Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive Guide for Nonprofits

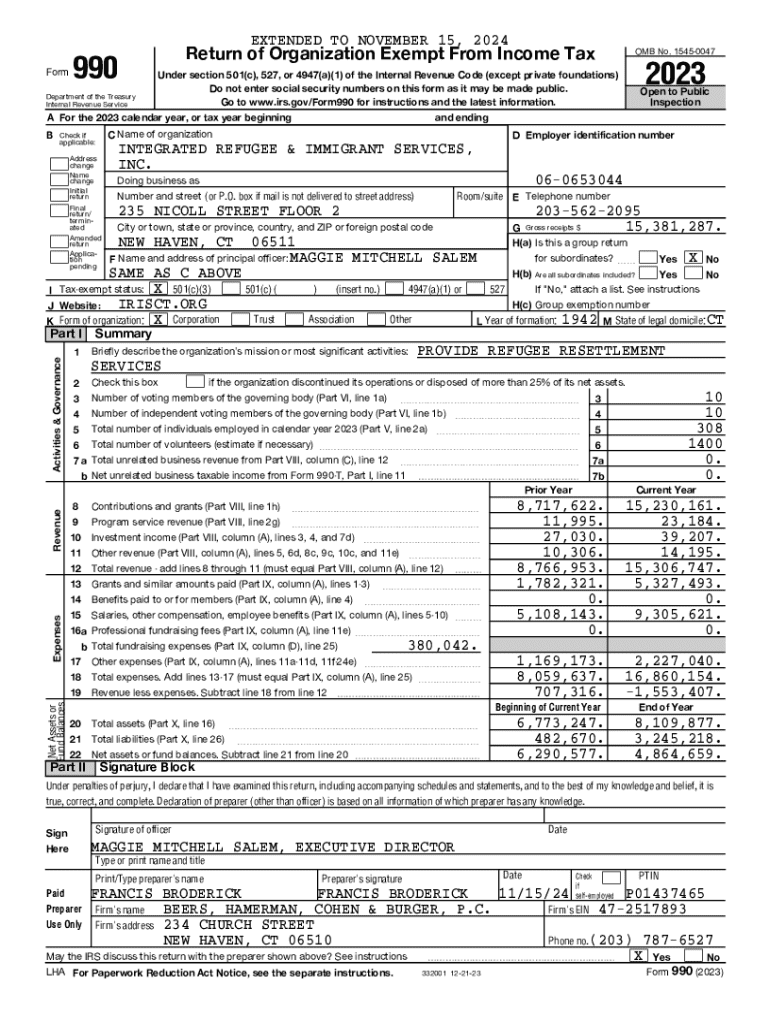

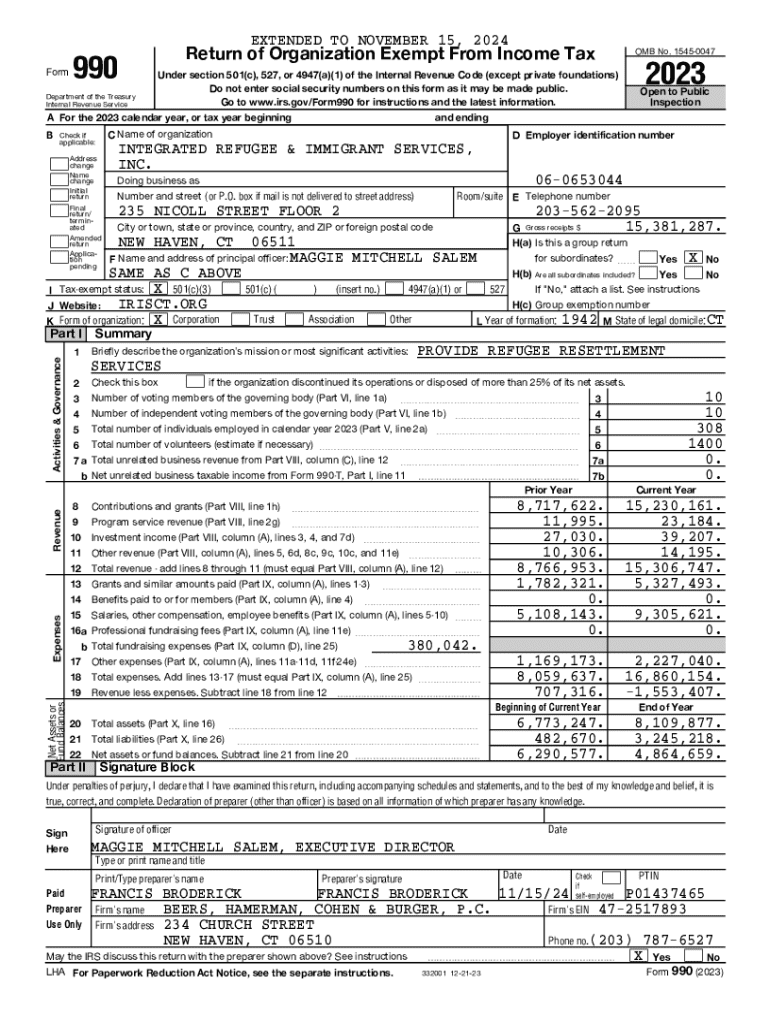

Understanding Form 990

Form 990 is a crucial document which tax-exempt organizations, including nonprofits, must submit to the IRS annually. This form provides comprehensive financial information about the organization, and its purpose is to promote transparency and accountability within the nonprofit sector.

