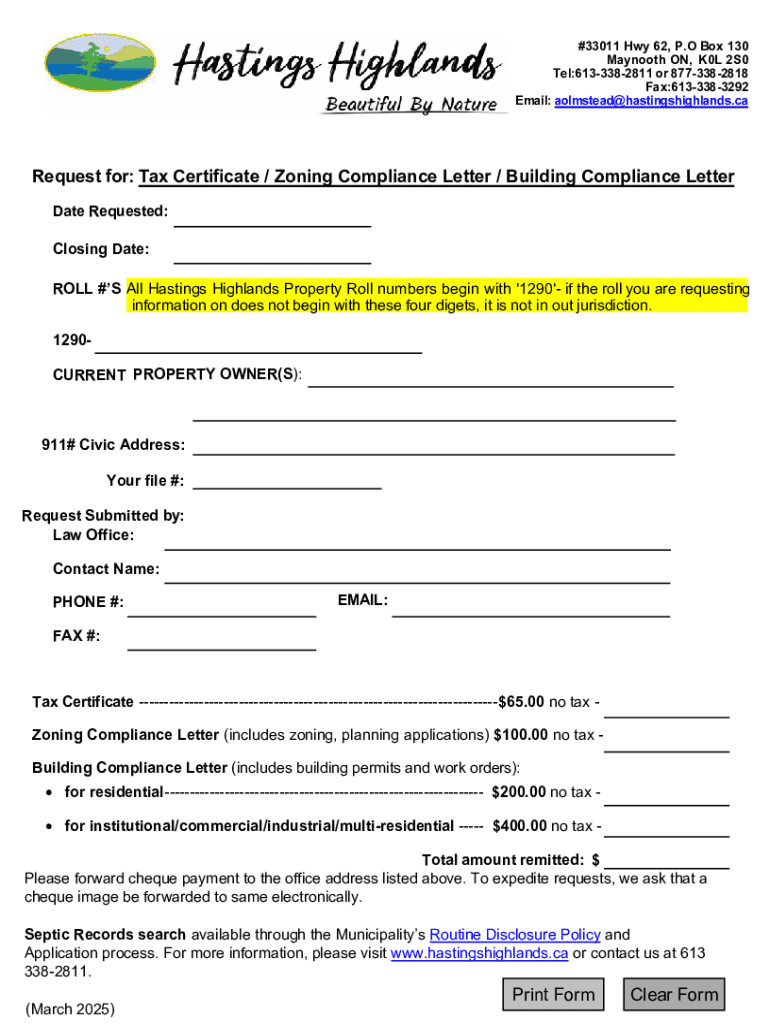

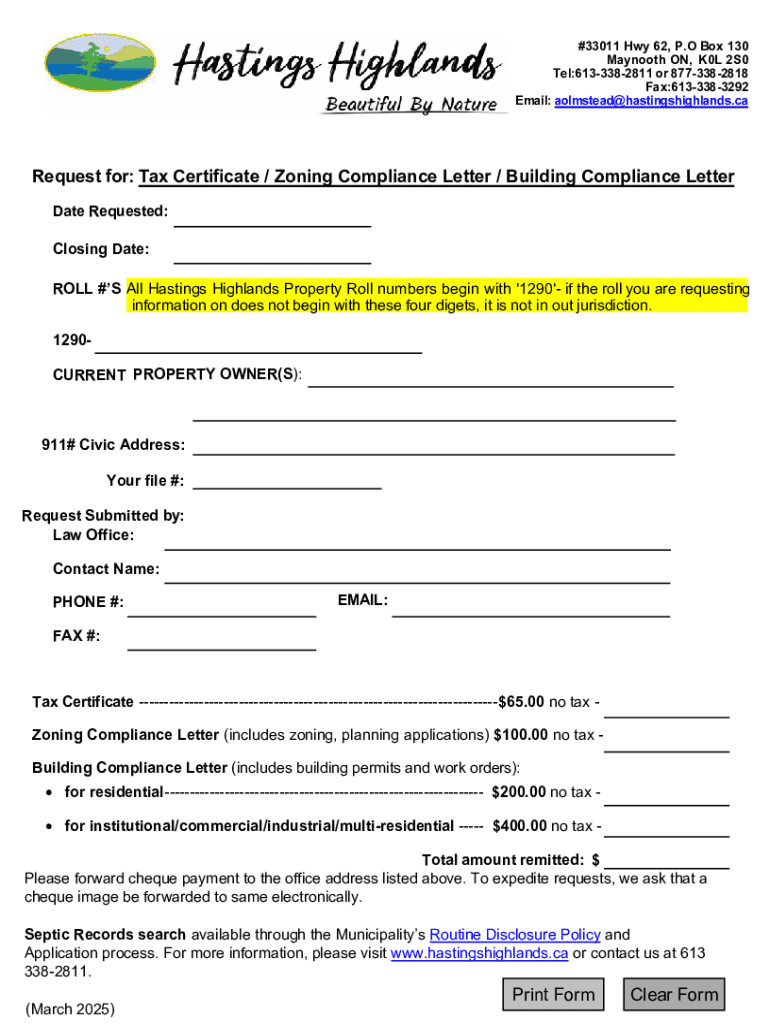

Get the free Request for: Tax Certificate / Zoning Compliance Letter ...

Get, Create, Make and Sign request for tax certificate

How to edit request for tax certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out request for tax certificate

How to fill out request for tax certificate

Who needs request for tax certificate?

Request for Tax Certificate Form: A Complete Guide

Understanding tax certificates: What you need to know

A tax certificate serves as an official document that verifies a taxpayer’s fulfillment of tax obligations, which can vary by jurisdiction. It is crucial for both individuals and businesses, particularly when applying for loans, grants, or in cases of property transfers. The relevance of a tax certificate becomes evident during audits or when validating tax-exempt status.

Common types of tax certificates include exemption certificates and clearance letters. Exemption certificates typically denote that a particular entity is exempt from certain taxes, while clearance letters affirm the payment of all due taxes, confirming the taxpayer's compliance with applicable regulations.

Eligibility and requirements for requesting a tax certificate

Not everyone can request a tax certificate. Generally, individuals or business entities with a valid tax identification number and a track record of tax compliance are eligible. Specific state or local regulations may also dictate additional eligibility criteria.

Before submitting a request, certain prerequisites must be met. You'll need to gather a set of essential documents, which typically include personal identification such as a driver’s license or passport. For businesses, documentation might involve incorporation papers, business licenses, and previous tax filings. Ensuring all documents are current and accurate aids in a smooth application process.

How to request a tax certificate: Step-by-step guide

Requesting a tax certificate involves several straightforward steps.

FAQs and common concerns

When making a request for a tax certificate, applicants often have several concerns. One common question involves what to do if the request is denied. Typically, you can file an appeal or reapply after addressing the denial's reasons.

