Get the free Health Claim Form

Get, Create, Make and Sign health claim form

How to edit health claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health claim form

How to fill out health claim form

Who needs health claim form?

Health Claim Form: How-to Guide

Understanding the health claim form

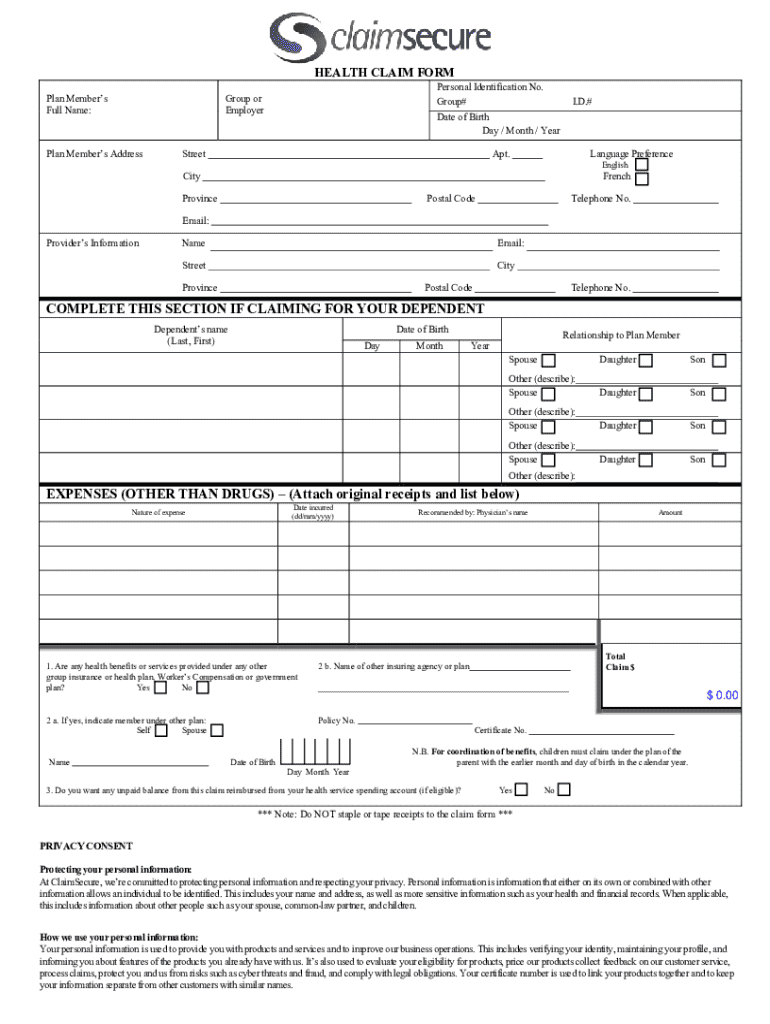

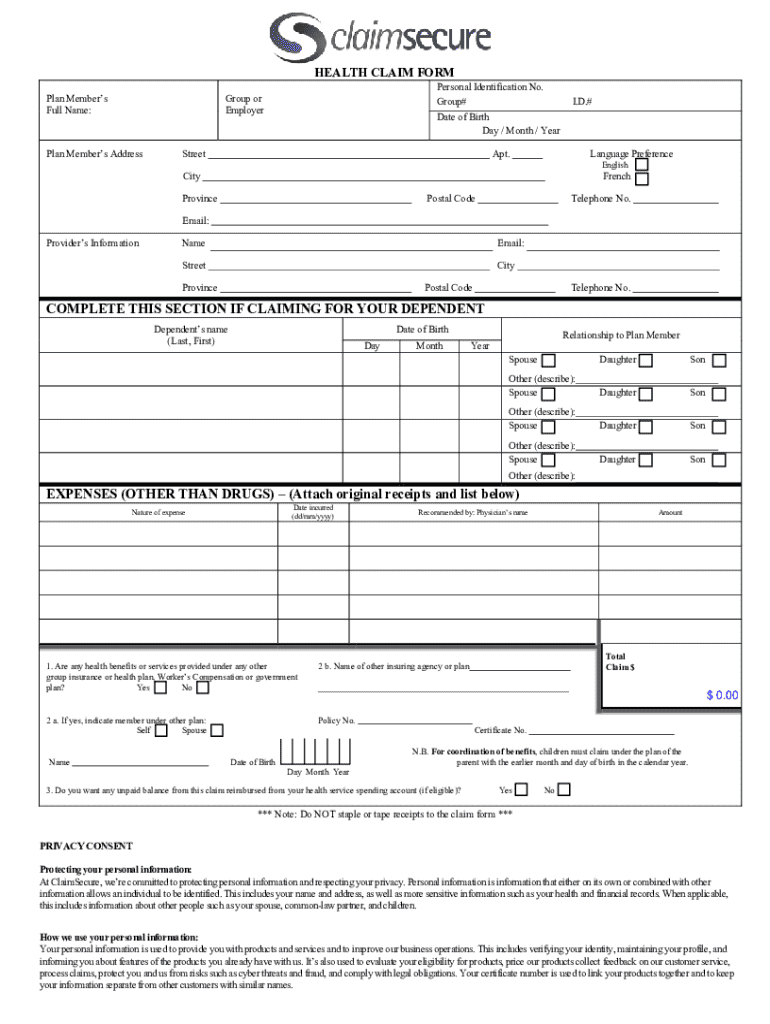

A health claim form is a vital document used to request payment from a health insurance provider for medical services rendered. These forms are essential for both individuals and healthcare providers as they facilitate the reimbursement process, ensuring that healthcare providers receive their payments while patients have their treatment costs covered. Knowing how to correctly fill out and submit a health claim form can significantly impact the efficiency of claims processing.

