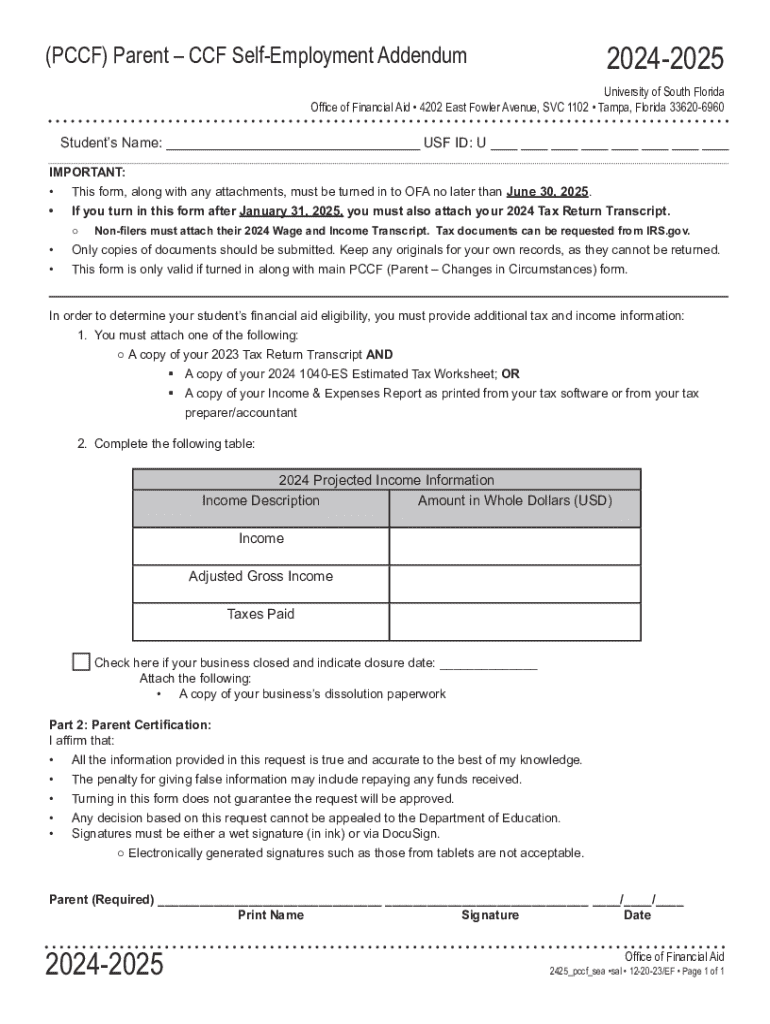

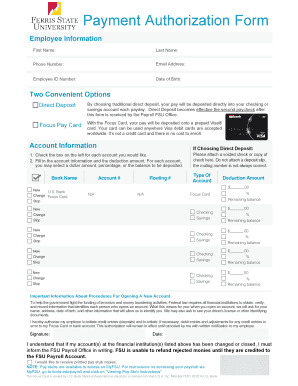

Get the free Parent – Ccf Self-employment Addendum

Get, Create, Make and Sign parent ccf self-employment addendum

Editing parent ccf self-employment addendum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out parent ccf self-employment addendum

How to fill out parent ccf self-employment addendum

Who needs parent ccf self-employment addendum?

