form is an essential document used for reporting generous gifts made during a tax year. Specifically designed for the IRS, this form covers the reporting requirements and calculations necessary for the gift tax. Completing the 4-709 form correctly is crucial, as errors or omissions may lead to penalties or unforeseen tax liabilities.

Understanding the significance of the 4-709 form is vital not only for compliance but also for financial planning. Individuals must be aware of what qualifies as a taxable gift and when they need to file this form. Common scenarios requiring the 4-709 form include large monetary gifts or property transfers, which can surpass stipulated annual exclusion limits.

Who needs to file the 4-709 form?

Filing the 4-709 form is essential for various individuals and entities. Specifically, any person who gives a gift that exceeds the annual exclusion limit set by the IRS needs to file this form. Generally, this applies to individuals, estates, and trusts who are involved in transfer activities. To ascertain eligibility, one must understand the thresholds for taxable gifts.

Special considerations should be noted for married couples. They can choose to split gifts, effectively allowing both spouses to utilize their individual exemptions and maximize gift giving without excessive tax implications.

Key components of the 4-709 form

The 4-709 form is divided into three main parts, each serving a specific purpose in the overall process of gift tax reporting. Understanding these segments helps streamline the completion of the form, ensuring all necessary information has been included.

Terms within the form, such as 'donor,' 'donee,' and 'exclusion,' are essential for accurate completion. Familiarizing oneself with these terms can greatly improve the accuracy of the submission.

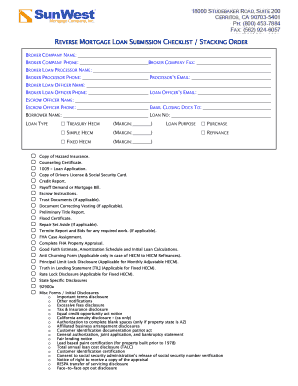

Step-by-step guide to completing the 4-709 form

Completing the 4-709 form might seem daunting, but breaking it down into steps can simplify the process. Here’s an easy guide to follow:

Common mistakes to avoid when filing the 4-709 form

Even minor errors can lead to repercussions when submitting the 4-709 form. Common mistakes include miscalculating taxable gifts or neglecting to report gifts that surpass the limits. Therefore, maintaining accuracy is paramount.

Double-checking information before submission is always advisable. Utilizing checklists and referencing IRS guidelines can significantly contribute to a successful filing.

Filing deadlines and extensions for the 4-709 form

Filing the 4-709 form comes with specific deadlines. Generally, the form is due on April 15th following the year of the gift. However, if this date falls on a weekend or holiday, the deadline is extended.

Understanding these deadlines and being proactive in your filing can save you from unpleasant surprises down the road.

Exclusions applicable to the 4-709 form

The 4-709 form also considers various exclusions that can mitigate tax liabilities. Understanding these exclusions is critical for efficient tax planning, allowing individuals to maximize their gifting potential.

By leveraging these exclusions, you can make more significant gifts without incurring tax liabilities.

Resources for managing your 4-709 form

Leveraging technology can simplify the daunting task of form filling. pdfFiller offers interactive tools that not only guide users through the form but also simplify the overall process of document management.

Using platforms like pdfFiller ensures that individuals and teams can manage their documentation effectively and with minimal stress.

Adaptations for different situations involving the 4-709 form

The 4-709 form’s application can vary significantly depending on the giver's particular circumstances. For example, gifts made through trusts or cross-border transactions may entail additional considerations. Recent changes to tax laws also influence how individuals should approach their filing.

Understanding these complexities will prepare you to file the 4-709 form accurately and effectively.

Features and benefits of using pdfFiller for the 4-709 form

Utilizing pdfFiller to manage the 4-709 form offers numerous advantages. This cloud-based platform provides users with interactive tools aimed at enhancing the document handling process. Its collaborative features allow teams to manage the form together seamlessly.

By choosing pdfFiller, users are empowered to simplify their document-related tasks, including gift tax reporting.

Related forms and resources for complementary needs

While the 4-709 form is crucial for reporting taxable gifts, it may not be the only form required. Other forms may often accompany it, specifically regarding estate and tax returns.

Seamlessly transitioning between these forms using pdfFiller will streamline tax season and ensure all necessary documentation is readily available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 4-709 directly from Gmail?

How do I make changes in 4-709?

How do I complete 4-709 on an Android device?

What is 4-709?

Who is required to file 4-709?

How to fill out 4-709?

What is the purpose of 4-709?

What information must be reported on 4-709?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.