Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

Understanding Form 990

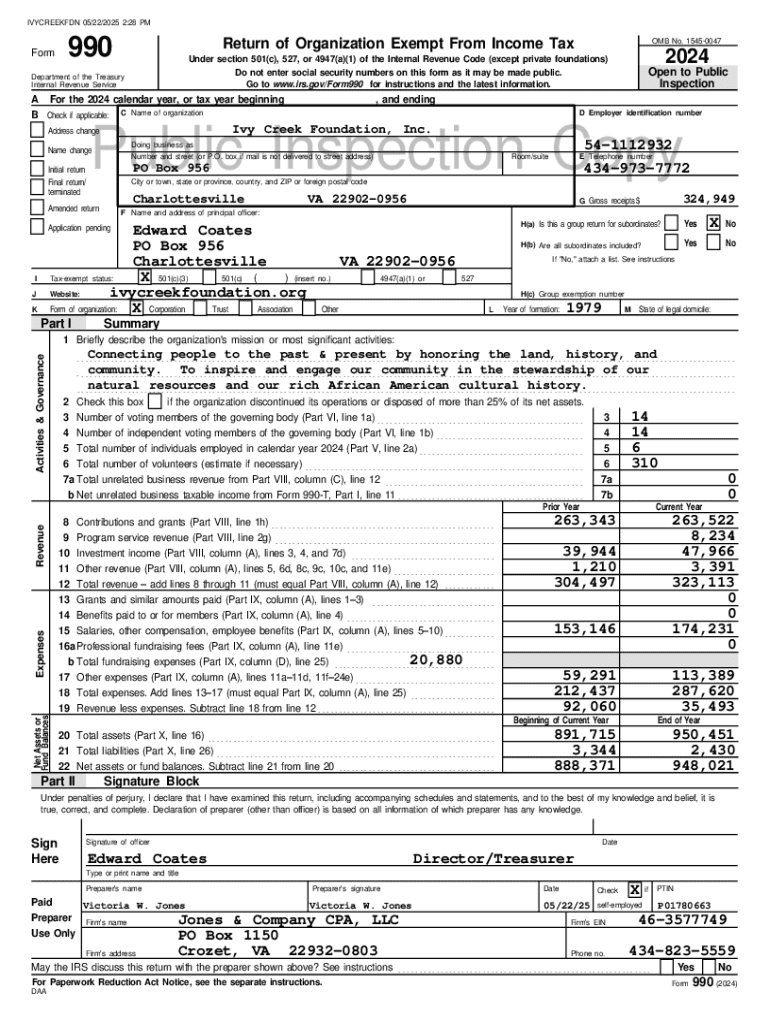

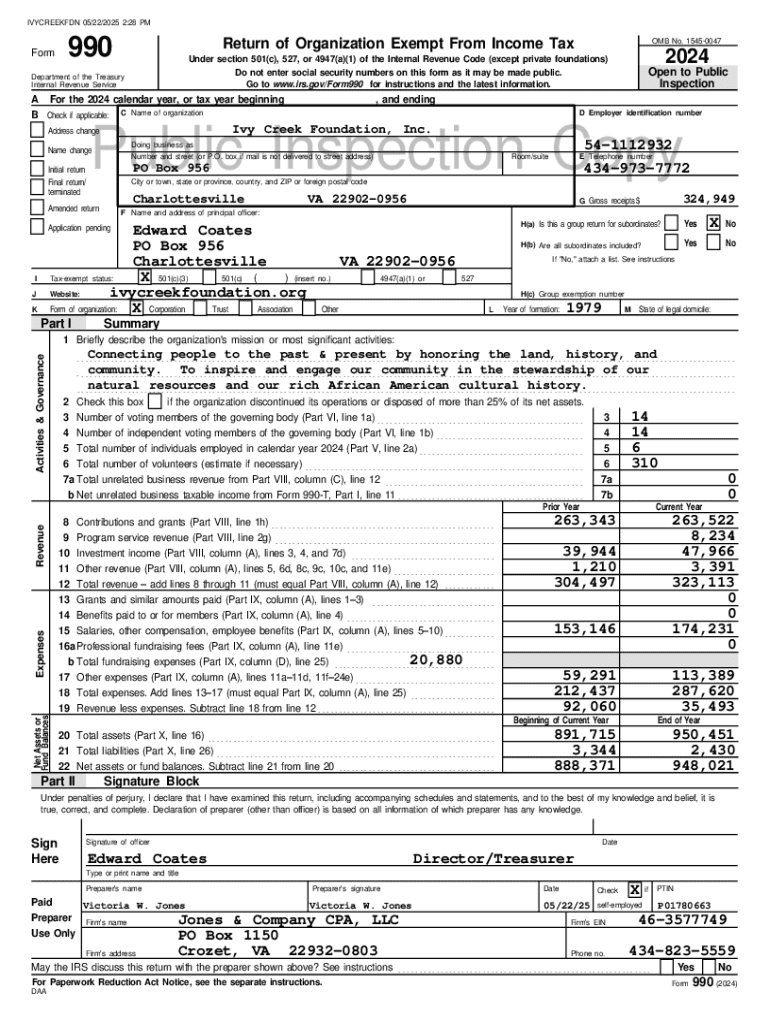

Form 990 is an essential document for non-profit organizations in the United States, serving as a public record of a charity's financial activities, governance, and tax status. Filing this form is a requirement set by the Internal Revenue Service (IRS) for most tax-exempt organizations, and it provides crucial transparency to the public about a nonprofit’s financial health and operational integrity.

