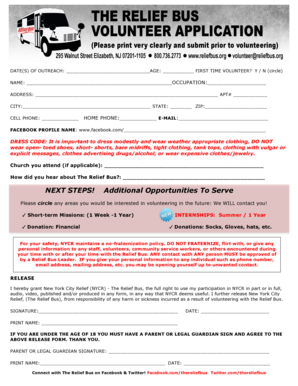

Get the free 2025 Estate Tax Form M706 Instructions

Get, Create, Make and Sign 2025 estate tax form

How to edit 2025 estate tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 estate tax form

How to fill out 2025 estate tax form

Who needs 2025 estate tax form?

2025 Estate Tax Form - How-to Guide

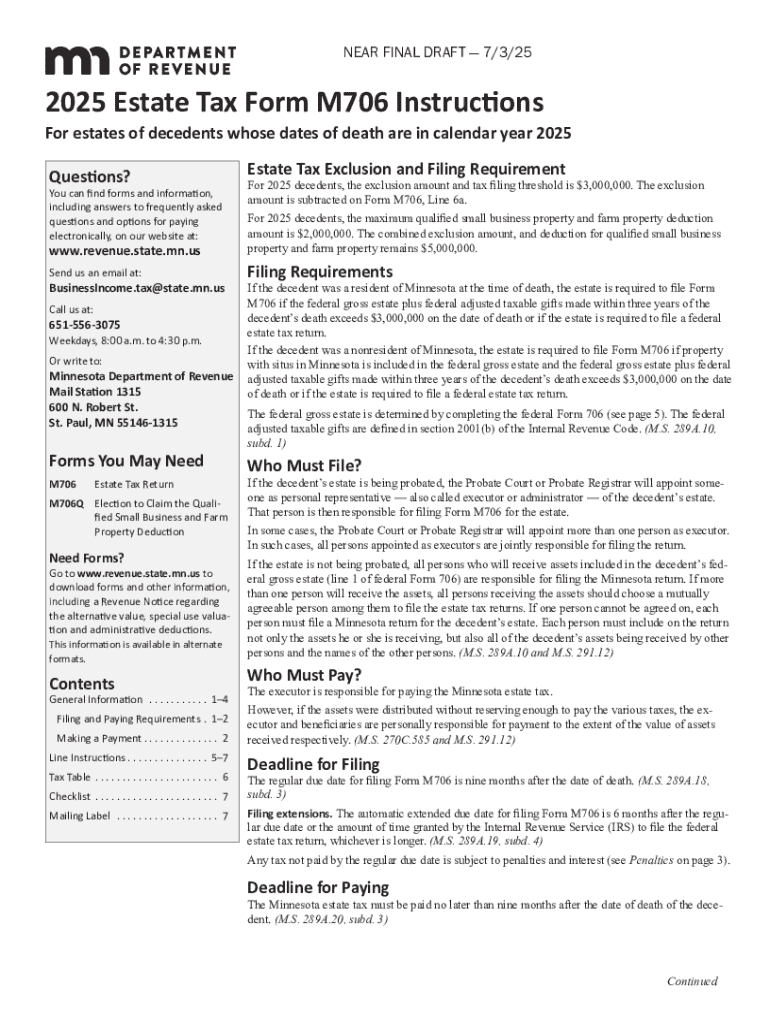

Understanding the 2025 Estate Tax Form

The 2025 Estate Tax Form is a crucial document that individuals must become familiar with during the estate settlement process. This form serves as a declaration of a deceased person's estates to determine if estate taxes are due, and it is essential for accurately reporting assets, deductions, and calculating any taxes owed. Proper understanding of this form is vital not only for compliance purposes but also to ensure efficient distribution of the deceased's assets.

Filing this form is critically important for several reasons. First, it helps heirs and personal representatives comply with federal laws regarding estate tax obligations. Secondly, it provides a comprehensive overview of the estate's financial standing, which can aid in transparent estate planning and management. With significant changes introduced in 2025, being well-versed in the nuances of this form will empower estates to navigate their tax liabilities effectively.

2025 marks a year of notable updates regarding estate taxation. The exemption limits, tax rates, and various reporting requirements have been amended to reflect changes in the financial landscape, making it imperative to stay informed of these modifications to ensure compliance.

Who needs to file the 2025 estate tax form?

Determining whether you need to file the 2025 Estate Tax Form hinges on specifics of the estate's value and assets. Generally, estates with a gross value exceeding the federal estate tax exemption threshold are required to file. As of 2025, this threshold stands notably higher than in previous years, owing to annual adjustments for inflation.

Eligibility criteria for filing include not only the estate's total value but also the nature of the assets held within. Estates with complex assets, such as businesses or significant investments, may face different filing requirements than simpler estates. Furthermore, while some states have their estate taxes, federal exemptions may differ, impacting overall liability.

Key components of the 2025 estate tax form

Understanding the structure of the 2025 Estate Tax Form is essential for accurate completion. The form consists of several key sections, each designed to capture specific information crucial to estate evaluation and taxation. These include personal information about the decedent, detailed asset valuations, liabilities, deductions, and ultimately the calculation of any taxes due.

Each section serves a distinct purpose and must be filled out meticulously. The 'Personal Information' section gathers data about the deceased, while the 'Asset Valuation' section requires comprehensive documentation of all assets, including real estate, bank accounts, and personal property. Additionally, the 'Liabilities and Deductions' section allows for clarification on outstanding debts or expenses that can offset taxable estate values. Finally, through 'Tax Calculations,' an estimation of any owed taxes can be determined.

Step-by-step instructions for completing the 2025 estate tax form

Completing the 2025 Estate Tax Form can seem daunting, but the process becomes more manageable with proper guidance. The first step is to gather all necessary documentation, which involves identifying assets, collecting information about debts, and understanding any deductions that can be claimed.

