Get the free 74-176

Get, Create, Make and Sign 74-176

Editing 74-176 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 74-176

How to fill out 74-176

Who needs 74-176?

74-176 Form: A Comprehensive How-to Guide

Understanding the 74-176 form

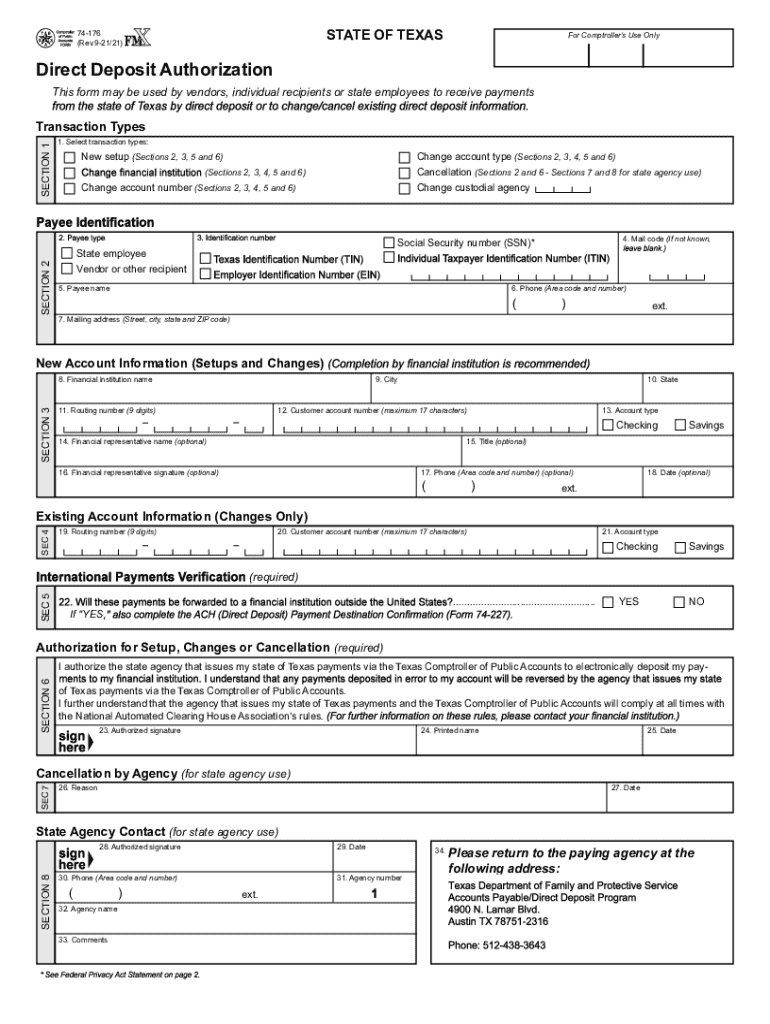

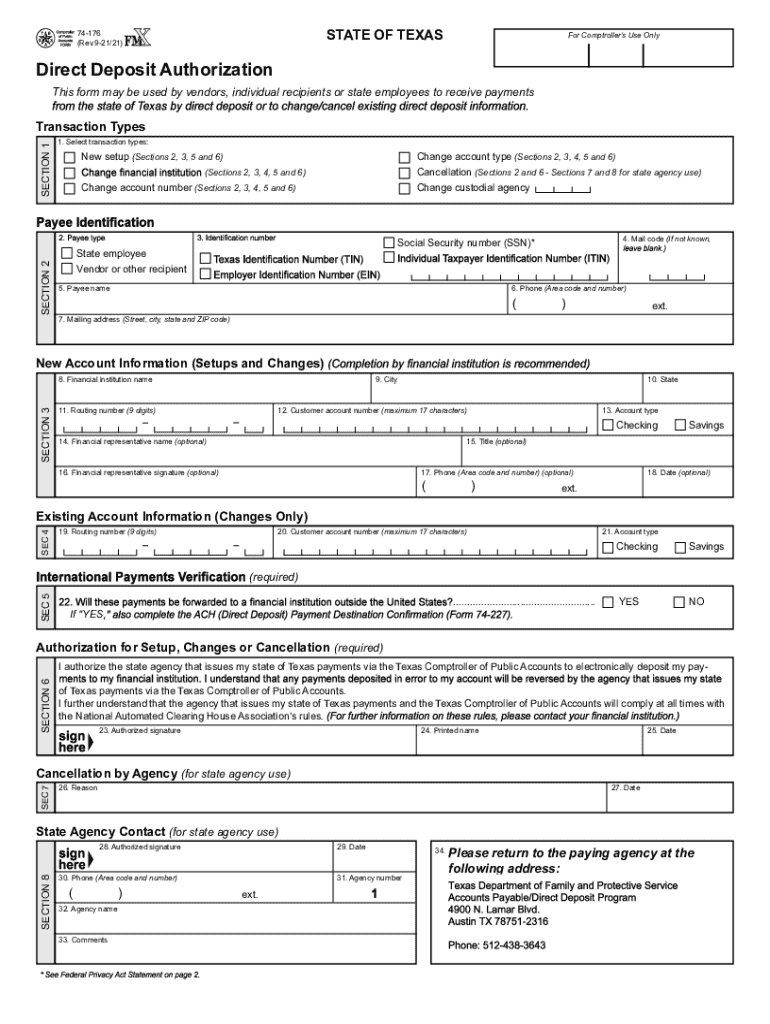

The 74-176 form is a vital document used in various financial and tax management capacities. This form serves primarily as a means to report certain financial information, allowing individuals and organizations to provide necessary data for tax compliance and efficiency. It holds significance in both personal finance and broader organizational financial practices, making it an indispensable tool for accurate reporting.