The importance of Form 990 in the nonprofit sector cannot be overstated. It not only helps organizations maintain their tax-exempt status but also plays a vital role in promoting transparency and trust with potential donors, grantors, and the general public. The information contained within this form can directly influence funding opportunities and partnership possibilities.

Components of Form 990

Form 990 consists of several parts that collectively provide an overview of an organization’s mission, financial performance, and governance practices. A thorough understanding of each component is crucial for accurate and compliant filing.

Additionally, various schedules and attachments may be required based on the organization’s specific activities, facilitating a more detailed disclosure of complex financial transactions.

Filing requirements and deadlines

Understanding who must file Form 990 is key for compliance. This generally includes tax-exempt organizations that meet specific minimum income thresholds, which may vary, but typically organizations with gross receipts exceeding $200,000 or total assets exceeding $500,000 must file.

It’s critical for organizations to track their financial performance accurately, as errors in filing frequency can result in penalties and complications in maintaining compliance.

Interactive tools for Form 990

Utilizing tools like pdfFiller can significantly enhance the process of completing Form 990. pdfFiller is designed to provide users with editable templates uniquely tailored for Form 990, promoting efficiency whether you are working independently or as part of a team.

A step-by-step guide using pdfFiller can make the filing process straightforward: upload your document, fill out necessary sections, make any edits required, and save or send your Form 990 securely.

Common mistakes to avoid

Mistakes in completing Form 990 can lead to penalties, unwanted scrutiny, and even issues with maintaining tax-exempt status. Being aware of these common pitfalls is crucial to ensure compliance.

To ensure compliance, organizations should perform a thorough review of their Form 990 before submission. Collaboration with experienced team members can also enhance accuracy.

Penalties and consequences of non-compliance

The repercussions of failing to file Form 990 accurately and on time are significant. Nonprofits can incur penalties of $20 per day, with a maximum penalty reaching $10,000 for late filings, which can add up quickly.

Long-term, repeated non-compliance could jeopardize an organization’s tax-exempt status, potentially affecting funding opportunities and the ability to receive grants. To avoid these risks, organizations should remain diligent in their filing practices and stay aware of deadlines.

Establishing a compliance calendar or checklist can be invaluable for staying organized, helping to ensure timely submissions and adherence to IRS regulations.

Public inspection and transparency regulations

Nonprofits have a legal obligation to make their Form 990 available for public inspection. This transparency serves both the organization and its stakeholders, allowing for informed decision-making by donors and members of the public who are interested in supporting the organization.

Organizations should embrace these transparency regulations as an opportunity to build credibility and strengthen relationships with funding partners and the public.

Navigating the filing modalities

When it comes to filing Form 990, nonprofits have the choice between electronic and paper submissions. Each option has its unique advantages, and knowing which is best for your organization depends on your specific needs.

Choosing the right filing modality can save valuable time and resources, making it essential to weigh the options carefully before making a decision.

Historical context and recent changes to Form 990

Form 990 has evolved significantly since its inception, adapting to changing needs within the nonprofit sector. Over the years, amendments have been made to improve transparency and reporting measures, helping organizations ensure they meet IRS requirements.

Staying updated with the changes in Form 990 is crucial for organizations not only for compliance but also for leveraging new reporting opportunities that can enhance financial transparency.

Additional insights for organizers

Integrating Form 990 into your overall financial strategy can provide insights that benefit fundraising, grant-writing efforts, and stakeholder engagement. By understanding the financial data shared in this form, organizations can better tailor their communications and strategies to align with donor intentions.

By leveraging the data from Form 990, organizations can enhance their transparency and ultimately their sustainability in the nonprofit landscape.

FAQs about Form 990

Numerous questions arise concerning the intricacies of Form 990 filings. Addressing these FAQs can help demystify the process for many organizations navigating taxation and compliance.

Organizations should take time to address these common queries, relieving fears related to compliance and properly educating themselves on the process.

Connecting with professional support

Considering the complexities surrounding Form 990, engaging a tax professional may be beneficial, particularly for larger or more intricate organizations. An experienced accountant or consultant can help navigate IRS regulations, ensuring accurate and timely filings.

Ultimately, seeking the right professional support can lead to more effective reporting and organizational sustainability, reducing the risks of errors and penalties associated with Form 990.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How do I edit form 990 online?

Can I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.