For individuals, understanding health claim forms can make a considerable difference when navigating the complexities of insurance coverage. For healthcare providers, these forms are tools that help streamline billing processes and ensure that they are compensated for their services.

Types of health claim forms

There are several standard health claim forms used across the healthcare industry, each designed for different types of claims. The most commonly used form is the CMS-1500, utilized primarily by non-institutional healthcare providers to bill Medicare and other payers. Understanding the nuances between different types of health claim forms is key to successful claim submission.

Additionally, there are specific forms for situations that may require varying degrees of documentation, such as out-of-network claims, specialty claims, or claims involving durable medical equipment. Choosing the right form is crucial to avoid delays or denials during the claims process.

Preparing to file a health claim

Before filing a health claim form, it is essential to gather all necessary information. This includes personal information like your full name, address, and insurance details, as well as specifics from your healthcare provider. Collecting all relevant medical documentation like bills, receipts, and diagnostic reports will help in completing your claim accurately.

Reviewing your insurance policy is also crucial. Pay attention to key terms and clauses to ensure you follow the proper procedure for filing a claim. Important timelines for submitting claims can dictate whether a claim is accepted or denied, so be well-informed.

Step-by-step guide to filling out a health claim form

To begin, download the appropriate health claim form, like the CMS-1500, from reputable sources such as pdfFiller. Make sure you have the most recent version. Once you have the form ready, filling it out correctly is crucial. Each section typically requires specific information, such as patient details, provider details, diagnosis codes (ICD-10), procedure codes (CPT/HCPCS), and charges.

Take your time to ensure that everything is accurate. Often errors in the completion of these forms can lead to delays in processing or even denials of claims. A detailed examination of the form can save time and reduce frustration later.

Common mistakes to avoid

Common mistakes in health claim forms can lead to rejected claims or need for resubmission which can delay the revenue cycle significantly. One of the most frequent errors is missing information; always double-check that every section has been completed accurately. Incorrect coding is another common issue; make sure ICD-10 and CPT codes are up-to-date and relevant.

Before submitting, create a checklist of potential errors. Verify all entries, from dates to charges, and ensure all documents being submitted match the information provided in your claim.

Submitting the health claim form

When it comes to submitting your health claim form, you have options: online or paper submission. Many providers have embraced electronic claims submission, which can expedite the review process. If submitting online, consider using platforms like pdfFiller that offer electronic claims filing services to streamline your experience.

If you opt for paper submission, ensure that you send the claim to the correct address. Contact details for various insurance providers can usually be found on their websites. Additionally, make copies of all submitted documents for your records, as keeping track of your submissions is essential for potential future inquiries.

After submission: Tracking and managing your claim

Once your claim has been submitted, keeping track of its status is crucial. Most insurance companies provide online tools that allow you to check the status of your claims in real-time. Additionally, don’t hesitate to contact customer service if there are any delays or if questions arise regarding your claim.

If you experience a denial, it’s essential to understand the reasons. Insurance companies typically send denial letters detailing why a claim was not approved. Carefully review this information, as it may guide you in disputing the decision through an appeals process. Document everything to have a clear record of actions taken.

FAQs about health claims

Addressing common questions about health claims can demystify the process for many individuals. For instance, what can you do if you disagree with your insurance company’s decision? Most insurers have an established appeal process. Be sure to familiarize yourself with it to safeguard your rights as a policyholder.

Specific situations, like filing for out-of-network services, may require additional documentation or clarification of benefits. If you fail to file within a specific timeline, you might miss coverage for those expenses. Always outline clearly when these deadlines occur in your insurance policy.

Additional support and resources

Seeking help with health claims can be an invaluable resource when navigating the sometimes confusing process. Consider reaching out to insurance brokers or patient advocates who can provide guidance specific to your situation. Furthermore, there are online communities and forums where individuals share their experiences, offering support and advice.

Keeping abreast of changes in your health insurance policy will equip you with vital information. Signing up for email updates from your insurer can ensure you stay informed about any shifts in the claims process or policy regulations.

Comprehensive tools available on pdfFiller

pdfFiller offers an array of tools that streamline the process of creating, editing, signing, and managing health claim forms. Features like document editing and eSigning enable users to easily modify PDFs without the hassle of printing or scanning, making it easier to submit claims correctly and on time.

Moreover, collaborative features let users work in tandem with healthcare professionals or insurance representatives, which can simplify the process of ensuring all necessary information is accurately submitted. Sharing claims through secure links can aid in managing claims without confusion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the health claim form in Gmail?

How can I fill out health claim form on an iOS device?

Can I edit health claim form on an Android device?

What is health claim form?

Who is required to file health claim form?

How to fill out health claim form?

What is the purpose of health claim form?

What information must be reported on health claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.