Get the free Form 144

Get, Create, Make and Sign form 144

How to edit form 144 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 144

How to fill out form 144

Who needs form 144?

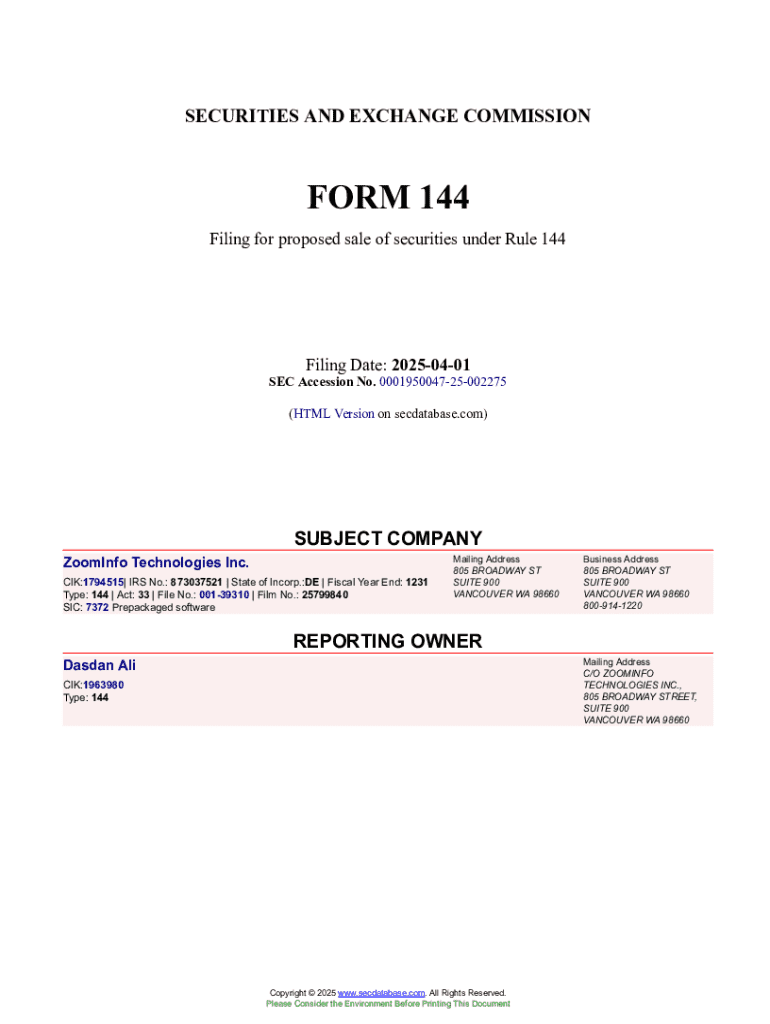

Complete Guide to Understanding and Filing Form 144

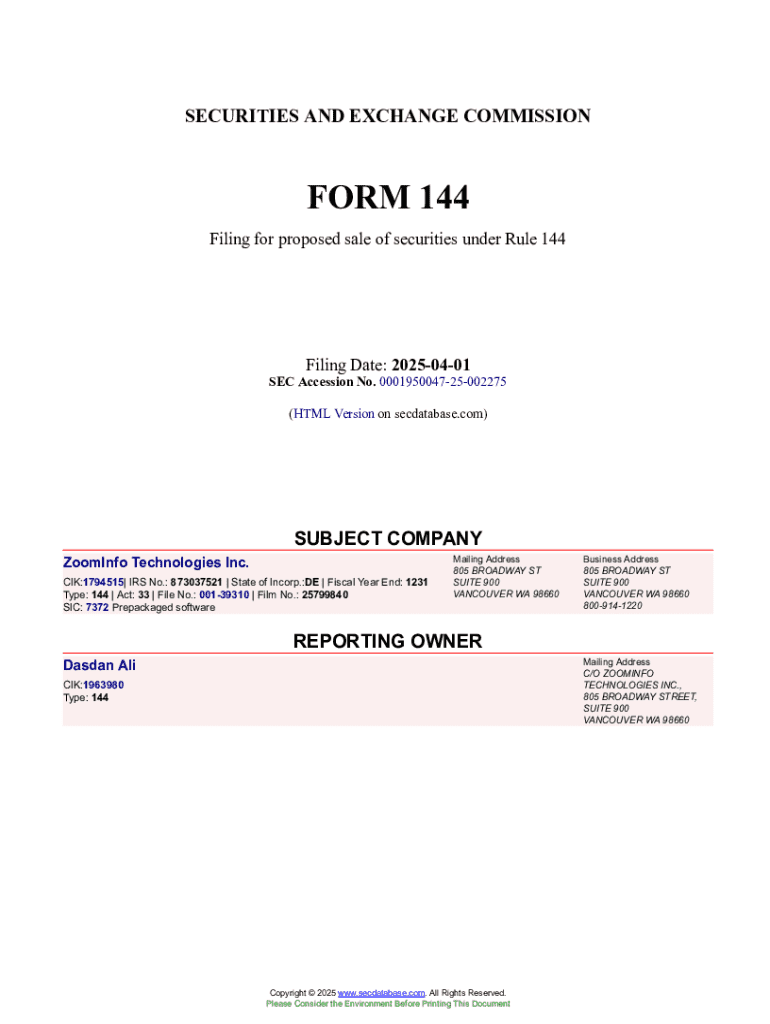

Understanding Form 144

Form 144 is a crucial document required by the Securities and Exchange Commission (SEC) for individuals looking to sell securities in amounts exceeding certain thresholds. This form facilitates compliance with insider trading regulations by ensuring that transactions are reported transparently. It is particularly important for affiliates of public companies, such as directors or officers, who may have insider information.

The purpose of filing Form 144 is to notify the SEC of impending sales of securities. It plays a significant role in protecting the integrity of the markets by providing critical information to regulators and investors alike. The filing indicates that the seller has a legitimate reason for selling their securities, reducing the likelihood of market manipulation.

Key stakeholders involved in this process include the issuers of the securities, the sellers (generally officers or affiliates), and the SEC itself. Form 144 is required when the seller, who is an affiliate of the issuer or holds restricted securities, plans to sell more than 5,000 shares or securities worth more than $50,000 within a three-month period.

Key information required on Form 144

Filing Form 144 necessitates attention to various essential details. These details include the seller's information, the issuer's name and details, and the planned transaction specifics. Typically, the form requests crucial information such as dates of intended sales, the number of shares to be sold, and whether the sales will be conducted on a principal or riskless basis. Accurate completion of these fields ensures compliance and mitigates the risk of penalties.

Documentation required for submission often involves proof of the security's ownership and, in some instances, a statement of the seller's intent. This verification can include stock certificates or account statements indicating ownership of the shares to be sold.

