Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

How to Complete and Manage Form 990

Understanding Form 990: The essentials

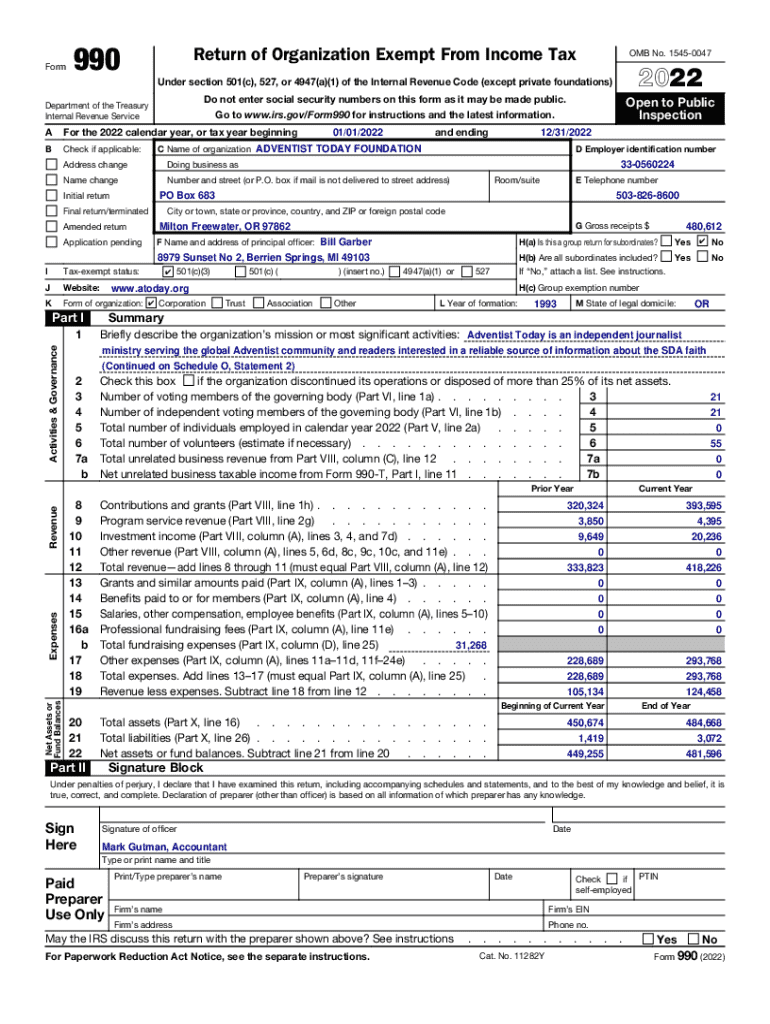

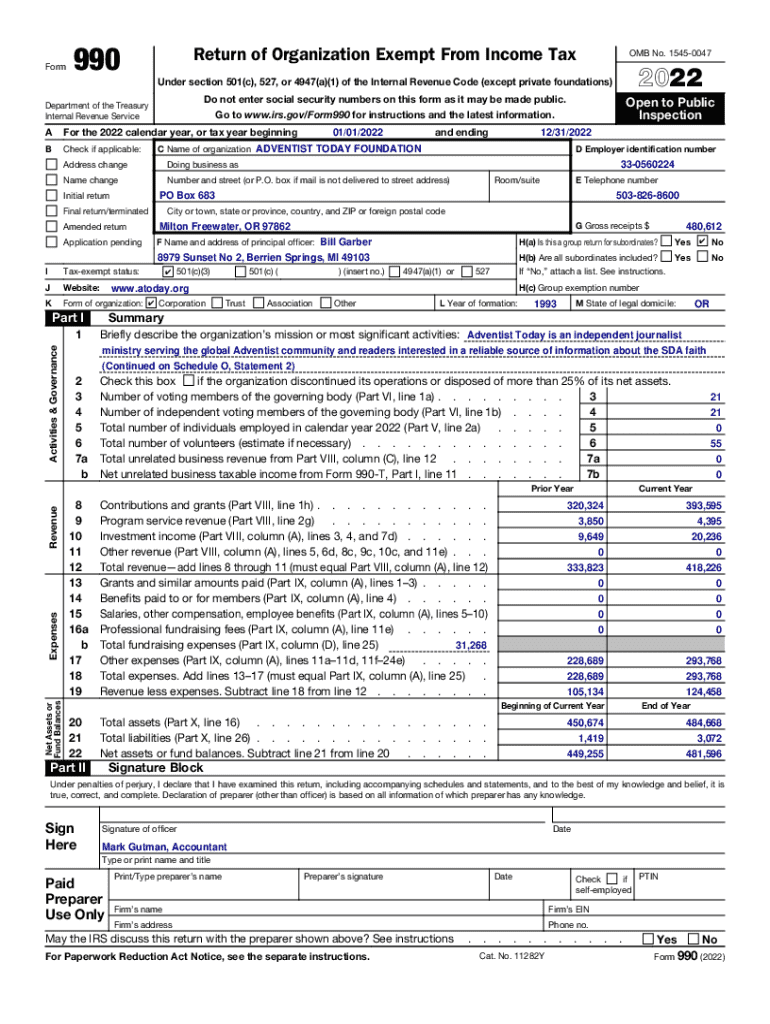

Form 990 is a vital document that nonprofit organizations in the United States must file annually. It provides the IRS with detailed insights into a nonprofit's financial performance, governance, and operational strategies. Essentially, it's a comprehensive report that ensures transparency and accountability in the nonprofit sector, allowing stakeholders to assess how well an organization manages its resources and serves its mission.

The importance of Form 990 cannot be understated. It serves multiple stakeholders, including donors, grant-makers, and the general public, by offering a clear view of an organization’s financial health. The main objectives of filing Form 990 include promoting accountability, providing information essential for tax compliance, and assisting with public trust by detailing how funds are utilized within the community.

Components of Form 990

Form 990 is comprised of several key sections, each serving a specific purpose. It includes:

Understanding the various schedule variants such as Schedule A for public charity status and Schedule B for donor information is also crucial for complete compliance and accurate reporting.

Who must file Form 990?

Eligibility for filing Form 990 primarily encompasses nonprofits that fall under specific IRS categories. Generally, organizations that are exempt from federal income tax under Section 501(c)(3) must file this form, unless they fall within certain criteria for exemptions.

