Get the free Schedule 14a

Get, Create, Make and Sign schedule 14a

How to edit schedule 14a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 14a

How to fill out schedule 14a

Who needs schedule 14a?

Schedule 14A Form: A Comprehensive How-to Guide

Understanding Schedule 14A

Schedule 14A is a crucial document that public companies must file with the SEC when soliciting votes from shareholders. Its primary purpose is to provide transparent and complete information about corporate governance decisions, ensuring that shareholders have the necessary data to make informed voting choices. This form plays a vital role in maintaining the integrity of corporate governance.

The importance of Schedule 14A extends far beyond just a regulatory requirement; it aims to foster a transparent relationship between companies and their shareholders. By mandating disclosure of essential information regarding corporate actions, executive compensation, and other critical decisions, it emphasizes accountability in management practices.

Key elements of Schedule 14A

The Schedule 14A form consists of several key elements that companies must disclose. These elements include mandatory information about the company's background, details of proposed corporate actions, and executive compensation information. Each of these components serves a specific purpose in providing shareholders with a comprehensive overview of the agenda.

Mandatory information required in a Schedule 14A includes a detailed background of the company, encompassing its history, principal business activities, and management structure. Additionally, it must outline any proposed corporate actions such as mergers, acquisitions, or significant market changes. Moreover, transparency about executive compensation is crucial, disclosing how executive pay is tied to the company's performance and governance practices.

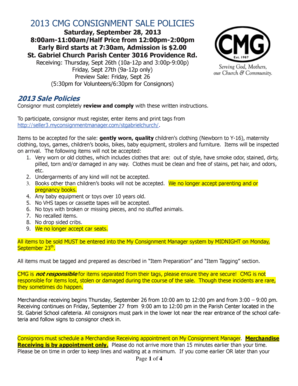

Filing requirements and deadlines for 14A forms

Filing a Schedule 14A form involves adhering to specific deadlines set by the SEC. Generally, companies are required to file the form with the SEC at least 20 days before the date of the shareholder meeting. However, if certain corporate actions are involved, companies may need to submit the form even earlier to allow for adequate review by the SEC.

Proper filing includes following guidelines regarding the format, necessary disclosures, and submission methods. Companies often utilize electronic filing systems provided by the SEC, which streamline the submission process. Recent legal changes emphasize the need for timely and accurate filings, reflecting the increased scrutiny on corporate compliance.

SEC review process for Schedule 14A

Once a Schedule 14A form is submitted, it undergoes a review process by the SEC. This comprehensive review ensures that all required disclosures are complete and compliant with SEC regulations. During this process, the SEC may issue comments or request additional information, which companies must address promptly to facilitate the approval of their filings.

Common reasons for the rejection of Schedule 14A filings include incomplete disclosures, unclear language, or failure to meet regulatory standards. Companies can, and often do, amend their filings in response to SEC inquiries, which underscores the importance of thorough preparation and compliance during the initial submission phase.

Filling out the Schedule 14A form

Filling out the Schedule 14A form can be a meticulous task that requires careful attention to detail. To start, it’s crucial to gather all necessary information, including background data about the company, financial statements, and specifics about proposed actions. This groundwork sets the stage for completing the actual form effectively.

Once the necessary information is compiled, the next step is completing the proxy information. Consistency and clarity are paramount; statements should be concise and directly address the shareholders' interests. Including shareholder proposals demands attention as well, ensuring that all submitted proposals comply with SEC guidelines. Following best practices in drafting and organization significantly aids the overall accuracy and compliance of the filing.

Managing proxy solicitations with Schedule 14A

Proxy solicitation represents a critical aspect of corporate governance, and managing it efficiently is essential for successful shareholder engagement. Companies must devise effective strategies for their proxy campaigns, ensuring they communicate clearly with shareholders about the implications of their voting decisions.

Best practices for proxy campaigns include targeted messaging, which resonates with shareholders’ concerns, and timely information dissemination to allow sufficient time for consideration before the meeting. Leveraging technology, such as webinars or virtual meetings, invites increased participation and feedback, facilitating a more interactive approach to shareholder engagement.

Specific regulations impacting Schedule 14A

Schedule 14A is guided by several specific regulations under the SEC, notably Regulation 14A provisions. These regulations delineate requirements for proxy statements, obligations regarding shareholder proposals, and prohibitions against false statements. To ensure compliance, companies must thoroughly understand these regulations' nuances.

Of particular note are the rules about shareholder proposals outlined in 240.14a-8, which provide a structured process for proposals to be included in the proxy statement. Companies must navigate these regulations carefully, especially in light of increasing scrutiny and strict enforcement actions related to disclosure practices. Additionally, unique considerations apply to TARP recipients, given heightened transparency requirements.

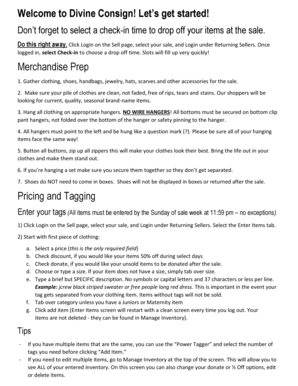

Using pdfFiller for Schedule 14A

pdfFiller streamlines the filing process for Schedule 14A, making it more manageable for companies and teams. With cloud-based editing features, users can easily fill out their documents, ensuring accuracy and compliance along the way. The platform’s eSignature functionality eliminates the need for physical signatures, simplifying collaborations within teams.

Interactive tools within pdfFiller are tailored specifically for Schedule 14A users. Templates designed for this form aid in timely submissions, while step-by-step instructions guide users through complex areas of the filing process. The technology not only saves time but also reduces the risk of errors in filing, enhancing overall efficiency.

Common FAQs related to Schedule 14A

Navigating the complexities of Schedule 14A raises several common questions. One prevalent concern is what to do if a filing deadline is missed. In such cases, companies should consider filing an amendment as soon as possible while being transparent with the SEC regarding the delay.

Another frequent inquiry centers around how to amend a filed Schedule 14A. Companies must submit an amended filing that clearly outlines the changes being made and provide justifications for these amendments. Additionally, understanding the nuances of proxy voting procedures ensures that companies can accurately guide shareholders through the voting process.

Case studies and examples of Schedule 14A in action

Examining real-world instances where Schedule 14A has been successfully filed provides invaluable insights. Companies that prioritize transparency and comprehensive disclosures often experience favorable outcomes, such as increased shareholder trust and higher voting participation, demonstrating the effectiveness of clear communication through these filings.

Conversely, case studies highlighting failed compliance underscore the ramifications of overlooking critical disclosures. These situations often lead to shareholder dissent or regulatory scrutiny, revealing the direct impact that Schedule 14A compliance has on a company's reputation and operational effectiveness.

Future trends in Schedule 14A and corporate governance

Looking ahead, several emerging regulations are poised to influence the landscape of Schedule 14A filings significantly. As the SEC continues to adapt to the dynamic corporate environment, companies must stay informed about potential regulatory shifts that may shape disclosure requirements. Furthermore, innovations in proxy solicitation strategies are expected to evolve, leveraging technology to foster enhanced shareholder engagement.

Predictions suggest that the future role of technology will expand in document management, creating more streamlined, efficient processes that effectively meet regulatory demands while accommodating evolving shareholder expectations. Companies that embrace these trends will likely find themselves at an advantage in navigating the complexities of corporate governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule 14a to be eSigned by others?

How do I execute schedule 14a online?

Can I edit schedule 14a on an iOS device?

What is schedule 14a?

Who is required to file schedule 14a?

How to fill out schedule 14a?

What is the purpose of schedule 14a?

What information must be reported on schedule 14a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.