Filing process of Form 144

To file Form 144, follow a structured step-by-step process to ensure a smooth submission. First, gather all necessary information, including issuer details and the specifics of the securities involved. It's helpful to have your financial documents readily available for reference.

Next, accurately fill out the form, paying close attention to each section to avoid omissions or errors. A thorough review of the data is crucial; double-check for any mistakes before submission to prevent delays or potential legal issues.

Submit your completed Form 144 electronically or via traditional mail to the appropriate SEC office. It is advisable to keep track of filing deadlines, which state that Form 144 must be filed with the SEC concurrently with the sale of securities, ensuring that filings are completed in a timely manner to avoid regulatory repercussions.

Example scenarios for filing Form 144

Consider a situation where an officer of a technology company intends to sell 7,000 shares of stock they own. Since the number of shares exceeds the 5,000 shares threshold, the officer must file Form 144 prior to executing the sales transaction. Accurately filling out each section of the form would include the company's name, total shares to be sold, and the nature of the transactions.

Common mistakes include failing to file on time, omitting essential details, or providing inaccurate transaction values. Such oversights can lead to compliance issues, potential fines, or even restrictions on future transactions. Ensuring that you fully understand the filing requirements can significantly reduce these risks.

Recent changes and updates to Form 144 filing

Filing requirements for Form 144 have evolved in recent years. The SEC continuously reviews these regulations to enhance transparency and mitigate potential abuses in trading practices. For instance, there has been an increased emphasis on electronic filings to streamline processes for both issuers and affiliates.

