Get the free Forms 990 / 990-ez Return Summary

Get, Create, Make and Sign forms 990 990-ez return

Editing forms 990 990-ez return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out forms 990 990-ez return

How to fill out forms 990 990-ez return

Who needs forms 990 990-ez return?

Forms 990 990-EZ Return Form: A Comprehensive Guide

Understanding Form 990 and Form 990-EZ

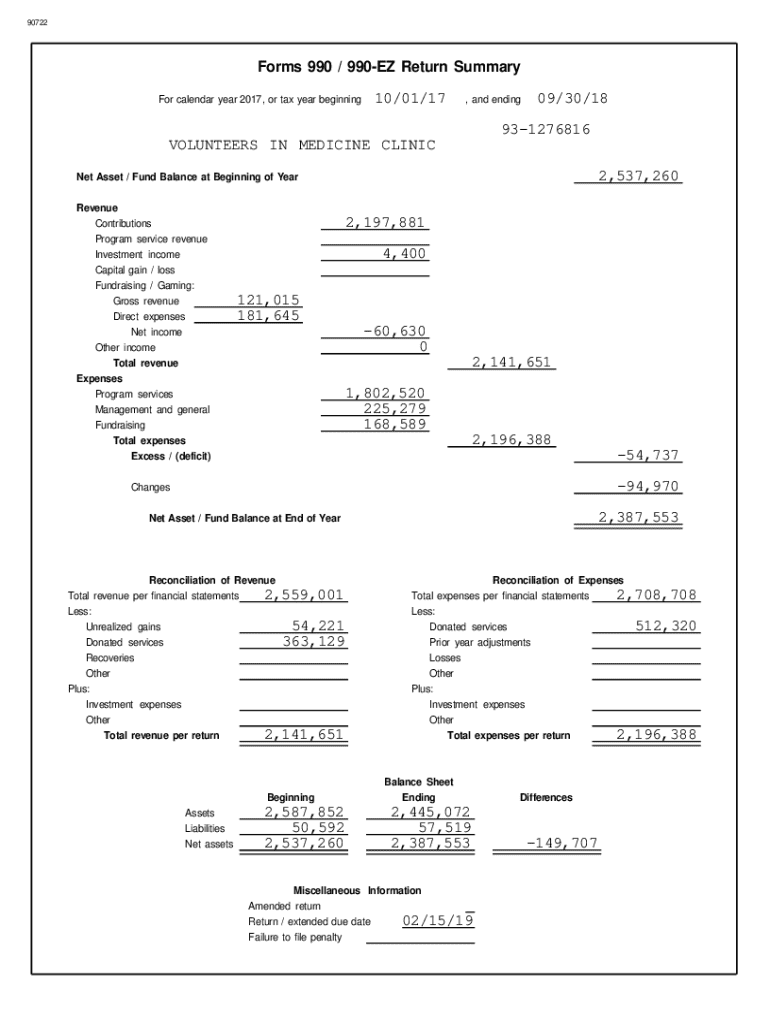

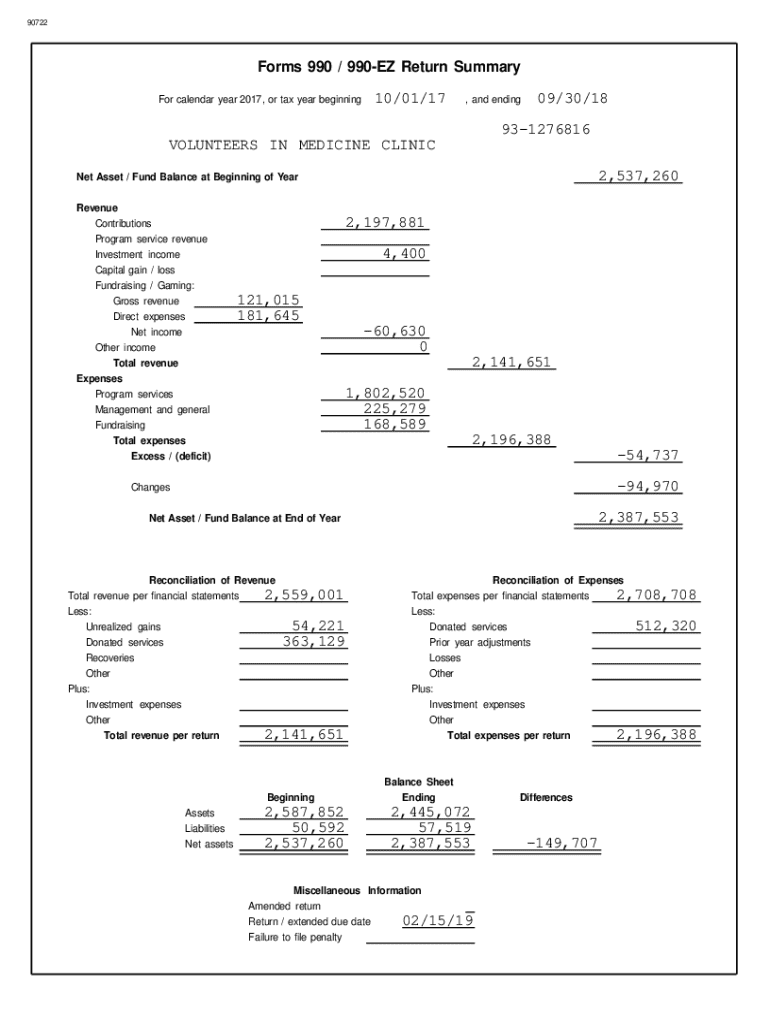

Form 990 serves as the IRS's primary tool for collecting information from tax-exempt organizations about their financial activities. This comprehensive form provides transparency to the public, detailing how these organizations operate. In contrast, Form 990-EZ is a streamlined version intended for smaller nonprofits, allowing them to submit a simplified snapshot of their financial status while still meeting IRS requirements.

Key differences between Form 990 and Form 990-EZ include the size of organizations that can file each form, as well as the level of detail required. While Form 990 requires extensive disclosures on governance and financial activities, Form 990-EZ simplifies these requirements, making it more accessible for smaller organizations. Generally, organizations with gross receipts below $200,000 and total assets under $500,000 may file Form 990-EZ.

Ultimately, understanding which form applies to your organization is crucial for compliance with IRS rules and regulations, ensuring proper governance and public trust.

Eligibility criteria for filing Form 990-EZ

Organizations must assess their eligibility to file Form 990-EZ based on specific income thresholds and operational size. The IRS sets the requisite limits clearly: nonprofits with gross receipts of less than $200,000 and total assets under $500,000 at the end of the year qualify to use Form 990-EZ. This ensures that smaller organizations are not overwhelmed by excessive reporting requirements.

Additionally, unique considerations might apply for nonprofits with fluctuating income levels or those transitioning from a smaller to a larger operational framework. Understanding these nuances can prevent incorrect filings and possible penalties.

Diligently reviewing these criteria ensures compliance and maximizes the benefits of utilizing the simplified Form 990-EZ.

Preparing to file Form 990-EZ

Before diving into the filing process, organizations should prepare by gathering all necessary documentation. Essential items include the Tax Identification Number (TIN), recent financial statements, and a list of key personnel, including board members. Having this information readily available simplifies the process and reduces errors during filing.