Begin by accurately filling out the personal information section. Ensure all names, dates, and identification numbers are correct. Proceeding to the asset valuation section, report all bank accounts, real estate, and investments, ensuring age-accurate valuations are used. Understanding how liabilities impact your taxable estate is crucial, so be thorough when documenting debts. Finally, calculate the estate tax due by subtracting deductions from total valuation before applying current federal tax rates.

Common mistakes to avoid include underreporting asset values, failing to account for all liabilities, or submitting the form without adequate documentation. These errors can result in penalties or audits, emphasizing the need for diligence and clarity throughout the process.

Tools for managing the 2025 estate tax form

With the complexities surrounding the 2025 Estate Tax Form, utilizing technology can streamline the process significantly. One such tool is pdfFiller, which offers a cloud-based platform designed for creating, editing, and managing PDF forms, making estate tax preparation more efficient.

pdfFiller provides interactive features that enhance the user experience. Features such as eSigning, document sharing, and cloud access mean that completing the 2025 Estate Tax Form can happen from anywhere, on any device. The ability to collaborate with financial advisors or legal representatives within the platform ensures completeness and accuracy, reducing potential errors.

Filing the 2025 estate tax form

Once the 2025 Estate Tax Form is completed, the next step is to file it correctly. There are multiple filing options available, with electronic submission rapidly gaining favor among personal representatives. Paper submissions can still be used but are subject to longer processing times.

It’s crucial to be aware of key deadlines for filing and payments. Missing these deadlines can lead to penalties or interest charges on unpaid taxes. Typically, the forms are due nine months after the date of death, although extensions can sometimes be requested. After submission, monitoring the status of the form is advisable to ensure it has been received and is being processed.

Post-filing actions: what comes after submission?

Once the 2025 Estate Tax Form is submitted, understanding the next steps in the process is vital. The assessment process will begin, during which the IRS will review the submitted information to validate the accuracy of the reported details. Correspondingly, there may be audits or inquiries regarding specific aspects of the submission, especially in complex estates.

Being prepared for potential follow-up communications from the IRS is key. Maintaining organized records and being responsive to requests for additional information can mitigate complications. Additionally, it’s essential to consider future tax liabilities that may arise from assets appreciation or changes in tax legislation that could affect the estate down the line.

Comprehensive overview of estate tax considerations in 2025

Understanding the estate tax landscape in 2025 is crucial for effective estate planning. The federal estate tax exemption for 2025 sees significant adjustments — set at a level that allows many estates to escape federal estate taxes entirely. An overview of federal rates reveals progressive incrementation that can impact higher-end estates. Individual estate planning must take into account these variations, which necessitate informed decisions about asset distribution and tax efficient strategies.

Estate taxes are governed not only by federal guidelines but also by state regulations, with many states implementing their estate tax frameworks. These differences further complicate estate planning strategies, especially for individuals who hold properties in multiple states. Working with legal and financial professionals is essential to navigate these complexities and optimize estate tax liabilities.

Strategies for effective estate planning

Successful estate planning is integral to minimizing estate tax exposure. One of the most effective strategies is utilizing gifts that can reduce the overall estate value before death. Annual gift exclusions may allow individuals to pass more wealth tax-free to heirs while simultaneously reducing future estate tax burdens.

Establishing trusts can also play a critical role in effective estate planning. Various trust structures allow for tax efficiencies while providing control over asset distributions. In particular, irrevocable trusts can remove assets from the taxable estate, while revocable trusts facilitate streamlined management during one's lifetime. Furthermore, using life insurance in estate plans can offset potential estate tax liabilities by providing liquidity for tax payments upon death.

Future outlook: changes to expect post-2025

Looking beyond 2025, potential modifications to estate tax laws could reshape the estate planning landscape significantly. Legislative proposals aimed at altering the estate tax exemption levels, tax rates, or implementation of additional reporting requirements are consistently under discussion. Monitoring any changes in federal and state tax regulations will be crucial for individuals engaging in estate planning.

Emerging trends, such as a growing focus on wealth transfer strategies through digital assets and advancements in technology, are also likely to impact estate planning. As family dynamics evolve with increasing rates of blended families and non-traditional relationships, tailored estate planning approaches will need to be adopted to accommodate diverse family structures.

FAQs about the 2025 estate tax form

As with any intricate document, common questions arise concerning the 2025 Estate Tax Form. Frequently asked questions often center around eligibility for filing, specific documentation requirements, and potential impacts of recent tax reforms. Engaging with financial advisors and tax professionals can provide clarity and direction, ensuring that individuals feel supported throughout the filing process.

Conclusion: empowering your estate planning journey

Navigating the 2025 Estate Tax Form is a vital aspect of estate management. Utilizing tools like pdfFiller empowers users to manage their estate tax documentation efficiently, ensuring smooth editing and collaboration throughout the process. By adopting a proactive approach to estate planning and staying informed about tax regulations, individuals can significantly simplify their compliance responsibilities while safeguarding their heirs' financial futures.

Understanding the nuances of the 2025 estate tax form, including its requirements and updates, is critical for ensuring smooth estate management. Utilizing pdfFiller to aid in the completion and submission of this form can facilitate a stress-free experience, empowering users to focus beyond filing obligations towards a well-planned estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 estate tax form to be eSigned by others?

Can I create an electronic signature for the 2025 estate tax form in Chrome?

How can I fill out 2025 estate tax form on an iOS device?

What is 2025 estate tax form?

Who is required to file 2025 estate tax form?

How to fill out 2025 estate tax form?

What is the purpose of 2025 estate tax form?

What information must be reported on 2025 estate tax form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.