Changes in regulations may impact how and when Form 144 is submitted. With notable updates, it is essential for filers to stay informed about compliance expectations and key dates for upcoming adjustments to the filing process. This ongoing vigilance will help prevent any interruption in the ability to sell securities.

Tips and best practices for filing Form 144

First-time filers should find it beneficial to familiarize themselves with the Form 144 structure, ensuring that they gather all relevant information before starting. A good practice is to seek templates or guidance from experienced peers or professionals in the field.

Adopting strategies that reduce filing errors is paramount. This might include having a checklist of required information, utilizing software tools designed for compliance, or engaging a compliance consultant for complex situations. Always ensure that you have a clear understanding of filing requirements and include essential details, maintaining accuracy throughout the process.

Utilizing reporting software for Form 144 compliance

In today’s digital workspace, utilizing reporting software like pdfFiller can vastly improve the Form 144 filing experience. pdfFiller offers a range of features tailored for compliance, allowing users to fill out forms accurately and efficiently from any location with internet access.

The integration of eSignature solutions and document management tools enhances the process, enabling seamless collaboration among stakeholders. Utilizing these technology tools can not only streamline filing but also foster a more organized approach to managing multiple forms, including regulatory requirements.

Frequently asked questions about Form 144

What should you do if you misfile or need to amend your submission? It is important to file an amended Form 144 to rectify errors, ensuring that all inaccuracies are corrected promptly to remain in compliance with SEC regulations. Additionally, you can access your submission history via the SEC's EDGAR database to review past filings and ensure transparency.

Clarifying common misunderstandings regarding Form 144 can help demystify the process. For example, many filers may mistakenly believe that Form 144 is not necessary for smaller transactions when, in fact, compliance is essential regardless of the sale volume as long as you are affiliated with the issuer.

Related products and solutions for document management

To streamline your overall document management capabilities, pdfFiller provides features that extend beyond Form 144. This includes comprehensive tools for editing PDFs, collaboration features for team projects, and robust options for tracking document progress.

Connecting Form 144 to other regulatory filings ensures a holistic approach to compliance. Users can easily navigate their obligations to ensure they meet all necessary requirements through a singular platform, effectively maintaining their focus on business operations.

Contacting an expert for assistance

As navigating Form 144 can get complex, especially for first-time filers or those dealing with unique circumstances, reaching out to experts can be invaluable. Finding support through resources like pdfFiller can provide users with the guidance needed to navigate any potential pitfalls.

Users can easily contact pdfFiller support for detailed help in completing the form or understanding specific scenarios. Engaging with knowledgeable personnel helps mitigate risks and enhances compliance efforts for securities transactions.

Staying updated with Form 144 developments

Staying informed about any changes in regulations related to Form 144 is crucial for compliance. Subscribing to updates from the SEC or following platforms like pdfFiller can aid in ensuring your understanding of the requirements remains current.

This proactive approach enables filers to anticipate changes and adjust their processes accordingly, thereby strengthening their regulatory compliance and overall understanding of securities trading requirements.

Community engagement and collaborative spaces

Engaging with a community of fellow users can be incredibly beneficial when filing Form 144. Joining forums or discussion groups allows individuals to share experiences, exchange tips, and learn from others who have navigated similar situations.

These collaborative spaces foster an environment of collective learning, enhancing the knowledge base of all participants. Being part of a community focused on document management and compliance can empower users to tackle filing challenges effectively, leading to better outcomes.

Explore additional related topics

Form 144 is just one facet of the broader spectrum of SEC regulations and compliance requirements. Understanding the implications of insider trading laws and familiarizing yourself with various SEC forms and requirements can significantly bolster your overall knowledge and responsiveness in financial transactions.

By exploring related topics such as insider trading practices and general compliance standards, individuals and organizations can better prepare themselves for the intricacies of securities trading and their responsibilities in upholding market integrity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 144 to be eSigned by others?

How do I edit form 144 online?

How do I fill out the form 144 form on my smartphone?

What is form 144?

Who is required to file form 144?

How to fill out form 144?

What is the purpose of form 144?

What information must be reported on form 144?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.