Certain organizations are exempt from filing, including those with gross receipts under $50,000, and churches, if applicable. Understanding the thresholds for filing requirements is essential to ensure compliance, avoiding penalties, and maintaining tax-exempt status.

Detailed filing requirements

Filing Form 990 necessitates careful preparation and organization of key documentation. Nonprofits must gather financial statements, fundraising records, and program descriptions. It's essential to ensure all supporting documentation aligns with the figures reported in the form to uphold accuracy.

Deadlines for filing Form 990 typically fall on the 15th day of the 5th month after the end of the nonprofit’s fiscal year. Organizations opting for extensions should be mindful of the application process. Additionally, determining whether to file online versus via paper can impact convenience and efficiency — online submission is often faster and offers built-in error checks.

Step-by-step guide to completing Form 990

Completing Form 990 involves a step-by-step approach that begins with compiling the necessary information. Each section should be navigated methodically to ensure accurate reporting of financial data and organizational activities.

When filling out financial information, it's crucial to provide clear, transparent calculations and accurately categorize income and expenses. Strategies for reporting programmatic activities include setting clear metrics for success and detailing specific program outcomes, which can strengthen the narrative of mission impact.

Reviewing for completeness is key. Many organizations overlook not just accuracy but also the clarity of their narrative and performance descriptions, which are vital for reader understanding. Common errors such as underreporting revenue and misclassifying expenses should be diligently avoided.