Common mistakes during the preparation phase often involve incomplete or unclear documentation. It’s crucial to review all figures and narratives meticulously to ensure accuracy. Missing information can lead to delays in processing or, worse, penalties for noncompliance with IRS requirements.

By assembling these materials upfront, filing Form 990-EZ becomes a much smoother operation, ultimately leading to successful compliance with minimal stress.

Step-by-step guide to completing Form 990-EZ

Completing Form 990-EZ can seem daunting, but breaking it down into manageable sections can streamline the process. Start with Part I, which focuses on revenue, expenses, and changes in net assets. Provide an accurate accounting of income sources, total expenses, and any significant changes in net assets, as these are vital for the IRS’s understanding of your organization’s financial health.

Moving to Part II, outline the organization’s balance sheet, detailing assets, liabilities, and net assets. Accuracy in this section is critical, as it reflects the financial stability of the nonprofit. Part III requires a narrative summarizing program service accomplishments; this is your opportunity to showcase your successes directly to the public and the IRS.

Part IV contains a checklist of required schedules, ensuring that you do not overlook any necessary documentation. Pay attention to form-specific schedules and additional attachments as required.

Utilizing platforms like pdfFiller can significantly enhance your form completion experience by offering editing tools to correct errors easily, ensuring that everything is accurate before submission. The user-friendly interface simplifies collaboration, allowing multiple stakeholders to ensure the document's integrity.

Electronic filing of Form 990-EZ

E-filing Form 990-EZ offers numerous advantages over traditional paper filing. Many organizations find e-filing faster and more efficient, significantly reducing processing time and minimizing the risk of clerical errors that can occur with manual entries. Moreover, electronic submissions typically receive immediate acknowledgment, providing peace of mind.

To e-file using pdfFiller, first, log in or create an account, then access the 990-EZ template. Follow the on-screen prompts to enter your organization's information accurately. The platform also provides tips for ensuring compliance, helping you avoid common pitfalls during the e-filing process. Once completed, submit your form electronically to the IRS within the required deadlines.

By utilizing an electronic filing platform like pdfFiller, organizations can navigate the requirements of Form 990-EZ with greater efficiency and confidence.

