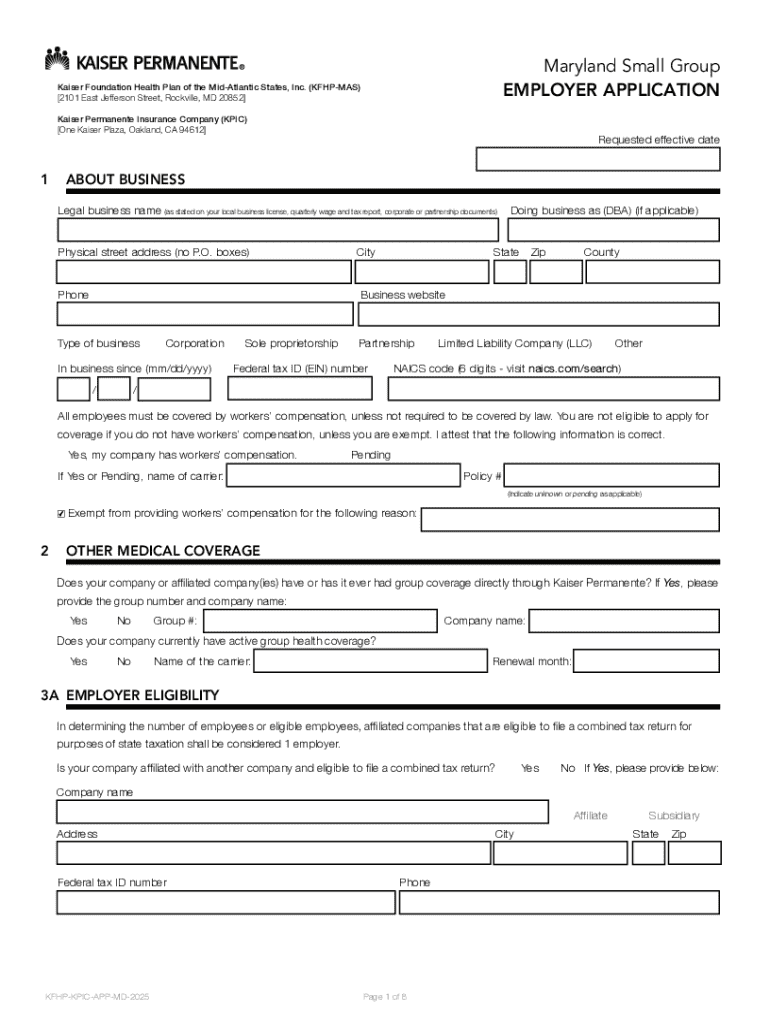

Get the free Maryland Small Group Employer Application

Get, Create, Make and Sign maryland small group employer

Editing maryland small group employer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland small group employer

How to fill out maryland small group employer

Who needs maryland small group employer?

Guide to the Maryland Small Group Employer Form

Understanding the Maryland Small Group Employer Form

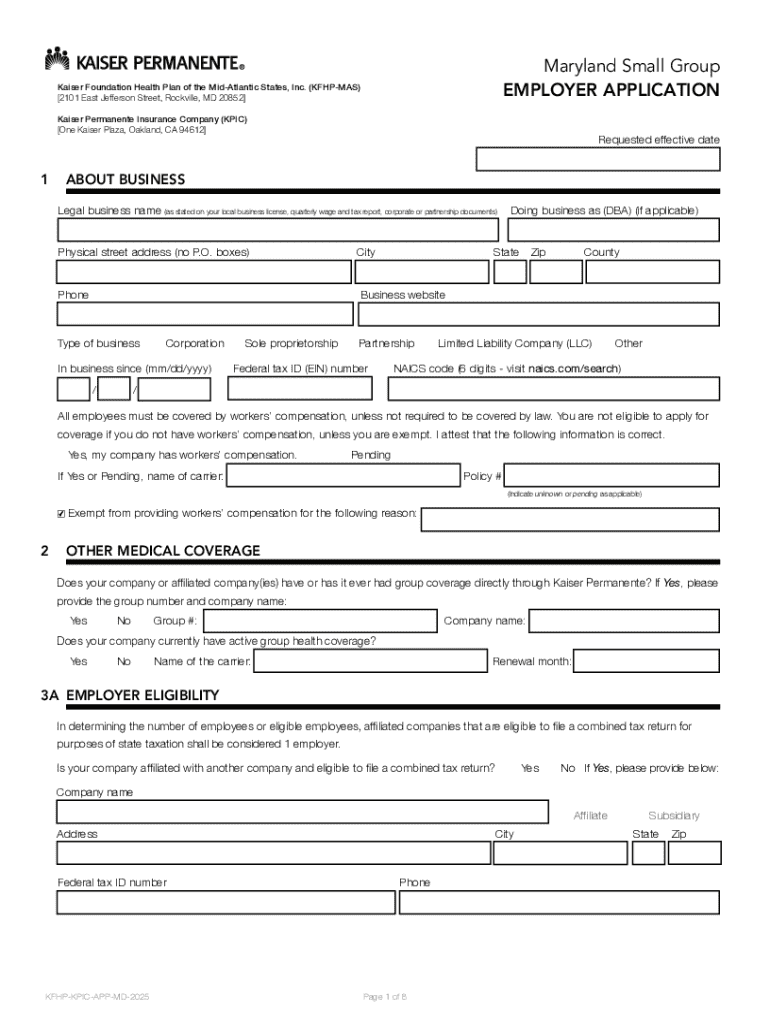

The Maryland Small Group Employer Form is a crucial document designed to facilitate the health insurance enrollment process for small businesses in Maryland. Specifically, it must be completed by employers with 2 to 50 employees who wish to provide health insurance to their workers. By gathering specific information about the employer and its employees, this form allows the state to evaluate eligibility for various health programs and ensure compliance with regulations.