Understanding potential penalties

Timely filing of Form 990 is critical, as failing to do so can result in significant penalties. For instance, the IRS can impose fines that escalate based on the size of the organization and how late the submission is. Furthermore, ensuring accuracy is paramount; misreporting can also trigger accuracy penalties.

To mitigate risks, organizations should implement internal controls for financial reporting and consider engaging with financial advisors or consultants who specialize in nonprofit compliance. This step can enhance the overall integrity of financial disclosures.

Public inspection regulations

Organizations that file Form 990 are subject to public disclosure regulations. This includes making copies of the Form 990 available for public inspection, covering a range of documents from application for exemption to annual filings.

Accessing Form 990 filings is facilitated through the IRS website and various third-party databases. Nonprofits should understand the implications of transparency and accountability, as public trust hinges significantly on how well they communicate their financial and operational activity to stakeholders.

History and evolution of Form 990

Over the years, Form 990 has undergone major revisions and additions, reflecting changing regulations and societal expectations around nonprofit transparency. Significant revisions have included the modernization of financial reporting requirements and enhanced narrative sections to better explain a nonprofit’s mission and impact.

Understanding these changes is crucial as they affect how nonprofits report and fundraise, also necessitating ongoing education for nonprofit leadership on best practices in compliance and reporting.

Using Form 990 for charity evaluation research

Form 990 is a valuable tool in assessing nonprofit performance. It provides critical insights into revenue streams, expenditures, and programmatic effectiveness that evaluators and grant-makers utilize to make informed funding decisions.

Analyzing data from Form 990 can be performed through various techniques, including comparative analysis with peers in the same sector or using metrics to gauge financial health against performance outcomes. Case studies demonstrate how robust analyses of Form 990 data can lead to strategic organizational shifts and increased funding opportunities.

How to read and interpret Form 990

To effectively analyze Form 990, stakeholders should focus on understanding financial statements presented within the form. Key figures like revenue, expenses, and net assets are critical for assessing the sustainability and financial viability of a nonprofit.

Interpreting the section on program service accomplishments is equally vital as it illustrates not only how funds are spent but also the impact made in the community. Nonprofits can use insights gained from these interpretations to make informed decisions regarding strategic initiatives and program adjustments.

Third-party resources for assistance with Form 990

Navigating the complexities of Form 990 filing can be daunting without the right tools and resources. Numerous platforms and services cater to nonprofits, providing guidance, editing tools, and filing assistance.

Utilizing these resources not only simplifies the filing process but also enhances compliance, empowering nonprofits to focus more on their mission and less on documentation.

Accessing and locating Form 990 text

Finding both current and historical versions of Form 990 is straightforward through accessible online databases like the IRS website and dedicated nonprofit resources. These platforms allow users to search for specific organizations and retrieve a wealth of data relevant to their charitable interests.

For streamlined access and management, navigating platforms like pdfFiller offers a cloud-based solution that enables efficient document creation and editing, allowing users to stay organized while easily accessing various versions of the Form 990 as needed.

Leveraging pdfFiller for Form 990 management

pdfFiller stands out as a comprehensive tool for managing Form 990 due to its versatile features tailored specifically for nonprofit documentation. This cloud-based platform empowers users to seamlessly edit PDFs, eSign, and collaborate with team members, all from a single accessible workspace.

Benefits include easy document sharing among colleagues, effective tracking of changes made in Form 990, and the capacity to store all relevant documents securely. By streamlining the preparation and submission process, pdfFiller enables nonprofits to focus on their core mission delivery more effectively.

FAQs about Form 990

Numerous questions arise about Form 990, making it essential for nonprofit organizations to clarify common misunderstandings. For instance, many assume that only large organizations need to file Form 990, but various subsections apply based on different criteria, including revenue and type of activities.

First-time filers often express concern over the complexity of the form and potential errors. To avoid pitfalls, organizations should familiarize themselves with the filing requirements and consider utilizing resources such as professionals or online platforms like pdfFiller that simplify the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 online?

How can I edit form 990 on a smartphone?

How do I complete form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.