For organizations seeking tax-exempt status under section 501(c)(3) or similar segments, Form 990 serves as a standard reporting medium. By filing this form, nonprofits disclose their activities, financial performance, and governance policies to stakeholders, donors, and the public. This transparency helps build trust and credibility, essential for attracting donations and funding.

Different versions of Form 990 exist, including Form 990, 990-EZ, and 990-N, catering to various sizes and types of organizations. Knowing which form applies is essential for compliance.

Who must file Form 990?

Not all nonprofits are required to file Form 990. The primary eligibility criteria include having an annual gross receipt of $200,000 or assets above $500,000. Smaller organizations may be eligible to file Form 990-EZ or Form 990-N, often referred to as the e-Postcard, if their gross receipts are under $50,000.

Certain organizations, like churches and government entities, are exempt from filing Form 990. However, failing to submit the appropriate form can lead to severe consequences, including penalties and the potential loss of tax-exempt status.

Filing modalities

Nonprofits have the option to file Form 990 electronically or via paper submission. Electronic filing is encouraged as it’s faster, may reduce errors, and provides instant confirmation. However, organizations can still opt for paper filing if necessary.

When choosing between these methods, consider the pros and cons. Electronic filing streamlines the process and minimizes the likelihood of mistakes, while paper filing might be more familiar to some organizations.

To eFile Form 990, navigate to the IRS website or use accredited software. Follow the step-by-step guide that typically includes creating an account, entering your organization’s information, reviewing for accuracy, and submitting.

Key components of Form 990

Form 990 consists of several major sections that collectively represent your organization’s financial health and governance practices. Key components include the overview of revenue and expenses, governance policies, compensation of highest-paid employees, and other financial reporting.

Each section plays a vital role in providing transparency. For example, the financial statements detailing income, expenses, and assets give donors insight into how funds are utilized. Governance questions ensure that the organization is adhering to rules and maintains ethical standards.

Preparing to fill out Form 990

Preparation is key when tackling Form 990. Gather essential documents, including financial statements, tax records, and organizational bylaws. This facilitates a smoother filing process.

Collaboration within your team is vital. Assign roles and responsibilities clearly. For instance, the finance team should prepare financial statements, while the executive director might handle governance questions.

Common mistakes when filing Form 990

Filing Form 990 can be tricky, and several common pitfalls can lead to penalties or compliance issues. Frequently overlooked items include annual disclosures needed in your filing, or misreporting income and expenses.

Ensuring that all required attachments accompany your form is critical. Missing attachments can lead to penalties and unnecessarily complicate your filing process.

Filing deadlines and important dates

Form 990 must be filed annually, with deadlines typically set for the 15th day of the 5th month following the end of the fiscal year. Extensions can be requested, allowing organizations additional time to prepare their filings.

Being keenly aware of these deadlines prevents last-minute rushes and potential penalties. Utilizing tools to track your filing status can also ensure you remain compliant.

Penalties for noncompliance

Noncompliance with Form 990 filing can lead to significant penalties. Financial penalties can accrue based on how late the form is and on the size of the organization.

Moreover, failure to file can lead to the revocation of your tax-exempt status, which can severely impact fundraising efforts and the organization's ability to operate effectively.

Public inspection regulations

Form 990s are public documents, promoting transparency within the nonprofit sector. Organizations are required to make their Form 990 available for public inspection, which can include providing copies on demand or maintaining an online database.

This requirement is critical for donors and stakeholders as it helps them evaluate the effectiveness and financial health of an organization before contributing.

Navigating Form 990 data published by the IRS

The IRS publishes data from Form 990 that can be valuable for research and evaluation. Analyzing this data helps stakeholders understand trends within nonprofit sectors and assist organizations in improving their performance.

Understanding the data can also aid in grant applications and fundraising efforts, giving insights into successful financial practices.

Historical context of Form 990

Form 990 has evolved significantly since its inception, reflecting the changing landscape of nonprofit regulation and oversight. Over the years, modifications to the form have aimed at increasing transparency and accountability in the nonprofit sector.

Changes in the regulatory environment require nonprofits to keep up with compliance practices, ensuring that they adapt to maintain their tax-exempt status.

Use cases of Form 990 in charity evaluation research

Form 990 offers invaluable insights into organizations' financial health and governance. Researchers often analyze this data to gauge a nonprofit's operational effectiveness and to understand funding trends.

Additionally, donors use this information to make informed decisions about their philanthropic contributions, ensuring their donations are directed towards organizations that demonstrate fiscal responsibility and effective governance.

Expert tips for successfully managing Form 990

Effective management of Form 990 requires best practices in record keeping and organization-wide collaboration. Accurate record keeping helps avoid errors during filing and makes future preparation easier.

Engaging with tax professionals can also be beneficial, as their expertise may provide insights into compliance and strategic tax planning. As the process becomes more automated, leveraging technology for streamlined filing can further enhance efficiency.

Interactive tools for Form 990 completion

Utilizing interactive tools enhances the Form 990 completion process. Tools offered by pdfFiller, for example, allow organizations to leverage step-by-step wizards that guide users through filling out the required forms efficiently.

Additionally, interactive calculators can help organizations accurately report financial data, ensuring all figures align with IRS standards. These tools not only improve accuracy but also reduce the time required for filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 on a smartphone?

How do I edit form 990 on an iOS device?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.