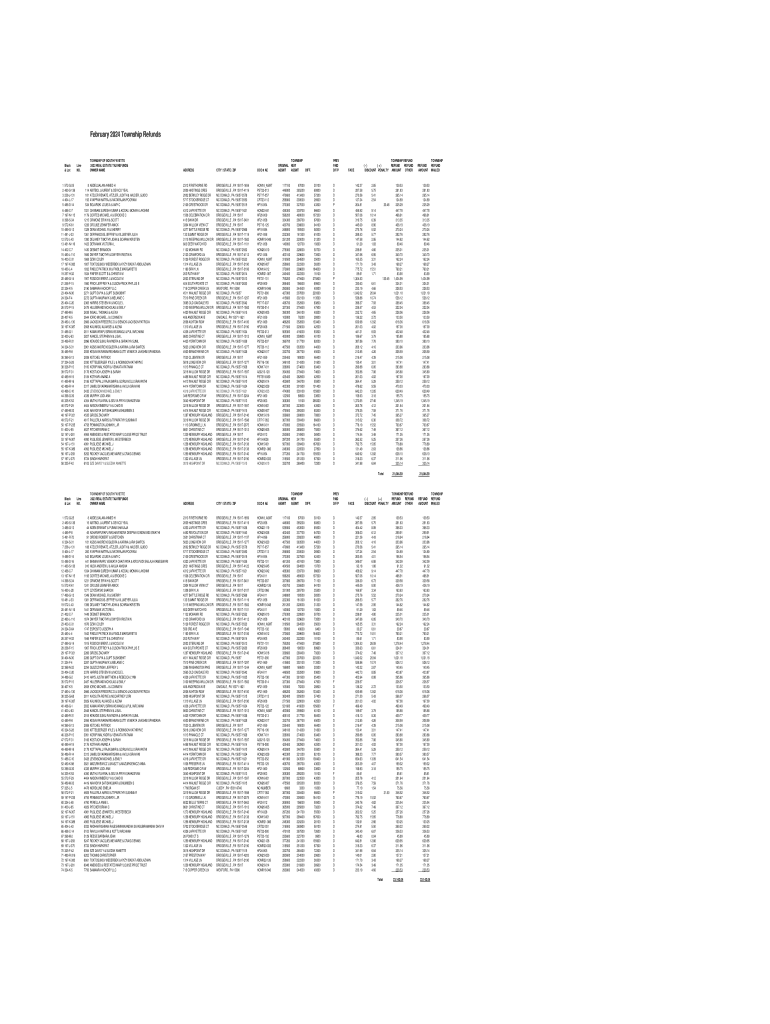

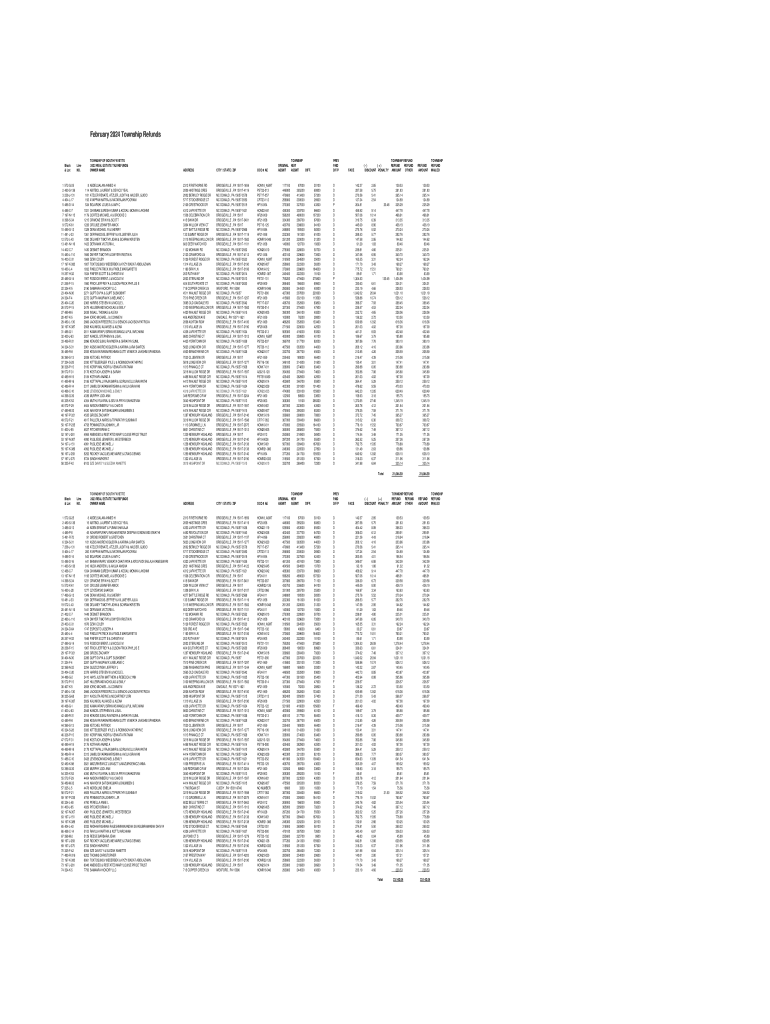

Get the free February 2024 Township Refunds

Get, Create, Make and Sign february 2024 township refunds

Editing february 2024 township refunds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out february 2024 township refunds

How to fill out february 2024 township refunds

Who needs february 2024 township refunds?

February 2024 Township Refunds Form: A Comprehensive Guide

Overview of township refunds

Township refunds refer to the reimbursements provided by local municipalities to residents for certain eligible expenses incurred within the township. These refunds can significantly support residents by easing their financial burdens and promoting community engagement. The availability of refunds also plays a vital role in budgeting for township governments, ensuring that funds are effectively allocated to services and projects that benefit the community.

February 2024 key dates

Understanding key dates is crucial for successfully navigating the refund process. Below is a summary table detailing the important timelines associated with the February 2024 township refunds.

Eligibility criteria for refunds

To qualify for the February 2024 township refunds, applicants must meet specific criteria outlined by the township. Primarily, residents of the township are eligible, while non-residents typically do not qualify unless specified otherwise. Eligible expenses may include property taxes, specific municipal fees, and certain community service fees. However, it's important to understand common ineligibilities. Non-qualified expenses may include utility bills, penalties, and fees related to code violations.

Understanding the February 2024 township refunds form

The February 2024 township refunds form serves as a formal application for residents seeking to claim their refunds. This form can be accessed through the official township website and comes in two formats: a printable PDF for those who prefer paper submissions and an online submission option that allows for a more streamlined process. Key sections of the form include a personal information section, a detailed listing of eligible expenses along with documentation requirements, and lines for signature and date to confirm the authenticity of the submission.

Step-by-step instructions for completing the form

Completing the February 2024 township refunds form requires careful attention to detail to ensure a smooth application process. Here’s how to do it:

Interactive tools for managing your refund request