Understanding the Parent CCF Self-Employment Addendum Form

Understanding the parent ccf self-employment addendum form

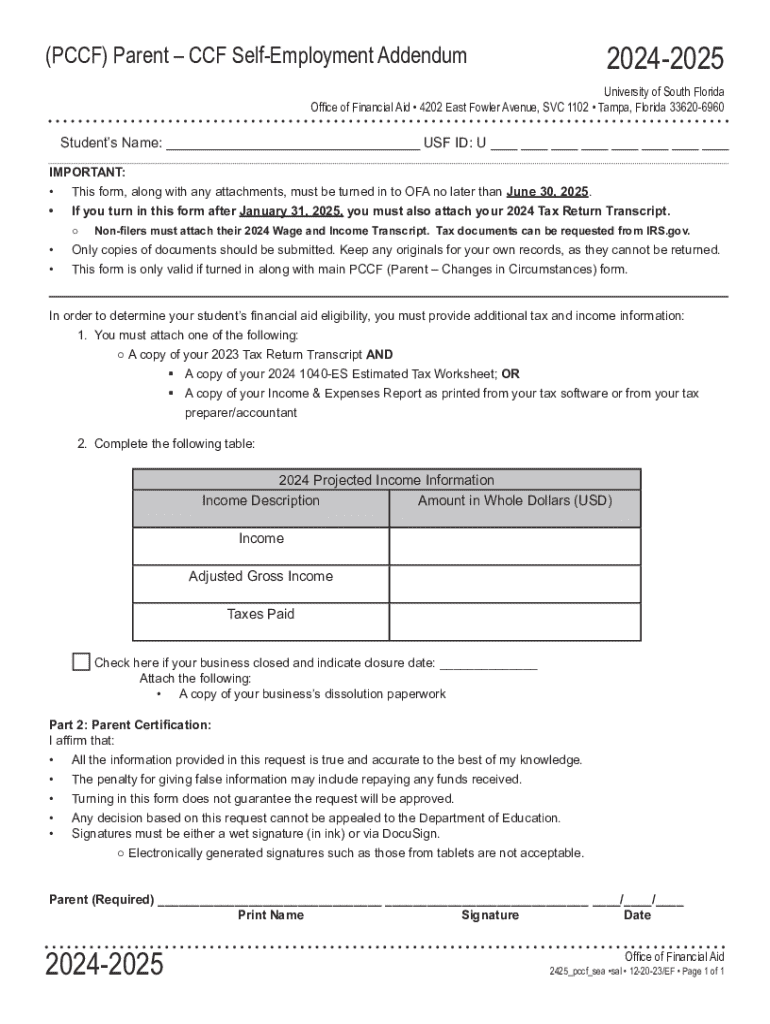

The Parent CCF Self-Employment Addendum Form is a vital document used primarily in financial assessments to provide a clear picture of self-employment income for parents seeking assistance or benefits. This form helps organizations and agencies evaluate the financial status of self-employed individuals when determining eligibility for various programs. By detailing the nuances of income and business-related expenses, the addendum ensures that families receive the appropriate level of support based on accurate financial representation.

The significance of this addendum cannot be overstated; it allows reviewers to take into account the variability and complexity of self-employment income, which often differs from traditional employment. Parents engaged in various entrepreneurial ventures can use this form to delineate their earnings and associated costs, both of which are crucial for a comprehensive financial assessment.

Key sections of the parent ccf self-employment addendum form

The Parent CCF Self-Employment Addendum Form is structured to provide essential information clearly and concisely. Each section serves a specific purpose, ensuring that all relevant data regarding the parent's self-employment is accurately reported. The main sections include personal information, business specifics, income reporting, current employment status, and additional financial information, each playing a crucial role in rendering a holistic view of the applicant's financial health.

These sections collectively gather necessary details that financial reviewers use to assess income and determine eligibility for programs. Understanding each part of this form is critical for smooth completion and accurate representation of self-employed income.

Step-by-step guide to completing the form

Completing the Parent CCF Self-Employment Addendum Form may seem overwhelming, but with the right preparation and information at hand, the process can be streamlined. Start by gathering necessary documents such as tax returns, business records, and current financial statements, which will provide all the information needed to fill out the form accurately. This preparation is key to minimize errors and omissions during submission.

When you are ready to begin filling out the form, follow this step-by-step process to ensure comprehensive coverage of each section:

Avoid common mistakes, such as underreporting income or miscalculating deductions, which could lead to complications with your application. Double-check all entries and consider using a tax professional or financial advisor's expertise if you're unsure.

Editing and modifying your parent ccf self-employment addendum form

One of the conveniences of using pdfFiller is the ability to edit your Parent CCF Self-Employment Addendum Form easily. Whether you need to make corrections or updates, the platform provides simple tools that allow you to modify text, alter figures, and even add comments or notes for clarity.

To save your work, pdfFiller offers an intuitive save function. You can easily revisit your form at any time, ensuring that you can keep your information updated as your business circumstances change. It's advisable to set reminders to review your financial documents periodically, ensuring all information remains accurate and relevant.

Signing and submitting the addendum

When it's time to submit your Parent CCF Self-Employment Addendum Form, understanding the signing process is essential. With pdfFiller, you can easily set up an electronic signature (eSignature), expediting the signing process. eSignatures are legally recognized and streamline the process of submitting important documents.

Once signed, you have various submission options. You can choose to submit online directly through pdfFiller or opt for offline methods, such as mailing a hard copy to the appropriate agency. Analyze the best practices for submitting financial forms, ensuring you keep a copy of your submitted addendum for your records, regardless of the submission method chosen.

FAQs about the parent ccf self-employment addendum form

Any new form can prompt questions and concerns, and the Parent CCF Self-Employment Addendum Form is no different. Individuals often ask common questions about the specific requirements of the form, such as how to calculate net income or which deductions are permissible. Addressing these queries can aid in thorough and accurate completion of the form.

Some typical concerns include the following:

These questions reflect common issues that can affect completion, but with the right resources and guidance, parents can navigate these challenges effectively.

Additional tips for managing financial documentation

Staying organized is crucial when managing financial documentation related to your self-employment. It’s not just about completing the Parent CCF Self-Employment Addendum Form but maintaining a systematic approach toward all financial records. This includes keeping tax records, invoices, and expense receipts neatly filed. Such organization fosters accuracy and reduces the likelihood of errors in reporting income.

Using pdfFiller's collaborative features, you can simplify the management of these documents, allowing team members to access and contribute to shared files easily. This accessibility means that anyone involved in your financial reporting can stay up-to-date, regardless of location.

Next steps after submission

After submitting your Parent CCF Self-Employment Addendum Form, it’s important to understand the review process that follows. The reviewing agency will assess the information you've provided against their criteria to determine your eligibility for assistance. Notifications regarding the status of your application will typically be communicated via your preferred contact method.

Being proactive after submission is key. You should monitor your application status and be prepared to provide any additional information if requested. This diligence ensures a smoother experience in obtaining any financial assistance for your family.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete parent ccf self-employment addendum online?

How do I edit parent ccf self-employment addendum online?

Can I create an electronic signature for signing my parent ccf self-employment addendum in Gmail?

What is parent ccf self-employment addendum?

Who is required to file parent ccf self-employment addendum?

How to fill out parent ccf self-employment addendum?

What is the purpose of parent ccf self-employment addendum?

What information must be reported on parent ccf self-employment addendum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.