Key features of the 74-176 form include the detailed capture of personal and financial data, which is crucial for accurate reporting and compliance. Unlike other forms that may focus solely on income, the 74-176 form encompasses a broader spectrum, including payment details, authorization signatures, and any relevant attachments for thoroughness. Its unique nature sets it apart from similar forms, ensuring users have a comprehensive resource for financial tracking.

Preparing to use the 74-176 form

Before you can fill out the 74-176 form, it's essential to determine who needs to complete it. Both individuals and organizations may find themselves in need of this form, particularly when it comes to tax reporting or other financial disclosures. Eligibility can depend on specific criteria such as the type of financial activity being reported or the amounts involved.

Gathering the necessary information is crucial for effective use of the 74-176 form. Required personal details typically consist of your full name, address, and tax identification number. When it comes to financial information, you will need to have your bank details, relevant income information, and any additional financial records that may pertain to the report. Avoid common pitfalls such as overlooking key pieces of information or making simple clerical errors that can delay processing.

Step-by-step instructions for filling out the 74-176 form

Accessing the 74-176 form is straightforward. You can find it on leading document management platforms like pdfFiller, where it's available for download. This platform ensures that the form is accessible and ready for use in digital format, allowing for easy editing and submission.

When it comes to filling out the form, it's best to break it down into sections for clarity:

Utilizing pdfFiller’s editing tools can simplify the process of filling out the form. You can easily navigate through the fields and check for errors to ensure all information is accurate and compliant with requirements.

Editing and reviewing the 74-176 form

After filling out the 74-176 form, reviewing and editing it becomes paramount. pdfFiller offers robust features that enable users to edit the content seamlessly. You can add comments or annotations to provide context or clarify specific sections of your submission.

A collaborative review process is also beneficial. Sharing the form with team members or advisors allows for collective input and ensures that everyone’s perspectives are considered. pdfFiller's sharing features facilitate efficient feedback collection, preventing miscommunications and ensuring thoroughness.

Signing the 74-176 form

Once your 74-176 form is complete, signing is the next step. pdfFiller provides multiple methods for signing, including electronic signatures, which are both convenient and legally valid in many jurisdictions. It's essential to check digital signature laws applicable to your region.

To sign the form using pdfFiller, follow these simple steps:

Submitting the 74-176 form

After signing, you will need to submit your 74-176 form. You have various options for submission, including electronic submission through pdfFiller, which is the most efficient method. This way, you can track your submission status electronically, ensuring that your documents are received and processed.

If you prefer alternative methods, such as mailing or submitting in person, ensure that you follow the specific guidelines provided for those methods. It's also a good practice to track your submission status, utilizing tools that verify that your form has been received.

Managing your 74-176 form with pdfFiller

Effective management of your 74-176 form is vital, and pdfFiller assists with several features that enhance this process. For instance, storing your form securely on pdfFiller ensures that your sensitive information remains protected while being easily accessible whenever needed.

Additionally, pdfFiller offers revision history and version control, allowing users to keep track of edits made to the form. This feature is invaluable, especially when you need to revert to an earlier version or analyze changes over time. Maintaining an organized workflow with your documents can save both time and effort.

Frequently asked questions (FAQs)

Many users have common queries regarding the 74-176 form. Such questions typically revolve around the form's purpose, requirements, and methods for error correction. Understanding these queries can provide clarity and enhance your experience with the form, thus facilitating smoother filing processes.

For troubleshooting, common issues may include difficulty in accessing the form or problems with electronic signatures. Ensure that you review the guidelines associated with pdfFiller, as well as any FAQs provided to expedite any resolutions necessary during the form's preparation and submission.

Conclusion of the guide

The 74-176 form plays a significant role in effective financial documentation and compliance. By utilizing pdfFiller’s extensive features for editing, signing, and managing this form, users can navigate the often-complex process with greater efficiency and ease. Proper form management is not only a matter of compliance; it's instrumental in achieving optimal financial organization.

Leverage all of pdfFiller’s offerings to enhance your experience with the 74-176 form, ensuring that you meet all requirements while simplifying your document management tasks. With the right tools in hand, you can efficiently handle your financial documentation and keep your focus on what truly matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 74-176 directly from Gmail?

How can I edit 74-176 from Google Drive?

Can I edit 74-176 on an iOS device?

What is 74-176?

Who is required to file 74-176?

How to fill out 74-176?

What is the purpose of 74-176?

What information must be reported on 74-176?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.