Another frequent query pertains to expected timelines for receiving the tax certificate. Depending on local jurisdiction, processing times can vary; however, online applications may be faster compared to postal requests. If issues arise during this process, it’s best to contact your tax authority directly for clarification or assistance.

Interactive tools and resources on pdfFiller

pdfFiller provides an array of tools to enhance your document management experience. Among these are document templates tailored for tax certificate requests. Using these templates can save you time and ensure that you meet all required criteria.

The platform also offers tips for efficient document management, including features for eSigning and secure document sharing. If you require assistance, pdfFiller's customer support options, comprised of tutorials and a live chat feature, ensure users can get timely help.

Legal and compliance considerations

It’s important to understand the legal obligations associated with tax certificates. Failing to maintain accurate records may lead to complications down the line, affecting eligibility for tax credits or exemptions. Relying on a streamlined platform like pdfFiller ensures that sensitive information is managed securely and compliant with regulations.

Keeping your records up-to-date is critical; regular audits and compliance checks can significantly streamline the tax certificate request process, safeguarding against unexpected legal repercussions.

Exploring other related tax resources on pdfFiller

Beyond tax certificate requests, pdfFiller provides access to a range of additional forms related to tax compliance. Whether it’s appeals, corrections, or state-specific tax information, users can find all necessary resources under one roof.

These resources offer comprehensive guides and templates tailored to various tax-related procedures, enhancing users' overall experience and making tax management significantly more straightforward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify request for tax certificate without leaving Google Drive?

How do I edit request for tax certificate in Chrome?

How do I edit request for tax certificate on an iOS device?

What is request for tax certificate?

Who is required to file request for tax certificate?

How to fill out request for tax certificate?

What is the purpose of request for tax certificate?

What information must be reported on request for tax certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.