To enhance the experience of submitting a refund request, several interactive tools are available for applicants. An online status check feature allows residents to monitor the progress of their refund applications, thereby reducing uncertainty. Additionally, an FAQ section provides answers to common questions about the refund process, while contact information for the township clerk's office ensures residents can easily seek further assistance.

Refund processing timeline

Once the February 2024 township refunds form is submitted, applicants can expect a defined timeline for processing. Typically, applications are processed within 4-6 weeks, with payments commencing shortly after. Residents are encouraged to follow up on their refund status if they haven't received communication within this timeframe. Monitoring the status online or directly contacting the township clerk’s office are effective methods to ensure transparency in the refund process.

Success stories and testimonials

Many township residents have successfully navigated the refund application process, sharing their positive experiences. For instance, Mary J., a longtime resident, recounts how her refund helped offset the cost of her property taxes, showcasing the tangible benefits that refunds provide. These testimonials underline the importance of the township refund program and its positive impact on community members, allowing them to reallocate funds towards urgent needs or community improvement projects.

Related forms and documentation

Aside from the February 2024 township refunds form, there are other pertinent documents that residents may need to consider. For instance, individuals moving into a new home may require a change of address form, while those seeking property tax exemptions should complete the respective form for eligibility evaluation. Having these forms readily available can simplify interactions with township services and enhance compliance with local regulations.

Frequently asked questions specific to February 2024 refunds

Residents often have questions about the township refund process, especially concerning what to do if their refund is denied. In such cases, applicants are encouraged to review the reasons for denial thoroughly and consider assembling any necessary documentation or information for appeal. Resubmission guidelines are typically provided by the township, ensuring clarity and transparency for those who must navigate challenges in the refund application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit february 2024 township refunds from Google Drive?

How do I make changes in february 2024 township refunds?

How do I fill out february 2024 township refunds on an Android device?

What is february township refunds?

Who is required to file february township refunds?

How to fill out february township refunds?

What is the purpose of february township refunds?

What information must be reported on february township refunds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.