Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

How to Complete the Form 990

Understanding the Form 990

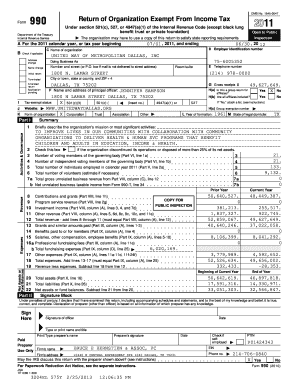

Form 990 serves as the IRS's primary tool for gathering information from tax-exempt organizations. Its primary purpose is to provide transparency about financial activities, ensuring that nonprofits adhere to laws governing their tax-exempt status. Essentially, Form 990 acts as a public document that gives insight into an organization's operations and financial health, thereby promoting accountability within the nonprofit sector.

Completing Form 990 is not merely an administrative task; it is vital for maintaining the trust of donors and the general public. By disclosing financial data, details about governance structures, and programmatic accomplishments, organizations can build credibility and trust among stakeholders.

Why is Form 990 Required?

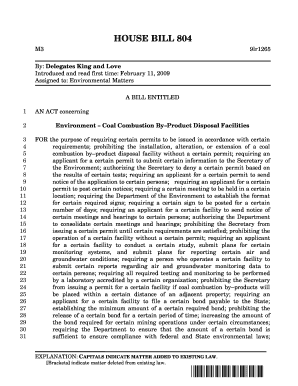

Form 990 is required due to legal obligations placed on tax-exempt organizations under IRC Section 501(c). This form allows the IRS to monitor compliance with various regulations and ensures that organizations are serving public interests rather than private ones. Furthermore, the transparency afforded by this form helps deter financial mismanagement and potential fraud.

The requirement for Form 990 also extends to most nonprofit entities, emphasizing the importance of accountability. Donors, funders, and even volunteers seek to understand how organizations are allocating their resources and whether they are effectively achieving their missions.

Key Components of Form 990

The Form 990 is a comprehensive document divided into multiple sections that cover various aspects of an organization’s operations. Key sections include organization identification, financial information, governance, management, revenue, and expenses. Each section plays an important role in painting a complete picture of the nonprofit's activities.

Understanding the form's layout is critical for accurate completion. It consists of several parts and schedules that may require additional information concerning specific aspects, like compensation of key employees or detailed revenue reporting.

Who Must File Form 990?

Not every nonprofit is required to file Form 990. Generally, organizations that are recognized as tax-exempt under IRC Sections 501(c)(3) through 501(c)(27) must file based on their income level. There are also specific exemptions based on the organization's annual revenue and donor structure.

Completing Form 990: Step-by-Step Instructions

Before diving into the completion of Form 990, it’s essential to gather all necessary documentation, including financial statements, board meeting minutes, and a detailed account of fundraising activities. Preparation is the key to accuracy and clarity.

Section A: Organization Information

Begin by filling out basic organizational information, including the legal name, address, and Employer Identification Number (EIN). It's crucial that this data matches IRS records to avoid complications.

Section B: Financial Information

Here, organizations report detailed income and expenses. It's vital to ensure that the sources of income are categorized correctly and that expenses align with IRS guidelines. Supporting financial documents should always be referenced for accuracy.

Section : Governance and Management

This section requires disclosure about governing body practices, including board member information and terms of office. Proper governance documentation reflects well on the organization and can mitigate compliance risks.

Section : Revenue and Expenses

Accurate categorization of revenue sources—such as contributions, grants, and fees for services—is vital. Similarly, expenses must be divided into functional categories like program services, management, and fundraising.

Common pitfalls to avoid

Errors can create significant delays and issues with the IRS. Common pitfalls include misreporting financial information, poor mission statement clarity, and lack of detailed program descriptions. Accurate data entry and thorough review is critical.

Filing modalities for Form 990

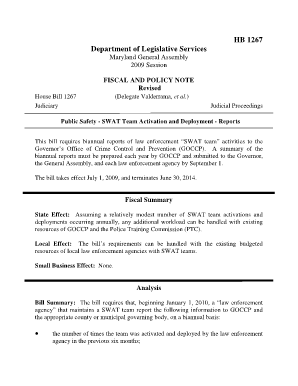

Organizations may choose between traditional paper filing or electronic filing. While paper filing offers a straightforward manual process, electronic filing is becoming the preferred method, as it provides efficiency and immediate confirmation of submission.

Using eSignature and document management tools

Platforms like pdfFiller enhance the filing process by allowing users to edit, sign, and collaborate on documents remotely. This flexibility can significantly simplify workload sharing among team members, leading to more accurate filings.

Important deadlines and penalties

Timely filing of Form 990 is crucial. Generally, Form 990 must be filed on the 15th day of the 5th month after the end of the fiscal year. For organizations with a fiscal year ending December 31, the deadline is May 15.

Missing this deadline can lead to significant penalties. The IRS may impose a fine of $20 for each day the form is late, culminating in a maximum penalty of $10,000 for larger organizations.

Extension options available

Filing for an extension is permitted, offering an additional 6 months to complete Form 990. However, an extension only applies to filing, not payment deadlines, if applicable. Organizations must submit Form 8868 to request this extension.

Public inspection regulations

Form 990 is available for public inspection, allowing potential donors, regulators, and the public to access its contents. This scrutiny underscores the importance of transparency in the nonprofit sector; it helps stakeholders ensure that organizations are operating as intended.

While the information included is mostly straightforward, sensitive details—like donor lists—are not publicly disclosed. Many organizations choose to redact certain information to protect privacy while fulfilling public disclosure requirements.

Using Form 990 for charity evaluation research

Donors and funding bodies increasingly rely on Form 990 as an evaluation tool, assessing the health and alignment of nonprofits with their missions. Through evaluating metrics, such as the program expenses ratio, donors can ascertain how much of their contribution will directly support charitable activities.

Understanding financial health through Form 990 data serves as a guide for sustained support. Metrics like administrative expenses are closely analyzed to assess operational efficiency, which can significantly affect future funding decisions.

Historical context of Form 990

Form 990 has evolved significantly since its introduction, adapting to the growing need for transparency in the nonprofit sector. Initially a much simpler document, it has grown to encompass various complex regulations and reporting requirements to match changing laws and public expectations.

Recent trends show an increasing focus on transparency, with many organizations utilizing social media and websites to further disclose information. Notably, a more substantial focus on the impact and effectiveness of organization's programs is evident in the data reported in Form 990.

Resources for further understanding Form 990

Numerous third-party resources provide useful guides and information for completing Form 990. Websites such as the IRS's official page and nonprofit-focused organizations offer detailed worksheets, FAQs, and tools to facilitate the completion of this critical form.

Regularly engaging with community forums can further clarify common issues surrounding Form 990. Participating in discussions allows organizations to share tips, seek troubleshooting advice, and learn best practices from peers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 for eSignature?

Can I sign the form 990 electronically in Chrome?

How do I edit form 990 straight from my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.