Key deadlines and filing requirements

Understanding key deadlines is critical for organizations filing Form 990-EZ. The form is generally due on the 15th day of the fifth month following the end of your organization’s fiscal year. For most organizations operating on a calendar year, this means a May 15 deadline. Keeping an accurate calendar and notifications can help ensure timely filings and avoid penalties.

If organizations anticipate needing more time, they can file for an extension using Form 8868, which grants an automatic six-month extension. This is particularly helpful for organizations with unpredictable circumstances that may affect their ability to prepare the form on time.

Awareness of these deadlines is a crucial step in maintaining compliance and ensuring your organization’s ongoing tax-exempt status.

Amending a previously filed Form 990-EZ

Organizations might find the need to amend a previously filed Form 990-EZ due to discovery of errors or new information. The IRS provides the opportunity to amend returns, but understanding when and how to do so is essential. If you realize that you’ve omitted significant details or made calculation errors, an amendment should be considered immediately.

The process typically involves re-filing the form with corrected information and clearly marking it as an amendment. This can help address inaccuracies and demonstrate your organization’s commitment to compliance. It’s wise to consult IRS guidelines or use reliable resources, such as pdfFiller, to navigate this process effectively.

Amending a return could improve both accuracy and accountability, reinforcing public trust in your nonprofit organization.

Frequently asked questions about Form 990-EZ

Several common queries arise regarding Form 990-EZ. Primarily, organizations worry about the consequences of failing to file. Nonprofits that neglect to submit the required forms risk penalties and even the loss of their tax-exempt status, making timely submission crucial. Understanding the importance of these forms is vital for governance and compliance.

Another frequent question involves the Group Exemption Number (GEN), which permits affiliated organizations to file under a single return. Understanding any differences between Form 990-N, known as the e-Postcard for very small organizations, and Form 990-EZ is also essential for appropriate compliance and filing.

Getting accurate, actionable answers to these FAQs can directly impact your organization’s compliance journey.

Additional compliance and filing considerations

Organizational changes, such as mergers, changes in leadership, or operational modifications, can significantly impact your filing responsibilities. It’s crucial to stay informed and adapt your filing approach according to any structural changes that occur. Maintaining unity in governance and documenting changes properly can help mitigate compliance issues.

Regular IRS reviews and audits can be daunting for many organizations. Understanding the framework of these audits and how to maintain transparency and accountability within your board can reinforce your organization’s standing. Constant engagement with IRS requirements allows nonprofits to maintain tax-exempt status while fulfilling their filing obligations.

Proactive management of these considerations strengthens not only compliance but also public trust and credibility for your organization.

Leveraging pdfFiller for streamlined document management

pdfFiller's cloud-based platform empowers users to seamlessly edit, eSign, and manage documents, making the filing process for Form 990-EZ incredibly straightforward. Teams can collaborate in real-time, ensuring accuracy and compliance while harnessing smart AI assistance to preempt common filing errors.

The tools provided by pdfFiller simplify tracking multiple forms and maintaining an organized filing system. Users can easily navigate through various filings, efficiently manage deadlines, and enhance overall productivity through structured workflows.

By integrating pdfFiller into your document management strategy, nonprofit organizations streamline their compliance processes and ensure that each filing is completed meticulously, enhancing operational efficiency.

Success stories and testimonials

Many organizations have shared positive experiences using pdfFiller for Form 990-EZ, highlighting simplified workflows and reduced stress during tax season. Users report that the platform's ease of access has significantly improved collaboration within teams, leading to more accurate filings.

Case studies of nonprofits reveal how pdfFiller streamlined their filing processes, ensuring compliance while freeing up resources that were previously dedicated to paperwork. Testimonials emphasize the satisfaction of having a dependable tool that meets their evolving documentation needs.

These success stories serve as a testament to pdfFiller's transformative impact on managing Form 990-EZ and reinforce its role as a valuable ally for nonprofits.

Next steps: Filing your Form 990-EZ

Before submitting Form 990-EZ, organizations should conduct final checks to ensure all information is accurate and complete. Reviewing each section thoroughly allows for the identification of potential discrepancies that could hinder timely processing. Prepare for future filings by maintaining a consistent schedule for gathering information and documentation throughout the year.

Additionally, take advantage of available resources for continuous learning to stay updated on IRS regulations and best practices for filing. Engaging with online communities or professional networks can provide valuable insights and support, ensuring your organization remains compliant.

Proactively managing the filing of Form 990-EZ ensures your organization maintains tax-exempt status while demonstrating accountability and transparency to stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send forms 990 990-ez return for eSignature?

Can I sign the forms 990 990-ez return electronically in Chrome?

Can I create an eSignature for the forms 990 990-ez return in Gmail?

What is forms 990 990-ez return?

Who is required to file forms 990 990-ez return?

How to fill out forms 990 990-ez return?

What is the purpose of forms 990 990-ez return?

What information must be reported on forms 990 990-ez return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.