The importance of this form cannot be overstated, as it directly impacts an employer's ability to offer health coverage that meets both the needs of employees and state requirements. Small businesses often encounter unique challenges regarding health insurance, making it imperative that they navigate this process correctly. Understanding the requirements for small employers, including employee count and pertinent information, lays the foundation for successfully completing the form.

Preparing to fill out the form

Before completing the Maryland Small Group Employer Form, employers must determine their eligibility. To qualify as a small group employer, businesses must have between 2 and 50 full-time employees. This ensures that the employer is categorized correctly under Maryland's small group health insurance regulations. It's essential for employers to keep accurate records regarding employee numbers, as this can significantly impact their health insurance options.

In addition to confirming eligibility, various documentation and information must be gathered to fill out the form accurately. Required information includes:

Step-by-step instructions for completing the form

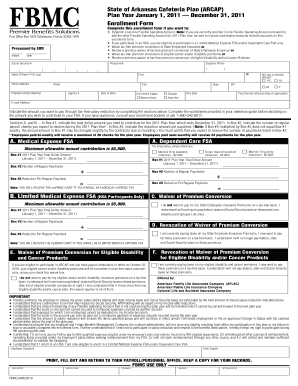

Filling out the Maryland Small Group Employer Form can seem daunting, but breaking it down section by section simplifies the process. Below is a detailed breakdown of information needed in each part of the form.

1. **Employer Information**: This section requires a description of the business structure (e.g., LLC, Corporation), registered business name, and address. This information helps insurance providers identify and reach the employer.

2. **Employee Information**: Fill in the details regarding the demographics of employees, including the total number of employees, their job titles, and whether they are full-time or part-time. Providing this information accurately is crucial for determining eligibility.

3. **Insurance Information**: This section should detail any existing health plans currently offered to employees. Employers must specify the type of coverage provided and the number of employees enrolled.

4. **Compliance Information**: Ensure that all the information business practices are compliant with Maryland state regulations. This may also include documenting any previous infractions or issues related to health insurance regulations if they exist.

Interactive tools for form completion

To make the process of completing the Maryland Small Group Employer Form smoother, using tools like pdfFiller can provide substantial benefits. pdfFiller offers unique features that facilitate the creation and management of documents.

Key features of pdfFiller include:

To access these features, simply visit the pdfFiller website and navigate to the small group employer form section, where you can easily get started.

Common challenges and solutions

Despite having clear instructions, small group employers often encounter challenges when filling out the Maryland Small Group Employer Form. Some of the most frequently encountered issues include incomplete information and misclassification of employees. Missing details can delay the review process, which can subsequently affect health coverage timelines.

If you face any difficulties, consider these tips:

Finalizing and submitting your form

Once the form is completed, it's essential to finalize it before submitting. A review checklist can be beneficial in ensuring accuracy. Key aspects to verify include:

The Maryland Small Group Employer Form can be submitted electronically through designated platforms. A step-by-step guide should be followed to ensure that attachments are included, and submission confirmation receipts are retained. For those who prefer traditional methods, mail submissions are also acceptable, but it's recommended to send documents through traceable methods.

Post-submission considerations

After submitting the Maryland Small Group Employer Form, employers should keep track of their submission status. Maryland state authorities typically have a reviewing phase where they verify the information provided. Employers can expect to hear back within a defined timeframe, which can vary, so patience is key.

Understanding this process helps in anticipating necessary follow-ups or adjustments, should any issues arise. Keeping records of all communications relating to the submission also assists in maintaining thorough documentation for potential future reference.

Connect with support

For additional help during the completion of the Maryland Small Group Employer Form, pdfFiller offers exceptional customer support services. Users can reach out via phone or through their online help center for immediate assistance.

Additionally, pdfFiller users can access live chat features to receive support on-demand. The wealth of resources provided ensures that users are not left to navigate the process alone.

Maximizing your experience with pdfFiller

Integrating the Maryland Small Group Employer Form into your document workflow via pdfFiller can significantly enhance efficiency. This platform not only supports form completion but offers a cohesive tool for managing various document types seamlessly.

Benefits include easy access to all documents from any location, enhanced collaboration capabilities, and robust storage options. By utilizing pdfFiller's cloud-based platform, users are empowered to manage their documentation needs proficiently and effectively.

FAQs about the Maryland Small Group Employer Form

Employers often have questions as they navigate the Maryland Small Group Employer Form. Here are some of the most common queries:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my maryland small group employer directly from Gmail?

Where do I find maryland small group employer?

Can I edit maryland small group employer on an iOS device?

What is maryland small group employer?

Who is required to file maryland small group employer?

How to fill out maryland small group employer?

What is the purpose of maryland small group employer?

What information must be reported on maryland small group employer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.