Get the free Form 10.01-m

Get, Create, Make and Sign form 1001-m

Editing form 1001-m online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1001-m

How to fill out form 1001-m

Who needs form 1001-m?

Form 1001-: A Comprehensive How-To Guide

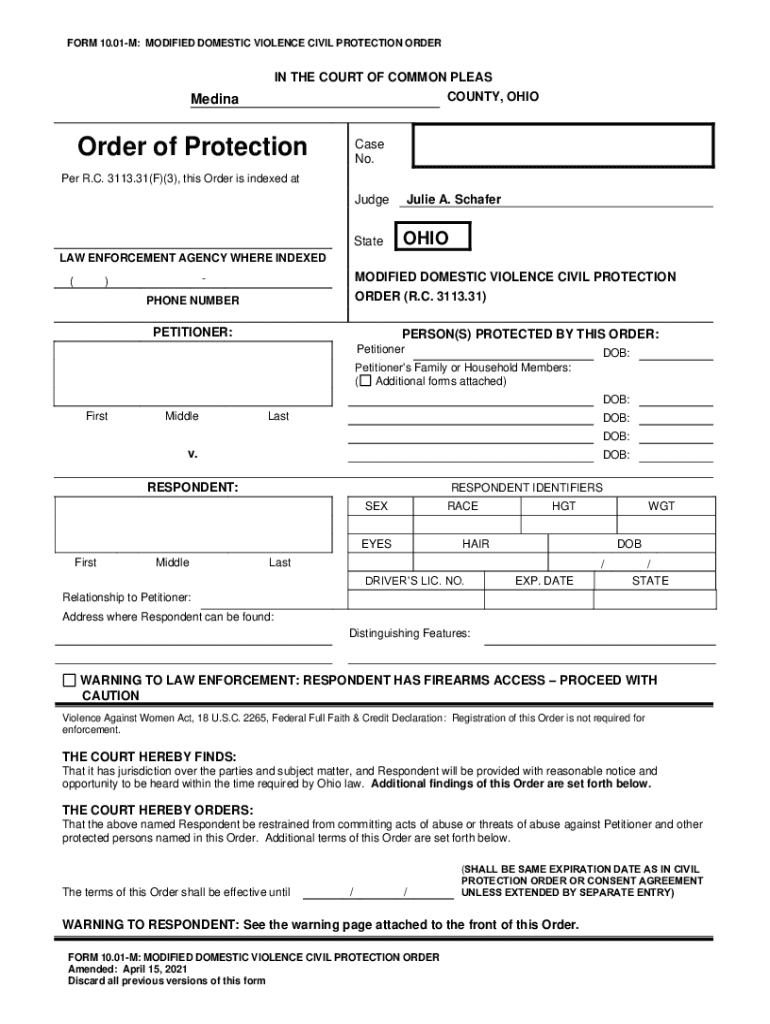

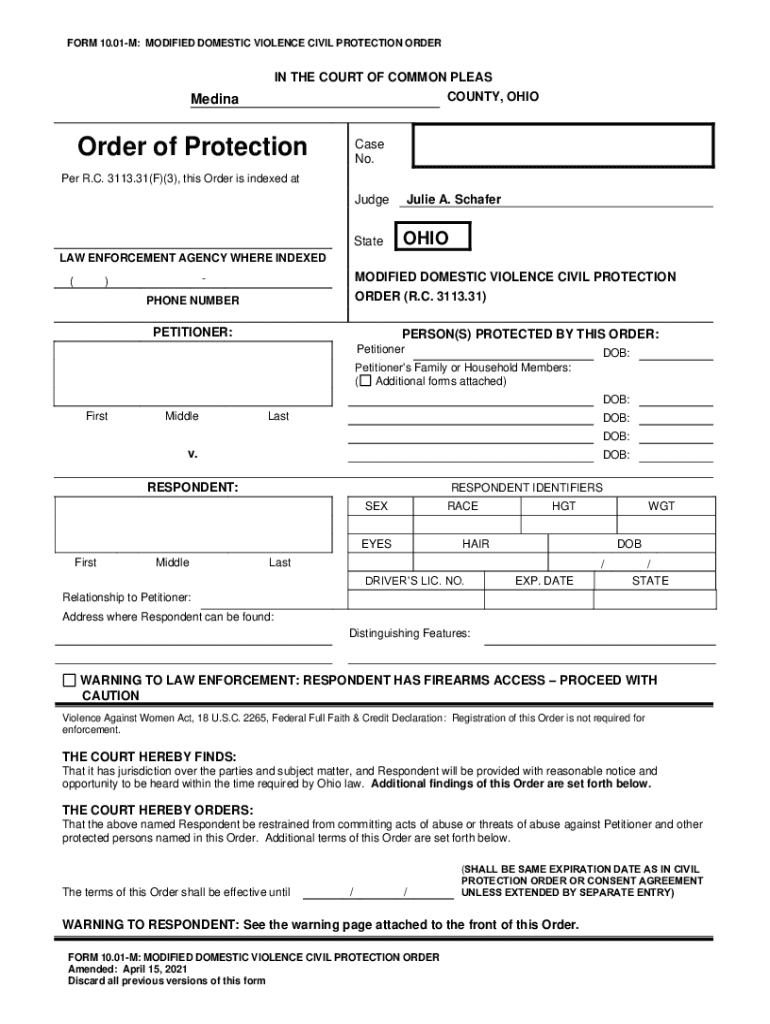

Overview of the Form 1001-

The Form 1001-M is a specialized document that serves a vital role in various administrative processes. It is designed to collect essential information for specific organizational purposes, ranging from tax reporting to compliance documentation. By understanding its significance, individuals and teams can streamline their workflows effectively.

The primary purpose of the Form 1001-M revolves around documenting important data that ensures consistent compliance with regulatory standards. This form serves multiple stakeholders, including individuals, teams, and businesses that require formal acknowledgment of essential information for legal or operational needs.

In a world where document management is crucial, understanding the Form 1001-M is essential for ensuring effective and efficient handling of necessary paperwork.

Understanding the key elements of the Form 1001-

The structure of Form 1001-M comprises several sections which need to be filled out accurately to ensure completeness. Each section is tailored to gather specific information, facilitating a seamless understanding of the data required. Common terminologies linked to this form include terms like 'applicant,' 'submission date,' and 'compliance requirements,' which are pivotal in guiding users through the completion process.

Commonly collected data points on this form usually involve personal and organizational information, including names, addresses, financial identifiers, and compliance-related details. By comparing the Form 1001-M to similar forms, users can appreciate its uniqueness in terms of format and data requirements, which are streamlined for specific administrative tasks.

Step-by-step guide to completing the Form 1001-

Completing the Form 1001-M can seem daunting, but following a structured approach can simplify the process. Begin by gathering all required information. This includes identification documents, financial data such as tax ID numbers or revenue reports, and any supporting documents necessary for verification.

After collecting the required information, proceed to fill out each section of the form. Detailed instructions for all parts are usually provided on or accompanying the form. If you encounter complex sections regarding compliance or financial details, don’t hesitate to consult additional resources or guidance to ensure accuracy.

After completing the form, review it thoroughly to ensure all entries are correct. Common mistakes include missing signatures, incorrect information, and failure to provide documentary evidence. A checklist can aid in reviewing the required fields to confirm that every section is complete.

Finally, you can submit the form in various ways, including online submission or hard copy. Ensure timely processing by following deadline guidelines and confirming submission methods accepted by the relevant authority.

Editing and managing your Form 1001- with pdfFiller

Using pdfFiller for managing your Form 1001-M simplifies the documentation process. Start by uploading the form directly into the platform. This step allows easy access to a suite of editing tools that can help modify text, add comments, and integrate necessary digital elements.

With pdfFiller, you can also utilize eSignature features within the editing interface. Signing the document digitally is convenient, and collaboration with others becomes hassle-free as you can share files with permissions set for authorship or viewing.

Version control is another essential aspect of using pdfFiller. You can track modifications made to the form over time, ensuring that no important changes go unnoticed. Save and share options enable easy dissemination of the final document, greatly enhancing efficiency in document management.

Frequently asked questions (FAQ) about Form 1001-

It’s common for users to encounter issues while dealing with the Form 1001-M. Should you face complications, the first step is to refer back to the completion instructions, which address common problems. If issues persist, reaching out to support for quick resolution is advised.

Users can contact pdfFiller’s help desk through their website for assistance. Be sure to provide details of the problem encountered for quick troubleshooting. If the Form 1001-M remains unaccepted despite all efforts, it's prudent to explore alternatives or related forms.

Additional tools and resources from pdfFiller

pdfFiller offers a variety of tools and resources to enhance your experience with the Form 1001-M. Interactive templates are available for quick form creation, ensuring users can draft the necessary documents swiftly while maintaining compliance.

Additionally, related forms for streamlined document management are easily accessible through the platform, allowing for a comprehensive set of tools tailored to meet diverse needs. Keep an eye out for upcoming webinars and tutorials that aim to educate users about effective document creation and management techniques.

Case studies and user testimonials

Real-life success stories provide valuable insights into the effective use of the Form 1001-M. Numerous individuals have reported that by utilizing this form alongside pdfFiller, they significantly reduced their documentation turnaround time, enabling timely compliance and reporting.

Teams have also benefited from enhanced collaboration through shared access to the Form 1001-M in pdfFiller, leading to greater accuracy as multiple stakeholders can contribute to the form, ensuring all necessary data points are captured.

Best practices for document management

Effective document management transcends just filling forms; it incorporates a disciplined approach to storing and retrieving forms. Organize your files systematically by categorizing them according to departments, priorities, or submission dates. This organization allows for swift access when needed.

Additionally, ensure compliance and security with your documents by encrypting sensitive information and adhering to legal standards. Leveraging cloud solutions like pdfFiller also benefits remote access, allowing you to manage your documents anywhere, anytime, while maintaining a centralized storage system.

Innovations in document management

The landscape of document management is evolving rapidly with trends in form automation gaining ground. These innovations allow users to complete forms more efficiently through automated data entry and streamlined processes, significantly reducing the time and effort required.

As a leader in this space, pdfFiller continuously adapts to changing needs in document handling. The platform integrates new features aimed at enhancing user experience and ensuring that users have access to the latest tools that facilitate effective form management.

Connecting with community insights

For those seeking shared experiences or additional support, community forums and user groups dedicated to the Form 1001-M can be valuable resources. Engaging with others provides insights into best practices, troubleshooting, and tips for effective use of the form and related features.

Collaborative projects utilizing Form 1001-M bring together diverse perspectives on the best practices for completion and submission, fostering a community driven by shared knowledge and collective problem-solving.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 1001-m directly from Gmail?

How can I get form 1001-m?

How do I edit form 1001-m online?

What is form 1001-m?

Who is required to file form 1001-m?

How to fill out form 1001-m?

What is the purpose of form 1001-m?

What information must be reported on form 1001-m?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.